Get the free Mandate for Joint Accounts

Get, Create, Make and Sign mandate for joint accounts

Editing mandate for joint accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mandate for joint accounts

How to fill out mandate for joint accounts

Who needs mandate for joint accounts?

Comprehensive Guide on Mandate for Joint Accounts Form

Understanding the mandate for joint accounts

A mandate for joint accounts is a legal document that outlines the rights and responsibilities of each account holder in a joint bank account. Its primary purpose is to clarify how the account can be operated, including the authority to make transactions, deposits, and withdrawals. This form is crucial in helping joint account holders understand their roles and ensures that financial decisions can be made collaboratively.

The importance of a mandate for joint accounts cannot be overstated; it serves to prevent misunderstandings and disputes among account holders. Whether it's family members managing household expenses or business partners pooling resources, a mandate establishes guidelines that reflect the intentions of all parties involved. Common scenarios for joint account use include married couples managing shared finances, roommates splitting rent and bills, and business partners who need to streamline their financial operations.

Key features of the mandate for joint accounts

The legal implications of joint accounts are significant, as they can influence liability and ownership of funds. One account holder’s action can impact all participants in the account, which is why understanding the type of joint account is fundamental. Common types of joint accounts include joint tenancy, where both holders have equal ownership, and tenants in common, where ownership can be unequal and transferable. The mandates may differ based on these structures.

Moreover, mandates can be categorized into standard and special types. Standard mandates often provide basic instructions regarding transactions, while special mandates may impose specific restrictions or define unique operating procedures according to the agreement among the parties involved. Being aware of these differences helps in selecting the appropriate structure that aligns with your financial objectives.

