Get the free Arizona Form 122

Get, Create, Make and Sign arizona form 122

Editing arizona form 122 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 122

How to fill out arizona form 122

Who needs arizona form 122?

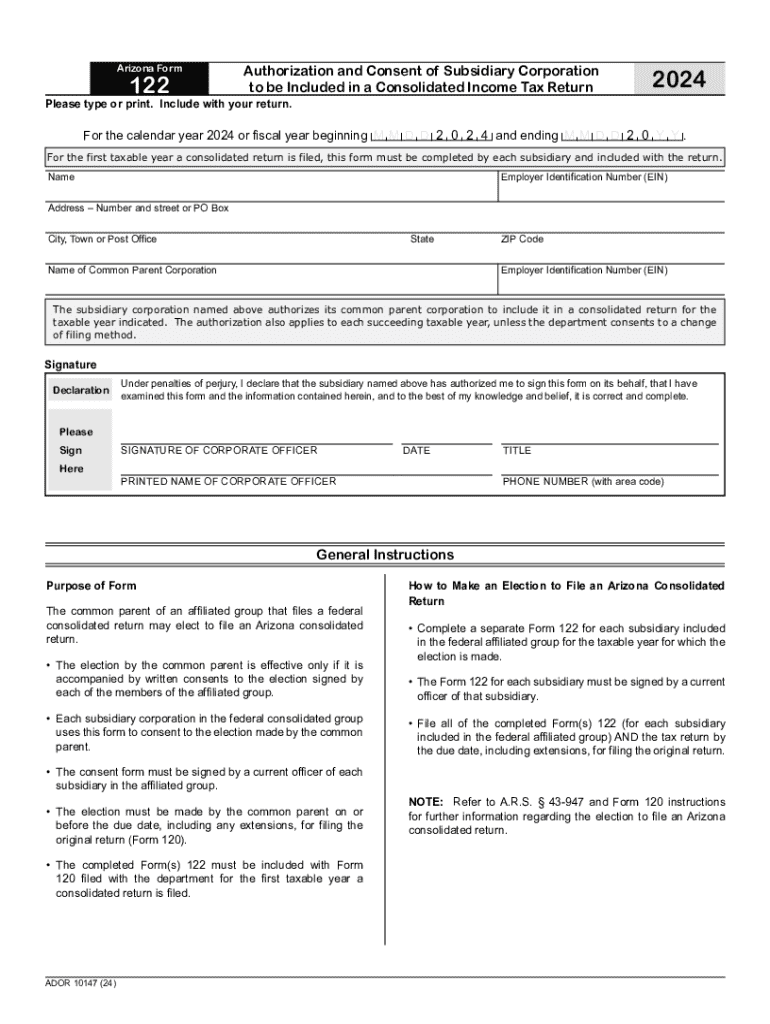

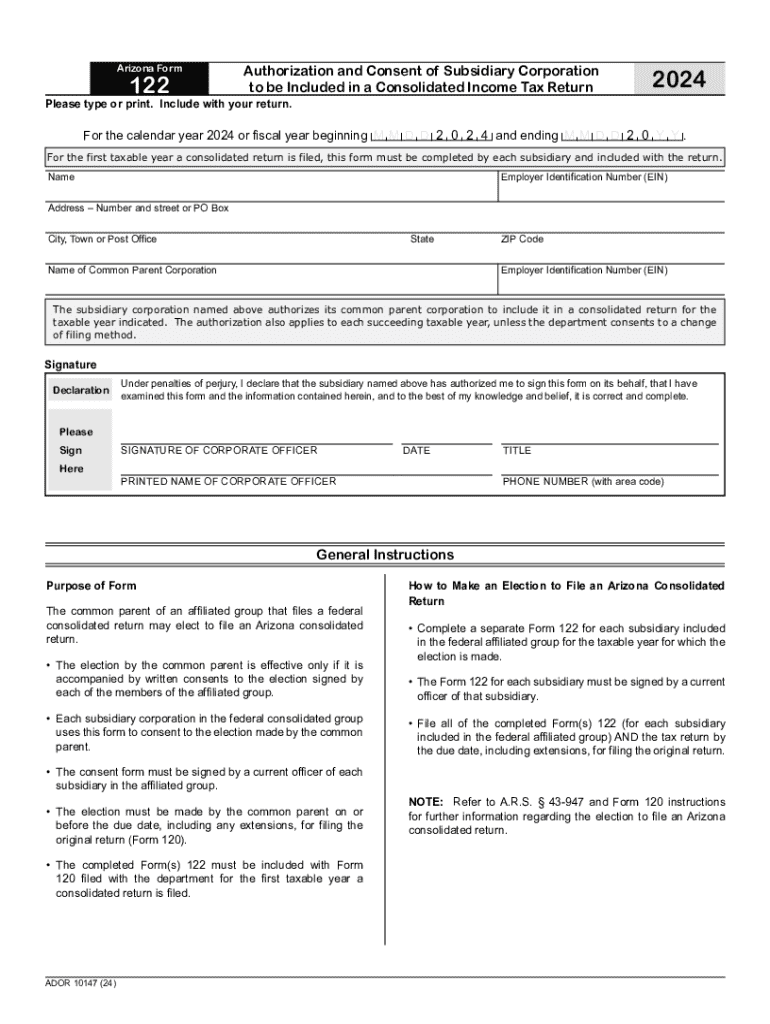

A comprehensive guide to Arizona Form 122

Understanding Arizona Form 122: What you need to know

Arizona Form 122 is a critical document used in various legal processes within the state, primarily serving as a financial disclosure form for individuals undergoing bankruptcy or family law proceedings. By submitting this form, individuals provide a detailed overview of their monthly income, expenses, and debts. This information is essential for courts to assess financial situations accurately.

