Get the free Cdtfa-230-m

Get, Create, Make and Sign cdtfa-230-m

How to edit cdtfa-230-m online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-230-m

How to fill out cdtfa-230-m

Who needs cdtfa-230-m?

Complete Guide to the CDTFA-230- Form: Filing and Management Made Easy

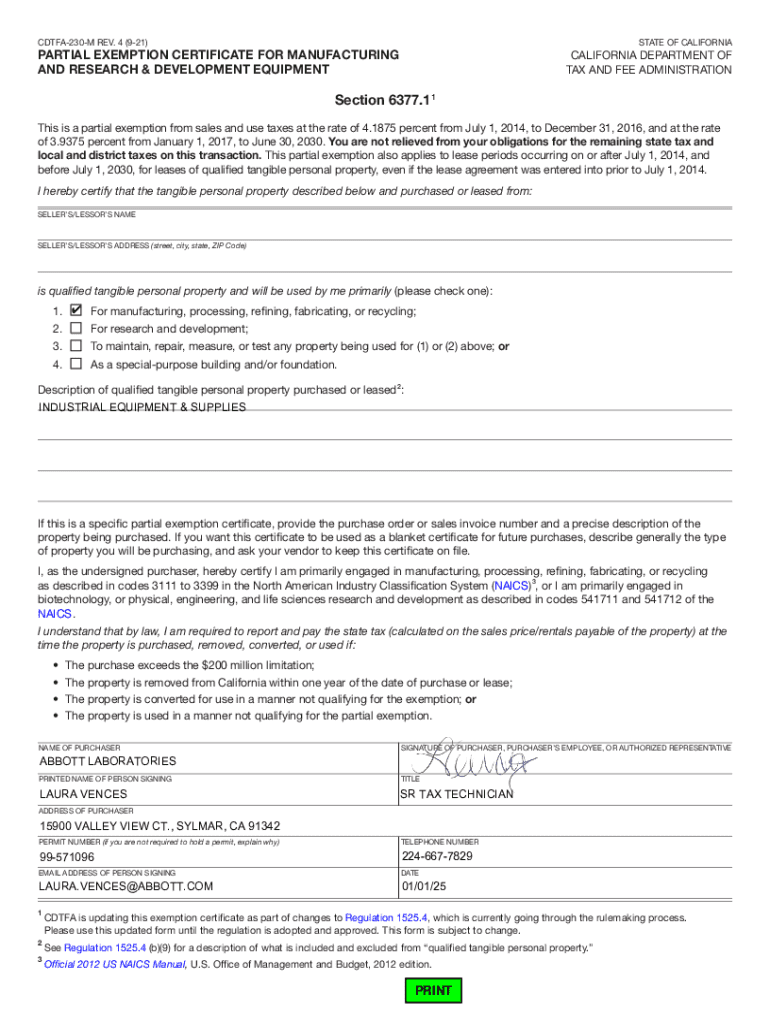

Overview of the CDTFA-230- form

The CDTFA-230-M form is an essential document issued by the California Department of Tax and Fee Administration (CDTFA) aimed at streamlining tax-related compliance for businesses. This form primarily assists in the reporting of transactions related to both sales tax and usage tax. Its timely and accurate submission is crucial for maintaining tax compliance within the state.

The importance of the CDTFA-230-M form cannot be overstated; missing the submission deadline or incorrect filings can lead to penalties and increased scrutiny from the tax authority. Key users of the CDTFA-230-M form include small business owners, accountants, and tax professionals who need to ensure accurate reporting to avoid costly errors.

Purpose and scope of the CDTFA-230- form

The primary purpose of the CDTFA-230-M form is to document sales and usage tax transactions during specified periods, particularly for businesses operating in the state of California. The form is utilized in various scenarios, such as when a business needs to report taxable sales made in a quarter or pinpoint tax exemptions that may apply.

