Get the free Ct-240

Get, Create, Make and Sign ct-240

Editing ct-240 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-240

How to fill out ct-240

Who needs ct-240?

CT-240 Form: How to Guide

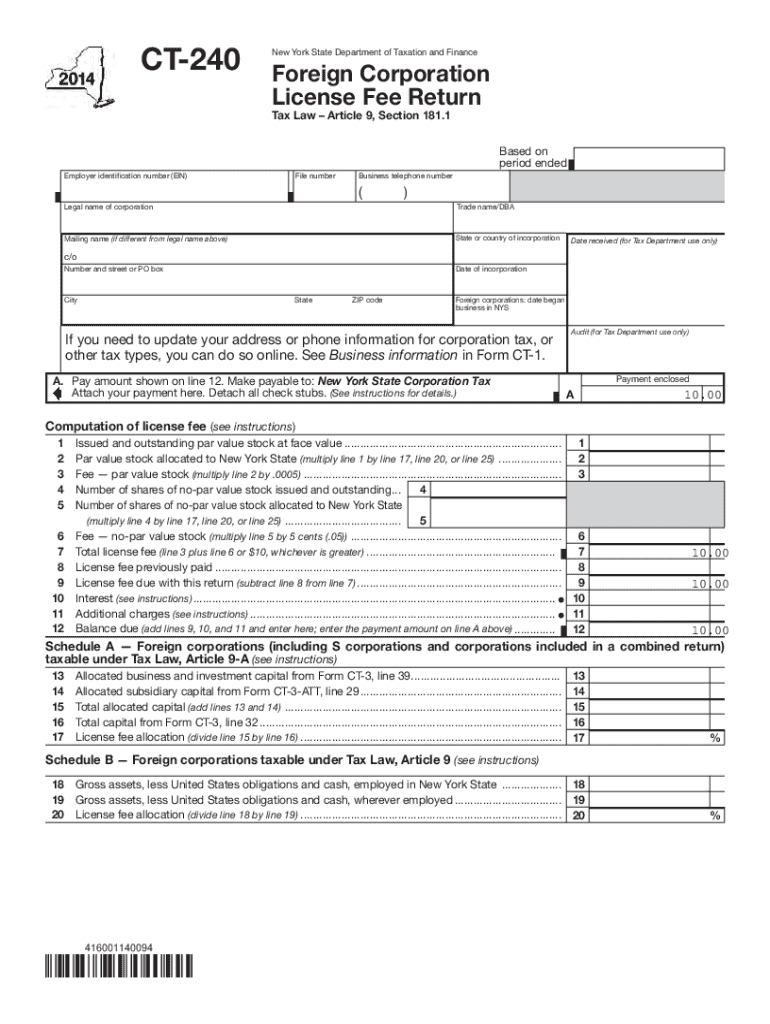

Understanding the CT-240 form

The CT-240 form is a key document used in the Connecticut tax filing process, specifically designed for certain corporations and partnerships operating within the state. This form plays a pivotal role in determining business tax liabilities in Connecticut, outlining the financial data required for accurate tax computation. An in-depth understanding of the CT-240 form is essential for businesses to not only ensure compliance with state laws but also to optimize their tax position.

Filing the CT-240 is crucial for both individual taxpayers who operate as sole proprietors and business entities such as corporations and partnerships. By accurately completing this form, businesses can claim deductions and credits and report their taxable income correctly, significantly affecting their overall tax burden.

Key features of the CT-240 form

The CT-240 form consists of several sections, each designed to collect specific information critical for determining tax liabilities. The identification information section requires basic details about the business, including the legal name, address, and Employer Identification Number (EIN). This basic data establishes the identity of the taxpayer responsible for the submission.

The financial data requirements section demands comprehensive reporting of income, expenses, and applicable deductions. Understanding common terms such as 'taxable income,' which refers to the income subject to tax after deductions, is essential for accurate reporting.

Step-by-step instructions for completing the CT-240 form

Completing the CT-240 form accurately requires careful preparation and attention to detail. Follow these steps to ensure a thorough submission.

