Get the free Assignment of Life Insurance Proceeds

Get, Create, Make and Sign assignment of life insurance

How to edit assignment of life insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out assignment of life insurance

How to fill out assignment of life insurance

Who needs assignment of life insurance?

Understanding the Assignment of Life Insurance Form

Understanding the assignment of life insurance

The assignment of life insurance is a crucial yet often overlooked aspect of financial planning. This process allows the policyholder to transfer the rights and ownership of a life insurance policy either completely or partially. Understanding this assignment is essential for effective estate planning and ensures that beneficiaries are protected in various circumstances. Assigning a life insurance policy can serve multiple purposes, from securing a loan to managing estate taxes.

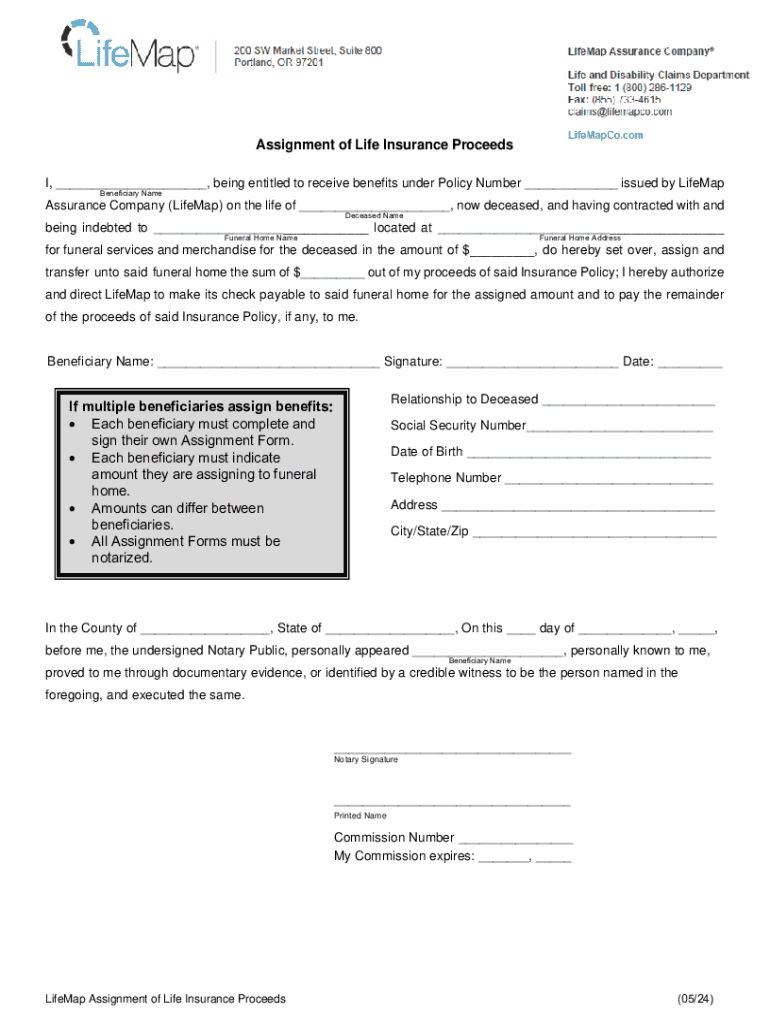

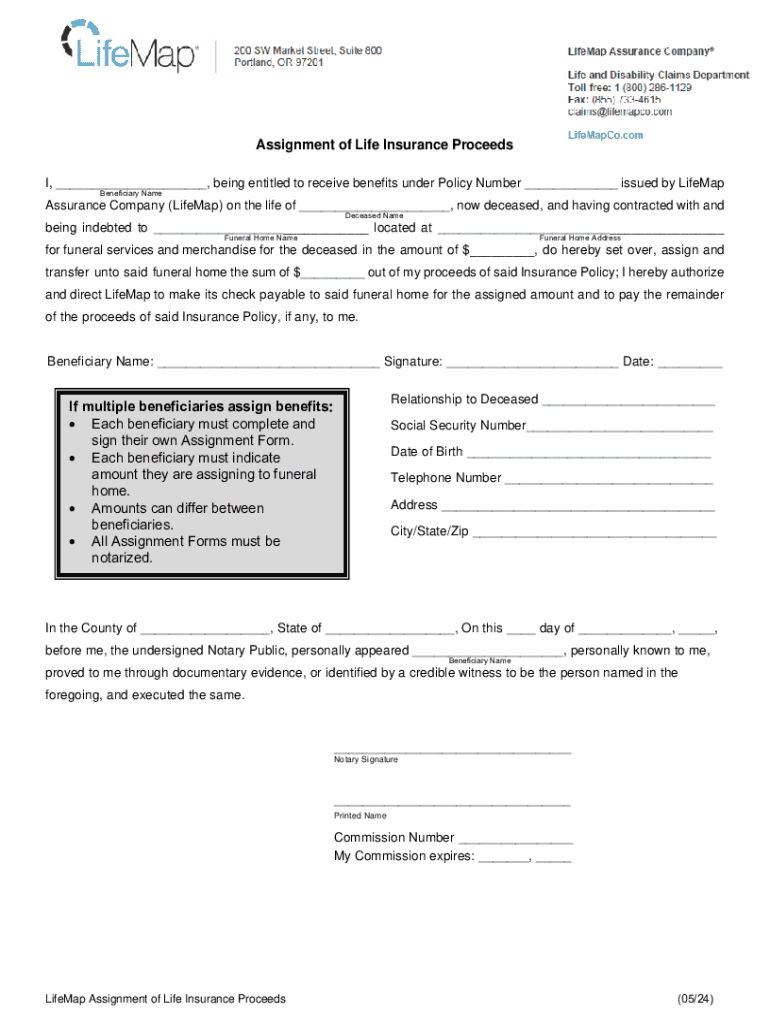

Key components of the assignment of life insurance form

The assignment of life insurance form is structured to collect vital information related to the policyholder and the beneficiaries involved. This includes essential details such as the policy number, the name of the insured, and identification of the assignee. Ensuring accuracy in these components is critical as any discrepancies can lead to future disputes.

Specific clauses within the form may stipulate whether the assignment is absolute or collateral. An absolute assignment transfers ownership completely, while a collateral assignment retains some rights for the original policyholder, typically for securing loans. Understanding these distinctions is vital to determine which option aligns with your financial objectives.

Step-by-step guide to completing the assignment of life insurance form

Completing the assignment of life insurance form requires careful preparation. Start by gathering all necessary documentation, including your life insurance policy and personal identification. Having a clear understanding of your insurance policy's terms and conditions will offer clarity as you navigate through the form.

Next, fill out the form section by section. This often includes specific fields for the policyholder's and assignee's information, as well as the actual terms of the assignment. Always aim for clarity and accuracy to avoid complications. Double-checking your entries can prevent common issues down the line.

Common mistakes to avoid include misinterpreting the terms within the form and providing incomplete information. Thoroughly reviewing each section can mitigate these pitfalls.

Finalizing the assignment

After accurately completing the assignment of life insurance form, the next step is signing the document. Both the policyholder and the assignee must provide their signatures, which confirms the agreement to the transfer of rights. Notarization might be required in some states to validate the assignment, adding an extra layer of security and trust.

Submitting the form is the final step in the assignment process. It’s important to submit the forms to the insurance company directly, as they will keep it on record. Retaining copies for personal records is also crucial. This not only aids in maintaining documentation but also provides a reference in case issues arise regarding the assignment.

Managing your assigned life insurance policy

