Get the free Cardholder Dispute Form

Get, Create, Make and Sign cardholder dispute form

How to edit cardholder dispute form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholder dispute form

How to fill out cardholder dispute form

Who needs cardholder dispute form?

Your Complete Guide to the Cardholder Dispute Form

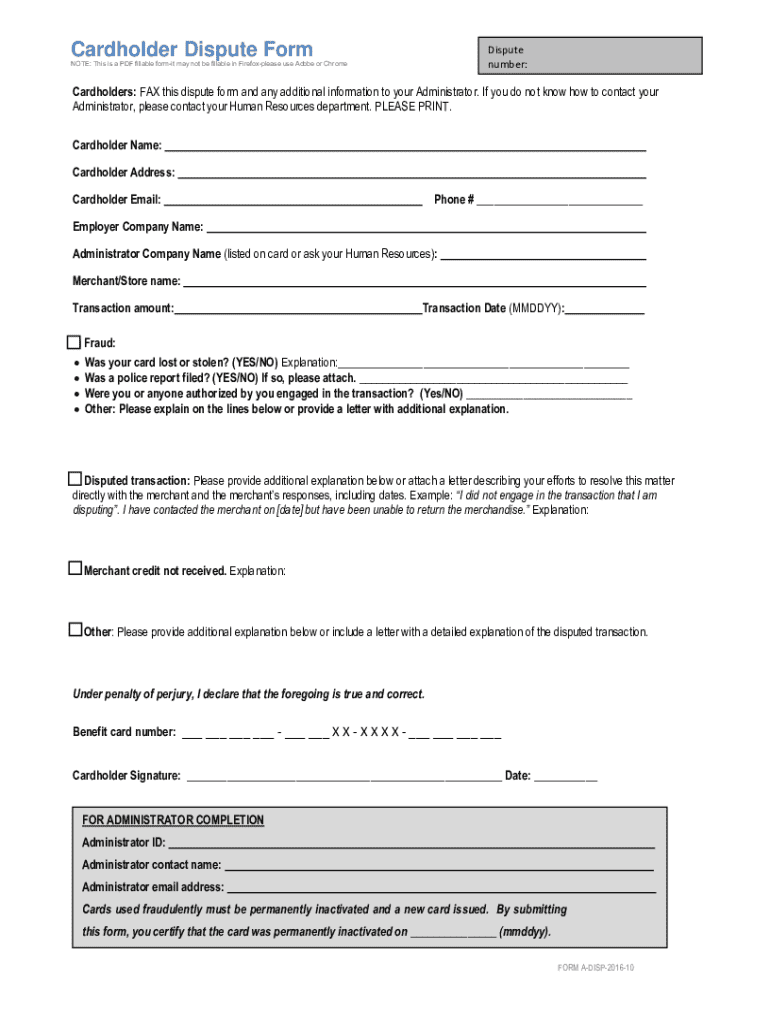

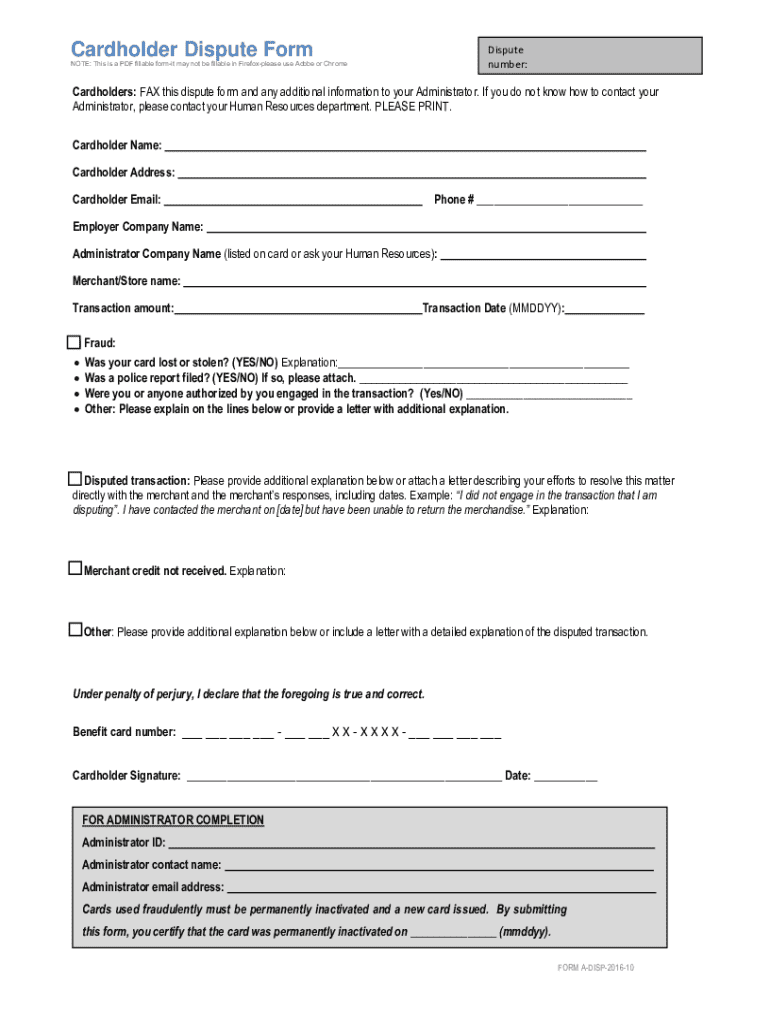

Understanding the cardholder dispute form

A cardholder dispute form is a formal document aimed at reporting issues or discrepancies related to credit or debit card transactions. When a cardholder notices unauthorized charges, billing errors, or goods/services not received, this form serves as the first step to resolve the matter with their financial institution.

Completing the cardholder dispute form accurately is paramount as it ensures that all relevant information is submitted for a prompt resolution. Missteps or omissions can prolong the dispute process, leading to frustration and potential financial loss.

Common situations that may necessitate a dispute form include unauthorized transactions, incorrect billing amounts, and failure to deliver goods or services ordered. Understanding these scenarios can help cardholders react appropriately and manage their accounts efficiently.

Preparing to fill out the cardholder dispute form

Before diving into filling out the cardholder dispute form, gather all necessary information and documents. This preparation can significantly streamline the process and enhance the chances of a successful dispute resolution.

Examples of required data typically include:

Identifying relevant transaction details is crucial. Investigate your bank statements thoroughly to ensure the accuracy of the information you're providing. Moreover, deciding whether to submit the form online or via paper is vital, as each method has its own advantages, such as speed and convenience.

Step-by-step guide to completing the cardholder dispute form

Filling out the cardholder dispute form can feel overwhelming. However, by breaking it down into sections, the process becomes much more manageable.

1. **Personal Information**: This section typically requires your full name, address, and contact information ensuring your financial institution can reach you if needed.

2. **Account Information**: You will need to fill in your account number, the type (e.g., checking, savings), and details pertinent to the transaction in question.

3. **Dispute Details**: Here, describe the nature of your dispute in detail and select the relevant category, such as:

4. **Supporting Documentation**: Attach any documents that support your claim, such as invoices, emails, or receipts. Clear documentation helps validate your dispute.

5. **Signature and Verification**: Finally, ensure you sign and date the form to verify your submission. Completing this crucial step is necessary for processing your dispute.

