Get the free mo 1120s instructions 2024

Get, Create, Make and Sign mo 1120s instructions 2024

Editing mo 1120s instructions 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo 1120s instructions 2024

How to fill out mo-1120s

Who needs mo-1120s?

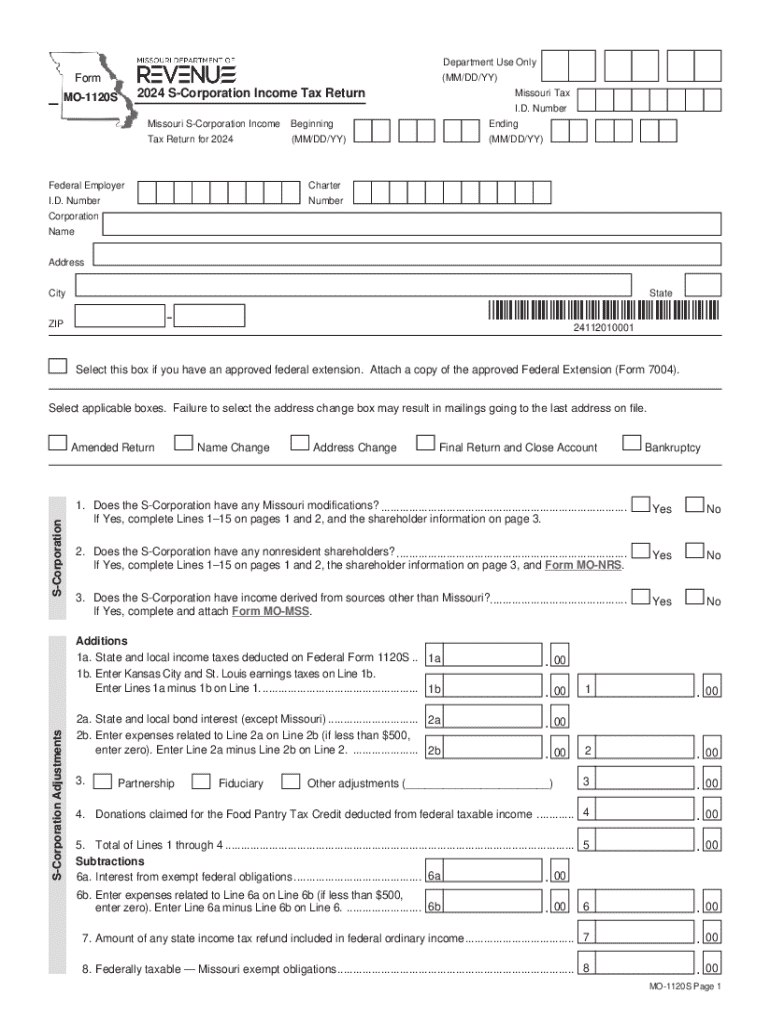

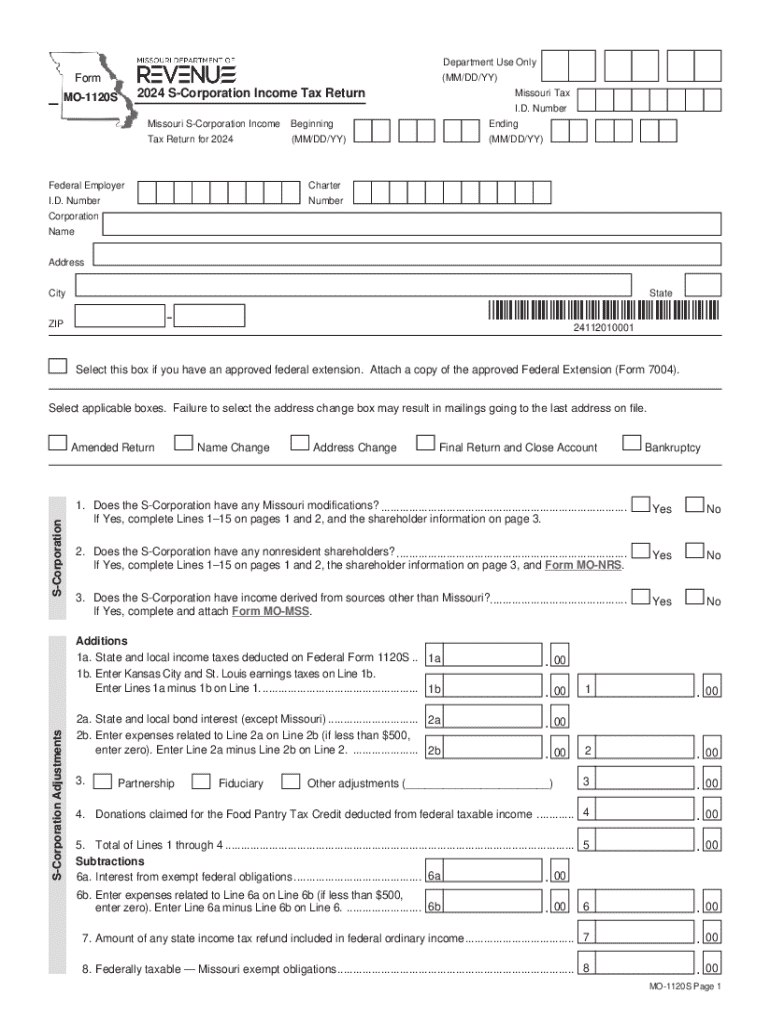

Guide to the MO-1120S Form: Essential Insights and Instructions

Understanding the MO-1120S Form

The MO-1120S Form is a crucial document for S Corporations operating in Missouri. This form serves multiple purposes, primarily enabling these corporations to report their income, deductions, and other essential information to the Missouri Department of Revenue. It is significant not only for compliance but also for allowing S Corporations to pass through their income to shareholders without facing double taxation, which is a unique advantage in comparison to C Corporations.

Filing the MO-1120S Form correctly is vital for the financial health of your business. Even a minor mistake can lead to complications, including audits or penalties. Understanding its nuances can greatly simplify your tax process, making it a necessary step for organizational success.

Who needs to file the MO-1120S Form?

Eligibility for filing the MO-1120S Form primarily includes domestic S Corporations that operate in Missouri. Key eligibility criteria involve having an active S Corporation status, which requires at least 100 shareholders, all of whom must be U.S. citizens or residents, and only one class of stock. However, certain corporate entities, such as banks, insurance companies, and international entities, are typically exempt from filing this form.

Key features of the MO-1120S Form

The MO-1120S Form has a structured format, divided into various sections that require specific information from S Corporations. Understanding the form structure helps in efficient filling. Typical sections include general information about the corporation, income reporting, deductions, and credits. Accurate completion is essential to avoid delays in processing your submission.

Additionally, keeping track of filing deadlines is critical. S Corporations must ensure they file the MO-1120S Form by the due date, usually the 15th day of the third month following the end of their tax year. Failing to meet this deadline can result in penalties, making it crucial to have a system for monitoring these important dates.

Step-by-step instructions for completing the MO-1120S Form

Completing the MO-1120S Form can initially seem daunting. Following a structured approach makes the process manageable. The first step is gathering all necessary information and documents, such as financial records, income statements, and balance sheets. You’ll also need essential identification numbers, including your Employer Identification Number (EIN) and business details.

Step 1: Gather necessary information and documents

Essential documents include financial statements and tax records. Ensure you have the following:

Step 2: Fill out general information section

In the general information section, you need to provide details like the corporation's name, address, and EIN. Common mistakes include typos in the tax ID or forgetting to sign the form. Double-check your entries to minimize errors.

Step 3: Report income

Accurate income reporting is essential. Break down different income types: ordinary income, capital gains, and other relevant revenues. Each category should be clearly documented and aligned with your financial statements.

Step 4: Deductions and credits

You can claim certain allowable deductions like business expenses, employee wages, and operational costs. Additionally, investigate available credits that your S Corporation may qualify for, which can significantly reduce your overall tax liability.

