Get the free Business Report of Unclaimed Property

Get, Create, Make and Sign business report of unclaimed

Editing business report of unclaimed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business report of unclaimed

How to fill out business report of unclaimed

Who needs business report of unclaimed?

Business report of unclaimed form - A comprehensive how-to guide

Understanding unclaimed funds and their reporting

Unclaimed funds are financial assets or entities that have gone untouched for a specific period, typically due to inactivity or lack of proper identification of the rightful owners. Various types of unclaimed funds can include bank accounts, insurance claims, utility deposits, and overpayments. Under state law, businesses are required to report these unclaimed funds to maintain accurate financial records and adhere to regulatory standards.

Timely reporting of unclaimed funds holds immense importance for both individuals and businesses. Delays can lead to complications and penalties, causing financial strain. For businesses, it is essential to ensure compliance to safeguard reputation and maintain good relationships with regulatory bodies.

Preparing to complete the business report of unclaimed form

Before you fill out the business report of unclaimed form, it is crucial to gather all necessary documentation. This may include: ownership records that prove your rights to the funds, transaction records showing the nature and history of activity, and identification documents to verify your identity.

Determining your eligibility is equally essential. Not all unclaimed funds are reportable by every entity, so reviewing your jurisdiction's regulations is key. Additionally, avoid common pitfalls such as incomplete documentation or errors in spelling names, as these can lead to processing delays.