Editing and customizing your cardholder dispute form

Using interactive tools from pdfFiller allows you to customize your cardholder dispute form easily. Editing features for PDFs enable you to add, remove, or modify any information directly within the document.

For example, you can highlight sections of your form for emphasis or rearrange content to improve clarity. Tips for customizing your form include:

eSigning the cardholder dispute form

eSigning is the process of signing documents electronically, providing a secure and convenient way to validate your cardholder dispute form. To eSign your form on pdfFiller, follow these steps:

It's essential to ensure legal compliance with electronic signatures, as many regions recognize them as valid as traditional handwritten signatures, making your eSigned document legally binding.

Managing your cardholder dispute submission

Once you submit your cardholder dispute form, managing its status is crucial to ensuring your concerns are addressed timely. Here are actionable ways to monitor your dispute:

Staying proactive ensures that your dispute does not fall through the cracks, and enhances the likelihood of a favorable outcome.

Common mistakes to avoid when filing a cardholder dispute form

Even minor errors on your cardholder dispute form can lead to complications or delays. Here are common pitfalls to be aware of:

Taking care to avoid these common mistakes can make a significant difference in the outcome of your dispute process.

Best practices for future transactions

Prevention is always better than cure, especially regarding financial transactions. Here are some tips for avoiding future disputes and managing your transactions effectively:

Taking proactive measures can significantly decrease the likelihood of disputes, enabling you to manage your finances more effectively.

Resources for additional support with cardholder disputes

If you require further assistance with your cardholder dispute, there are numerous resources available. Start by contacting your financial institution directly for dispute assistance. Additionally, here are a few helpful avenues to explore:

Understanding your rights and the resources at your disposal can empower you during the cardholder dispute process, ensuring your concerns are addressed adequately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cardholder dispute form?

How do I edit cardholder dispute form on an iOS device?

How do I edit cardholder dispute form on an Android device?

What is cardholder dispute form?

Who is required to file cardholder dispute form?

How to fill out cardholder dispute form?

What is the purpose of cardholder dispute form?

What information must be reported on cardholder dispute form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.