Get the free Nd-1es

Get, Create, Make and Sign nd-1es

Editing nd-1es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nd-1es

How to fill out nd-1es

Who needs nd-1es?

Understanding the ND-1ES Form: A Comprehensive Guide for Taxpayers in North Dakota

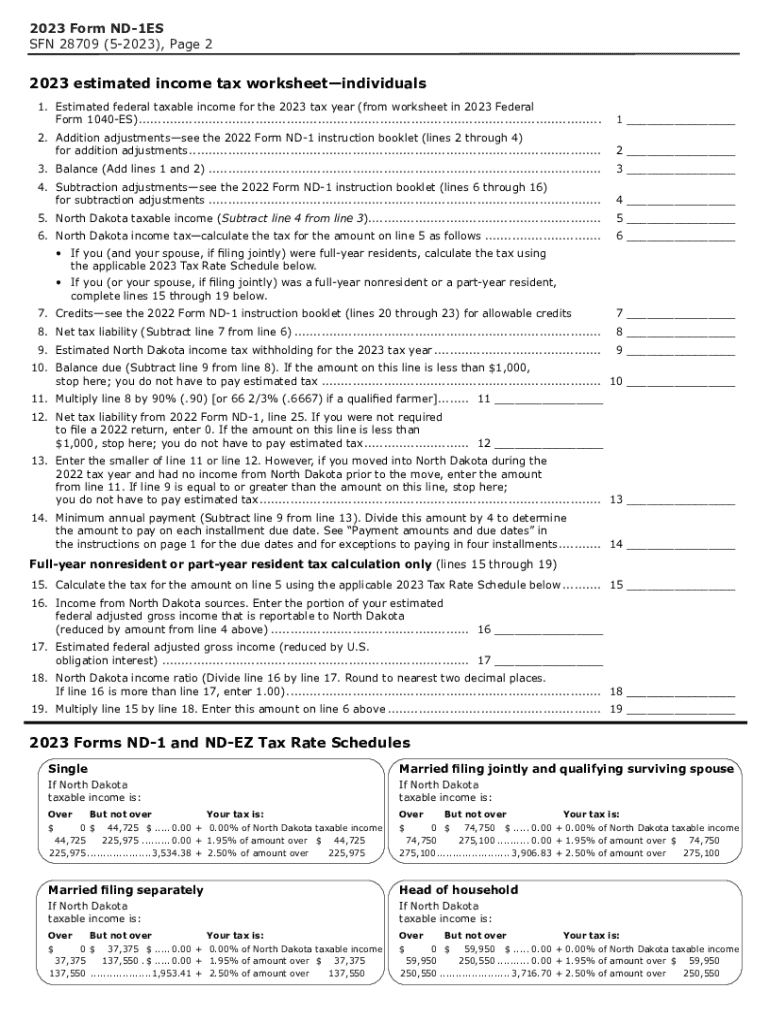

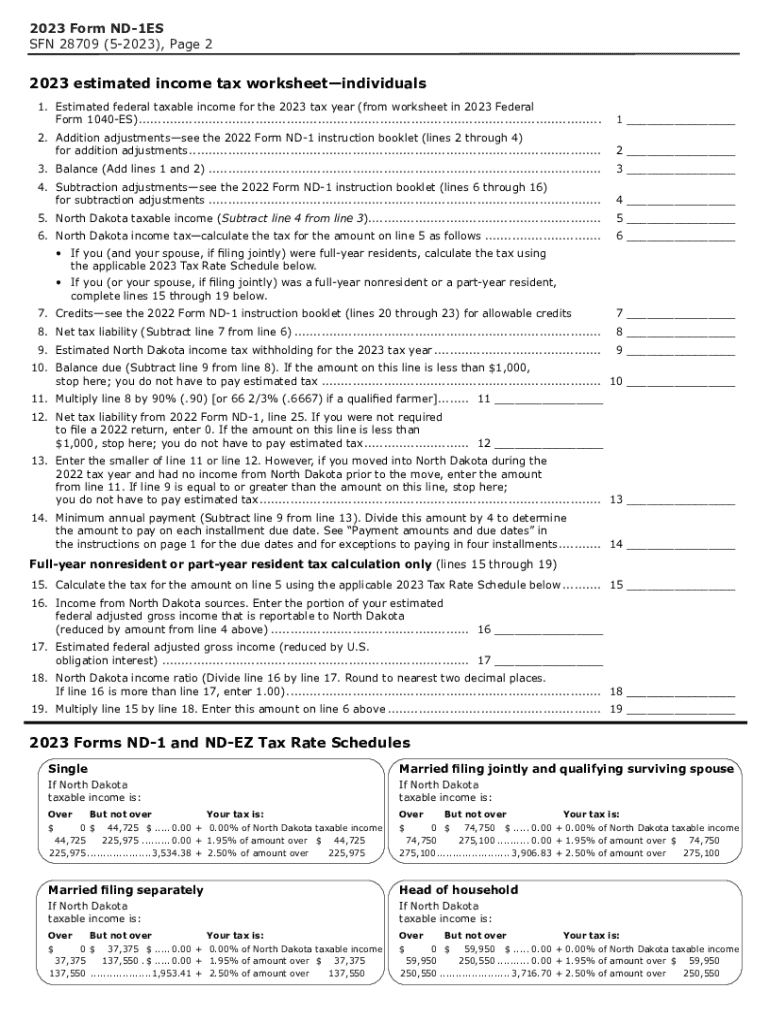

Overview of ND-1ES Form

The ND-1ES Form serves as an essential document for residents of North Dakota, particularly for individuals who need to estimate their income tax liabilities. It is designed to help taxpayers accurately project their expected income tax obligations throughout the year. The purpose of the ND-1ES Form is to allow taxpayers to break down their estimated income tax payments, ensuring they meet their regulatory obligations promptly.

