Get the free Required Minimum Distribution Request

Get, Create, Make and Sign required minimum distribution request

Editing required minimum distribution request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out required minimum distribution request

How to fill out required minimum distribution request

Who needs required minimum distribution request?

Required Minimum Distribution Request Form: A Comprehensive Guide

Understanding required minimum distributions (RMDs)

Required Minimum Distributions, commonly known as RMDs, are the minimum amounts that retirees are legally required to withdraw from their retirement accounts each year. The Internal Revenue Service (IRS) mandates RMDs to ensure that individuals do not defer taxes indefinitely on their retirement savings. This is crucial for effective retirement planning, as it directly impacts a retiree's cash flow in their later years.

Understanding RMDs involves recognizing their importance in financial planning for retirement, as these distributions ensure that retirees utilize their savings. Not only do these withdrawals provide cash flow, but they also serve as a means for the government to collect taxes on these accumulated funds.

Who is affected by RMD rules?

RMD rules primarily affect individuals aged 72 and older, who are required to start taking distributions. This age requirement is critical, as failing to comply can result in severe tax penalties. Additionally, RMDs apply to various types of accounts, including traditional IRAs, 401(k)s, and other defined contribution plans, while Roth IRAs are exempt until the account holder's death.

Knowing who is affected by these rules ensures that retirees and their advisors can strategize effectively to manage their withdrawals and obligations responsibly.

Consequences of not taking RMDs

Neglecting to take your RMD can lead to significant penalties, including a hefty 50% excise tax on the amount that should have been withdrawn. This tax imposes a substantial financial burden that complicates retirement planning. Moreover, not taking RMDs can disrupt an individual's tax strategy, leading to unintended tax implications down the road.

