Comprehensive Guide to Credit Card Authorization Agreement Forms

Understanding credit card authorization agreements

A credit card authorization agreement form is a pivotal document used in various financial transactions, allowing merchants to obtain explicit consent from cardholders to process payments. This form serves a dual purpose: it protects both the customer and the business by minimizing risks associated with unauthorized transactions. When a customer provides their information on this form, they effectively grant authority to the merchant to charge their credit card for specified amounts or services.

The importance of these agreements cannot be overstated. They lay the groundwork for trust between customers and businesses, providing a clear outline of payment expectations. With the soaring rates of online transactions and subscription services, having a credit card authorization agreement form in place has become essential in ensuring that both parties are protected against potential fraud and misunderstandings.

Key components of a credit card authorization agreement form

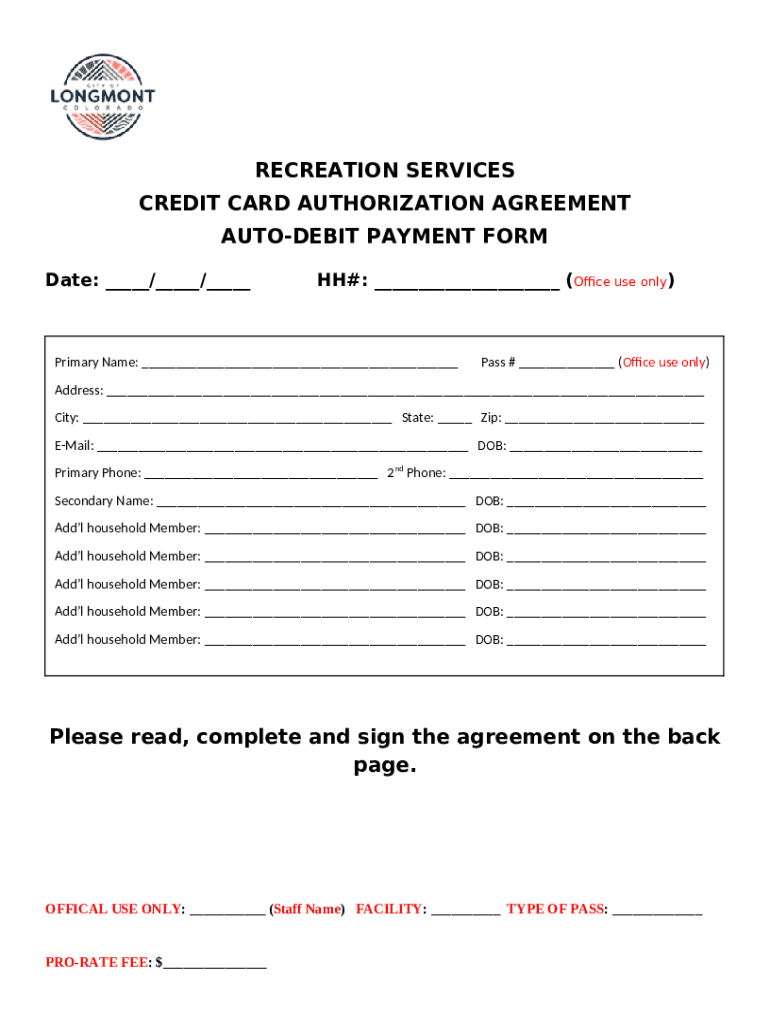

Understanding the critical elements of a credit card authorization agreement form ensures that the document is filled out correctly and thoroughly. Essential components include:

This includes the name, billing address, and contact details of the cardholder.

It consists of the merchant's name, address, and contact information, creating transparency for the transaction.

Clearly defines the maximum amounts that can be charged, frequency of charges, and the services or goods provided.

The cardholder's signature is crucial as it signifies their agreement to the outlined terms, complemented by the date of agreement.

Benefits of using a credit card authorization agreement form

Utilizing a credit card authorization agreement form brings about several advantages that can enhance business operations and customer relations. Firstly, it serves as a strong defense against chargebacks, which can occur when a customer disputes a charge. This form acts as proof of consent, giving businesses a robust stance against fraudulent claims.

Additionally, it significantly improves transaction security. By clearly outlining the payment terms, both the customer and merchant are on the same page, which mitigates misunderstandings or disputes regarding payments. Moreover, such clarity serves to strengthen the business-customer relationship by instilling a sense of trust, as customers know exactly what they are agreeing to concerning payments. Ultimately, this form serves as a legally binding document that protects the interests of all parties involved.