Step 1: Gathering required documentation

Before you start filling out the CT-240 form, gather all necessary documentation. This includes your previous year's tax returns, financial statements, and records of income and expenses. Having this information at hand simplifies the reporting process and minimizes the risk of errors.

Step 2: Filling out the identification section

Begin by entering your company details accurately in the identification section. Include your legal business name, address, and EIN. Ensure that all information matches your records to prevent submission issues.

Step 3: Entering financial information

Next, report your financial information. Provide accurate totals for your income and expenses. It’s critical to understand each line item on the form, largely because incorrect reporting could lead to audits or penalties. Also, calculate your taxable income carefully to reflect deductions and credits correctly.

Step 4: Reviewing common mistakes to avoid

Common errors include misreporting income, neglecting to include deductions, or simple math mistakes. Always double-check calculations and ensure all required fields are filled. Best practices involve having another person review your form to catch errors you might have overlooked.

Editing and adjusting your CT-240 form using pdfFiller

Editing your CT-240 form is made seamless with pdfFiller. This platform offers user-friendly editing tools that allow you to modify your document from any device with internet access. The cloud-based feature means you can work on your forms remotely, providing flexibility and ease.

To edit and fill out the CT-240 form with pdfFiller: Access the CT-240 template through pdfFiller's interface, where you can easily input your data. The platform offers interactive features, such as automatically calculating fields based on the inputs provided, ensuring your form remains error-free.

Signing and submitting your CT-240 form

Once you have completed the CT-240 form, you must sign it and submit it to the relevant department. eSigning the CT-240 through pdfFiller is fast and secure, eliminating the need for paper trails while ensuring your signature is validated.

Submission guidelines dictate that you file your form electronically for faster processing. Ensure you are aware of the deadlines, as submitting late can incur penalties. Dates generally vary, so always check the Connecticut Department of Revenue Services for the most accurate information.

Managing your CT-240 form post-submission

After submitting your CT-240 form, tracking its status is essential. pdfFiller allows users to maintain a digital copy of their submitted forms, enabling easy access to records when needed.

If adjustments are necessary, follow the outlined procedures for amending your CT-240 form. You’ll need to complete a specific amendment form, ensuring you provide accurate updates and additional documentation as required by the state.

Related forms and additional resources

In addition to the CT-240, you might encounter related forms such as the CT-241 and CT-242. Each of these forms serves distinct purposes and should be reviewed carefully based on your financial situation.

For further assistance, various resources are available online. Websites of the Connecticut Department of Revenue Services provide detailed guides and contacts for direct support regarding tax-related inquiries.

Frequently asked questions about the CT-240 form

Many first-time filers may have common queries regarding the CT-240 form. It’s essential to understand the requirements for compliance and situations that may necessitate expert consultation, such as complex financial situations that might complicate the tax filing process.

Best practices for first-time filers include organizing all pertinent documents beforehand and utilizing online resources to clarify any uncertainties. If issues arise, connecting with tax professionals is advisable to ensure accurate filings.

Leveraging pdfFiller for document management

Beyond the CT-240 form, pdfFiller offers additional templates that are beneficial in various business contexts. Efficient document management involves collaborating with teams, and pdfFiller provides extensive tools to streamline these processes.

This platform's features enhance teamwork on document management, including real-time updates and sharing capabilities that facilitate seamless collaboration on important documents.

Conclusion: Empowering your filing journey with pdfFiller

Utilizing pdfFiller for your CT-240 form not only simplifies the filing process but also enhances your ability to manage essential documents effectively. Through its user-friendly tools and comprehensive features, pdfFiller empowers users to take control of their tax documentation.

By leveraging technology, you can reduce the complexity of tax filing and streamline the process, making the CT-240 form a mere step in your comprehensive tax planning strategy. Take advantage of pdfFiller to elevate your document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-240 online?

How do I edit ct-240 straight from my smartphone?

How do I complete ct-240 on an iOS device?

What is ct-240?

Who is required to file ct-240?

How to fill out ct-240?

What is the purpose of ct-240?

What information must be reported on ct-240?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.