Get the free Verification of Recurring Cash Contributions - glo texas

Get, Create, Make and Sign verification of recurring cash

Editing verification of recurring cash online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of recurring cash

How to fill out verification of recurring cash

Who needs verification of recurring cash?

Verification of Recurring Cash Form: A Comprehensive Guide

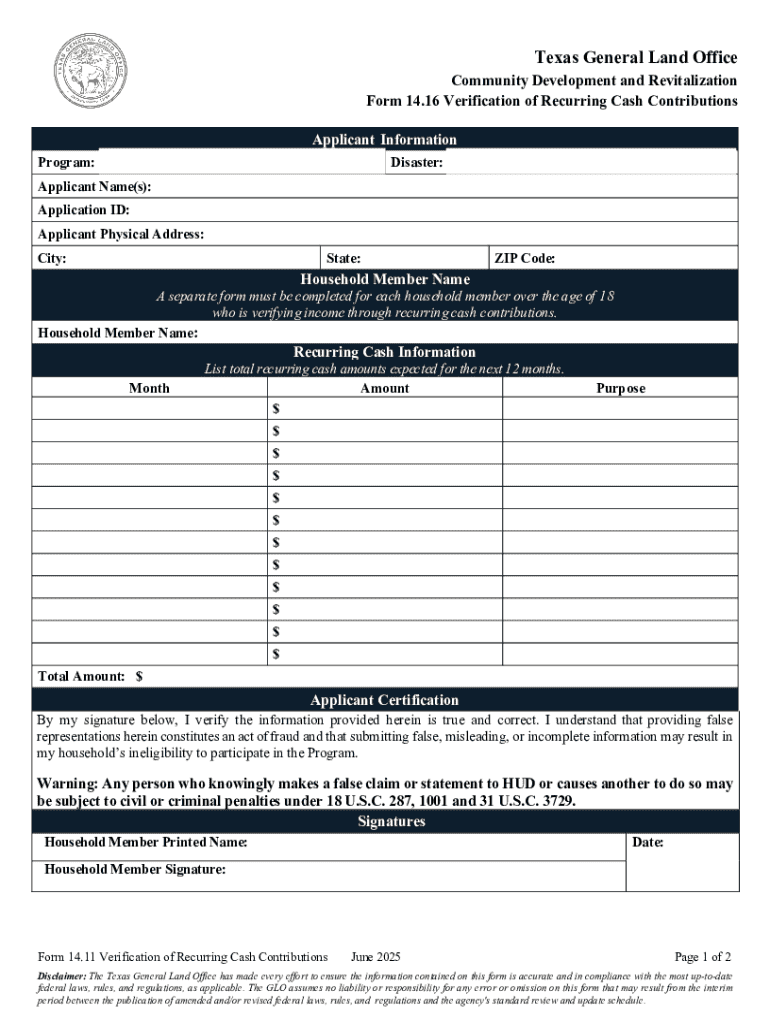

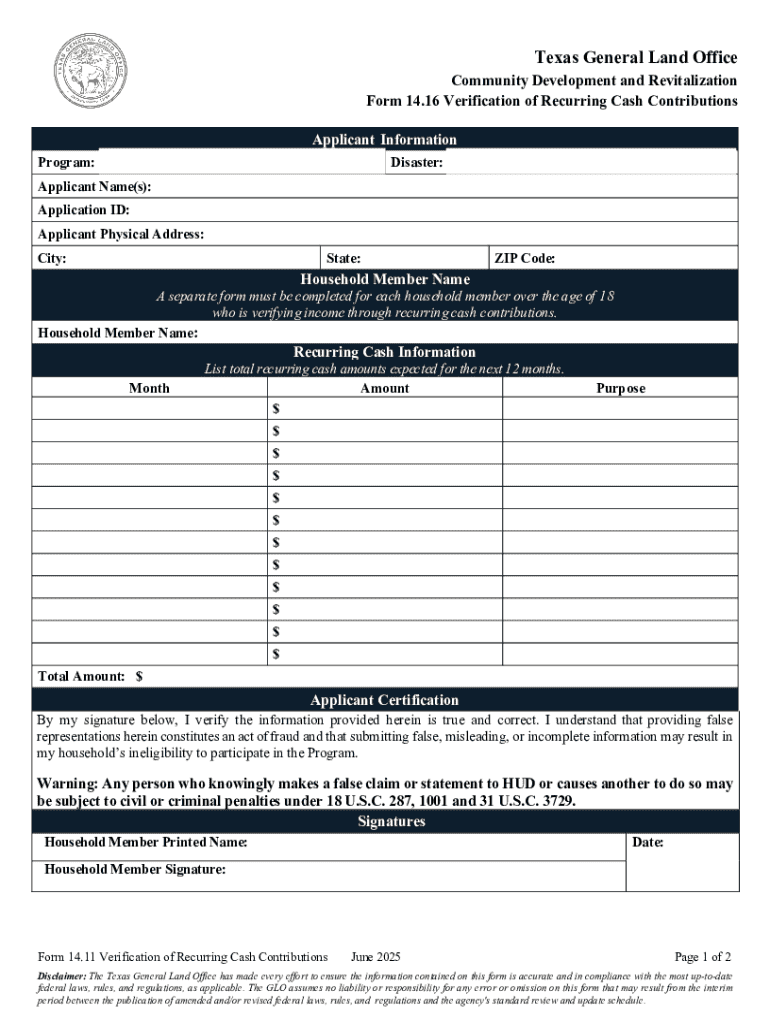

Understanding the verification of recurring cash form

Recurring cash forms are essential documents in personal finance, business operations, and non-profit organizations. They play a critical role in managing ongoing payments and ensuring that funds are allocated appropriately. Verifying these forms is crucial because it adds an additional layer of accuracy and security, ensuring that the financial documentation is correct and compliant.

