Get the free Nebraska Nonprofit Organization Annual Renewal Attestation

Get, Create, Make and Sign nebraska nonprofit organization annual

How to edit nebraska nonprofit organization annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska nonprofit organization annual

How to fill out nebraska nonprofit organization annual

Who needs nebraska nonprofit organization annual?

Nebraska Nonprofit Organization Annual Form: A Comprehensive Guide

Understanding Nebraska nonprofit organizations

A nonprofit organization in Nebraska is an entity established not for the purpose of making a profit but to serve a specific community interest or cause. These organizations, which can range from charities to educational institutions, play a fundamental role in the socio-economic landscape of Nebraska. To function effectively, nonprofits must adhere to annual compliance requirements to maintain their legal status and ensure continued support from donors and the government.

Annual compliance isn’t just a bureaucratic hassle; it’s essential to foster transparency and accountability, thereby building trust with stakeholders. Additionally, understanding the framework governing nonprofits, including the statutes that apply to them, is crucial for anyone involved in nonprofit management in Nebraska.

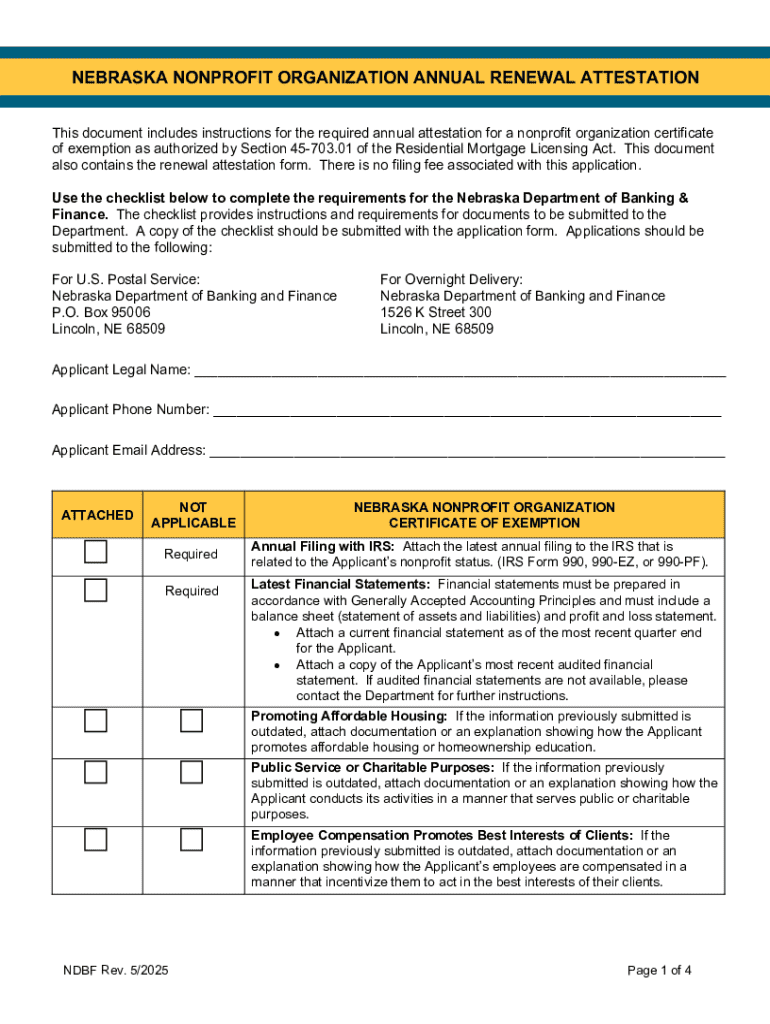

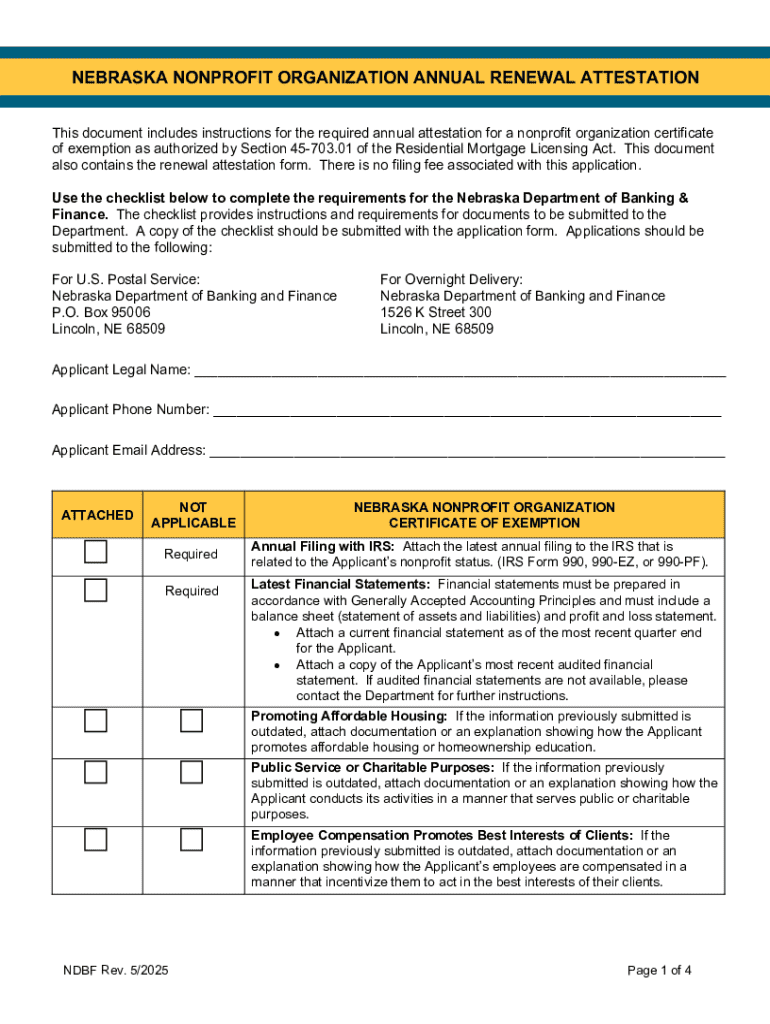

Nebraska nonprofit organization annual form overview

The Nebraska Nonprofit Annual Form is a crucial document required for all registered nonprofit organizations in the state. This form serves to provide the state with an overview of the nonprofit's operations, financial health, and compliance with state regulations. By annually renewing their status through this form, nonprofits demonstrate their continued commitment to their mission and accountability.