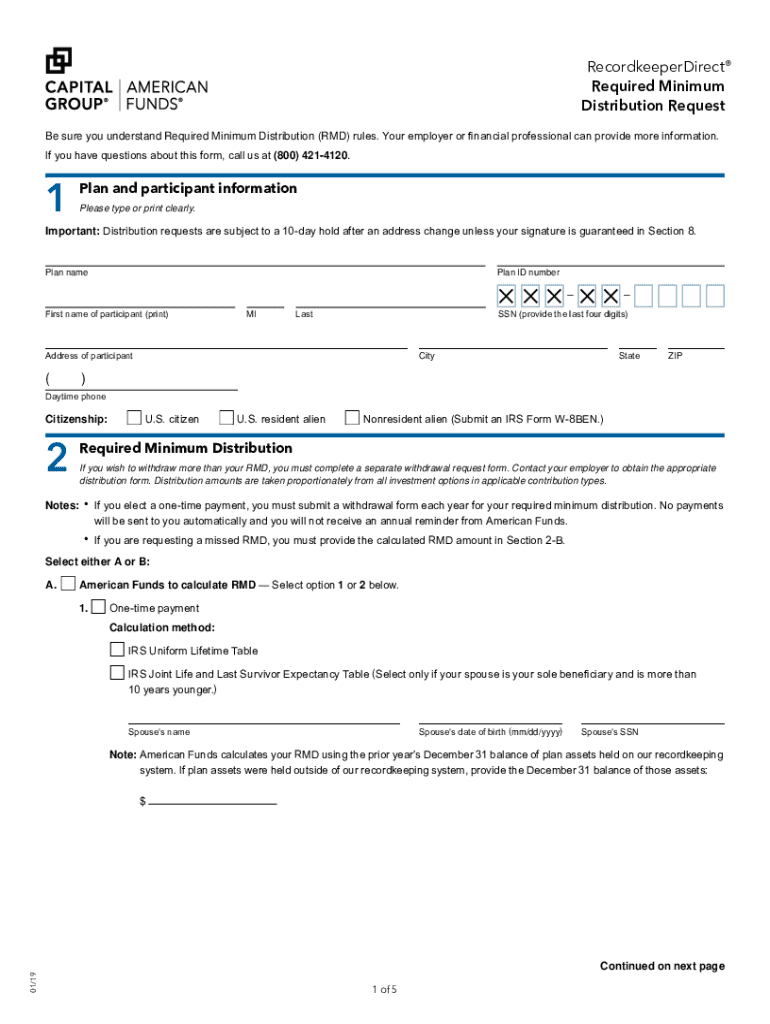

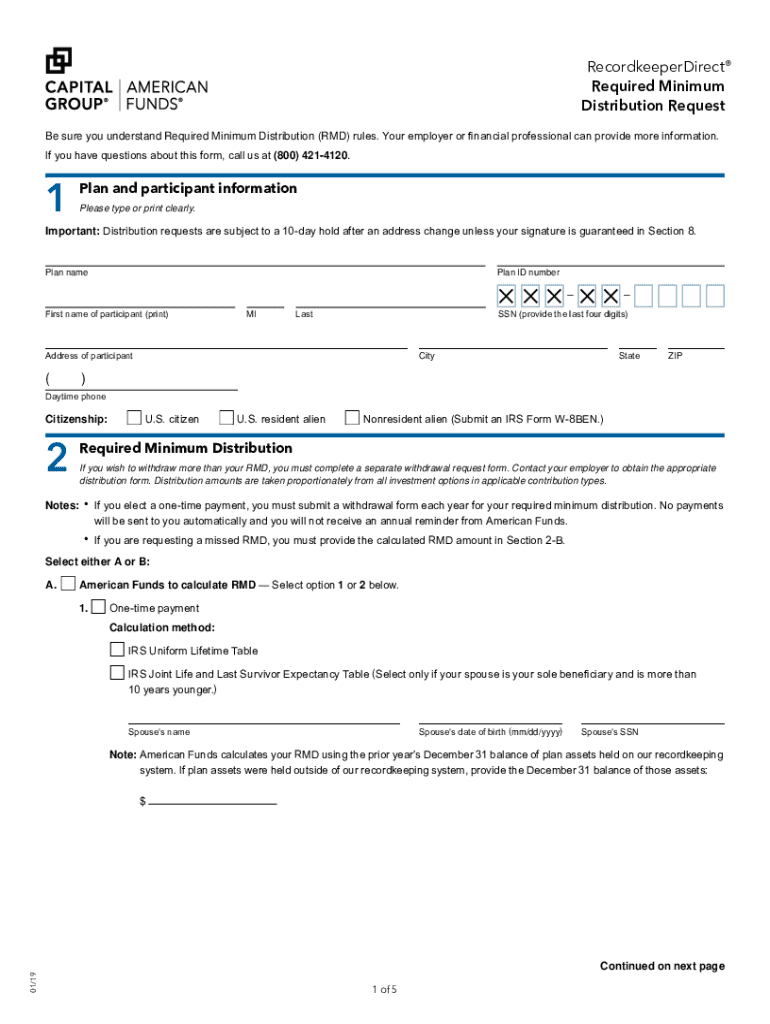

Key features of the required minimum distribution request form

The Required Minimum Distribution Request Form is an essential document for retirees looking to withdraw their mandatory distributions. This form serves a vital purpose in formalizing requests, ensuring tax compliance, and facilitating withdrawals from retirement accounts.

Completing the RMD request form accurately is crucial to avoid delays or compliance issues. It's the official method of communicating with your retirement account provider about your intentions regarding withdrawals.

Overview of required information

Typically, the RMD request form requires several personal details, including your name, Social Security Number (SSN), and account numbers. Additionally, donors must select from various distribution amounts and specify tax withholding preferences to ensure compliance with IRS regulations.

Step-by-step guide to completing the RMD request form

Before you begin filling out the required minimum distribution request form, it’s essential to prepare effectively. Gather all necessary documents such as account statements and your identification. Having this information ready will facilitate a smoother application process.

Preparation before filling the form

Start by ensuring you understand the aggregates of your retirement funds to accurately determine your required distribution. Consulting your financial advisor during this step can also provide clarity on any implications or strategies for your withdrawals.

Filling out the form: section by section

Personal information section

In the personal information section, enter your full name, Social Security Number, and relevant account details. Errors in this section can lead to processing delays, so double-check each entry.

Account information and RMD calculation section

This section typically requires you to provide specifics about your retirement accounts and how your RMD is calculated. Often, financial institutions have helpful calculators to determine this amount.

