Get the free Certification of Final Taxable Value - vcpa vcgov

Get, Create, Make and Sign certification of final taxable

How to edit certification of final taxable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certification of final taxable

How to fill out certification of final taxable

Who needs certification of final taxable?

Certification of Final Taxable Form: A Comprehensive Guide

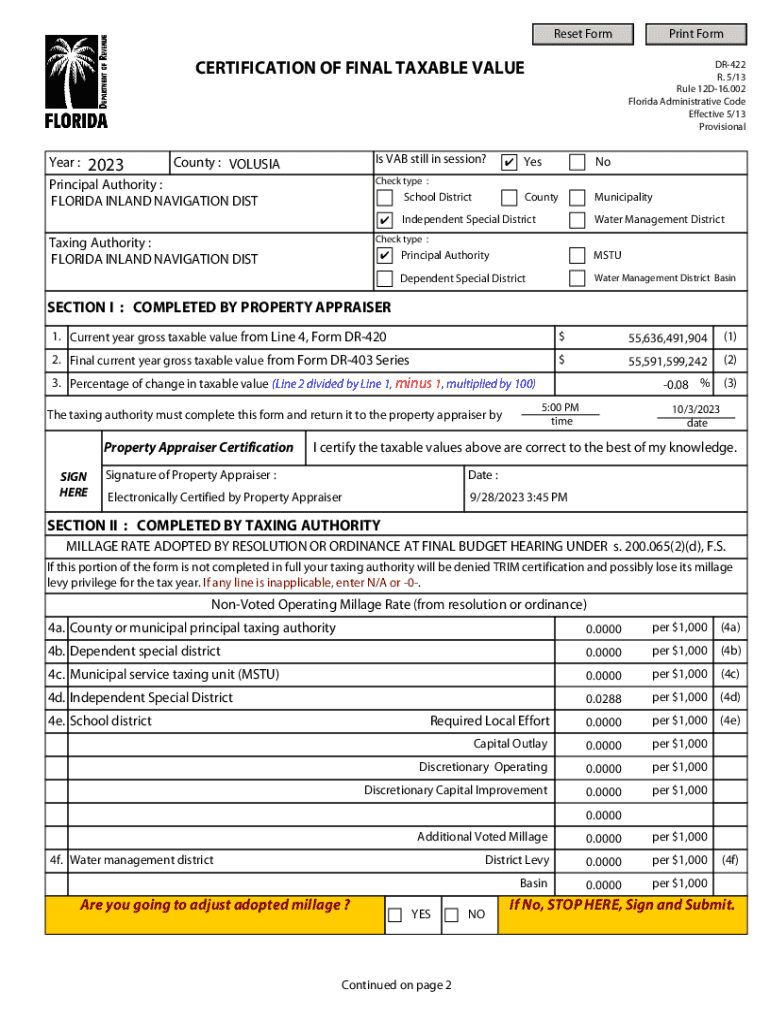

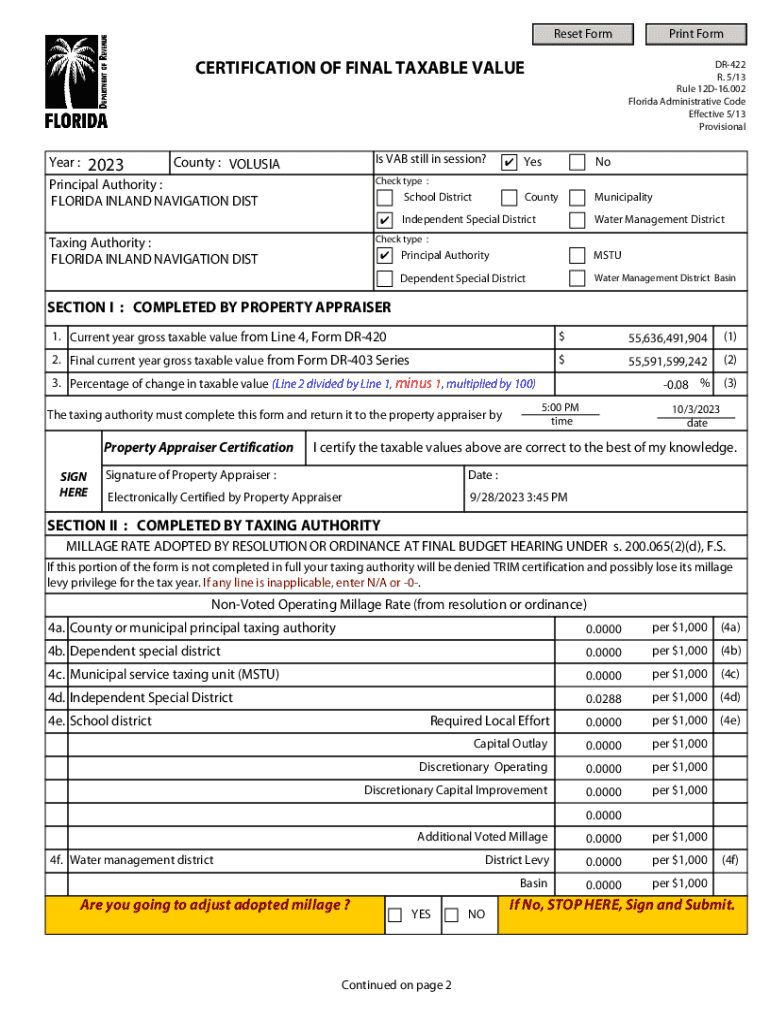

Overview of the Certification of Final Taxable Form

The certification of final taxable form acts as an essential documentation process, confirming that all tax-related information has been accurately reported and complies with statutory requirements. This certification validates the details submitted in various tax forms, ensuring transparency and legal compliance for both individuals and businesses. Its primary purpose is to encapsulate an official affirmation from the taxpayer or authorized entity that the reported information is true and complete.

In an ever-evolving tax landscape, the importance of certification cannot be overstated. It serves as a safeguard against potential penalties for incorrect filings, supports taxpayers during audits, and reinforces the reliability of financial reporting. Moreover, when it comes to property tax oversight and corporate tax submissions, proper certification builds trust between taxpayers and regulatory bodies.

Types of taxable forms

Different taxable forms cater to varying tax categories. The primary forms that must undergo certification include the personal income tax form, corporate tax form, and property tax forms. Each of these forms is designed to address specific tax obligations based on the taxpayer's circumstances.

Understanding the key differences between these taxable forms is crucial for effective tax compliance. For instance, personal income tax forms focus solely on individual earnings, while corporate tax forms necessitate a detailed breakdown of business finances, including deductions for expenses and credits for various business activities.

Understanding the certification process

The certification process can seem overwhelming, but breaking it down into manageable steps simplifies it significantly. Below is a detailed step-by-step guide for certifying a final taxable form.

While navigating this process, it’s essential to avoid common pitfalls such as overlooking required fields, failing to attach supporting documents, or submitting the form late. Ensuring due diligence at each stage can prevent complications and streamline tax interactions.

Interactive tools for certification

Utilizing tools like pdfFiller significantly enhances the certification process. This platform offers an array of features designed for seamless document management.

By integrating these interactive tools, the entire certification process is simplified, reducing the time and effort needed to manage tax obligations. Collaborating through pdfFiller can lead to increased accuracy and timely submissions.

