Get the free Notc

Get, Create, Make and Sign notc

How to edit notc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notc

How to fill out notc

Who needs notc?

Your Comprehensive Guide to the NOTC Form

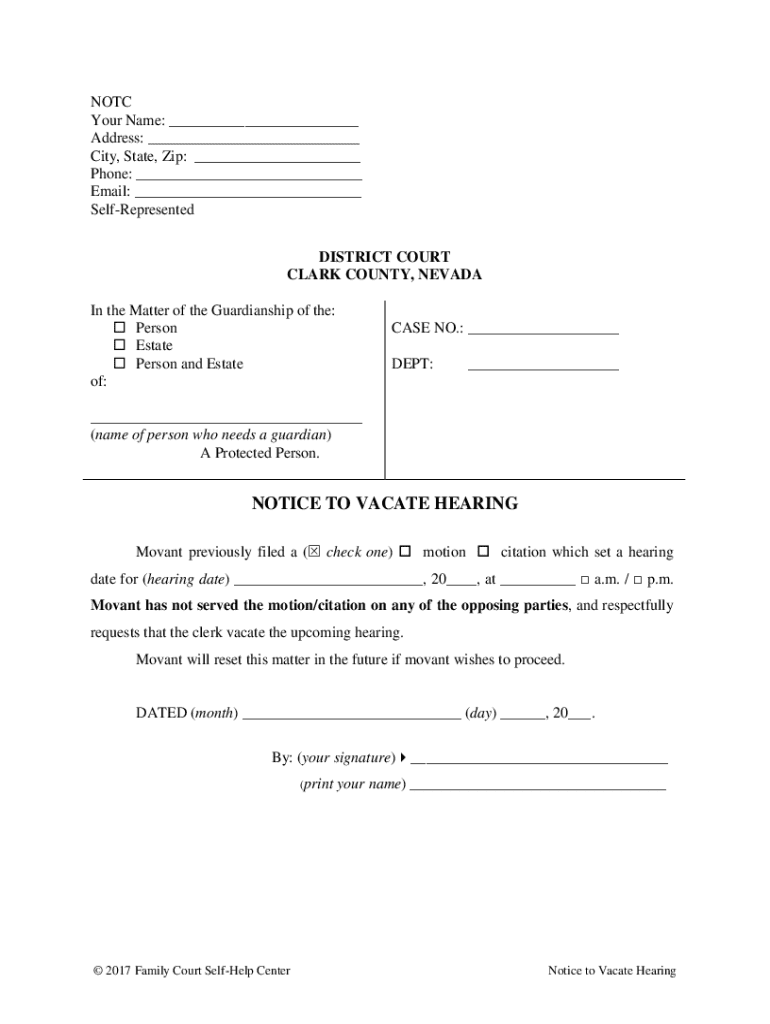

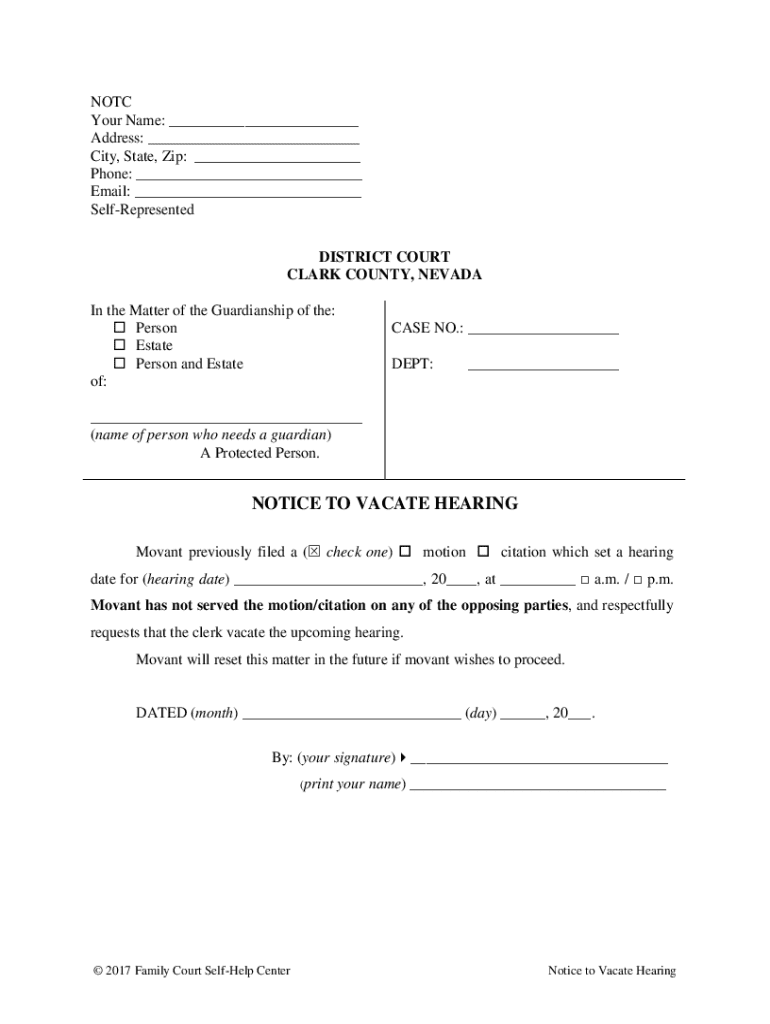

Understanding the NOTC form

The NOTC form, short for Notice of Tax Credit, serves as a crucial tool for both individuals and teams navigating the complexities of taxes and health insurance premiums. This document is particularly important for those who receive premium tax credits (PTC) under the Affordable Care Act (ACA) as it enables them to report their advance payments and reconcile their tax obligations. By understanding how to effectively fill out the NOTC form, users can ensure compliance and maximize their available tax credits while avoiding potential issues during tax season.

Additionally, the NOTC form plays a significant role in capturing essential data that assists in verifying eligibility for continued health insurance coverage. For anyone who has ever felt overwhelmed by tax regulations, the NOTC form simplifies the process and provides clarity, making it an essential document in the tax filing toolkit.

Who needs to use the NOTC form?

The NOTC form is particularly relevant to a variety of demographics. Primarily, it is essential for individuals and families who have availed themselves of health insurance coverage through the Health Insurance Marketplace and received advance premium tax credits. Those who have undergone significant life changes, such as income alterations or family size changes, may also find themselves needing to fill out the NOTC form to update their tax information and ensure their health insurance remains affordable.

Key components of the NOTC form

Understanding the key components of the NOTC form makes one more efficient in completing it. This form includes several sections which require specific personal details, tax information, and signatures. Each component serves a distinct purpose to ensure that the submitted information adheres to the IRS guidelines and effectively communicates the necessary data regarding one's health insurance coverage and associated premiums.

Within these sections, you will also encounter terminology that may be unfamiliar. Engaging with resources and glossaries related to the NOTC form can help clarify key terms and ensure a complete understanding of the requirements.

How to prepare for filling out the NOTC form

Before diving into the NOTC form, it’s crucial to prepare adequately. Gathering the appropriate documentation ahead of time will streamline the process and reduce frustration. Documents may include previous year’s tax returns, statements showing health insurance coverage, and records of any advance premium tax credits received throughout the insurance year.

