Get the free Mis 4252

Get, Create, Make and Sign mis 4252

Editing mis 4252 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mis 4252

How to fill out mis 4252

Who needs mis 4252?

Your Ultimate Guide to the MIS 4252 Form

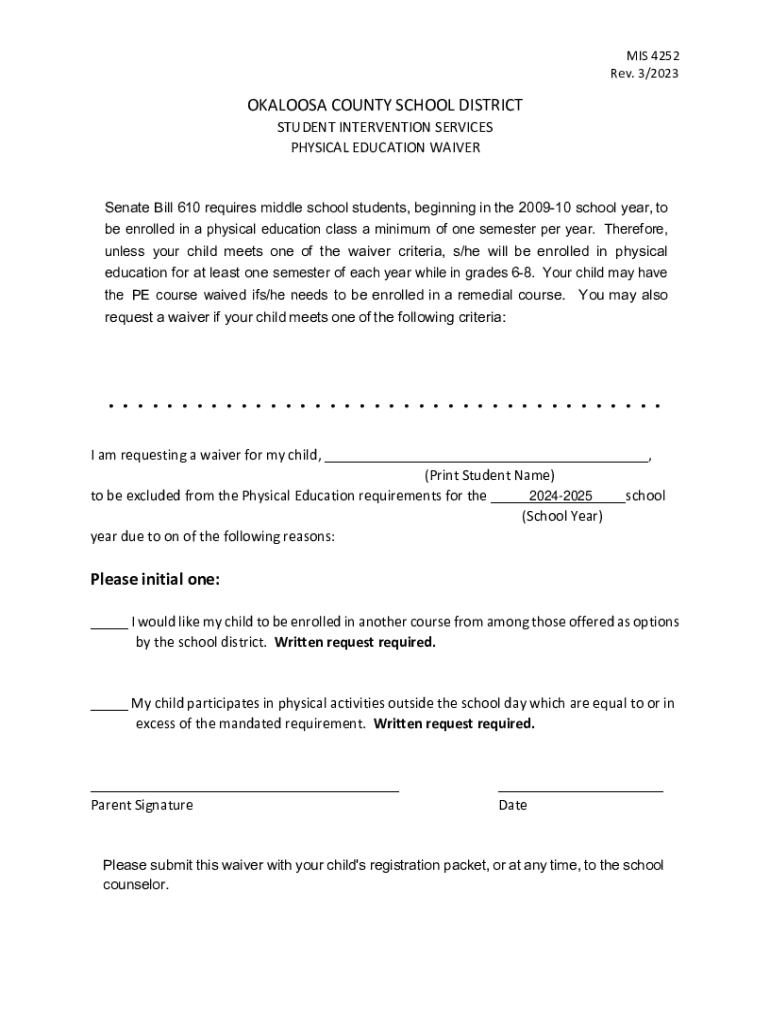

Understanding the MIS 4252 form

The MIS 4252 form is an essential document used in various financial and administrative processes, primarily aimed at collecting key financial data. Its main purpose is to provide a standardized method for reporting information that can easily be interpreted by financial institutions and government bureaus. Understanding the nuances of the MIS 4252 form is crucial for both individuals and businesses who navigate compliance and reporting requirements regularly.

The significance of the MIS 4252 form cannot be overstated, as it serves as a benchmark for accuracy in financial reporting. Whether you're a small business owner or a financial analyst, correctly utilizing this form can impact decision-making processes and audits. Common scenarios where the MIS 4252 form comes into play include tax reporting, loan applications, and financial audits.

Key components of the MIS 4252 form

Structurally, the MIS 4252 form is divided into several sections, each designed to capture specific types of information. It's important to familiarize yourself with these components to fill out the form correctly and efficiently.

Step-by-step instructions for filling out the MIS 4252 form

Filling out the MIS 4252 form may seem daunting, but with a careful, structured approach, it becomes manageable. Begin by gathering all necessary documentation to ensure accuracy.

3.1 Gathering required information

You'll want to collect tax documents, income statements, and any other relevant financial records before you start. Verifying the accuracy of these documents is essential, as discrepancies can lead to complications.

3.2 Completing Section A: Identification Information

In this section, pay special attention to your name, address, and identification number. Ensuring these fields are accurate will streamline the processing of your form and minimize the risk of rejection. Double-check spelling and formatting.

3.3 Filling Section B: Income Details

This section is where you list all income sources. You'll need to provide detailed figures. Utilizing tools like pdfFiller can simplify data entry, allowing you to focus on accuracy rather than format.

3.4 Completing Section : Miscellaneous Information

Use this area to add any additional context that might be important for the reviewer. Important considerations include potential deductions or unique circumstances that might influence your financial status.

3.5 Reviewing your form before submission

Before you hit the submit button, review the form thoroughly. A checklist of key elements to double-check includes:

Editing and managing your MIS 4252 form with pdfFiller

pdfFiller provides a robust platform for managing your MIS 4252 form. One of its significant features is the editing capabilities that help maintain your document's integrity while making necessary changes.

4.1 Using pdfFiller’s illustration tools

Modifying your MIS 4252 form can be done effortlessly with tools designed specifically for PDF editing. By using features like drag-and-drop, you can easily rearrange text and images, ensuring that your form reflects the most accurate information.

4.2 Saving and retrieving edited forms

One of the advantages of using a cloud-based platform is the ability to access your forms anytime, anywhere. With pdfFiller, you can save your MIS 4252 form in the cloud and retrieve it as needed, which significantly reduces the risk of losing important documents.

eSigning the MIS 4252 form with pdfFiller

eSigning adds an additional layer of convenience and security when submitting your MIS 4252 form. Understanding the eSignature process will save time and enhance compliance.

5.1 Understanding the eSignature process

eSignatures are legally binding in most jurisdictions, making them a reliable alternative to traditional signatures. pdfFiller ensures that all eSigned documents meet legal requirements.

5.2 Steps to eSign your completed form

To eSign your MIS 4252 form:

5.3 Legal validity of eSigned documents

The legal standing of eSigned documents allows users to conduct business without the delays often associated with paperwork. Familiarize yourself with local laws to ensure compliance.

Common mistakes and how to avoid them

Even seasoned users can make errors while completing the MIS 4252 form. Identifying frequent pitfalls can save you from potential setbacks.

Preventative measures include drafting your entries on paper beforehand, creating checklists, and using the functionalities offered by pdfFiller to streamline the process.

Troubleshooting submissions and grievances

During the submission process, you might encounter issues leading to rejection of your MIS 4252 form. Knowing how to troubleshoot these problems can expedite resolution and ensure compliance.

Various resources are available through pdfFiller to assist with any grievances surrounding the MIS 4252 form.

Collaborating on the MIS 4252 form with your team

For businesses, collaboration on documents like the MIS 4252 form can foster better data accuracy and streamline the completion process. pdfFiller's collaboration tools make this possible by allowing multiple users to engage with the document.

Frequently asked questions about the MIS 4252 form

Users often have questions when dealing with the MIS 4252 form. Here are some of the most frequently asked queries and valuable tips from experienced users.

Additional considerations for effective document management

Effective document management goes beyond filling out forms; it requires the establishment of best practices that ensure compliance and organization.

Incorporating these best practices will not only enhance your document management but also streamline the processes necessary for robust financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the mis 4252 form on my smartphone?

How do I complete mis 4252 on an iOS device?

How do I edit mis 4252 on an Android device?

What is mis 4252?

Who is required to file mis 4252?

How to fill out mis 4252?

What is the purpose of mis 4252?

What information must be reported on mis 4252?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.