Get the free Business Credit Application

Get, Create, Make and Sign business credit application

Editing business credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business credit application

How to fill out business credit application

Who needs business credit application?

Business Credit Application Form: A Comprehensive How-to Guide

Understanding business credit applications

A business credit application form is a crucial tool for companies seeking financial backing through loans or lines of credit. It serves as a formal request to credit providers, encapsulating vital information that helps these institutions assess the creditworthiness of the applying business. The significance of business credit cannot be overstated; it enables firms to secure funding necessary for expansion, daily operations, and purchasing inventory. A reliable credit history can distinguish a business in a crowded marketplace.

Many business owners may wonder why they need a specific application form for credit. The answer lies in the structure and efficiency it provides. With the right business credit application form, businesses can streamline their funding requests, leading to a variety of advantages.

Who needs a business credit application?

Business credit applications aren’t just for large, established corporations; they have a broad audience, encompassing various types of businesses. Understanding who will benefit from these applications can help in tailoring lending strategies effectively.

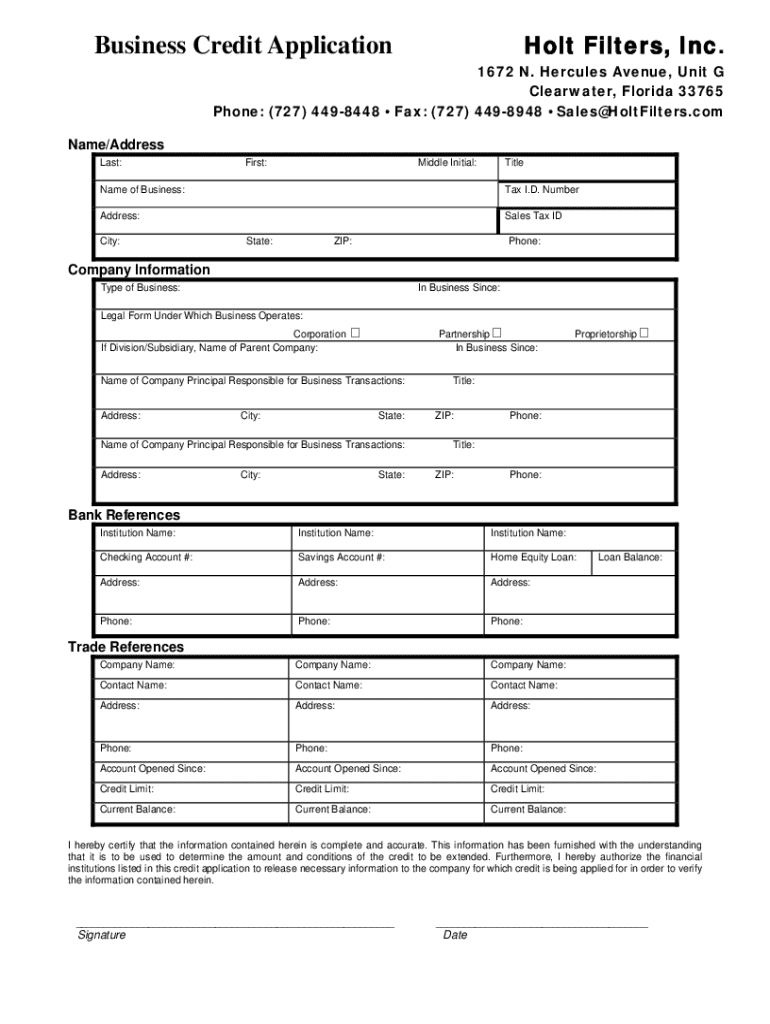

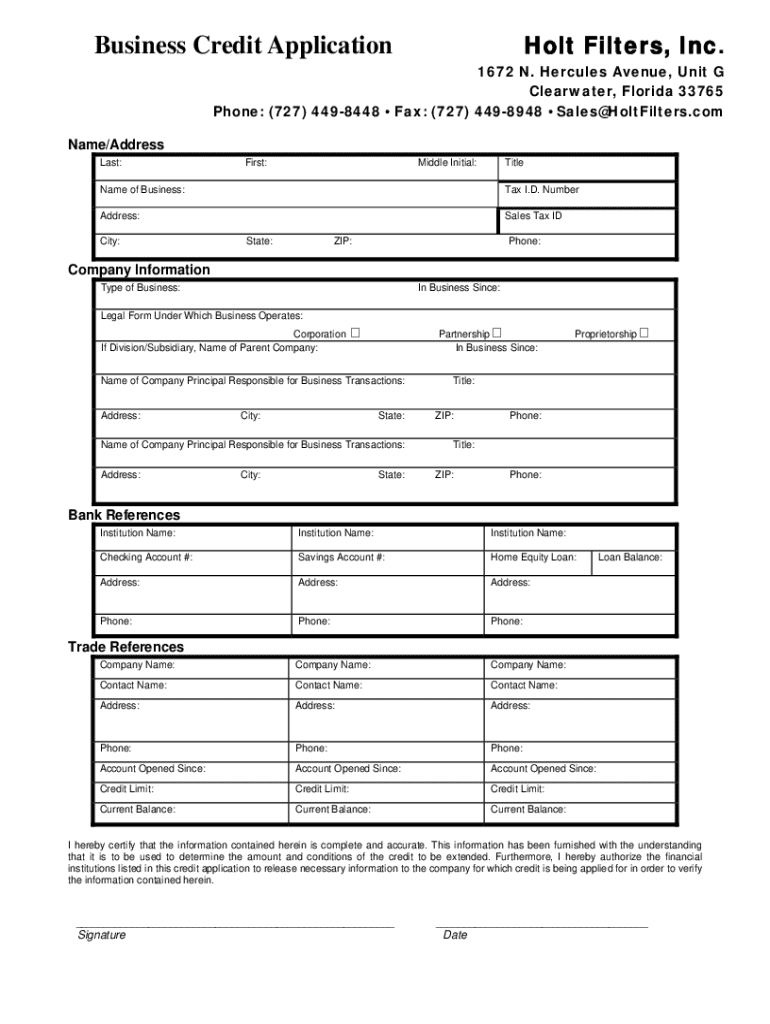

Components of a business credit application form

A well-prepared business credit application form includes various components, each providing essential information to the lender. Businesses should be mindful of the details they provide, as these will directly impact the lender’s decision.

In addition to the primary components, lenders might request supporting documentation to substantiate the information provided. These documents can include tax returns, bank statements, and even a business or strategic plan that outlines future objectives.

How to access a business credit application form

Locating a business credit application form can be straightforward, particularly when utilizing online resources. Several financial institutions make their application forms readily accessible on their websites.

For the best experience, consider visiting pdfFiller, which offers a range of customizable templates tailored to suit different types of applications, ensuring you're not only filling out any form, but the right form for your specific situation.

Step-by-step guide to filling out the business credit application form

Filling out a business credit application form might seem daunting at first, but following a step-by-step process can simplify the task significantly. Ensuring that all required information is gathered before you begin will save time and eliminate frustration.

