Get the free Seec Form 3 - seec ct

Get, Create, Make and Sign seec form 3

Editing seec form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out seec form 3

How to fill out seec form 3

Who needs seec form 3?

Comprehensive Guide to SEEC Form 3

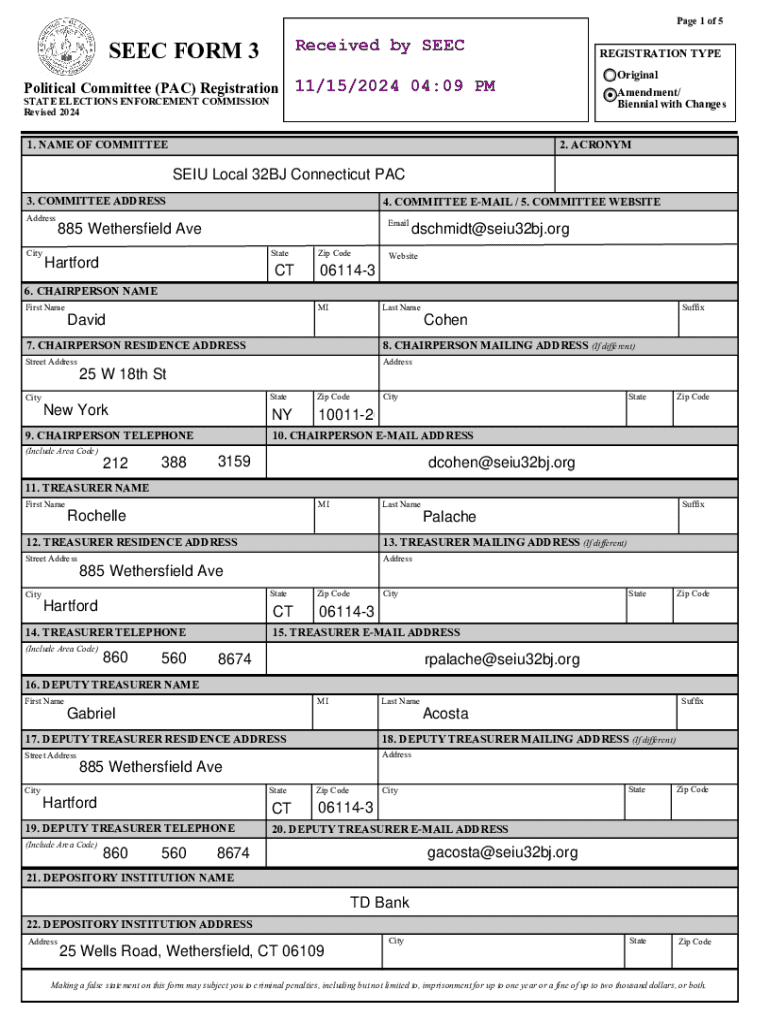

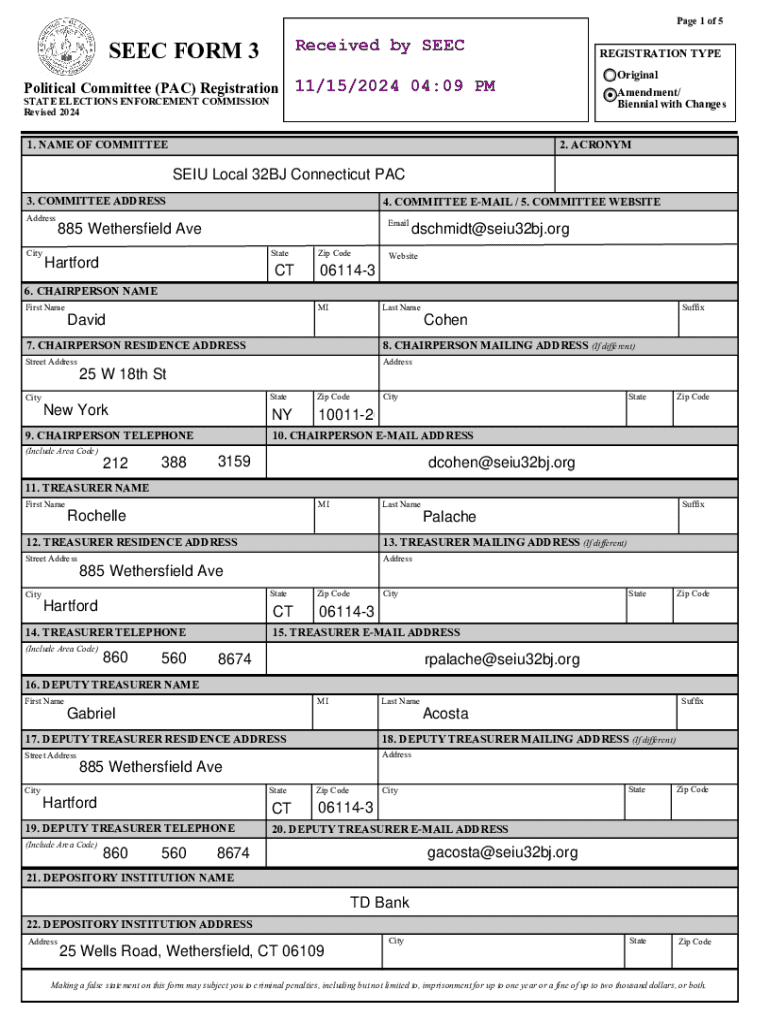

Overview of SEEC Form 3

The SEEC Form 3 serves as a vital compliance tool across numerous sectors, including education and healthcare. Specifically designed to ensure adherence to regulatory standards, the form functions as both a reporting document and a means of accountability. Its role is increasingly significant as organizations strive to meet operational transparency and reporting accuracy requirements.

