Get the free Beneficiary Selection Form - Option D

Get, Create, Make and Sign beneficiary selection form

Editing beneficiary selection form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary selection form

How to fill out beneficiary selection form

Who needs beneficiary selection form?

Beneficiary selection form - How-to guide

Understanding the importance of beneficiary selection

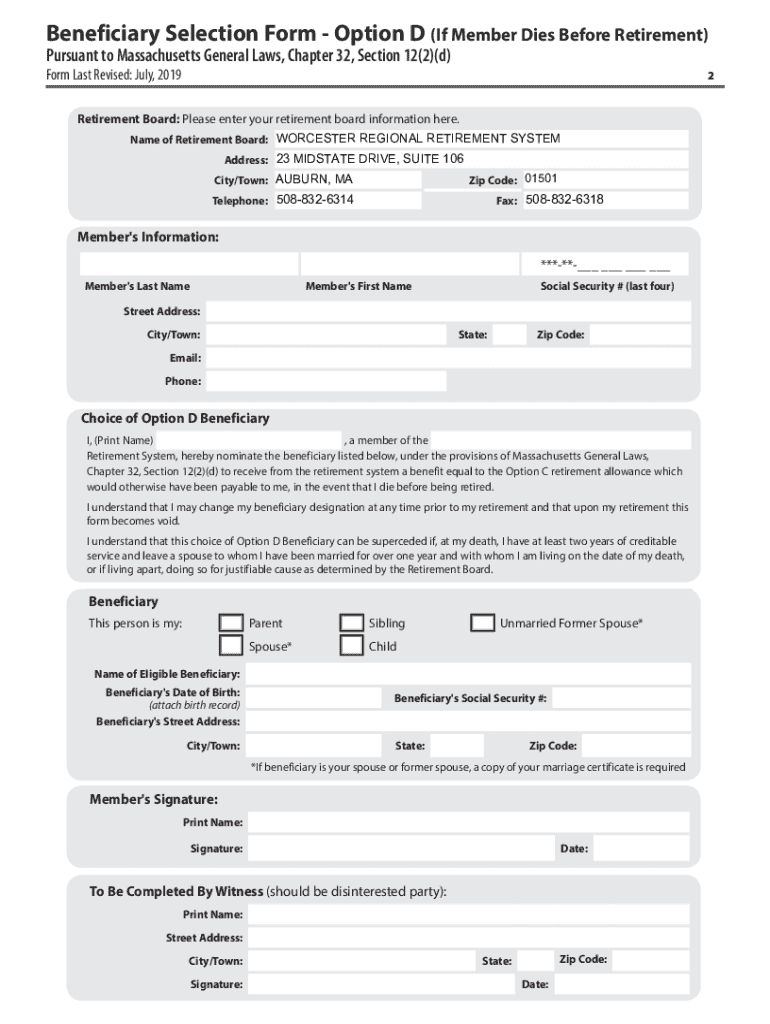

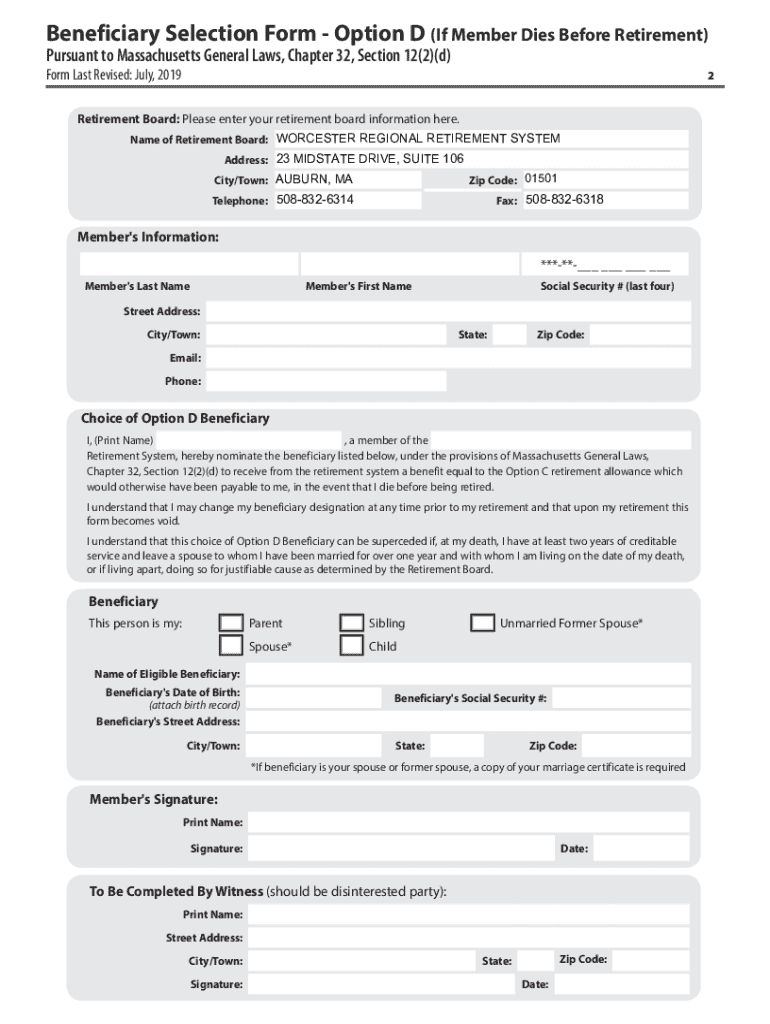

A beneficiary selection form is a crucial document used to designate individuals or entities as recipients of your assets upon your passing. This could pertain to life insurance payouts, retirement accounts, or other financial assets. Understanding this form is key, as it plays a significant role in ensuring your intentions for asset distribution are honored.

