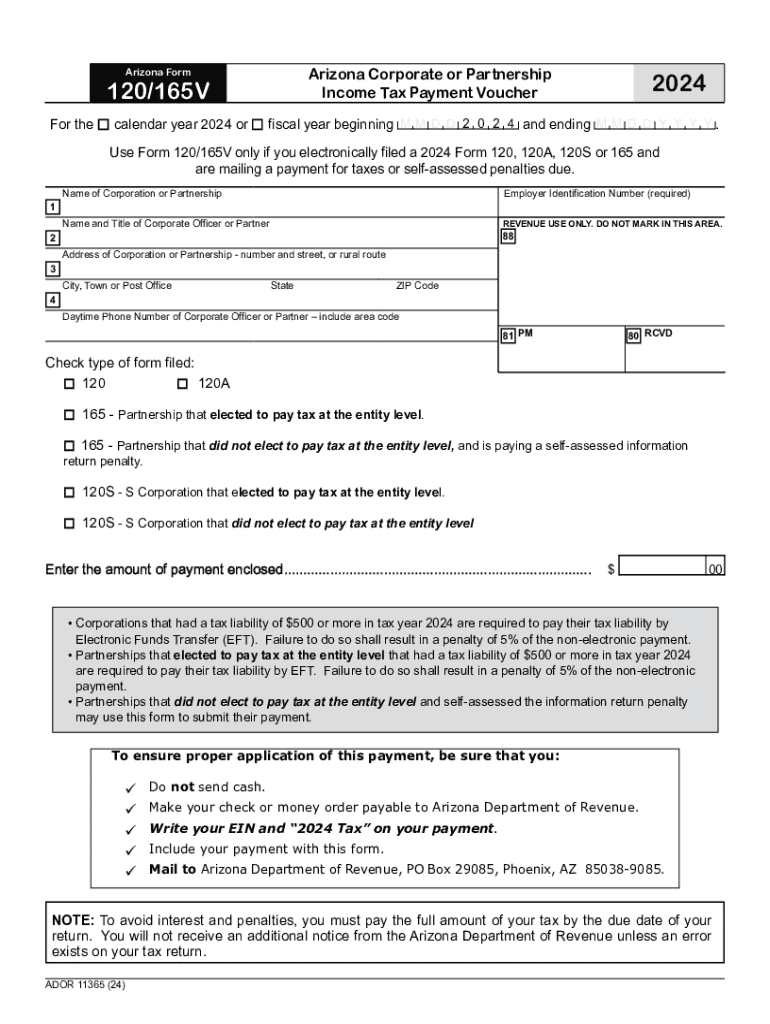

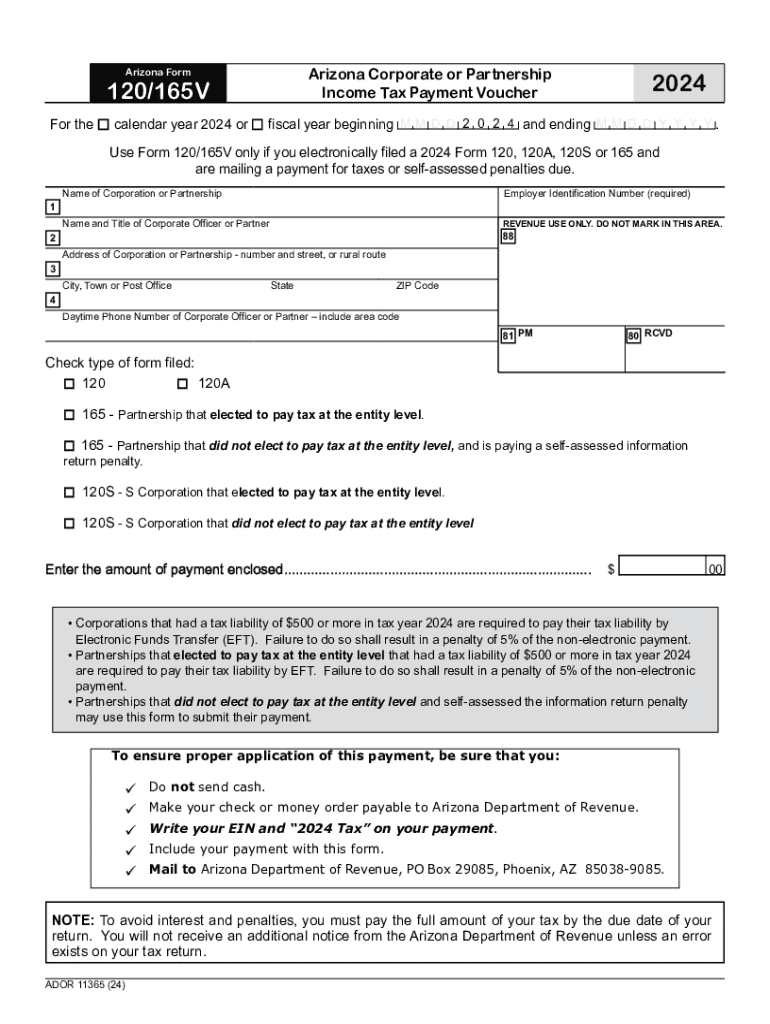

Get the free Arizona Corporate or Partnership Income Tax Payment Voucher

Get, Create, Make and Sign arizona corporate or partnership

Editing arizona corporate or partnership online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona corporate or partnership

How to fill out arizona corporate or partnership

Who needs arizona corporate or partnership?

Arizona Corporate or Partnership Form Guide

Understanding corporate and partnership forms in Arizona

Choosing the right business structure is crucial for any entrepreneur in Arizona. Corporate and partnership forms dictate your business’s operational framework, liability exposure, and tax obligations. A corporate form operates as a legal entity separate from its owners, while partnerships involve two or more individuals or entities working together to run a business. Understanding these distinctions is important not just legally but also in terms of financial implications.

When considering which structure suits your needs, think about factors like personal liability, tax treatment, and the management structure. Corporations typically offer limited liability protection, which safeguards personal assets from business debts. In contrast, partnerships might provide more operational flexibility but could expose personal assets to the risks involved in running a business.

Types of corporate and partnership forms in Arizona

Arizona offers multiple corporate and partnership forms, each with its unique advantages and challenges. Understanding these can help entrepreneurs make informed decisions that align with their business objectives.

Overview of common corporate forms

