Get the free Agency Retirement Savings Plan Application and Instructions

Get, Create, Make and Sign agency retirement savings plan

How to edit agency retirement savings plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out agency retirement savings plan

How to fill out agency retirement savings plan

Who needs agency retirement savings plan?

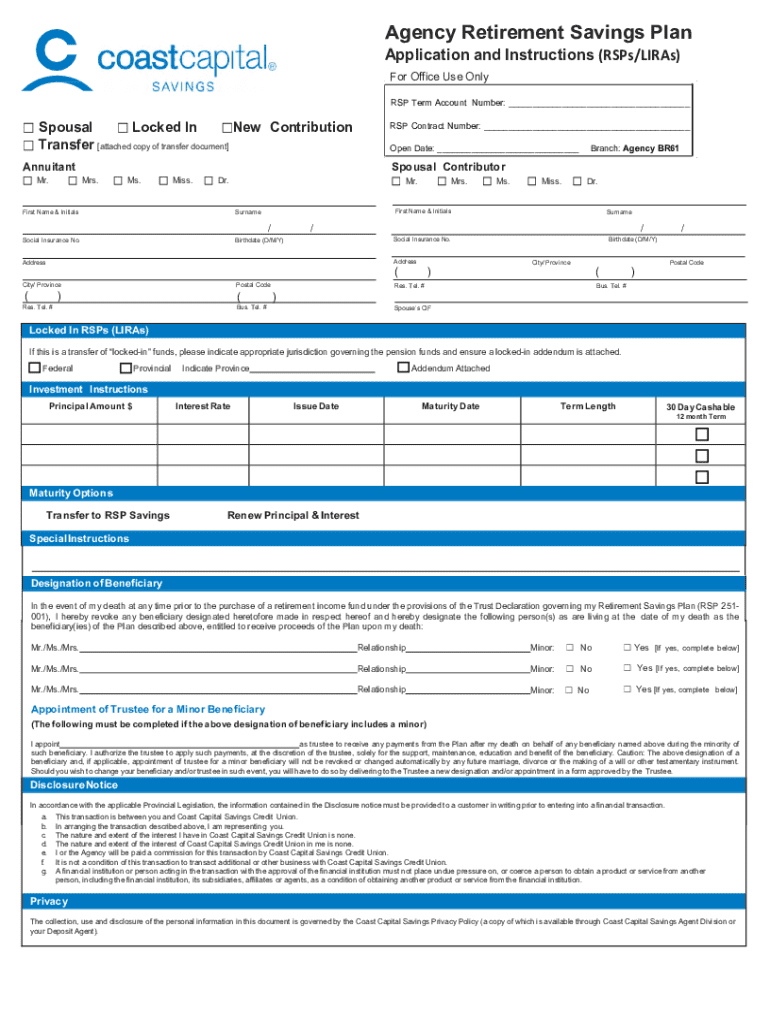

Comprehensive Guide to the Agency Retirement Savings Plan Form

Understanding the Agency Retirement Savings Plan

An Agency Retirement Savings Plan is a structured savings program designed to help employees of government agencies and organizations prepare for retirement. Its primary purpose is to educate and assist users in saving systematically over their working years, resulting in a more secure financial future during retirement.

Eligibility for participation in this plan generally includes all employees of the agency who meet certain requirements, which may include length of service, employment status, and full-time versus part-time work. It's vital for potential participants to review the specific eligibility criteria detailed in their agency’s retirement plan documentation.

Key components of the Agency Retirement Savings Plan Form

The Agency Retirement Savings Plan Form serves as a critical document for documenting and managing an employee’s contributions to their retirement savings account. The form is structured to capture essential information that the agency needs to process contributions effectively.

It requires personal information, such as your name and address, along with your Social Security number, which is crucial for tax reporting purposes. Additionally, employment information like your agency, position, and hire date must be provided, ensuring accurate record-keeping linked to your employment.

Step-by-step guide to completing the Agency Retirement Savings Plan Form

Completing the agency retirement savings plan form requires attention to detail and careful organization. Follow this step-by-step guide to ensure you navigate the process smoothly.

Common errors to avoid when completing the form

Mistakes in the agency retirement savings plan form can lead to delays in processing or improper contributions. Awareness of common pitfalls is essential.

Editing and submitting your Agency Retirement Savings Plan Form

Utilizing pdfFiller’s tools can simplify the editing and submission process for your Agency Retirement Savings Plan Form. This user-friendly platform offers features that enhance your experience.

With pdfFiller, you can efficiently edit your documents, ensuring that all required fields are correctly filled out before submission. Additionally, the cloud-based nature of the platform means you can work on your form from anywhere, making adjustments as needed.

Managing your Agency Retirement Savings Account post-submission

Post-submission, managing your retirement savings account is crucial for maximizing growth and ensuring you remain on track toward your retirement goals. Regular monitoring of contributions is essential.

Accessing and updating your information through pdfFiller means that you are never out of touch with your retirement plan. Resources for retirement planning and investment strategy can help you make informed decisions regarding your savings.

Frequently asked questions (FAQs) about the Agency Retirement Savings Plan

Understanding the intricacies of the Agency Retirement Savings Plan can prompt several questions. Let’s explore some frequently asked questions to clarify common concerns.

Interactive tools available on pdfFiller for Agency Retirement Savings Plan

pdfFiller offers a suite of interactive tools that enhance user experience when filling out and managing the Agency Retirement Savings Plan Form. These features aim to simplify the document management process.

Conclusion on the importance of the Agency Retirement Savings Plan

The Agency Retirement Savings Plan is a foundational tool in ensuring long-term financial security for employees nearing retirement. By being proactive and engaging with the plan, employees can build a substantial nest egg that supports their lifestyle once retired.

Utilizing available resources, like pdfFiller, for effective management makes navigating the complexities of retirement saving easier, empowering you to take charge of your financial future.

Resources for further learning and support

Whether you need help filling out the Agency Retirement Savings Plan Form or are looking for more information, various resources are available. Visit pdfFiller’s knowledge base for templates, guides, and tools to make your retirement planning smoother.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute agency retirement savings plan online?

How do I make edits in agency retirement savings plan without leaving Chrome?

How do I edit agency retirement savings plan straight from my smartphone?

What is agency retirement savings plan?

Who is required to file agency retirement savings plan?

How to fill out agency retirement savings plan?

What is the purpose of agency retirement savings plan?

What information must be reported on agency retirement savings plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.