The importance of the SEEC Form 3 cannot be overstated. It is essential for documenting contributions and expenses linked to campaign finance disclosure statements and ensuring that all relevant financial activities are adequately reported. This ensures that organizations maintain their reputation and comply with the necessary legal frameworks.

Who needs to use SEEC Form 3?

Both individuals and organizations can be required to fill out SEEC Form 3. Individuals who are involved in political campaigns, such as candidates or their campaign managers, must provide detailed financial disclosures. Meanwhile, organizations, especially those linked to political action committees or similar entities, need to ensure all contributions and expenses are accurately reported to remain compliant with financial regulations.

Key components of SEEC Form 3

Understanding the structure of SEEC Form 3 is crucial for accurate completion. The form is divided into several sections, each demanding specific details to effectively report financial activities.

Detailed breakdown of each section

In Section A, common information required includes the name of the candidate or organization, address, and identification numbers. To ensure accuracy, double-check that your details match any official documentation.

Section B’s accuracy is vital as it pertains to financial transparency. Common pitfalls include underreporting contributions or failing to document all sources. It’s advisable to maintain a thorough line list of contributions, checking numbers against receipts for accuracy.

For Section C, filling out expense details requires precision. Best practices involve categorizing expenses clearly to avoid confusion during audits. Examples of completed sections can often be found in accompanying guides or templates.

Required attachments and documentation

Completing the SEEC Form 3 requires certain attachments. Generally, this includes financial statements, a loan line document if applicable, and any relevant correspondence related to the campaign.

Ensure that all documents are compiled in the correct format before submission. Accepted formats typically include both electronic files and paper copies, adhering to guidelines specified by the regulatory body overseeing the form.

Step-by-step instructions for completing SEEC Form 3

A preparation checklist is vital to ensure a smooth completion process. Before starting, gather all necessary documents, such as financial records and previous filings to facilitate filling out each section accurately.

Line-by-line guide

Filling out Section A requires listing your name, address, and position. Make sure that these details match any official documentation. For Section B, document each contribution accurately—with details like the source and amount being critical for compliance.

In Section C, list out campaign-related expenses with clear categorization. Ensure to reference any necessary receipts or supporting documents. This step will make follow-up actions easier should your submission be audited.

Common mistakes to avoid during completion

Frequent errors during the completion of SEEC Form 3 often include missing or incorrect identification numbers and reporting errors in financial contributions. Each mistake can result in complications, including delays in processing or potential legal repercussions. Hence, it’s crucial to double-check every detail before submission.

Editing and signing SEEC Form 3

The role of pdfFiller enhances the experience of editing documents significantly. Users can easily upload the SEEC Form 3, edit text, and adjust any specifics as needed using features like OCR and diverse text editing tools provided within the platform.

eSigning the form is straightforward. By leveraging the electronic signature feature on pdfFiller, users can sign directly within the platform, ensuring both convenience and compliance with legal standards regarding the validity of e-signatures.

Filing and submitting SEEC Form 3

When it comes to submission methods, individuals and organizations can choose between online and paper submissions. The regulatory body typically has a specified portal for electronic submissions, while paper forms must be sent to the correct address based on jurisdiction.

It is advisable to track your submission closely. Processing times can vary, so checking in regularly with the overseeing body can help ensure that your SEEC Form 3 is being processed without issues.

FAQs about SEEC Form 3

Individuals often have queries regarding mistakes that occur during form completion. If you make an error, it’s generally advised to correct it before submitting; however, if submitted, check with the regulatory body for guidance on making amendments post-filing.

Retrieving a submitted form for edits can typically be done through the online portal, depending on the entity’s system. It’s essential to stay aware of the submission guidelines, especially if there are filing fees associated with SEEC Form 3.

Additional tools for managing forms with pdfFiller

pdfFiller offers various tools that simplify document management. Its comprehensive document solutions are designed to cater to users' needs by providing features for form creation, editing, and e-signatures, making it ideal for both individuals and teams.

Collaboration features allow teams to work on forms together, enhancing productivity and efficiency. Automated reminders and tracking functionalities serve to keep users informed about deadlines and submission statuses, ensuring no important steps are missed.

Exploring related forms and templates

Users often encounter other similar forms, such as the SEEC Form 30, which may have different requirements and structures. Understanding how these forms differ can aid in ensuring compliance across various reporting obligations.

pdfFiller efficiently supports diverse document needs, consolidating forms and templates into one accessible platform. This allows users to navigate between various filings seamlessly, ensuring that all documentation remains organized and easily retrievable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send seec form 3 for eSignature?

Can I sign the seec form 3 electronically in Chrome?

How do I fill out seec form 3 on an Android device?

What is seec form 3?

Who is required to file seec form 3?

How to fill out seec form 3?

What is the purpose of seec form 3?

What information must be reported on seec form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.