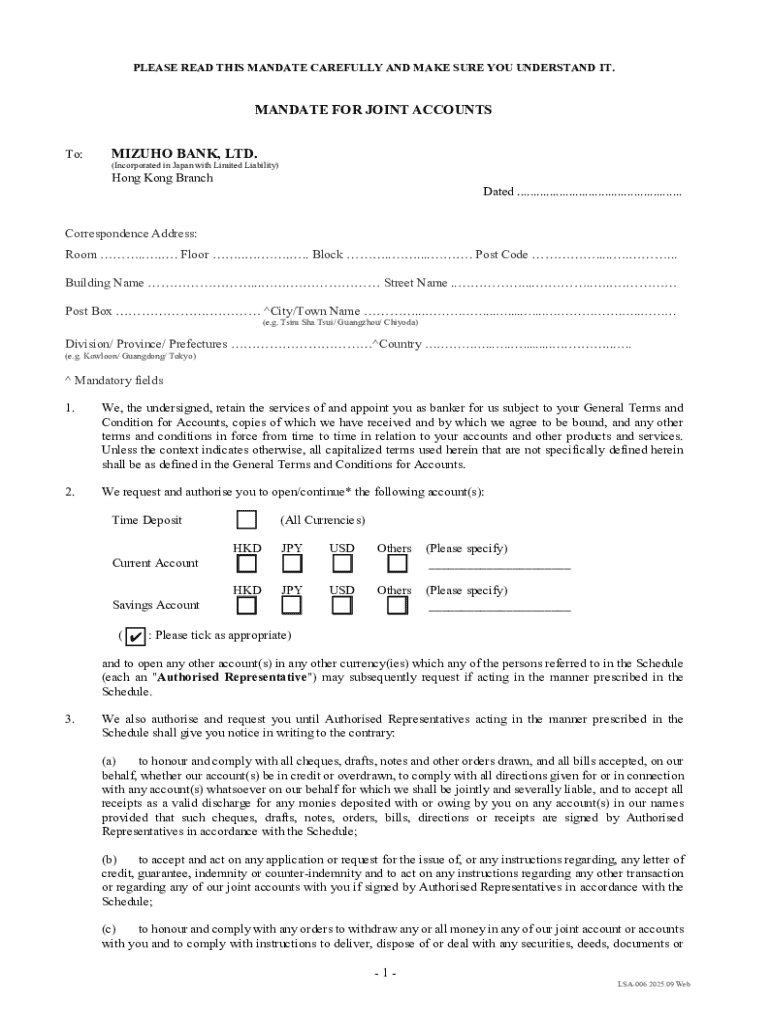

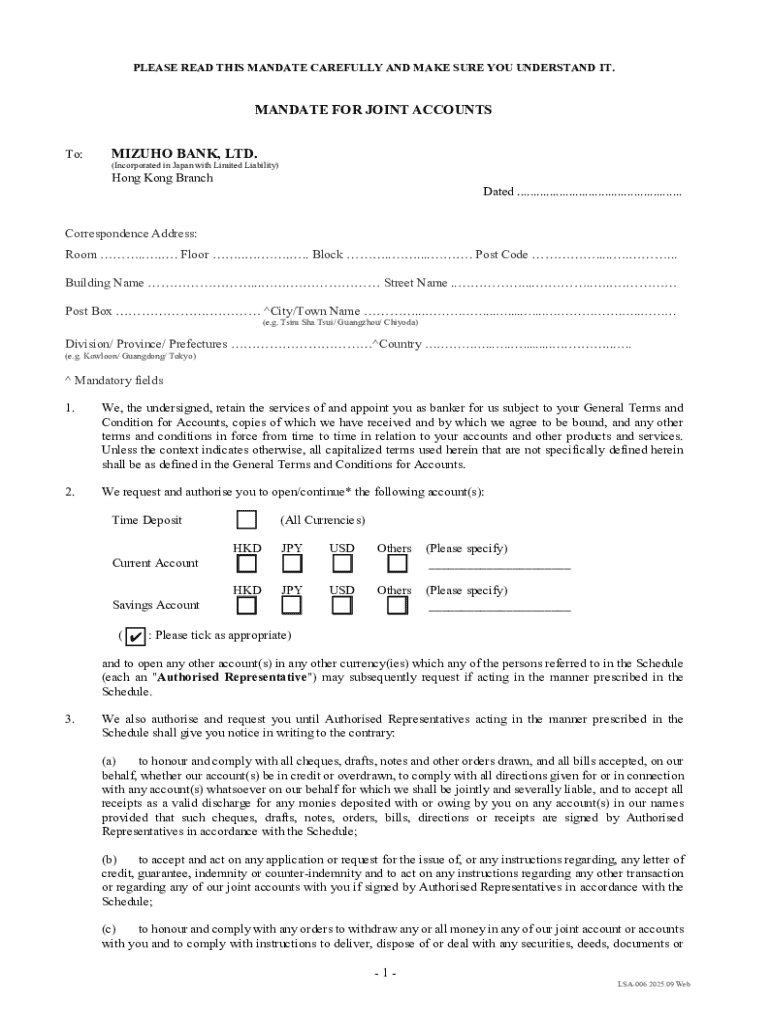

Important elements of the mandate form

When filling out a mandate for joint accounts form, several essential information fields must be completed. These include the personal details of each account holder, such as names, addresses, and identification numbers. Additionally, account information like account numbers and type must be accurately documented. Signatures and authorizations are also critical, as they validate the form and confirm that all parties agree to the stated terms.

Optional information fields may also be included, such as preferred contact methods and additional details about co-account holders. This information is not obligatory but can facilitate better communication among the parties involved.

Completing the mandate for joint accounts form

Filling out the mandate for joint accounts form requires a systematic approach. Start by gathering the necessary documents, such as identification and current account information, to ensure you have all the required data on hand. Next, proceed to fill out the required information carefully, double-checking for any inaccuracies. Providing accurate signatures is vital, as they serve as confirmation that each party agrees to the terms set in the mandate.

Finally, review the completed form for accuracy and completeness before submission. Common mistakes include omitting signatures, incorrect account numbers, or failing to provide personal details. To ensure compliance with legal requirements, consider consulting a financial advisor or legal professional if you have any questions regarding the mandate.

Editing the mandate for joint accounts form

If changes are necessary, editing a PDF form using pdfFiller is straightforward. The pdfFiller platform allows users to make edits efficiently, thanks to its user-friendly interface. To begin editing, upload your completed form onto the platform, and utilize the editing features to make necessary adjustments.