Best practices for filling out the credit card authorization agreement form

To ensure that a credit card authorization agreement form is filled out effectively, adhering to best practices is essential. Here’s a step-by-step guide on how to accurately complete the form:

Prior to filling out the form, collect all required details about the cardholder and merchant, including contact information and card specifics.

Double-check entries for accuracy to avoid misunderstandings. Each section should be filled out meticulously.

Before obtaining signatures, explicitly review the terms and limitations of the agreement with the cardholder to guarantee mutual understanding.

Common mistakes to avoid when using the form

Filling out a credit card authorization agreement form can seem straightforward, but it's easy to make mistakes that can have significant repercussions. One common error is providing incomplete or incorrect information, which can lead to denied payment requests or disputes. Always double-check the details entered on the form.

Additionally, failing to update cardholder information regularly can result in issues during payments. A cardholder's details can change, and neglecting to make these updates on the form could lead to failed transactions. Furthermore, keeping a secure record of all authorization agreements is vital; not retaining a record can create challenges in proving consent if a charge dispute arises.

How to edit and customize your form using pdfFiller

pdfFiller offers an efficient way to edit and customize your credit card authorization agreement form. Here’s a step-by-step process to do so:

Start by uploading the blank credit card authorization agreement form to the pdfFiller platform.

Use the interactive tools to modify any fields, add logos, or change text as necessary. The user-friendly interface makes it easy to personalize.

After making the necessary edits, save your document for future access and distribution.

Signing your credit card authorization agreement form

Whether you opt for traditional or electronic signing methods, pdfFiller simplifies the signing process. Electronic signatures are increasingly accepted and can streamline the transaction process significantly. Here’s how to eSign using pdfFiller:

Start by uploading the completed credit card authorization agreement form to pdfFiller.

Utilize the eSignature tool to place your signature on the form easily, ensuring it meets all legal standards.

Once signed, save the document and share it with the necessary parties, ensuring all maintain copies for their records.

Managing your credit card authorization agreements

After executing credit card authorization agreements, organizing and storing completed forms properly is crucial for easy access and management. pdfFiller offers robust features to help you manage these documents effectively. Utilize folders and tagging systems within pdfFiller to categorize and retrieve authorization agreements quickly.

Moreover, collaboration features provided by pdfFiller allow teams to work on documents seamlessly, making it easier to collectively review agreements or make adjustments as necessary. This capability fosters transparency and builds stronger operational practices within teams handling multiple transactions.

Frequently asked questions (FAQ)

As businesses increasingly adopt credit card authorization agreements, several questions arise regarding their implementation and legal implications. For instance, what situations specifically require a credit card authorization agreement? Generally, any recurring payment scenario, such as subscriptions or services, mandates its use to ensure consent and clarity among parties.

Another pertinent question involves the legal implications of using these forms. As long as they are filled out correctly and signed by all involved parties, credit card authorization agreements are legally binding. Furthermore, individuals concerned about their data security when using online forms often inquire how to protect their information. Employing reputable platforms like pdfFiller, which prioritizes security and privacy, ensures that sensitive information remains safeguarded during transactions.

Real-life scenarios and use cases

Businesses across various sectors leverage credit card authorization agreement forms to enhance their payment processes. For example, a restaurant that offers online reservation and payment services can utilize these forms to secure advance payments from customers, ensuring commitment and reducing no-shows. By requiring a credit card authorization, the restaurant protects itself from financial loss while ensuring that customers genuinely intend to keep reservations.

Similarly, subscription-based businesses, like streaming services, rely heavily on these agreements to manage recurring payments. This establishes a clear understanding of membership fees, payment schedules, and conditions for payment modifications. The overall impact on customer relationships is profound, as it fosters transparency and trust, leading to enhanced customer satisfaction and retention over time.

Subscribe for more insights

If you found this guide on credit card authorization agreement forms helpful, consider subscribing to our newsletter at pdfFiller. We regularly share insights on document management solutions, tips, and the latest trends in electronic forms. Stay informed and enhance your understanding of secure transaction practices.

Collecting feedback on your experience

Your experiences with credit card authorization agreement forms matter to us. We'd love to hear about your challenges and successes using these forms in your business. Sharing user feedback not only helps us improve our offerings but allows other users to benefit from collective experiences, further enhancing the utility of such forms in various transactions.