Beneficiary designation is critical in financial planning because it provides clarity on who will inherit your estate, significantly impacting your loved ones' financial stability. By failing to fill out a beneficiary selection form properly, you risk leaving your assets in limbo due to probate, where state laws dictate how your assets are distributed rather than your personal wishes.

Moreover, beneficiary selection directly affects estate planning. It allows you to avoid probate, saving time and potentially reducing taxes. Choosing the right beneficiaries ensures that your legacy is effectively managed according to your desires, rather than by court-appointed administrators.

Key components of a beneficiary selection form

A beneficiary selection form typically requires essential information to ensure clarity and accuracy. Some of the key components include:

Understanding the difference between types of beneficiaries is also crucial. Primary beneficiaries are the first in line to receive the assets, while contingent beneficiaries receive assets only if the primary beneficiaries cannot. Additionally, beneficiaries can be individuals or entities, like organizations or trusts, which could have implications for tax management and asset allocation.

Step-by-step guide to completing your beneficiary selection form

Before filling out your beneficiary selection form, preparation is key. Start by gathering necessary documents, such as Social Security numbers, dates of birth for beneficiaries, and details about the assets involved. This preparation ensures that you have accurate and comprehensive information.

It's often advisable to consult with financial advisors or legal professionals who can guide you through the complexities of beneficiary designations. They can provide insights specific to your financial situation and goals.

When filling out the form, follow these detailed instructions:

After completing the form, review it thoroughly for accuracy and completeness. If you are using pdfFiller, editing is straightforward; you can make necessary corrections directly online, ensuring your document is in perfect order.

Managing your beneficiary designations over time

Your beneficiary selection form should not be a static document. Life changes often necessitate updates; events like marriage, divorce, or the birth of a child can significantly impact who you wish to designate as your beneficiary. Additionally, fluctuations in your financial situation or the changing financial needs of your beneficiaries warrant reviewing and potentially revising your selections.

Using pdfFiller simplifies the process of updating your beneficiary selection form. To make changes, simply access your existing forms from the cloud-based platform and edit the necessary sections. Features such as easy access, version control, and sharing options make it a valuable tool for managing your beneficiary designations effectively.

Special considerations for different groups

If you are an active employee, it's crucial to be aware of specific policies regarding beneficiary designations that may vary by employer. Many companies provide resources through their HR departments to help employees fill out necessary forms correctly. Often, they have guidelines tailored to group life insurance benefits or retirement accounts like the Thrift Savings Plan.

For federal retirees or recipients of federal compensation, understanding unique guidelines affecting your benefits is essential. Federal regulations often dictate how designations are managed, and failure to comply can result in complications or delays in accessing those benefits for your loved ones.

Common questions about beneficiary selection

It's common to have questions while navigating beneficiary designations. A primary query is, 'Who can be designated as a beneficiary?' Generally, individuals (family, friends) and entities (charities, trusts) can be chosen. However, specific rules may vary by asset type and state laws.

Another frequent concern is, 'What happens if no beneficiary is designated?' In such cases, state laws will dictate asset distribution, often leading to probate, which can delay the process and increase costs. Additionally, conflicting beneficiary designations can create a complex legal situation, often resulting in disputes among heirs. It's critical to ensure your designations are clear and consistent across all documents.

Legal implications of beneficiary designations

Beneficiary designations carry significant legal implications. Each state has differing laws governing how beneficiary designations are treated, and understanding these is essential to ensure your designations are valid and enforceable. Legal binding typically requires that the designation is in writing, and some jurisdictions may require notarization or witness signatures, particularly for larger estate assets.

To ensure your designations are legally binding, confirm that the beneficiary selection form meets state requirements. Working with a legal professional can help navigate these implications, ensuring that your intentions regarding asset distribution are clear and enforceable.

Best practices for maintaining up-to-date beneficiary records

Keeping your beneficiary records up to date is an ongoing responsibility. One best practice is to review your designated beneficiaries at least annually or during major life changes. Regular audits ensure that your selections align with your current wishes and financial status.

Utilizing cloud-based solutions like pdfFiller enables convenient access to your documents, allowing for easy updates and management. Additionally, maintaining the confidentiality of your beneficiary information is crucial; limit access to this information and ensure all documents are stored securely.

Navigating related forms for beneficiary designations

In addition to beneficiary selection forms, other relevant estate planning forms may be necessary, including wills, testaments, and powers of attorney. Each plays a critical role in your overall estate plan and interacts with your beneficiary designations.

Using pdfFiller simplifies the process of accessing and filling out these related forms. The platform provides a suite of templates that streamline document creation and management, ensuring you have everything needed for comprehensive estate planning.

Conclusion: Empower yourself with effective beneficiary selection

A well-completed beneficiary selection form is vital not only for your peace of mind but also for the financial security of your estate and loved ones. Thorough understanding and proper adherence to the steps outlined can significantly ease the complexities surrounding beneficiary designations.

Continuous learning and careful management of your documents via platforms like pdfFiller will empower you to make informed decisions regarding your asset distribution, ensuring your intentions for legacy and care are clearly expressed and respected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiary selection form directly from Gmail?

How can I send beneficiary selection form to be eSigned by others?

How do I edit beneficiary selection form on an iOS device?

What is beneficiary selection form?

Who is required to file beneficiary selection form?

How to fill out beneficiary selection form?

What is the purpose of beneficiary selection form?

What information must be reported on beneficiary selection form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.