Get the free Change of Ownership/tax Information Change Form

Get, Create, Make and Sign change of ownershiptax information

How to edit change of ownershiptax information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of ownershiptax information

How to fill out change of ownershiptax information

Who needs change of ownershiptax information?

Change of Ownership Tax Information Form: A Comprehensive Guide

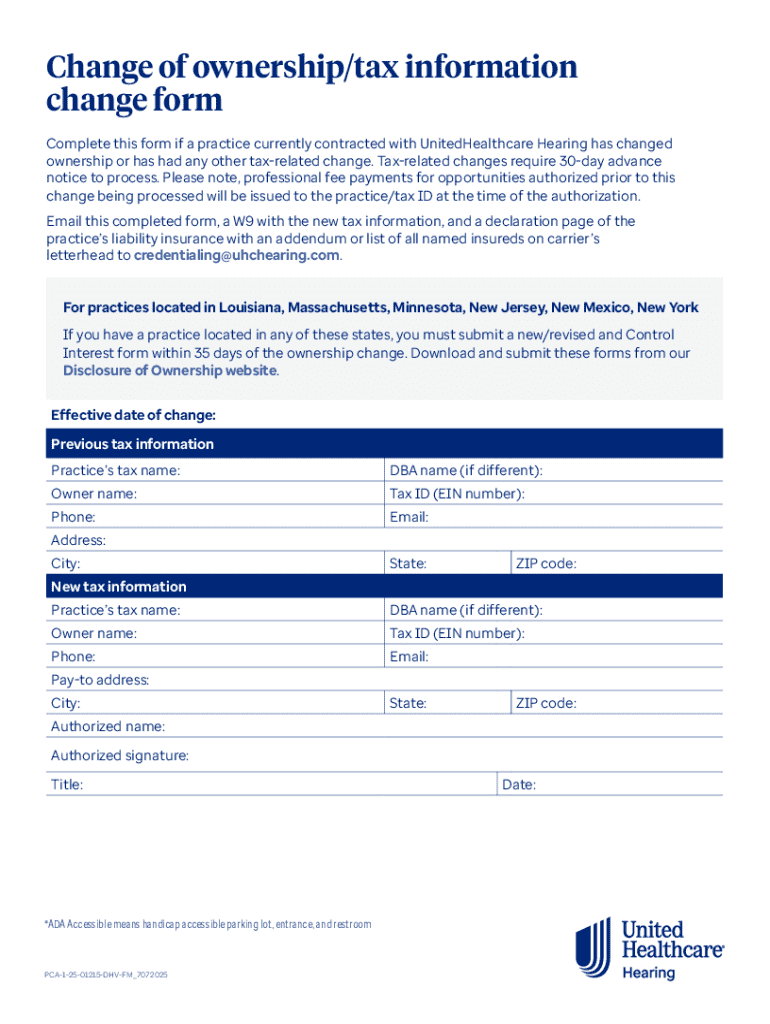

Understanding the change of ownership tax information form

The Change of Ownership Tax Information Form is essential for notifying local tax authorities of any changes in property ownership. This form provides updated information regarding ownership transfers, which is vital for the accurate assessment of property taxes.

Notably, this form plays a critical role in ensuring that tax records remain current. When property ownership changes—whether through sale, inheritance, or gifting—the tax implications may differ significantly. Failing to submit this form can lead to inaccuracies in tax assessments and potential penalties.

Who needs to fill out the form?

Filling out the Change of Ownership Tax Information Form is usually required for both individuals and entities involved in varying property transfer scenarios. Sellers must complete the form during a sale, while heirs will need it in case of property inheritance, and individuals gifting property to another party also have obligations here.

Specific requirements may vary based on the nature of the change in ownership. For example, a sale may require additional documentation related to the sale agreement, while inherited property necessitates proof of inheritance such as a will or trust document. Understanding who must collect and submit this form is crucial for compliance.

Detailed breakdown of the form sections

The Change of Ownership Tax Information Form comprises several sections, each requiring specific details. Understanding each part can simplify the completion process and improve data accuracy.

Personal information section

In the personal information section, you will be required to provide your full name, address, and contact information. It's essential to ensure that these details match your identification documents for verification purposes.