Once the assignment is complete, managing your assigned life insurance policy becomes critical. If circumstances change and you need to update the assignment, it's essential to understand the process for doing so. This can involve creating a new assignment form or amending the existing one with new information.

To check the status of your assignment, contacting the insurance company directly is often the most effective route. They can provide insights into any changes or updates regarding the policy and clarify the rights held by both the assignor and the assignee post-assignment.

Resources for assistance and information

Navigating the complexities of life insurance assignments can feel daunting, but various resources are available for assistance. Most insurance companies provide dedicated customer support services to answer any questions you might have regarding the assignment process. Utilize available websites for FAQs, guides, and specific state regulations tailored to your needs.

For more complicated scenarios, consulting with a legal expert may be wise, particularly regarding compliance with state regulations. They can help clarify the implications of assignments on trusts, estates, or in the context of divorce settlements.

Advanced options in life insurance assignment

The assignment of life insurance has broader implications, particularly in estate planning. When a policy is assigned, it can significantly impact how benefits are distributed upon death. If you’re considering assigning a policy, it's essential to grasp how this might affect inheritance and tax liabilities for your estate.

Additionally, life insurance can serve as a vital financial tool when securing loans. Lenders may allow life insurance policies to be used as collateral, giving policyholders additional leverage. Understanding the unique requirements and implications for lenders is crucial for making the most out of your life insurance.

Interactive tools for document management

For those managing their life insurance assignment documents,pdfFiller offers an exceptional platform for document management. Utilizing this cloud-based solution lets you edit, sign, and collaborate on necessary paperwork efficiently. Whether you're working solo or within a team, you're assured a streamlined experience.

Features available on pdfFiller enable users to track changes across documents, ensuring everyone involved has access to the most up-to-date forms. Keeping clear records and information prevents confusion and protects the interests of both the assignor and assignee.

Frequently asked questions (FAQs)

When dealing with the assignment of life insurance forms, various common questions often arise. Questions may pertain to the effects of an assignment on premiums or continued coverage. Knowing your rights and responsibilities can alleviate concerns when navigating assignments.

Should any issues arise regarding the assignment, such as contested claims, a clear understanding of the assignment agreement will aid in troubleshooting. If delays in processing occur, contacting the insurance company promptly can often resolve these hiccups.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the assignment of life insurance in Gmail?

How do I fill out assignment of life insurance using my mobile device?

How do I fill out assignment of life insurance on an Android device?

What is assignment of life insurance?

Who is required to file assignment of life insurance?

How to fill out assignment of life insurance?

What is the purpose of assignment of life insurance?

What information must be reported on assignment of life insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.