Key features of the Nebraska Nonprofit Annual Form include sections for financial reporting, governance information, and compliance certification. Organizations must determine whether they need to file based on their operational status and annual revenue, ensuring that all required forms are correctly submitted to maintain their nonprofit status.

Nebraska nonprofit organization filing requirements

Filing the Nebraska Nonprofit Organization Annual Form involves several important requirements designed to maintain organizational clarity and compliance. First and foremost, organizations must adhere to specific timelines for filing. Annually, most nonprofits must submit their forms by the 15th day of the fifth month following the end of their fiscal year. This creates a predictable rhythm for compliance and allows for adequate planning.

Failure to file on time can lead to consequences, including penalties or even revocation of nonprofit status—an outcome that could jeopardize funding. It's essential for organizations to prepare thoroughly, ensuring all necessary documentation is gathered ahead of time.

Step-by-step instructions to complete the Nebraska nonprofit annual form

Completing the Nebraska Nonprofit Annual Form can be a straightforward process when approached methodically. The form is divided into several sections, each requiring specific information and documentation.

Section 1: Basic organization information

In this section, nonprofits must provide basic organizational details, including the name, address, and tax identification number. Accuracy is key here, as mistakes can cause delays in processing.

Section 2: Financial information

Nonprofits need to report their revenue and expenses accurately to offer a clear picture of their financial health. This includes detailing both cash and in-kind contributions, which can be tricky, but are essential for a complete financial overview.

Section 3: Governance information

This section asks for information regarding the board of directors and management. Nonprofits need to ensure that they correctly document the number of board members, their terms, and any relevant affiliations to comply with governance standards.

Section 4: Compliance certification

Finally, organizations must complete a compliance certification. This is crucial as it attests to the accuracy of the information provided and reflects the organization’s commitment to ethical practices.

Digital tools for filling and submitting forms

Utilizing digital tools like pdfFiller enhances the efficiency of filling out the Nebraska Nonprofit Annual Form. Rather than dealing with cumbersome paperwork, nonprofits can leverage cloud-based services to manage their documents seamlessly.

Editing PDFs and active collaboration

With pdfFiller, nonprofits can easily edit their annual forms, collaborate with team members, and ensure all input is accurate before submission. The platform's collaborative features allow multiple users to review and revise the document, significantly reducing errors.

eSigning your Nebraska annual form

Securing eSignatures on the Nebraska Nonprofit Annual Form is simplified through pdfFiller. Users can easily add legally binding eSignatures, expediting the approval process.

Storing and managing documents in the cloud

Cloud storage solutions offered by pdfFiller mean that documents are available from anywhere, eliminating the worries associated with physical copies. Organizations can access their documents at any time, ensuring they can respond promptly to any inquiries or compliance checks.

Common challenges and solutions in filing

While filing the Nebraska Nonprofit Annual Form is necessary, many nonprofits encounter common challenges. Frequent errors include misreporting financial data and failing to meet submission deadlines. Such mistakes can lead to complications that nonprofits would rather avoid.

To mitigate these issues, organizations should establish a filing calendar and designate a compliance officer dedicated to overseeing the process. Regular training sessions on accurate reporting and compliance can also lessen the likelihood of mistakes.

State resources and support

For further assistance, nonprofits can contact the Nebraska Secretary of State’s office, which provides guidance on compliance and the annual filing process. The office encourages nonprofits to reach out with questions.

In addition, several online resources and professional organizations offer support tailored to Nebraska’s nonprofit landscape. From workshops on compliance to forums for peer support, there are numerous avenues for nonprofits to seek help.

Future considerations for nonprofit filings

Staying informed about upcoming changes in Nebraska nonprofit laws is essential for compliance. As legislative trends evolve, nonprofits must adapt their filing practices accordingly. For instance, any changes in reporting requirements or tax status could significantly impact how organizations approach their annual filings.

Monitoring trends affecting nonprofit infrastructure, such as funding shifts and emerging technologies, can also prepare organizations for future filing requirements.

Tips for maintaining nonprofit good standing

Maintaining good standing as a nonprofit extends beyond simply filing the Nebraska Nonprofit Annual Form. Organizations should proactively engage in community outreach and maintain transparent financial practices. By cultivating relationships with stakeholders, nonprofits can enhance their resource network and support system.

Additionally, nonprofits can benefit from regularly reviewing their governance structure to ensure compliance with best practices. This not only boosts operational effectiveness but also reinforces donor confidence and community trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nebraska nonprofit organization annual directly from Gmail?

How do I make edits in nebraska nonprofit organization annual without leaving Chrome?

Can I edit nebraska nonprofit organization annual on an iOS device?

What is nebraska nonprofit organization annual?

Who is required to file nebraska nonprofit organization annual?

How to fill out nebraska nonprofit organization annual?

What is the purpose of nebraska nonprofit organization annual?

What information must be reported on nebraska nonprofit organization annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.