Common corporate forms in Arizona include C Corporations, S Corporations, and Limited Liability Companies (LLCs). C Corporations are taxed as separate entities, which may pose a double taxation issue. On the other hand, S Corporations allow profits and losses to pass through to shareholders, avoiding double taxation but with certain eligibility criteria.

LLCs combine the liability protection of corporations with the tax benefits of partnerships, making them a popular choice among small businesses.

Overview of partnership forms

In Arizona, partnerships can take several forms, including General Partnerships, Limited Partnerships (LPs), and Limited Liability Partnerships (LLPs). General Partnerships involve two or more individuals who share liability and management responsibilities. Conversely, Limited Partnerships consist of at least one general partner who manages the business and one or more limited partners who contribute capital but have limited liability.

LLPs, a hybrid of the previous two, provide limited liability for all partners, which protects personal assets from the debts of the partnership.

Eligibility requirements for forming a corporation or partnership in Arizona

When forming a corporation or partnership in Arizona, several eligibility requirements must be met. Typically, owners should be of legal age, and residency can be a factor in some cases. Proper identification must also be provided, and businesses must register with the appropriate Arizona authorities.

Additionally, businesses must comply with regulations imposed by the Arizona Corporation Commission, which oversees corporate filings. Depending on the nature of the business, local business licenses and permits may also be required, further complicating the filing process.