With pdfFiller's robust features, you can add text, append signatures, and even annotate documents as needed before finalizing the form for submission.

Signing the mandate for joint accounts

Digital signatures are increasingly important in today’s digital world, providing a secure method for agreeing to terms. eSigning your mandate for joint accounts can be conveniently done via pdfFiller. This platform offers secure eSignature solutions that comply with legal standards, ensuring that your online signature is recognized and holds up in court.

The verification process is also essential; once you eSign, the platform may send confirmation or validation emails to ensure authenticity. This step adds an additional layer of security, assuring all parties that the signatures used are legitimate and binding.

Submitting the mandate for joint accounts

After completing the mandate form, submit it through your desired method. You can opt for online submission via your bank's website or mobile application, or choose to submit it in person at a local branch. Expect to receive confirmation once your submission is processed, ensuring that all account holders are notified of the changes.

If you’d like to stay updated on the status, many banks now offer tracking capabilities through their apps or websites, enabling you to monitor the progress of your submission efficiently.

Managing joint accounts after completion

Once the mandate is completed and submitted, ongoing management of the joint account becomes critical. Regularly updating account information, such as contact details or authorized signatories, helps keep the account current and secure. It's essential for each account holder to understand their roles and responsibilities; this can include designated financial management tasks or specific spending limits.

Resources for ongoing joint account management can include budgeting tools that help in tracking expenses or even mobile apps that facilitate integration with bank accounts. Having these tools can streamline the process and promote better financial health among account holders.

Troubleshooting common issues

Managing joint accounts isn't devoid of challenges. Common issues include disputes over transactions or disagreements on how funds should be allocated. If such disputes arise, resolving them amicably is vital. Consider open discussions to air grievances or, if necessary, seek mediation from a financial institution or professional consultant.

Understanding the implications of the mandate and having a clear agreement can often prevent these disputes from escalating. When seeking assistance, don’t hesitate to approach your bank or an attorney for guidance regarding your mandate for joint accounts.

Best practices for joint account management

Effective joint account management starts with establishing clear guidelines among all account holders. Discuss spending limits, responsible use of funds, and decision-making processes upfront to prevent future misunderstandings. Regular reviews of the joint account help ensure that all parties are aligned with the financial goals.

Implementing security policies further protects sensitive information, ensuring that personal details associated with the joint account are secure.

Unique benefits of using pdfFiller for your mandate needs

pdfFiller serves as an all-in-one document management platform that simplifies the process of handling forms like the mandate for joint accounts. With powerful collaboration tools built into the platform, team members can seamlessly work together to edit, eSign, and finalize documents without the hassles of traditional paperwork.

Utilizing pdfFiller for your mandate enhances productivity, reduces paperwork, and fosters better communication among account holders.

Case studies: Successful management of joint accounts

Examining real-life examples of successful joint account management reveals valuable insights. Consider a couple who utilize a joint account to manage household expenses efficiently. By establishing monthly budgets and reviewing transactions together, they avoid overspending and ensure their financial goals are met. Moreover, a business partnership employing a joint account for operational expenses illustrates how clear mandates reduce conflicts and facilitate decision-making.

These case studies highlight the importance of open communication and agreed-upon guidelines in effectively managing joint accounts. New users can learn from such experiences, ensuring they adopt similar practices to enhance their financial management strategies.

Next steps for effective joint account management

To streamline your experience managing a mandate for joint accounts, take advantage of pdfFiller’s extensive feature set. Explore its capabilities not only for editing and signing documents but also for tracking changes that allow seamless collaboration. Whether you're a couple managing a shared account or a team overseeing business expenses, adopting these tools elevates your financial management.

As you grow more familiar with the platform, consider exploring other document-related solutions that pdfFiller offers, ensuring you're equipped with comprehensive resources for all your documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mandate for joint accounts for eSignature?

How do I edit mandate for joint accounts online?

Can I sign the mandate for joint accounts electronically in Chrome?

What is mandate for joint accounts?

Who is required to file mandate for joint accounts?

How to fill out mandate for joint accounts?

What is the purpose of mandate for joint accounts?

What information must be reported on mandate for joint accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.