Verification helps prevent fraud, enhance accountability, and streamline payment processes. In sectors such as personal finance, businesses often rely on these forms to manage subscriptions, loans, and salaries. For non-profits, verified recurring cash forms can impact budgeting and financial planning significantly. Accurate verification practices foster trust and transparency among stakeholders.

Key components of the recurring cash form

A well-structured recurring cash form must include essential information for clarity and reliability. This typically involves both personal or organizational details, including names, addresses, and identification numbers, as well as specific recurrence schedules and payment amounts. It is crucial that the details are unambiguous, as errors can lead to significant financial discrepancies.

Common sections within the form include payment methods, authorization details, and signature fields. Payment methods should specify how transactions will be executed—whether through bank transfer, credit card, or another method. Authorization details must outline who is permitting the payments, while signature fields provide verification of consent and agreement from the parties involved.

Step-by-step guide to verify a recurring cash form

Verifying a recurring cash form requires careful attention to detail and a structured approach. Here’s a step-by-step guide to ensure the process is thorough and correct.

Best practices for verification

To enhance the effectiveness of verifying recurring cash forms, implementing best practices is essential. Regular audits and reviews should be scheduled to catch discrepancies early and maintain accurate financial records.

Employing digital solutions like pdfFiller’s electronic signatures can significantly improve efficiency. This platform allows for streamlined document management, including collaborative tools that facilitate team verification without the hassle of paper submissions.

Challenges in verifying recurring cash forms

While verification is essential, several challenges may arise during the process. Common errors include data entry mistakes and miscommunication with recipients, which can lead to delays and financial errors.

Additionally, adherence to regulatory compliance is critical. Each organization must align with financial laws and regulations to avoid potential fines and legal repercussions. Non-compliance can jeopardize an organization’s operational integrity and trustworthiness.

Utilizing technology in verification

Digital tools can streamline the verification of recurring cash forms, enhancing overall efficiency. pdfFiller offers a range of features that allow users to edit, sign, and manage documents within a single cloud-based platform. This eliminates the need for physical paperwork and reduces the risk of errors associated with manual processing.

The benefits of cloud-based solutions include accessibility from anywhere at any time and improved collaboration among teams. By moving verification processes online, teams can work concurrently, speeding up approvals and ensuring that changes are updated in real time.

Alternative methods for verification

In some cases, organizations may choose third-party verification services to ensure accuracy and compliance, especially when dealing with high-value transactions. While outsourcing can provide specialized expertise, it may also involve additional costs and potential loss of control over sensitive information.

Comparatively, manual verification can be more time-consuming than automated processes. However, manual methods can allow for unforeseen errors to be caught, whereas automated systems may streamline the process but could introduce their own set of risks if not properly managed.

Case studies: successful verification of recurring cash forms

Real-world examples illustrate the importance of accurately verifying recurring cash forms. In personal finance management, individuals who consistently verify their cash forms often find better control over their budgeting and spending habits. These practices not only help in identifying discrepancies early but also support overall financial health.

For businesses, a streamlined process for verifying recurring cash forms can lead to improved cash flow management. For instance, a company that implemented stringent verification protocols noticed a significant reduction in payment errors, leading to a smoother operation and increased stakeholder trust.

Interactive tools for verification

pdfFiller offers interactive tools to facilitate the verification of recurring cash forms, enhancing ease of use. The forms database and templates are user-friendly, allowing for quick access to necessary documentation. This can significantly speed up the verification process.

Moreover, customizable interactive checklists and workflow templates improve team efficiency by ensuring that all necessary steps are followed. These tools help track the verification process and ensure that nothing is overlooked, creating a more streamlined approach.

Closing remarks

In summary, the verification of recurring cash forms is a vital process that plays a significant role in maintaining financial accuracy and integrity. By adhering to best practices, utilizing technology, and facing challenges head-on, individuals and organizations can achieve a seamless verification process.

Encouraging the adoption of these best practices will not only enhance operational efficiency but will also foster a culture of accountability within teams. The ongoing adaptation and improvements of verification processes will ensure that financial operations remain robust and transparent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify verification of recurring cash without leaving Google Drive?

How do I complete verification of recurring cash online?

Can I create an electronic signature for signing my verification of recurring cash in Gmail?

What is verification of recurring cash?

Who is required to file verification of recurring cash?

How to fill out verification of recurring cash?

What is the purpose of verification of recurring cash?

What information must be reported on verification of recurring cash?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.