Step 5: Calculate tax liability

Calculating your tax obligations involves summing your total income and subtracting allowable deductions. Utilizing tools available through pdfFiller can simplify this task, ensuring accuracy and clarity in your tax calculations.

Step 6: Review and validate your form

Thoroughly review your completed form for inconsistencies. Errors can trigger audits or processing delays. Utilizing pdfFiller's error-checking tools can aid in validating your entries and ensuring you have met all requirements before submission.

Submitting your MO-1120S Form

Once the MO-1120S Form is completed, it is time to submit it. Several submission methods exist, providing flexibility depending on your preference. You can choose to electronically submit your form through pdfFiller's platform or print and mail it directly to the appropriate state department.

Various submission methods

For electronic submissions, pdfFiller offers a straightforward process where users can fill out the form interactively and submit it seamlessly. On the other hand, if you prefer traditional methods, you can print the completed form and mail it to the Missouri Department of Revenue.

Confirmation of submission

Post-submission, confirming the receipt of your form is pivotal. Check for confirmation emails or notifications through pdfFiller. If confirmation is not received within a reasonable timeframe, it’s advisable to follow up with the revenue department to ensure your submission was successful.

Post-filing: What to expect

After submitting the MO-1120S Form, it's important to track your submission status. You can usually verify your status online through the Missouri Department of Revenue’s website. Being proactive in this area helps mitigate any future issues.

Handling potential audits or inquiries

In the unlikely event that your submission triggers an audit or inquiry, preparation is the key. Gather all relevant documents and communicate openly with the auditors. Resources offered by pdfFiller can assist in audit preparedness, offering guidance on best practices and documentation management.

Frequently asked questions about the MO-1120S Form

To address common concerns regarding the MO-1120S Form, many users often inquire about filing issues and the specificity of eligibility criteria. Common questions relate to deduction eligibility and proper completion of the various form sections.

Contact information for further assistance

For further assistance, users can access resources provided by the Missouri Department of Revenue, including FAQs and contact details. Additionally, pdfFiller’s customer support is readily available to assist with any form-related queries, enhancing your filing experience.

Utilizing pdfFiller for your filing needs

pdfFiller offers a comprehensive document management solution tailored for handling the MO-1120S Form. With its cloud-based access, users can draft, edit, and manage documents seamlessly from any location, making it perfect for busy professionals.

Features of pdfFiller relevant to the MO-1120S Form

Some standout features include eSignature capabilities, enabling quicker approvals and submissions. Collaboration tools allow teams to work together efficiently on the form, ensuring all inputs are captured correctly. Moreover, secure storage solutions keep your sensitive documents safe.

Benefits of using pdfFiller for your S Corporation financial management

Using pdfFiller streamlines the financial management process by reducing the time spent on paperwork. The platform’s interactive nature ensures that you can adjust documents in real-time, reducing errors and speeding up the filing process. This collaborative environment supports teamwork, making the annual filing process less burdensome.

Related forms and documents

S Corporations may also need to be aware of other relevant forms, such as the MO-1120 for C Corporations and various tax-related documents that vary by state. Understanding these forms ensures compliance and efficient tax management.

Tools for finding other necessary forms

pdfFiller provides an interactive form finder resource that helps users identify and access the necessary forms easily, avoiding confusion and ensuring that no essential documents are overlooked.

Tips for efficient document management

Organizing business forms is vital for S Corporations. Create a filing system that enables easy access to completed documents and ensure that all files are stored logically. Digital document management can greatly reduce physical clutter and enhance security.

Leveraging technology, such as pdfFiller, streamlines the filing process through automatic reminders and collaborative features. Keeping compliant with state regulations is much easier when you implement a proactive approach towards document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mo 1120s instructions 2024 online?

Can I create an electronic signature for the mo 1120s instructions 2024 in Chrome?

Can I create an eSignature for the mo 1120s instructions 2024 in Gmail?

What is mo-1120s?

Who is required to file mo-1120s?

How to fill out mo-1120s?

What is the purpose of mo-1120s?

What information must be reported on mo-1120s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.