Filing the ND-1ES Form is crucial for individual taxpayers as it assists in managing their expected tax bills, especially in a state with unique tax structures like North Dakota. By submitting this form, you can avoid penalties associated with underpayment of taxes, ensuring that you remain compliant with state tax regulations.

Who needs to file the ND-1ES Form?

Several individuals are required to file the ND-1ES Form based on their specific tax situations. This includes self-employed individuals, freelancers, and those with multiple income sources who may anticipate fluctuations in their income throughout the year. High earners also fall into this category as they are often required to make estimated tax payments to avoid significant year-end tax liabilities.

Tax considerations may change due to new regulations, changes in income, or modifications in personal circumstances—such as starting a new job or receiving additional income streams. Staying informed about these changes is crucial in determining the necessity of filing the ND-1ES Form. It is advisable to revisit your tax obligations periodically, especially in light of evolving tax laws.

How to obtain the ND-1ES Form

Accessing the ND-1ES Form is a straightforward process. Taxpayers can download the ND-1ES Form directly from the North Dakota state website or through platforms like pdfFiller, which make the form easily accessible. Simply visit the designated webpage, locate the ND-1ES Form, and choose the option for downloading the PDF version. This form is available in various formats, allowing for easy customization or printing.

Additionally, pdfFiller offers interactive tools that simplify document management. Users can benefit from a cloud-based platform for editing, signing, and securely storing their ND-1ES Forms, enhancing accessibility and convenience. By utilizing these robust tools, taxpayers can streamline their filing process while maintaining an organized system for all their tax-related documents.

Step-by-step guide to filling out the ND-1ES Form

Completing the ND-1ES Form requires specific personal and financial information. Initially, gather essential details such as your full name, residential address, and Social Security Number (SSN). Next, estimate your income for the upcoming year, which is a critical aspect in completing the form accurately. Make sure you account for all income sources to avoid underreporting.

The form is divided into several distinct sections that require attention to detail:

Common mistakes can occur when filling out the ND-1ES Form, often leading to issues with tax obligations. Misreporting income or performing incorrect calculations can lead to underpayment penalties or further complications down the line. It is essential to double-check all figures before submitting to ensure compliance.

Editing and signing the ND-1ES Form

With pdfFiller, editing your ND-1ES Form becomes an effortless task. Users can access various editing tools that allow for changes, annotations, or notes directly on the document. This feature is particularly useful if you need to make last-minute adjustments or clarifications following consultations with financial advisors or tax professionals.

Once your form is complete and ready for submission, you can easily sign the ND-1ES Form electronically. pdfFiller grants users the ability to eSign documents, ensuring a paperless process that is both efficient and secure. Utilizing electronic signatures minimizes errors and expedites submission times, making it a highly beneficial option for modern tax management.

Submitting the ND-1ES Form

After completing and signing your ND-1ES Form, you can choose how to submit it. E-filing is available through platforms like pdfFiller, where the forms can be sent directly to the state’s tax agency electronically. This method is fast and offers the advantage of instant confirmation of receipt. Alternatively, if you prefer to submit via mail, ensure you follow the outlined mailing instructions provided either on the form or the North Dakota state website.

Important deadlines necessitate careful tracking to avoid penalties, typically tied to the income tax filing season. Familiarize yourself with the schedule for estimated tax payments and mark these dates in your calendar to remain compliant with the tax authority's requirements. Late submissions can incur costly fines, underscoring the importance of timely filing.

Managing your ND-1ES Form post-submission

Once your ND-1ES Form has been submitted, it’s crucial to track its status. Most electronic submission platforms, including pdfFiller, offer options for tracking submissions. This service enables you to verify whether your form has been received and processed successfully by the North Dakota tax authorities. Regularly checking your submission status helps ensure that all tax obligations are met without undue stress.

In addition to tracking submissions, maintaining records of your ND-1ES Form and all related documentation is vital. Proper documentation can be invaluable in future tax assessments or audits. pdfFiller's secure storage capabilities allow users to organize and access past forms at any time, making it easy to verify previous estimates or payments when preparing for future filings.

Frequently asked questions about ND-1ES Form

Questions regarding the ND-1ES Form often arise as taxpayers navigate their responsibilities. One common query is what to do in the event of discovering an error after submission. Taxpayers can amend their ND-1ES Form by filing a corrected version with the appropriate adjustments. Additionally, inquiries about underestimating taxes are frequent. Underestimating payments can lead to penalties, so it’s advisable to consult with a tax professional if uncertainties arise about income estimations.

Resources through pdfFiller offer assistance for individuals with specific questions about filing the ND-1ES Form, ensuring guidance is accessible. Users can reach out to customer support for help with any aspect of form management, whether related to the filing process or document features.

Tips for efficient tax management with pdfFiller

Leveraging the features of pdfFiller can optimize your overall tax management experience. Cloud-based collaboration tools allow team members to work together on tax documents efficiently, ensuring that everyone is on the same page when it comes to estimates, calculations, or filing strategies. Utilizing automation in document workflows can help reduce time spent on repetitive tasks, enhancing productivity.

Organizing your documents within pdfFiller is another best practice. Establishing structured folders and utilizing consistent naming conventions makes retrieving documents significantly easier. Regular updates to reflect the latest tax regulation changes will ensure that your documents are accurate and compliant, mitigating risks associated with outdated information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nd-1es online?

How do I make edits in nd-1es without leaving Chrome?

How can I fill out nd-1es on an iOS device?

What is nd-1es?

Who is required to file nd-1es?

How to fill out nd-1es?

What is the purpose of nd-1es?

What information must be reported on nd-1es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.