Begin by gathering essential documents like your company’s identification, financial statements, and ownership details. Each section of the application deserves attention to ensure accuracy.

Common mistakes to watch out for include providing incomplete information, misrepresenting your business status, and forgetting to sign and date the application — oversights that could lead to application rejections.

Editing and customizing the business credit application form

A tailored business credit application form can significantly enhance your submission's effectiveness. With pdfFiller's editing tools, you can customize the application to fit your needs easily.

To maintain clarity, always ensure that the information is coherent and straightforward. All required fields should be filled accurately to avoid delays in processing.

Digital signing and submission of the application

Digital signing is a convenient option that enhances the overall efficiency of submitting a business credit application. pdfFiller allows users to eSign documents securely, ensuring that your application is not only signed but also fully compliant with digital standards.

After submission: What to expect

Once submitted, it’s common to feel anxious about the status of your application. Typically, processing times for business credit applications can vary widely, ranging from a few days to several weeks, depending on the lender.

Understand how lenders evaluate applications; they typically look at factors such as credit history, financial stability, and the purpose of credit. Familiarizing yourself with these criteria can give you insights into how to strengthen your future applications.

Managing your business credit post-application

The completion of a business credit application is just the beginning of your credit journey. Effective management of your business credit afterward is crucial to your financial health. Regularly monitoring your credit score is advisable to remain aware of any changes that could impact your borrowing capacity.

Keeping track of your financial health goes beyond just monitoring credit scores. Utilization of credit must be strategic to maintain beneficial relationships with lenders. Staying in regular communication with lenders and utilizing credit responsibly are essential strategies.

Frequently asked questions (FAQs) about business credit applications

Potential applicants often have numerous questions regarding the business credit application process. Clarifying common concerns can streamline future applications and ease anxieties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business credit application for eSignature?

How can I get business credit application?

Can I sign the business credit application electronically in Chrome?

What is business credit application?

Who is required to file business credit application?

How to fill out business credit application?

What is the purpose of business credit application?

What information must be reported on business credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.