Get the free Business Equipment Tax Exemption Application

Get, Create, Make and Sign business equipment tax exemption

How to edit business equipment tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business equipment tax exemption

How to fill out business equipment tax exemption

Who needs business equipment tax exemption?

Business Equipment Tax Exemption Form - A How-to Guide

Understanding the business equipment tax exemption

A business equipment tax exemption allows certain business entities to avoid paying taxes on qualifying equipment purchases. Primarily aimed at promoting investment and growth, these exemptions can significantly lessen operational costs. Understanding what constitutes a tax exemption is key for businesses seeking to maximize their financial performance.

Not all equipment qualifies for this exemption. Typically, items like machinery, computers, office furniture, and specialized equipment for manufacturing may be included, depending on state regulations. The purpose of these tax exemptions is to incentivize businesses to invest in their infrastructure, potentially fostering job creation and local economic development.

Eligibility criteria for the tax exemption

To qualify for the business equipment tax exemption, organizations must meet specific requirements. Generally, eligible entities are limited to businesses that operate within certain sectors, such as manufacturing, technology, and service industries. Non-profit organizations may qualify in certain states, emphasizing the need for local regulations to be reviewed.

Furthermore, the type of equipment is critical in determining eligibility. For instance, standard office supplies may not qualify, while large machinery or technology upgrades might. Businesses must provide proper documentation including proof of purchase, equipment details, and tax identification numbers to substantiate their exemption claims.