Supporting documentation, such as a government-issued ID, can help when verifying identity, especially in cases where names or addresses may have changed.

Property information section

This section involves detailing the property type, whether it's residential or commercial. You will also need to provide property descriptions, street addresses, and identification numbers, like the parcel number or tax identification number. This data is crucial for local tax authorities to accurately assess property tax obligations.

Nature of ownership change

It is imperative to clearly define the nature of the ownership change. This involves selecting the type from categories such as sale, inheritance, or gift, each requiring specific details. For instance, if the change stems from a sale, such supporting documents as a purchase agreement should be included.

Step-by-step instructions for completing the form

Completing the Change of Ownership Tax Information Form may seem daunting, but with a systematic approach, it can be manageable. Start by gathering the necessary documents to ensure that all required information is available.

When filling out each section, read the instructions carefully. Utilize additional space provided for explanations, especially when circumstances are complex. Avoid common mistakes such as mismatched names or incorrect property identification numbers, as these can delay processing.

Once completed, it's crucial to review all the information for accuracy. Double-check each entry to ensure that there are no errors that could cause complications later.

eSigning and submitting your form online

Utilizing services like pdfFiller allows for the seamless eSigning of your Change of Ownership Tax Information Form. ESigning offers a secure and accessible way to finalize your document without printing or scanning.

To eSign your form in pdfFiller, simply upload your completed file, select the eSign option, and follow the prompts to add your signature electronically. This ensures compliance with local eSignature laws and simplifies the submission process.

After eSigning, confirm that your submission meets local guidelines—this may vary by jurisdiction. Ensure that submitted forms are sent to the correct local taxing authority or through established online portals, if available.

FAQs about the change of ownership tax information form

Many questions arise concerning the Change of Ownership Tax Information Form, particularly about timelines and the accuracy of entries. It's essential to understand that submission deadlines vary by jurisdiction, so checking with local tax authorities is crucial.

In case of mistakes on the form, promptly notify the tax office and submit a corrected form. Local regulations often allow you to amend your submission to rectify errors while avoiding penalties. Furthermore, understanding where to submit your form, whether by mail or electronically, is fundamental in ensuring timely processing.

Additional tools and features offered by pdfFiller

Using pdfFiller enhances the experience of managing your Change of Ownership Tax Information Form through interactive tools. These tools allow users to edit documents easily, collaborate with others, and store files securely in the cloud.

The platform also enables users to create templates for related documentation, streamlining workflow processes significantly. For instance, if you frequently deal with various tax forms, having customizable templates on hand can significantly speed up future submissions.

Support and resources for completing the form

Support for completing the Change of Ownership Tax Information Form can be readily obtained through various sources. Local tax authorities often have dedicated support lines or online resources to assist with any queries about filling out the form or clarifying submission guidelines.

Additionally, pdfFiller provides customer support that can troubleshoot form-related issues, offer guidance, or connect you with the right templates tailored to your needs. Networking with others through community forums can also yield valuable insights, as many have navigated similar situations.

Navigating the process after submission

Once your Change of Ownership Tax Information Form is submitted successfully, it's important to understand the next steps in the process. Typically, the local tax authority will assess the property value based on the new ownership details provided in the form.

Expect communication regarding any changes in tax assessments based on the submission. Depending on local regulations, timelines for assessments and any potential follow-up actions may vary, so it’s advisable to keep track of any correspondence with the tax authority.

Related tax information forms to consider

In addition to the Change of Ownership Tax Information Form, there are several other tax forms related to property transfer that you may need to consider. Familiarizing yourself with these forms can often help streamline related processes during property transactions.

Pay attention to seasonal considerations, as tax regulations can shift based on policies that change regularly. For example, some jurisdictions may require additional disclosures during tax season, making it essential to stay updated on any modifications to related documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send change of ownershiptax information for eSignature?

How do I make changes in change of ownershiptax information?

How can I edit change of ownershiptax information on a smartphone?

What is change of ownership tax information?

Who is required to file change of ownership tax information?

How to fill out change of ownership tax information?

What is the purpose of change of ownership tax information?

What information must be reported on change of ownership tax information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.