The importance of Form 122 in Arizona cannot be overstated, as it impacts decisions on bankruptcy filings, child support calculations, and more. Its design reflects Arizona’s unique legal landscape, considering the specific statutory obligations that residents must comply with. It also ensures that individuals uphold transparency and honesty in their disclosures, which is paramount in legal processes.

Who should use Arizona Form 122?

Arizona Form 122 is designed primarily for individuals seeking legal assistance due to financial distress, as well as legal professionals who assist these individuals in navigating complex legal terrains. It serves various needs, predominantly in family law cases, such as divorce proceedings, and in financial disclosures during bankruptcy filings. By using this form, individuals can ensure that their financial situation is correctly represented in legal contexts.

Common scenarios that necessitate the use of Form 122 include situations of divorce where parties need to disclose income and expenses for equitable distribution or child support assessments. It is also prominently used in bankruptcy cases, guiding decisions on repayment plans and eligibility for Chapter 7 or Chapter 13 bankruptcy relief. Awareness of when and how to utilize this form is vital for anyone involved in these legal matters.

Step-by-step guide to completing Arizona Form 122

Completing Arizona Form 122 requires careful attention to detail and organization. The following steps outline the best approach to ensuring accuracy and compliance.

Step 1: Gathering necessary information

Before you fill out Form 122, collect key documents such as income statements, pay stubs, bank statements, and records of your monthly expenses. These documents provide the necessary information required to accurately fill out each section of the form. Ensure you also have your Social Security Number and case number readily available, as you'll need these identifiers throughout the process.

Step 2: Filling out the form

Begin completing Form 122 by following the structured sections outlined in the document. Each box will ask for specific information, such as gross monthly income, all expenses divided into reasonable categories (housing, transportation, etc.), and any additional income sources. Make sure to double-check numeric entries and adhere to the provided instructions.

Step 3: Reviewing your form

Once completed, it's essential to review the form carefully. Look for common errors such as mathematical mistakes or incomplete sections, which can lead to issues during processing. Create a checklist summarizing the key components to ensure that every field has been filled in and that all necessary documentation is attached.

Step 4: Submitting the form

After confirming that your Form 122 is accurate, choose your submission method. Depending on local court regulations, you might have the option to submit online, by mail, or in person. Be mindful of submission deadlines, especially in time-sensitive cases, as failure to meet these can impact your legal outcomes.

Interactive tools for Arizona Form 122

Navigating the nuances of Form 122 becomes significantly easier with the help of modern technology. pdfFiller offers various tools that enhance the filing process, making it more efficient and user-friendly.

pdfFiller's comprehensive package allows users to edit PDFs seamlessly. With user-friendly editing tools, you can fill out, reshape, and customize your Form 122 effortlessly. Furthermore, eSigning capabilities ensure secure submission directly from the platform, eliminating the risks associated with traditional paper forms.

Interactive examples and templates are also available on pdfFiller, saving you valuable time. You can access editable Form 122 templates directly from the platform, along with video tutorials that guide you through filling out the form and submitting it correctly. This access helps you stay informed and reduces the likelihood of errors.

Frequently asked questions about Arizona Form 122

Even with detailed guides, users of Form 122 often have questions that need clarity. Below are some common inquiries regarding this form.

What if make a mistake on my Form 122?

If you notice a mistake after submitting, don’t panic. You can typically submit a corrected version, following the same procedures used for the original form. It's advisable to submit any corrections as soon as they are identified to maintain transparency with the court.

Can appeal a decision based on Form 122 filings?

Yes, if you disagree with a decision made based on your Form 122 filings, you may have the right to appeal. The process generally involves filing a notice of appeal and may require additional documentation. It's important to consult with legal counsel to ensure proper procedure is followed.

What to do after submitting Form 122?

After submission, stay proactive. Monitor the case status and respond to any inquiries or requests for additional information from the court. Communicating effectively can prevent delays and potential complications in your legal matters.

Related forms and legal documents

Understanding related forms can provide broader context for your filing of Form 122. Other frequently used forms in conjunction with Arizona Form 122 include the Arizona Form 121, which addresses related financial disclosures, and various Arizona bankruptcy forms tailored for different scenarios.

To find more related legal forms, resources are available online that provide guidance on obtaining these documents and understanding their implications. These resources can assist individuals as they navigate through the legal system.

Benefits of using pdfFiller for Arizona Form 122

Choosing pdfFiller to manage your Arizona Form 122 offers unparalleled convenience and efficiency. This cloud-based platform empowers users to edit PDFs, eSign, collaborate, and manage documents seamlessly from one centralized interface. No need for multiple applications — pdfFiller brings everything needed for effective document management together.

Besides allowing for comprehensive document management, pdfFiller enables remote collaboration among teams, which is particularly beneficial in legal settings where multiple inputs may be required. Every document is backed by security measures that ensure compliance and protect sensitive data, offering peace of mind while filing important documents.

Tips for successful document management with pdfFiller

To ensure you maximize your experience with pdfFiller, consider establishing best practices for using the platform effectively with Arizona Form 122 and other documents. Organizing your templates for easy access can save time and streamline filing processes.

Additionally, utilizing pdfFiller’s collaboration features can enhance teamwork, allowing multiple users to contribute without overlap or confusion. Leveraging interactive tools available for other forms will further benefit your document management strategies, ensuring you are constantly prepared for varying legal needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit arizona form 122 from Google Drive?

How can I send arizona form 122 for eSignature?

How do I complete arizona form 122 online?

What is arizona form 122?

Who is required to file arizona form 122?

How to fill out arizona form 122?

What is the purpose of arizona form 122?

What information must be reported on arizona form 122?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.