Get the free Nebraska Nonresident Income Tax Agreement

Get, Create, Make and Sign nebraska nonresident income tax

Editing nebraska nonresident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska nonresident income tax

How to fill out nebraska nonresident income tax

Who needs nebraska nonresident income tax?

Nebraska nonresident income tax form: A comprehensive guide

Overview of the Nebraska nonresident income tax form

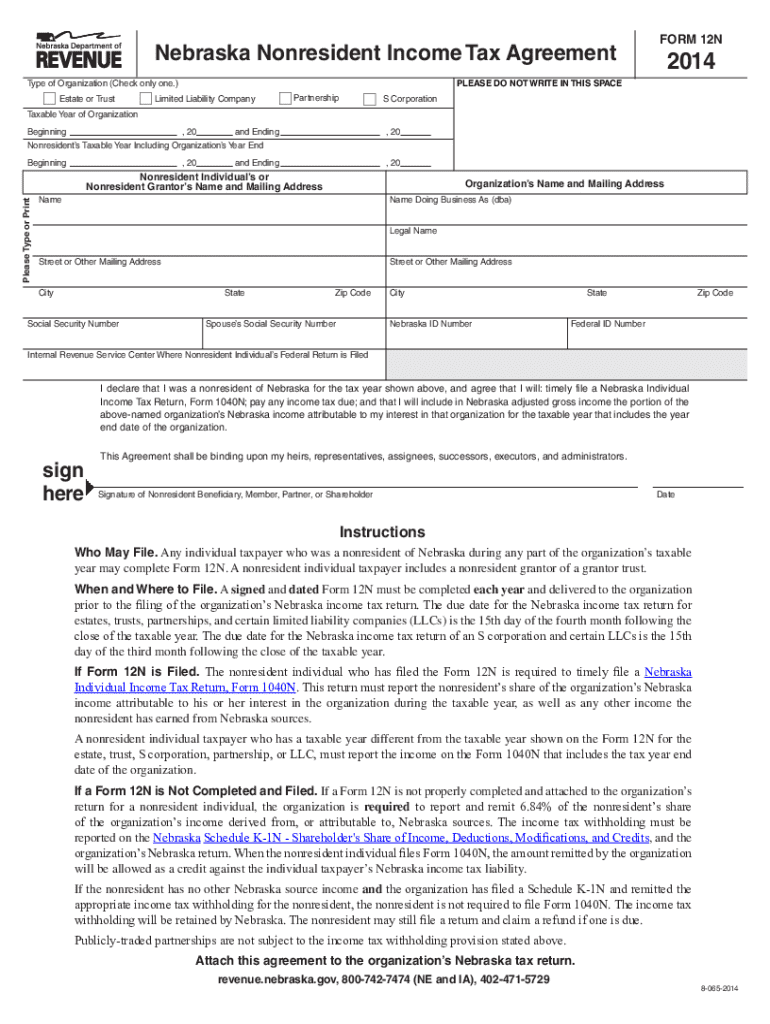

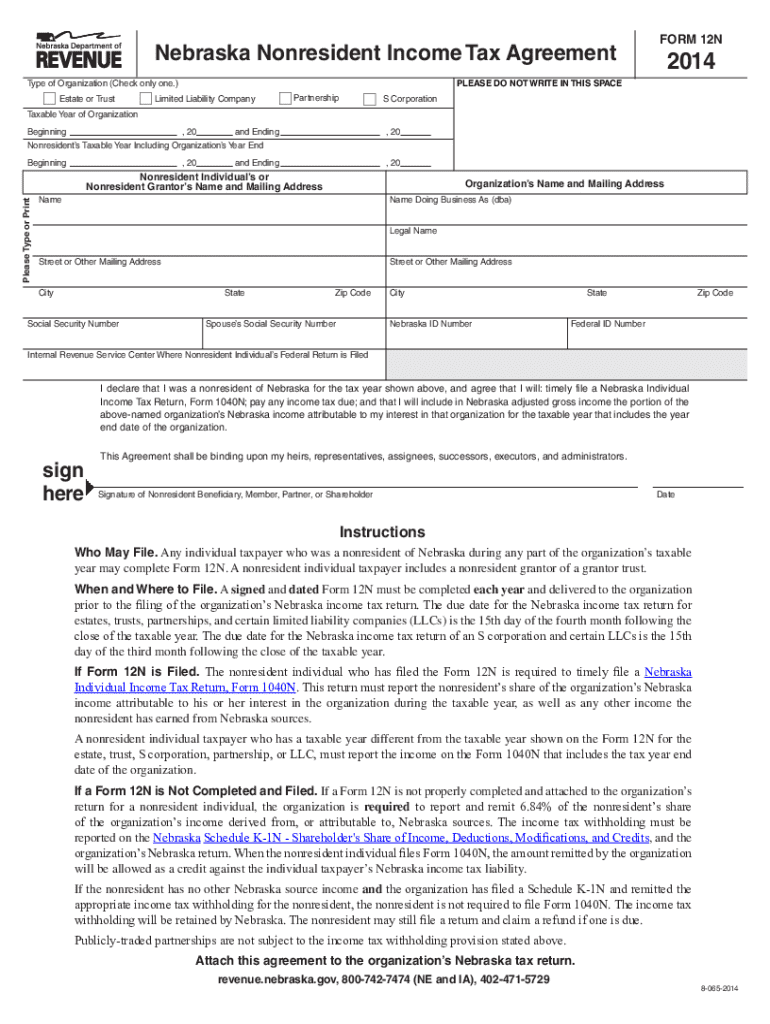

The Nebraska nonresident income tax form is a document that nonresidents use to report income earned from Nebraska sources and fulfill their tax obligations to the state. This form enables the Nebraska Department of Revenue to assess tax liability accurately based on the income nonresidents have generated while working or conducting business within the state.

Nonresidents required to file this form typically include those who have earned wages or have received other types of income from Nebraska sources. Understanding the distinction between residents and nonresidents is crucial, as Nebraska residents report all income regardless of where it’s earned, while nonresidents only report income specifically earned within the state.

Understanding Nebraska tax obligations for nonresidents

Nonresidents in Nebraska are subject to tax on income earned from Nebraska-based sources. This could include wages, business income, rental income, and certain investments. Distinct from resident taxation, which encompasses income from all sources, nonresidents only need to report what they earn while physically earning income in the state.

Withholding tax requirements also apply to nonresidents, where employers are obligated to withhold state taxes from wages paid to nonresident employees. This ensures that tax obligations are met progressively throughout the year. The current Nebraska state tax rates range between 2.46% and 6.84%, depending on income brackets, which directly affects the total tax owed for nonresidents.

Step-by-step guide to completing the nonresident income tax form

Gathering required information

To effectively fill out the Nebraska nonresident income tax form, start by collecting essential personal information, such as your full name, Social Security Number (SSN), and current address. In addition, ensure you have relevant financial documents on hand, like W-2s and 1099s, which provide details about the income earned during the tax year.

Filling out the tax form

When filling out the nonresident income tax form (Form 1040N), pay close attention to each section. The income section requires reporting of your Nebraska-source income, which must be accurately calculated. You should also research the deductions available for nonresidents, such as business expenses or contributions to an IRA, which can reduce taxable income.

Moreover, familiarize yourself with the various tax credits available to nonresidents, which can further lessen the tax burden. Common mistakes include failing to include all Nebraska-source incomes or incorrectly calculating deductions, so make sure to double-check your entries for accuracy.

Submitting your Nebraska nonresident income tax form

Available submission methods

Once you have completed the Nebraska nonresident income tax form, the next step is submission. You have several options for this, including electronic filing through state-approved software that can ease the process and even provide instant confirmation of acceptance. Alternatively, you may choose to mail the form directly to the Nebraska Department of Revenue, but ensure that you use the correct address and follow best mailing practices, such as certified mail for tracking.

