Get the free Ct-1096

Get, Create, Make and Sign ct-1096

How to edit ct-1096 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1096

How to fill out ct-1096

Who needs ct-1096?

A complete guide to the CT-1096 form

Overview of the CT-1096 form

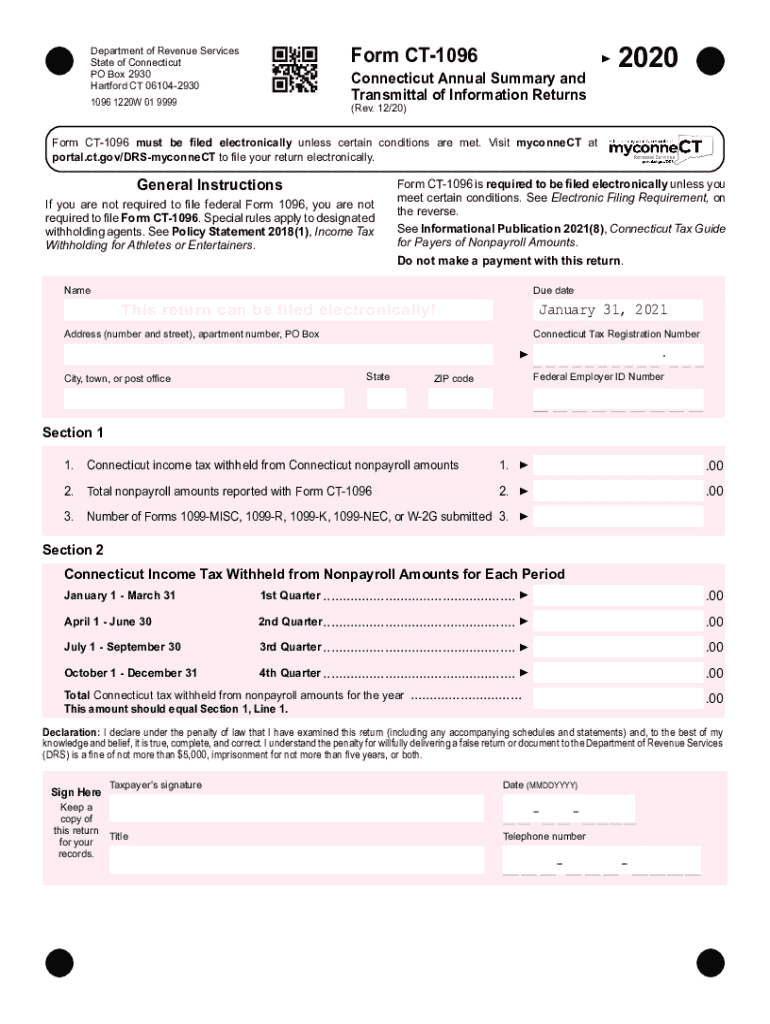

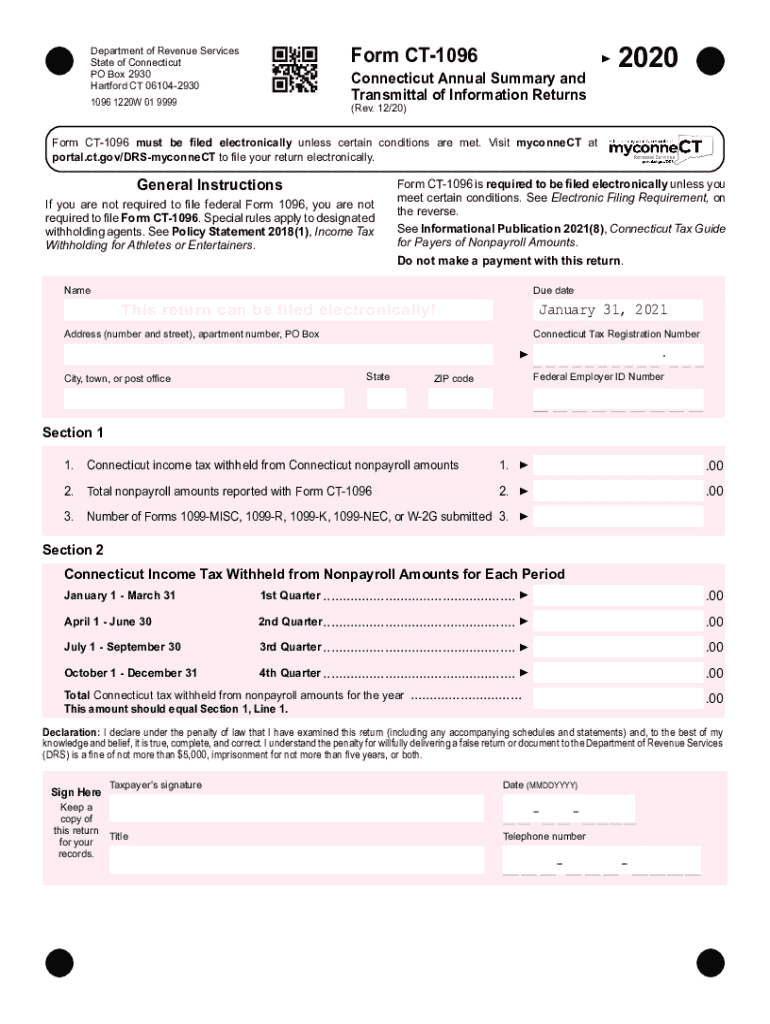

The CT-1096 form is an essential document for reporting annual summary payments made by businesses and individuals in Connecticut. This form serves as a means to summarize various types of income, including wages, rents, and non-employee compensation. Proper filing of the CT-1096 is crucial as it ensures compliance with state tax regulations and aids in maintaining transparent financial records.