Step-by-step guide to filling out the business report of unclaimed form

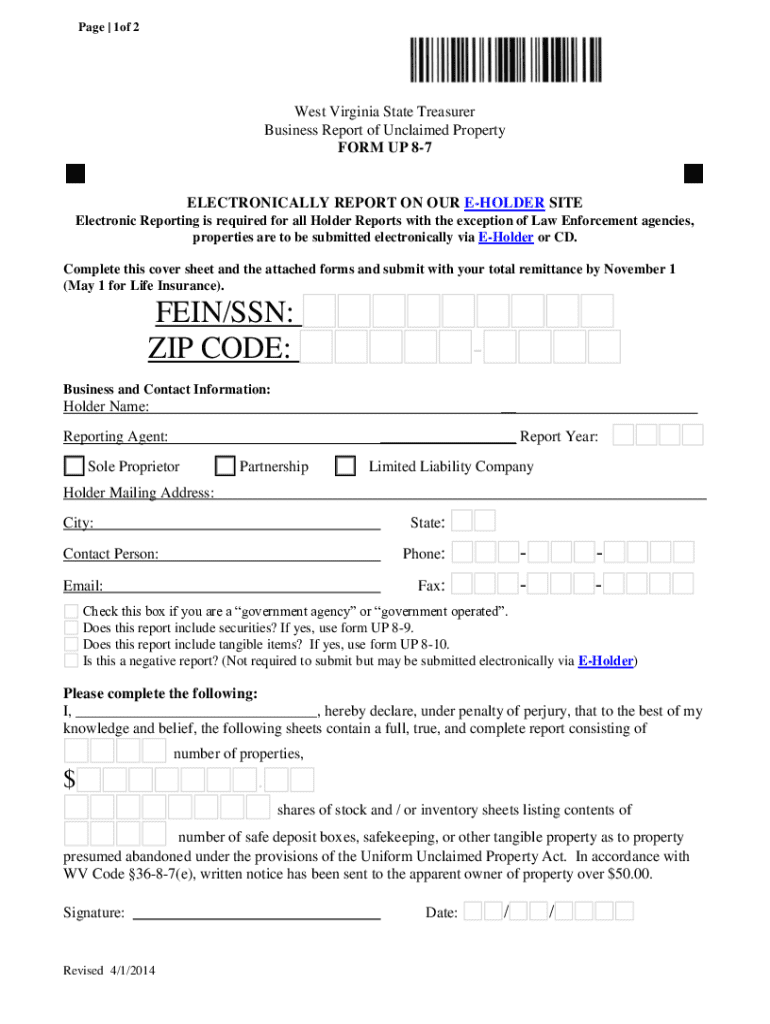

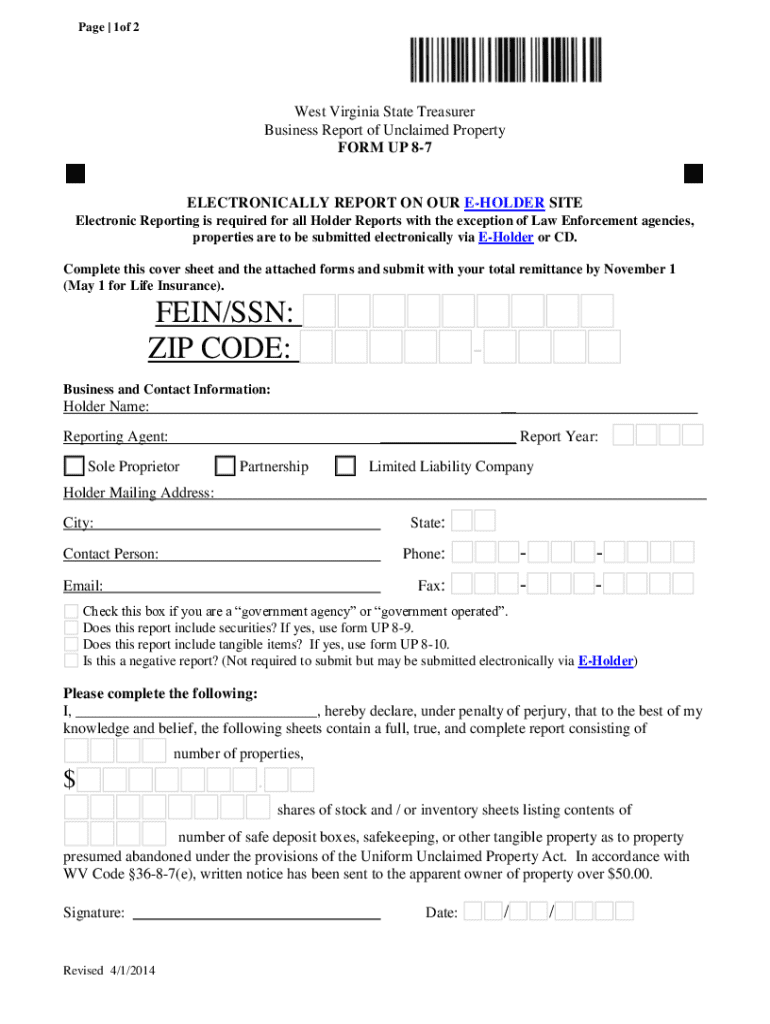

Filling out the business report of unclaimed form can be a straightforward process when you understand the form layout. The first section captures your identifying information, such as your business name, address, and contact details. Make sure these details are precise and current, as inaccuracies here can lead to complications down the line.

The second section focuses on a description of the unclaimed funds. You'll need to specify the amount in question, the origin of the funds, and the date of the last transaction. Being clear and thorough in this section helps to forestall potential inquiries and expedite processing.

Finally, provide the claimant details. This is where you clarify who is filing the report and their relationship to the funds. Describing your link to those funds lends credibility to your submission.

For accuracy and completeness, review the form multiple times and consider having a second pair of eyes look it over.

Editing and formatting your business report

Once your business report is drafted, utilizing tools from pdfFiller can enhance your document's appearance and functionality. pdfFiller offers robust editing capabilities that allow you to refine your report before submission. This includes correcting any mistakes or reshaping layout elements to ensure clarity.

When it comes to digital signatures, pdfFiller supports both traditional and e-signatures, ensuring your document meets all compliance requirements. Be aware that different states may have specific rules regarding signatures, so it's wise to double-check your submission against those regulations.

As a best practice, save your form as a PDF to ensure the formatting remains intact across different devices and platforms.

Submitting your business report of unclaimed funds

When it comes time to submit your business report of unclaimed funds, various methods are available depending on your state regulations. Many states offer online submission portals, which can streamline the process and provide immediate confirmation of receipt.

Mail-in options are also available, but remember to document your submission with tracking so you can confirm the report was received. After submission, be sure to confirm receipt and track the status of your report. Utilize any tracking numbers provided to stay updated.

Important considerations post-submission

After you’ve submitted your business report of unclaimed funds, it’s important to understand the potential timeline for processing your claims. While this varies by state, many agencies aim to process claims within a few weeks, though delays can occur depending on workload and the volume of claims.

Be aware of potential penalties for late submissions. Fines can impact both your business’s reputation and financial standing. If you encounter any processing issues, swiftly contact the appropriate agency for guidance and correction.

Frequently asked questions regarding unclaimed funds

Many individuals and businesses have questions when it comes to unclaimed funds. One common query is regarding errors on the form. Making a mistake on the report can lead to delays, so if an error occurs, contacting the relevant authority for guidance on how to correct it is imperative.

Businesses must also be aware of fines for not reporting unclaimed funds. These fines can accumulate, highlighting the importance of diligent reporting. Additionally, there is a statute of limitations for claiming unclaimed funds, which varies by state, necessitating timeliness in reporting and claiming.

Expanding your understanding: resources for businesses dealing with unclaimed funds

To further your knowledge about unclaimed funds, various resources exist. State-specific guidelines provide vital information tailored to your jurisdiction, ensuring you remain compliant and informed. Moreover, consider implementing recommended financial practices to prevent unclaimed funds from accumulating in the first place.

Staying updated on changes in regulations can help you avoid lapses in compliance. Consider subscribing to newsletters or alerts from regulatory authorities for the most current rules and practices.

Leveraging pdfFiller for ongoing document management

Using pdfFiller not only simplifies the process of filling out the business report of unclaimed form but also enhances your overall document management. With cloud-based document storage, you can access and edit your files from anywhere. This flexibility means that regardless of location, you can manage your finances and reporting obligations effectively.

Collaborative tools within pdfFiller allow teams to work together seamlessly, enabling real-time feedback and minimizing mistakes. The intuitive organization features make it easy to keep track of all relevant documents, including reports on unclaimed funds, ensuring nothing slips through the cracks.

Companies utilizing pdfFiller have reported improved efficiency in their document workflows. Happy clients attribute their success to streamlined processes that pdfFiller provides, allowing them to focus on growth rather than administrative headaches.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business report of unclaimed online?

How do I make edits in business report of unclaimed without leaving Chrome?

How can I edit business report of unclaimed on a smartphone?

What is business report of unclaimed?

Who is required to file business report of unclaimed?

How to fill out business report of unclaimed?

What is the purpose of business report of unclaimed?

What information must be reported on business report of unclaimed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.