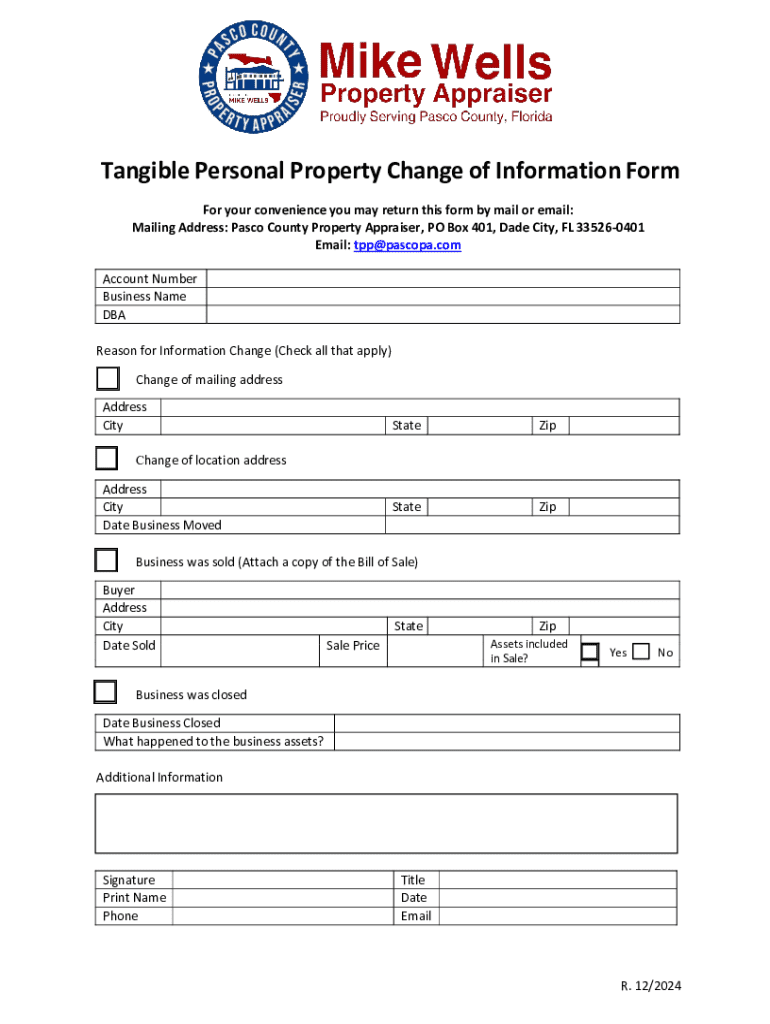

Get the free Tangible Personal Property Change of Information Form

Get, Create, Make and Sign tangible personal property change

Editing tangible personal property change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tangible personal property change

How to fill out tangible personal property change

Who needs tangible personal property change?

Comprehensive guide to completing your tangible personal property change form

Understanding tangible personal property

Tangible personal property refers to physical items that can be touched, moved, and physically possessed, as opposed to intangible assets like stocks or copyrights. Examples include vehicles, furniture, machinery, and electronics. Accurate record-keeping of these assets is essential for several reasons, including tax assessments, insurance claims, and legal disputes.

Maintaining precise and up-to-date records ensures property owners have documentation for tax purposes and other legal requirements. Certain scenarios necessitate notifying local authorities through a tangible personal property change form, such as changes in ownership, relocation of items, or reassessments due to changes in market value.

Overview of the tangible personal property change form

The tangible personal property change form serves a crucial role in facilitating updates regarding ownership and status of personal assets. By completing this form, property owners notify relevant tax authorities or administrative offices about changes that might affect property valuation or registration.

Key components of this form include:

When to use the tangible personal property change form

Understanding when to file the tangible personal property change form is vital for compliance. Several common scenarios require the use of this form, including changes in property ownership, relocating your property to a different address, or making updates due to assessment changes from local tax officials.

A variety of entities can file this form, including:

Step-by-step guide to completing the form

Completing the tangible personal property change form can be straightforward if you follow a structured approach. Start by gathering the necessary information related to the property you wish to update.

Your first task is to identify the property. Collect artifacts that can help substantiate your claims, such as receipts, titles or any documentation indicating ownership. Always confirm the current location of the property before filling out the form.

When filling out the form, follow these steps:

While filling the form, be mindful of common mistakes to avoid, such as providing incomplete information or misidentifying the property type, which could ultimately delay the process.

Submitting your tangible personal property change form

Once your tangible personal property change form is completed, it's crucial to understand how to submit it properly. You can utilize various methods of submission, including online options or traditional mailing. Notably, pdfFiller provides a user-friendly platform for online submission.

Submission methods include:

Keep in mind important submission deadlines that vary by region, as missing these may complicate your property registration. Upon submission, expect confirmation or an acknowledgment, which can be tracked for your records.

Editing and managing your documents with pdfFiller

pdfFiller stands out as a robust solution for handling your tangible personal property change form, offering several benefits. With its cloud-based access, you can manage documents from anywhere, making it especially practical for busy individuals and teams.

Some notable features include:

Editing and signing your form is straightforward in pdfFiller. Start by uploading the form to your account. From there, you can utilize interactive tools to make necessary edits, ensuring that every entry reflects accuracy before final submission. Additionally, pdfFiller offers e-signature options, enhancing the security and authenticity of your form.

FAQs about the tangible personal property change form

As with any administrative form, questions often arise regarding the tangible personal property change form. Here are some frequently asked questions that may help clarify common concerns.

What if I make a mistake after submission? It's advisable to contact the submitting authority to inquire about correcting any errors. Can I track my submission status? Many local governments provide tracking options for submissions. Finally, how do I handle disputes regarding property valuation? This typically involves demonstrating evidence to support your claims, possibly appealing the assessment.

Conclusion

Accurate property records are critical, especially in financial and legal matters. Ensuring your tangible personal property change form is correctly completed and submitted mitigates the risk of potential disputes or financial inaccuracies. Take advantage of pdfFiller to streamline your process, leading to more efficient document management and collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tangible personal property change to be eSigned by others?

How can I edit tangible personal property change on a smartphone?

How do I fill out tangible personal property change using my mobile device?

What is tangible personal property change?

Who is required to file tangible personal property change?

How to fill out tangible personal property change?

What is the purpose of tangible personal property change?

What information must be reported on tangible personal property change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.