Steps to file an Arizona corporate or partnership form

Filing an Arizona corporate or partnership form involves several clear steps, ensuring compliance with state laws while setting the stage for solid business operations.

Step 1: Choose your business structure

The first step is to choose a business structure suited to your needs. Consider factors such as liability, tax implications, and the level of management control you desire. Consulting with a legal or financial professional may provide additional insights.

Step 2: Name your business

Next, you’ll need to choose a unique name for your business. The Arizona Secretary of State has specific regulations regarding naming conventions, so familiarize yourself with these guidelines to avoid rejection.

Step 3: Prepare and file required documents

Essential documents required for corporations include Articles of Incorporation, while partnerships typically need a Partnership Agreement. Make sure to provide complete and accurate information to streamline the filing process.

Step 4: Obtain an EIN

An Employer Identification Number (EIN) is crucial for tax purposes. It’s required for hiring employees, opening bank accounts, and filing taxes. You can obtain an EIN easily through the IRS.

Step 5: Draft internal governance documents

Prepare internal governance documents such as company bylaws for corporations or a Partnership Agreement for partnerships. These documents outline operations, roles, and responsibilities within the business.

Step 6: Open a business bank account

Lastly, open a dedicated business bank account. This ensures separation between personal and business finances, simplifying bookkeeping and tax filing.

Interactive forms and tools on pdfFiller

pdfFiller provides a robust platform for managing Arizona corporate or partnership forms efficiently. The website boasts user-friendly PDF editing and signing tools, facilitating seamless collaboration among teams. Users can edit, sign, and share documents from any location, making it an ideal solution for remote teams.

Not only does pdfFiller allow real-time editing and feedback capabilities, but it also supports document management solutions. Users can store and organize forms in a secure, cloud-based environment, making it easy to retrieve essential documents when needed.

Tips for successfully managing your Arizona corporate or partnership form

To ensure long-term success, maintaining compliance with Arizona state regulations is essential. Annual report filing deadlines and tax obligations specific to Arizona corporations and partnerships should be carefully monitored to avoid penalties.

Additionally, adopting best practices for document storage and management is crucial. Utilizing pdfFiller for cloud storage not only keeps important documents secure but also ensures that they are easily accessible for audits or legal purposes.

Troubleshooting common issues with Arizona corporate or partnership forms

Even with careful planning, issues can arise during the filing process. One of the most common problems is errors in documentation, such as incorrect names or misfiled forms. Always double-check your forms before submission to minimize errors.

If you discover errors post-filing, remedies are available. Contact the Arizona Corporation Commission for guidance on rectifying mistakes. Additionally, various resources can provide support and assist in navigating the complexities of business formation.

Glossary of terms related to corporate and partnership forms

Understanding the language of corporate and partnership forms can demystify the filing process and enhance comprehension. Here’s a glossary of key legal terms typically encountered:

FAQs about Arizona corporate and partnership forms

Navigating the process of setting up a business can raise several questions. Here are answers to some commonly asked questions regarding Arizona corporate and partnership forms:

Final steps after filing your Arizona corporate or partnership form

After successfully filing your Arizona corporate or partnership form, focus on establishing strong operational practices. Create a strategic business plan that outlines your goals, target market, and operational procedures. This will guide your business towards sustainable growth.

Continuously educate yourself about business practices, legal requirements, and industry trends. Utilize resources like pdfFiller to manage documentation efficiently and streamline workflow processes. Being proactive will offer substantial benefits in navigating your entrepreneurial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona corporate or partnership to be eSigned by others?

Can I create an electronic signature for signing my arizona corporate or partnership in Gmail?

How do I edit arizona corporate or partnership on an Android device?

What is arizona corporate or partnership?

Who is required to file arizona corporate or partnership?

How to fill out arizona corporate or partnership?

What is the purpose of arizona corporate or partnership?

What information must be reported on arizona corporate or partnership?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.