Deadlines and penalties

Be mindful of the important filing deadlines for nonresidents, typically the same as residents: April 15th for tax returns. Late filing can incur penalties, including interest on unpaid taxes. To ensure compliance and avoid fees, it is advisable to plan ahead and submit your form on time.

Interactive tools and resources

For additional support, the Nebraska Department of Revenue provides various resources, including an online portal where you can find official forms and instructions related to nonresident taxes. Furthermore, interactive calculators are available for estimating tax owed or refunds for nonresidents, which can be a helpful tool in managing your tax liability.

If you have frequently asked questions about nonresident taxation, the state’s website includes a section that addresses common tax questions, ensuring you have access to reliable information as you navigate your tax responsibilities.

Collaboration features for team filings

If you are part of a team, consider how pdfFiller’s platform facilitates collaboration on tax documents. You can effortlessly share the Nebraska nonresident income tax form with team members, enabling real-time collaboration and input before final submission.

Additionally, tracking document versions and updates is easily managed within the platform, allowing for seamless workflow and reducing the risk of confusion or errors during the tax filing process.

Signing and securing your submission

Once completed, electronically signing your Nebraska nonresident income tax form can be done within pdfFiller, which streamlines the submission process. Digital signatures ensure verification and authenticity without the hassle of printing and mailing documents.

Moreover, document security is vital when dealing with sensitive tax information. pdfFiller implements comprehensive security measures, ensuring your documents are protected from unauthorized access and providing peace of mind as you file your taxes.

Troubleshooting common issues

What to do if you encounter errors on your form

If you run into errors while completing your Nebraska nonresident income tax form, it is crucial to identify specific error codes or issues you encounter. Consult the error reference section within the form instructions or the Nebraska Department of Revenue website to find solutions to common problems. Keep in mind that even minor errors can lead to significant delays in processing.

How to amend your submission if needed

In cases where you need to amend your submission after it has been filed, Nebraska allows for adjustments through a corrected form. This requires completing a Nebraska Amended Individual Income Tax Return (Form 1040X) and filing it according to the same guidelines as the original form. Be proactive about making corrections to avoid penalties or issues with your tax account.

Frequently asked questions (FAQs)

Nonresidents often have questions regarding their filing status and eligibility. Clarifications about income types that qualify for taxation, as well as the nuances of different tax credits available, can be found in the FAQs section provided by the Nebraska Department of Revenue.

Other common concerns include understanding how tax compliance affects residency status and what steps to take if a discrepancy arises. These FAQs serve as an important resource for nonresidents seeking to navigate Nebraska’s tax requirements efficiently.

Additional forms and resources for nonresidents

Several other forms may be necessary for nonresidents, such as forms related to specific deductions or credits. The Nebraska Department of Revenue site provides comprehensive access to related statutes and specific forms that may apply to your situation, ensuring you have all the tools you need at your fingertips.

If further assistance is required, the Nebraska Department of Revenue offers contact information to answer any lingering questions you may have regarding nonresident taxation and paperwork.

About pdfFiller: Your partner in document management

pdfFiller enhances the tax filing experience by offering features that simplify editing, signing, and collaborating on tax documents like the Nebraska nonresident income tax form. Users appreciate the platform's robustness in managing documents from any device, making tax time less daunting.

Testimonials from users highlight the ease of use and efficiency of pdfFiller’s tools, effectively streamlining their tax filing processes and alleviating unnecessary stress as they focus on compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nebraska nonresident income tax directly from Gmail?

How can I edit nebraska nonresident income tax on a smartphone?

How do I fill out nebraska nonresident income tax on an Android device?

What is nebraska nonresident income tax?

Who is required to file nebraska nonresident income tax?

How to fill out nebraska nonresident income tax?

What is the purpose of nebraska nonresident income tax?

What information must be reported on nebraska nonresident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.