Detailed instructions for completing the certification of final taxable form

Filling out a certification of final taxable form requires careful attention to detail. This section provides a comprehensive walkthrough of the necessary steps.

Many users have questions regarding specific fields or requirements. Some frequently asked questions revolve around the need for supporting documentation, the implications of entering estimated figures, and guidelines for electronic submissions.

Filing and submitting the certification

Once the certification of the final taxable form is complete, the next step is to determine the best filing method. Depending on the jurisdiction, several options might be available.

Timeliness is crucial, as most tax authorities have strict deadlines for submission. After submitting your form, expect to receive a confirmation of receipt. Depending on the submission method, further actions or follow-ups may be necessary.

Common issues and troubleshooting

Throughout the certification process, various problems may arise. Understanding these common issues can prompt quicker resolutions.

If you encounter specific challenges, reaching out to tax authorities can provide clarity. Furthermore, utilizing resources such as pdfFiller customer support can offer immediate assistance during the certification process.

Case studies and real-world applications

Understanding how certification affects various real-world situations can deepen your comprehension of its importance. Here are a couple of examples.

Common pitfalls can often be avoided by examining these examples, which highlight the necessity of careful record-keeping and transparency during the tax certification process.

Resources for further assistance

While navigating tax certification, various resources are available to assist taxpayers. Familiarizing yourself with governmental tax department websites can help you understand jurisdiction-specific requirements.

Utilizing these resources effectively improves your capacity to prepare for certification and empowers informed decision-making regarding tax obligations.

Best practices for maintaining accurate records

To ensure ongoing accuracy in tax matters, maintaining meticulous records is vital. This entails keeping copies of all submitted forms for future reference and evidence.

By following these best practices and leveraging interactive tools like pdfFiller, users can navigate the certification of final taxable forms with increased confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute certification of final taxable online?

Can I create an electronic signature for the certification of final taxable in Chrome?

How do I fill out certification of final taxable on an Android device?

What is certification of final taxable?

Who is required to file certification of final taxable?

How to fill out certification of final taxable?

What is the purpose of certification of final taxable?

What information must be reported on certification of final taxable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.