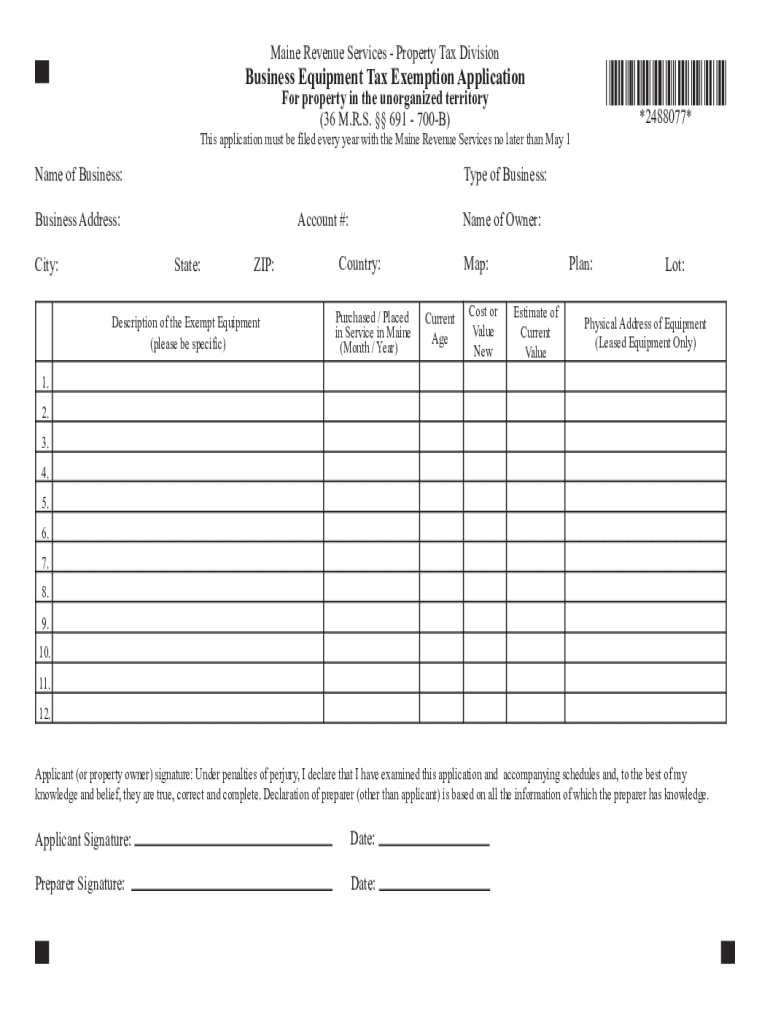

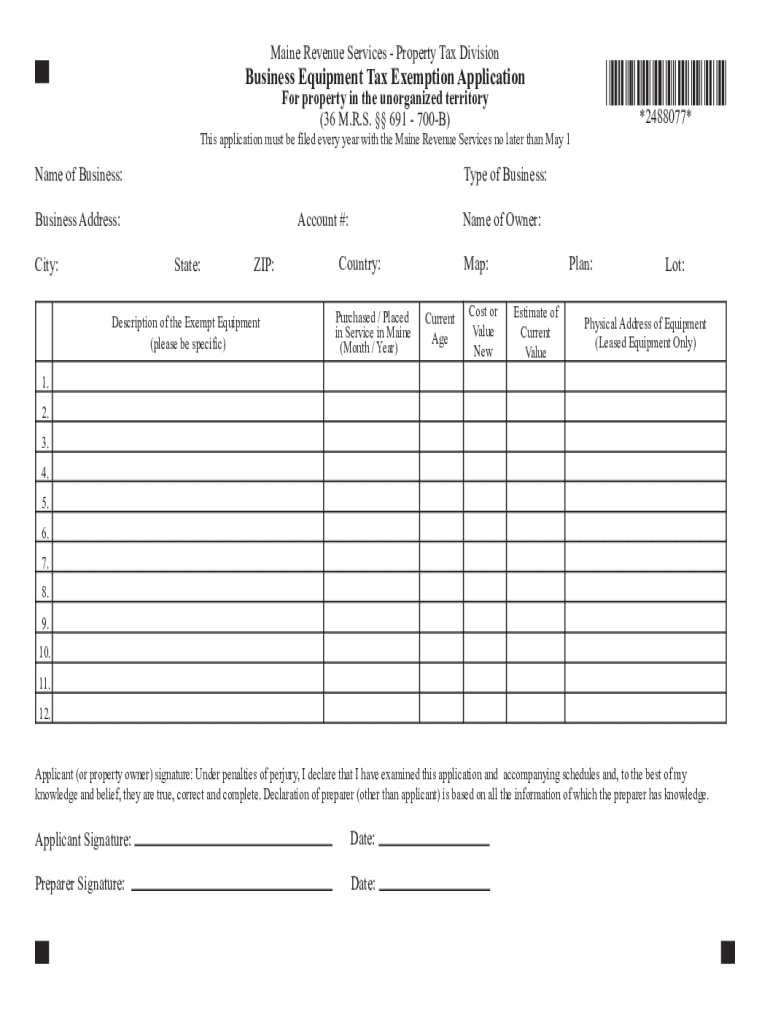

Filling out the business equipment tax exemption form

Completing the business equipment tax exemption form can seem daunting, but following a structured approach makes it manageable. Start with Section 1, where you will provide essential business details such as name, address, and registration number. Ensuring that all information is accurate is crucial to avoid future complications.

In Section 2, offer a detailed description of the qualifying equipment, including its classification and purpose within your business. The final section, Section 3, requires you to articulate your justification for exemption clearly. Use persuasive language, supported by data, to strengthen your case, emphasizing how the equipment contributes to business operations and growth.

Submitting the form

After completing the business equipment tax exemption form, the next crucial step is submission. Businesses can often choose between online submission and postal methods, depending on jurisdictional regulations. Online submissions tend to offer faster processing times and real-time confirmations.

Additionally, it’s essential to double-check state-specific submission guidelines, as requirements can vary significantly. After submitting, always track your application to stay informed about its status and follow up if you do not receive feedback within the expected timeframe.

Managing your tax exemption after approval

Once your business equipment tax exemption has been approved, you can enjoy the financial relief and other benefits that come with it. Approved exemptions often reduce operating costs and enhance your overall cash flow, allowing you to reinvest in other business areas such as hiring and marketing.

It's imperative to maintain meticulous records post-approval. Keeping accurate records not only helps in case of audits but also assists in future applications for exemptions. Utilizing tools within pdfFiller can streamline document management and ensure that your records remain organized and accessible.

Common questions and troubleshooting

As with any process, confusion regarding the business equipment tax exemption form can arise. Addressing frequently asked questions can clarify common misconceptions, such as who qualifies for exemptions and the specific types of equipment that may be included. It's essential to gather detailed information on these subjects to prepare effectively.

If applicants experience issues during the application process or face unexpected delays, they should not hesitate to seek assistance. Connecting with tax professionals can provide tailored guidance and improve the likelihood of successful applications. Community resources and local business support networks can also offer valuable insights and assistance.

Additional benefits of using pdfFiller for tax-related forms

Using pdfFiller offers a multitude of advantages when dealing with tax-related forms such as the business equipment tax exemption form. The platform's seamless document management allows for all necessary forms to be edited, signed, and organized in one location, eliminating the hassle of juggling multiple physical documents.

Moreover, pdfFiller’s collaboration features enable teams to work together on submissions in real time, ensuring that every detail is accurate and up to date before final submission. The eSigning functionality also simplifies the signing process, allowing for quick approvals that keep your business moving forward.

Case studies and success stories

Real-world examples underline the impact of the business equipment tax exemption on various industries. Companies ranging from tech startups to traditional manufacturing businesses have successfully utilized these exemptions, illustrating their value. For instance, a local manufacturing firm reported a 20% increase in capital investment after securing their tax exemption, showcasing how these savings can boost operational capacity.

Testimonials from business owners can provide profound insights into maximizing tax benefits while navigating the exemption process. By learning from these success stories, other businesses may find inspiration and strategies to optimize their tax situations as well.

Understanding compliance and regulations

Complying with regulations surrounding the business equipment tax exemption is critical for all applicants. Both state and federal guidelines outline eligibility, documentation requirements, and submission processes that must be adhered to. Understanding these regulations not only ensures compliance but also maximizes the potential financial benefits for the business.

Additionally, staying informed about legislative changes that may affect exemptions is vital. Utilizing resources like state tax department newsletters, industry associations, and professional tax advisers can help businesses keep track of evolving rules to remain compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the business equipment tax exemption electronically in Chrome?

How do I edit business equipment tax exemption on an iOS device?

How do I complete business equipment tax exemption on an iOS device?

What is business equipment tax exemption?

Who is required to file business equipment tax exemption?

How to fill out business equipment tax exemption?

What is the purpose of business equipment tax exemption?

What information must be reported on business equipment tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.