Certain individuals and businesses are required to use the CT-1096 form, primarily those who have made reportable payments during the year. This includes anyone who issues 1099 forms for payments exceeding $600 to contractors, freelancers, or other non-employees. Failing to submit this form can lead to penalties, making it vital for filers to understand when and how to complete it accurately.

Key features of the CT-1096 form

The CT-1096 form includes several key features necessary for reporting payments made within the year. The critical components reported on this form include payer information, payee details, and the total amounts for payments made throughout the year. Accurate reporting is vital as it reflects the financial relationship between the payer and the payee, which is important for both parties’ tax obligations.

Specifically, the CT-1096 summarises information related to distinct categories of payment reports, which may include income types such as wages, rents, interest, dividends, and non-employee compensation. The significance of submitting an annual summary cannot be overstated, as it helps the Connecticut Department of Revenue Services reconcile reported earnings and ensure accurate tax collections.

Detailed insights into the CT-1096 filing process

Preparing to file CT-1096

Before you start filling out the CT-1096 form, it's crucial to gather all required information about both the payer and payees. This includes important details such as the payer's name, Employer Identification Number (EIN), and address, alongside every payee's name, Social Security Number (SSN), and address. Additionally, maintaining a record of the total amounts for payments made to each payee throughout the year is essential.

Step-by-step instructions for filling out CT-1096

Filling out the CT-1096 can be straightforward when broken down into steps. First, ensure your payer information is correct in Part I, which includes your name, EIN, and address. Then, move on to Part II, where you summarize the annual payments made to all payees by filling in the total amounts categorized by payment type. Common mistakes include incorrect EINs, mismatched names and SSNs, and not totaling the amounts properly, all of which could result in penalties.

Electronic filing and management of CT-1096

With advancements in technology, electronic filing has become an efficient method for submitting the CT-1096 form. Using a platform like pdfFiller allows filers to enjoy several benefits, including streamlined processes and real-time editing tools. Users can easily edit, sign, and manage their documents from anywhere, ensuring a more organized approach to tax filing.

The steps to use pdfFiller for CT-1096 submission are simple: First, access the CT-1096 form directly in pdfFiller. Next, you can edit and complete the form using their user-friendly interface. Lastly, submitted forms can be done electronically, saving time and ensuring that your information is submitted securely.

Understanding state-specific requirements for CT-1096

Each state may have unique guidelines affecting the filing of forms like the CT-1096. In Connecticut, businesses and individuals must follow specific rules and regulations for 2024, including any recent updates related to payment reporting. An example of such a requirement is ensuring that all payments made are accurately reported by the designated deadlines to avoid penalties.

Comparing the CT-1096 with other states' filing requirements reveals that while many states have similar forms, the specifics can differ significantly. Therefore, being informed about Connecticut's regulations and preparing to provide any additional supporting documents, such as copies of issued 1099s, will enhance compliance and validation.

Common questions about form CT-1096

Addressing common queries can alleviate the confusion surrounding the CT-1096 form. For example, if you discover an error after filing, it's essential to promptly correct it by submitting an amended CT-1096, along with any necessary supporting documentation to the Connecticut Department of Revenue Services.

Another frequent concern is how long to keep records related to CT-1096. It's advisable to retain these documents for at least three years following the filing date, as the state may request these documents during audits. Additionally, filers should be aware that late filing can lead to penalties, which may include fines or interest on unpaid taxes.

Resources for additional support

For those requiring further assistance with the CT-1096 form, various resources are available. Connecticut State Tax Department contact information is readily accessible for direct inquiries regarding filing. Furthermore, official Connecticut tax resources provide updates and additional clarifications, ensuring that filers stay informed about any changes or common mistakes.

Community forums and support groups can also serve as beneficial platforms to connect with fellow filers who may share insights into their experiences with the CT-1096 form. Utilizing these networks helps build a support system where users can obtain real-world advice.

Conclusion of the filing experience

Successfully navigating the CT-1096 filing process can significantly simplify annual reporting for businesses and individuals alike. With tools like pdfFiller, users can take advantage of their cloud-based platform to manage document needs efficiently. Employing such resources not only enhances compliance but also streamlines future filing experiences.

Encouraging the continued use of digital tools for document management enables users to maintain better control over their financial reporting obligations, leading to more organized and compliant tax practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-1096 to be eSigned by others?

How do I edit ct-1096 in Chrome?

How can I fill out ct-1096 on an iOS device?

What is ct-1096?

Who is required to file ct-1096?

How to fill out ct-1096?

What is the purpose of ct-1096?

What information must be reported on ct-1096?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.