Understanding the tax implications of filing the CDTFA-230-M is essential; accurate reporting can directly influence a company’s financial standing, including potential refunds or credits for overpaid taxes. Moreover, there are a few common misconceptions surrounding this form—many believe it is only for businesses generating substantial revenue. In reality, all businesses with taxable transactions must file the form, regardless of their size.

Step-by-step guide to completing the CDTFA-230- form

Completing the CDTFA-230-M form requires a systematic approach to ensure accuracy and completeness. Here’s a breakdown of the steps.

Editing and managing your CDTFA-230- form

pdfFiller provides a robust platform for users to edit and manage their CDTFA-230-M form online. With the convenience of dealing with forms in a digital format, users can avoid the pitfalls typically associated with paper forms.

To edit your form on pdfFiller, follow these steps: log in to your account, upload the CDTFA-230-M form, and utilize the comment and markup tools to make necessary adjustments. The platform facilitates ease of use with various features like text boxes, signature fields, and annotation tools that enhance the editing process.

After editing, best practices for document management involve organizing files by date, type, and tax year. Utilizing cloud storage options enhances accessibility, allowing team members to access and work on documents from anywhere.

eSigning the CDTFA-230- form

The eSigning process provided by pdfFiller makes finalizing your CDTFA-230-M form quick and secure. Legal considerations surrounding electronic signatures are increasingly supportive, allowing many to sign documents without needing physical presence.

When utilizing pdfFiller to eSign your form, you’ll benefit from verification features that enhance security. This adds a level of trust and authentication, ensuring that the submissions are protected against unauthorized access.

Collaborating on the CDTFA-230- form

Collaboration on the CDTFA-230-M form can significantly streamline the process, especially for teams working towards tax compliance. Tools such as comment sections and shared access enable team members to provide input and make necessary edits seamlessly.

Efficient sharing options along with permissions management allow users to control who can edit the document or view sensitive information. This ensures that everyone remains on the same page, benefiting from real-time editing and feedback capabilities without the need for physical meetings.

FAQs about the CDTFA-230- form

As users navigate the process of submitting their CDTFA-230-M form, they often have several questions. Common queries revolve around submission deadlines, ways to troubleshoot issues, and how recent changes may impact the form or its requirements.

For any technical difficulties or uncertainties, pdfFiller facilitates a support system that provides comprehensive guidance. Keep an eye on updates or changes related to the CDTFA-230-M to stay compliant with the latest tax regulations.

Additional tips for effective document management

Effective document management is crucial for businesses, particularly when dealing with forms such as the CDTFA-230-M. Strategies for organizing forms include categorizing documents based on their function, regular backups, and maintenance of records for easy retrieval.

Using pdfFiller greatly enhances efficiency, offering a suite of tools tailored for ongoing document management. From editing capabilities to seamless integration in business workflows, it fosters a productive environment where document handling becomes a simplified task.

Contact and support information

For additional assistance regarding the CDTFA-230-M form or using pdfFiller, users can easily reach out via the contact options on the website. The platform offers a wealth of online resources and guidance tailored to common inquiries surrounding the form and its submission.

Utilizing these resources not only supports smooth completion of the CDTFA-230-M but also enhances overall document management capacities, promoting compliance and efficiency.

Interactive tool: CDTFA-230- form checklist

To aid users in tracking their progress when filling out the CDTFA-230-M form, pdfFiller offers a downloadable checklist. This checklist includes interactive features that allow users to mark off completed sections and steps as they progress, simplifying the filing process.

Such tools reinforce an organized approach to managing documentation, enabling users to ensure that every required detail is accounted for before submitting their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cdtfa-230-m?

How do I complete cdtfa-230-m on an iOS device?

Can I edit cdtfa-230-m on an Android device?

What is cdtfa-230-m?

Who is required to file cdtfa-230-m?

How to fill out cdtfa-230-m?

What is the purpose of cdtfa-230-m?

What information must be reported on cdtfa-230-m?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.