Distribution method selection

You can usually choose from one-time distribution options or opt for systematic withdrawals. Depending on your financial strategy, one of these methods may better suit your cash flow needs.

Tax withholding information

Lastly, specify your tax withholding preferences to avoid surprises when tax season arrives. This decision can significantly influence your overall tax liability for the year.

Common mistakes to avoid

One common pitfall is entering incorrect account numbers; this can lead to the form being rejected or delayed. Another frequent error is miscalculating the RMD amount. Using tools or consulting with a financial professional can prevent these mistakes.

Submitting your required minimum distribution request form

Once completed, the next step is to submit your required minimum distribution request form. Understanding your options for submission can streamline the process and reduce potential delays.

Options for submission

Most account providers offer online submission options, allowing for immediate processing of your RMD request through platforms like pdfFiller, where you can fill, sign, and submit your forms electronically. Alternatively, traditional mail options are available, but it's crucial to ensure that you send these documents securely to prevent any loss or identity theft.

Tracking your submission status

Keep an eye on your request’s progress by confirming its receipt with your financial institution. Many platforms provide tracking options, making it easy to stay informed about the status of your distribution.

Post-submission: what to expect

After submitting your RMD request form, it’s essential to know what comes next. Typically, you will receive confirmation of your submission, followed by a processing time before your funds are available.

Confirmation and processing time

Processing times can vary depending on the institution and the current workload. Generally, you should expect a processing timeframe of around 5-15 business days. Stay proactive by keeping track of this timeline and following up if necessary.

Receiving your distribution

Once processed, you'll receive your distribution via the method specified in your form. This can be through checks, direct deposits, or transfers. If you encounter any issues with your distribution, promptly contact your provider to resolve it.

Utilizing pdfFiller for your RMD requests

pdfFiller streamlines the entire process of managing your required minimum distribution request forms. From straightforward editing to seamless electronic signatures, pdfFiller enables users to navigate their financial paperwork conveniently and effectively.

Advantages of using pdfFiller

Using pdfFiller for your RMD requests offers various advantages. Its user-friendly interface allows you to edit forms seamlessly, while the eSignature capabilities facilitate quick and secure submissions. This platform simplifies the overall process, mitigating the hassle associated with managing required minimum distribution forms.

Collaborative features for teams

For financial teams managing multiple requests, pdfFiller’s collaborative features are incredibly beneficial. Team members can work together in real-time, helping to ensure that every form is completed accurately and submitted on time.

Accessing forms anywhere, anytime

Another critical benefit of using pdfFiller is the ability to access your documents from anywhere at any time. This cloud-based platform provides flexibility for both individuals and teams, keeping you connected to your essential financial forms and records.

Additional tips for managing retirement accounts and RMDs

Managing required minimum distributions goes beyond just filling out forms; it involves strategic planning and keeping up with regulatory changes. Staying informed about any modifications to RMD regulations can protect your interests and help you avoid costly mistakes.

Stay informed on changing RMD regulations

Regularly check the IRS website or subscribe to financial news sources to receive updates on RMD regulations. Knowledge is a powerful tool to ensure compliance and enhance your retirement strategy.

Planning ahead for future distributions

Set up a system to manage multiple accounts and plan distributions strategically. Consider consulting a financial advisor to build a comprehensive withdrawal strategy that aligns with your financial goals and minimizes your tax burden.

Engaging with customer support

At some point, you may need assistance while navigating your required minimum distribution request. pdfFiller provides a robust support system to aid users with their queries and challenges.

How to contact pdfFiller support

You can reach pdfFiller support through various channels such as live chat, email, or phone service. This accessibility ensures that users can get timely help when they need it most.

FAQs related to RMDs and pdfFiller services

Users often have specific questions regarding RMDs and how pdfFiller works. Ensure to review common FAQs available on the website, as they can provide quick resolutions to frequent queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find required minimum distribution request?

How can I edit required minimum distribution request on a smartphone?

How do I fill out required minimum distribution request on an Android device?

What is required minimum distribution request?

Who is required to file required minimum distribution request?

How to fill out required minimum distribution request?

What is the purpose of required minimum distribution request?

What information must be reported on required minimum distribution request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.