Get the free Medigap Helpline and Medigap Prescription Drug Helpline

Get, Create, Make and Sign medigap helpline and medigap

How to edit medigap helpline and medigap online

Uncompromising security for your PDF editing and eSignature needs

How to fill out medigap helpline and medigap

How to fill out medigap helpline and medigap

Who needs medigap helpline and medigap?

Navigating the Medigap Helpline and Medigap Form

Understanding Medigap

Medigap, also known as Medicare Supplement Insurance, is designed to cover the out-of-pocket costs that Original Medicare does not. This includes deductibles, copayments, and coinsurance. The primary purpose of Medigap is to help individuals manage healthcare expenses and provide financial stability when unexpected medical events occur.

One key benefit of Medigap insurance is the peace of mind it offers. By reducing the financial burden associated with healthcare services, beneficiaries can receive necessary care without the fear of excessive costs. Medigap plans are standardized by the federal government, meaning that the basic benefits are the same across different insurers, allowing for easier comparison.

Types of Medigap plans

There are ten standardized Medigap plans, labeled A through N. Each plan offers a different combination of benefits. For instance, Plan F is one of the most comprehensive plans, covering all out-of-pocket costs, while Plan K features lower premiums but higher cost-sharing responsibilities.

Understanding these plans' distinctions is crucial when selecting a Medigap policy. Each plan’s coverage can vary significantly, thus potential enrollees should assess their health needs, frequency of medical care, and financial situation to choose the most appropriate plan.

Navigating the Medigap Helpline

The Medigap Helpline serves as a vital resource for beneficiaries seeking assistance with their Medigap insurance. This service provides guidance not only on enrollment processes but also on navigating claims and managing existing coverage.

Through the helpline, users can receive personalized assistance regarding their specific Medigap insurance queries. From understanding which plan may best meet their healthcare needs to help with claim inquiries, the helpline is an invaluable tool for beneficiaries.

You can easily reach the Medigap Helpline by calling their dedicated phone number, which is typically available during standard business hours. Additionally, many states offer online platforms where you can find valuable resources and submit inquiries through email or live chat options.

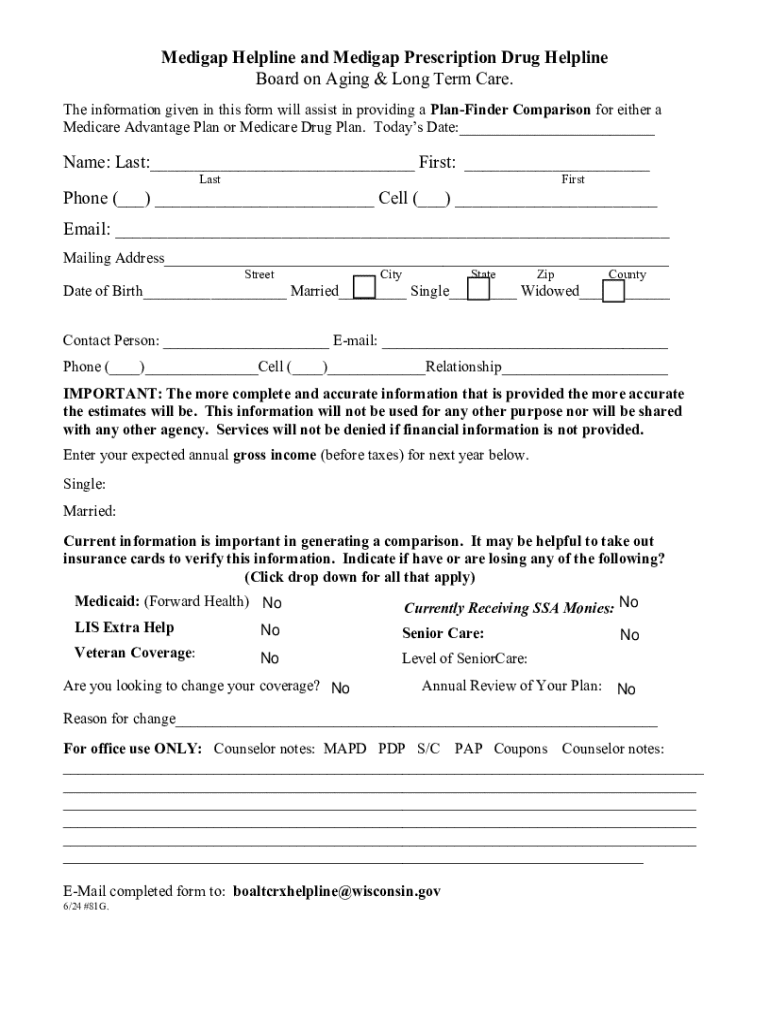

Step-by-step guide to the Medigap form

The Medigap application process requires a specific form to be filled out. This form is essential for gaining access to the Medicare Supplement coverage you need. Completing it correctly is crucial, as mistakes can delay your coverage.