Additionally, being aware of submission deadlines is equally important. Mark your calendar to ensure you submit the NOTC form before the due date to avoid penalties or issues with your tax return. Deadlines typically align with the general tax filing season, but there may be specific timelines based on your health coverage.

Step-by-step guide to completing the NOTC form

Utilizing a platform such as pdfFiller simplifies the process of accessing and completing the NOTC form. Here’s a straightforward step-by-step approach to guide you through the submission process:

By following these steps systematically, you can alleviate confusion and ensure that you have accurately filed the NOTC form, ultimately giving you peace of mind concerning your tax situation.

Using interactive tools for enhanced experience

pdfFiller offers a suite of interactive tools designed to enrich your experience while filling out the NOTC form. These features not only facilitate ease of use but also enhance collaboration, especially for teams working together to manage their tax documents.

Furthermore, teams can leverage collaborative options within pdfFiller to share the NOTC form with multiple users, enhancing teamwork and collective understanding of the tax obligations at hand.

Troubleshooting common challenges

Completing the NOTC form may come with its set of challenges, especially if you lack familiarity with tax processes or the specifics of the form itself. Questions often arise surrounding common concerns such as eligibility for tax credits or deadlines.

By acknowledging these challenges upfront, you can prepare accordingly and approach the completion of the NOTC form with increased confidence.

Best practices for efficient management of your NOTC form

After submitting your NOTC form, keeping track of its status is imperative. pdfFiller streamlines the submission process by providing tools that help you monitor the progress of your document. Regularly checking back can provide peace of mind, particularly if you have upcoming deadlines for your tax obligations.

These practices ensure not only that your NOTC form is successfully submitted but also that you maintain easy access to crucial tax documents, averting delays in any necessary follow-ups.

Leveraging support for additional help

For those needing further assistance with the NOTC form, numerous resources are available through pdfFiller. The platform offers comprehensive support to guide users through the intricacies of tax forms, ensuring they make informed decisions.

Using these support channels can alleviate concerns and ensure that your submission process is both successful and stress-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete notc online?

How do I edit notc online?

Can I create an electronic signature for the notc in Chrome?

What is notc?

Who is required to file notc?

How to fill out notc?

What is the purpose of notc?

What information must be reported on notc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.