To apply for a Medigap plan, you must first verify your eligibility, which typically includes being enrolled in Medicare Parts A and B. Once verified, the next step is filling out the Medigap form, which includes essential details about your personal information and health history.

When filling out the Medigap form, avoid common pitfalls such as omitting necessary information or providing incorrect details. Always double-check your entries to ensure accuracy, which will streamline your application process.

For best practices, submitting your Medigap application promptly is vital. Whether you choose to submit online or via mail, ensure you keep a copy of your application for your records.

Editing and managing your Medigap form

Managing your Medigap forms can be effortlessly accomplished with pdfFiller. This platform allows users to create, edit, and manage their Medigap documents seamlessly. Utilizing pdfFiller enhances your ability to personalize and modify your Medigap form according to your specific needs.

With features such as templates and collaborative tools, pdfFiller makes it easy to tailor your form and share it with family members or insurance advisors. You can track changes, obtain approvals, and maintain a smooth workflow.

Once your form is ready, you may need to sign it electronically. pdfFiller provides a straightforward process for eSigning documents, which is legally valid and recognized across most healthcare institutions.

Understanding the legal implications of electronic signatures is essential. They carry the same weight as traditional handwritten signatures, thus maintaining the integrity of your Medigap application.

Collaborating with others on your Medigap application

Sharing your Medigap form with trusted family members or insurance advisors can enhance the application process. With pdfFiller, you can grant access to collaborate on the document in real-time, making the experience more interactive.

When sharing documents, privacy and security are paramount. pdfFiller employs encryption and secure sharing options to protect sensitive information while ensuring your collaborators can access the necessary details to assist you.

If you find yourself needing more specialized assistance, don't hesitate to utilize the helpline to consult with a trained counselor. Knowing when to seek professional guidance can make a significant difference in your Medigap choices.

Using the helpline effectively involves preparing questions in advance and providing relevant personal details to quicken the response time.

Frequently asked questions about Medigap

As prospective Medigap policyholders navigate their options, they often have several questions. Common queries include concerns about coverage limits, premium costs, and how to switch plans. Understanding these details can alleviate anxiety and aid in a smoother enrollment process.

It’s essential to gather accurate information from reliable sources. This is where the Medigap helpline becomes an invaluable resource. When calling, prioritize asking about your specific plan concerns or clarifications that are impacting your decision-making.

Maximizing your helpline call involves preparing a concise list of questions and referencing any documentation you may have on hand to facilitate a more thorough discussion.

Medigap success stories

Many individuals have benefited significantly from enrolling in a Medigap plan. From covering extensive hospital bills to managing routine doctor visits, the stories are encouraging and showcase how essential Medigap can be in times of need.

For instance, a retiree diagnosed with a chronic illness shared how her Medigap plan helped her avoid crippling debt from medical expenses, enabling her to focus on recovery rather than finances. Such testimonials underscore the importance of having access to reliable insurance.

These experiences demonstrate how the Medigap Helpline plays a critical role in assisting beneficiaries in maximizing their coverage and relieving financial stress.

Ongoing management of your Medigap coverage

Once you have enrolled in a Medigap plan, continuous monitoring is essential to ensure it continues to meet your healthcare needs. Assessing your coverage periodically can help you determine if the benefits align with your current medical situation.

Annual renewals also warrant attention. Understanding the renewal process, potential changes in premiums, and new policy options available each year is crucial to making informed decisions.

By managing your Medigap coverage proactively, you ensure that your health insurance continues to provide the necessary support throughout various life stages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute medigap helpline and medigap online?

Can I sign the medigap helpline and medigap electronically in Chrome?

How do I edit medigap helpline and medigap straight from my smartphone?

What is medigap helpline and medigap?

Who is required to file medigap helpline and medigap?

How to fill out medigap helpline and medigap?

What is the purpose of medigap helpline and medigap?

What information must be reported on medigap helpline and medigap?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.