Get the free Beneficiary Selection Form - Option D

Get, Create, Make and Sign beneficiary selection form

How to edit beneficiary selection form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary selection form

How to fill out beneficiary selection form

Who needs beneficiary selection form?

A Comprehensive Guide to the Beneficiary Selection Form

Understanding the beneficiary selection process

The beneficiary selection form serves as a crucial document that outlines who will receive assets upon the death of an individual. This form is typically associated with various financial accounts, such as life insurance policies, retirement accounts, and trusts. It ensures that your assets are distributed according to your wishes, which is why understanding the beneficiary selection process is paramount.

Choosing the right beneficiary can have profound implications. It can provide financial security for loved ones, fulfill philanthropic goals, or ensure that your estate is managed according to your preferences. In scenarios where you neglect to designate beneficiaries, your assets may be distributed according to state laws, potentially leading to outcomes that conflict with your intentions.

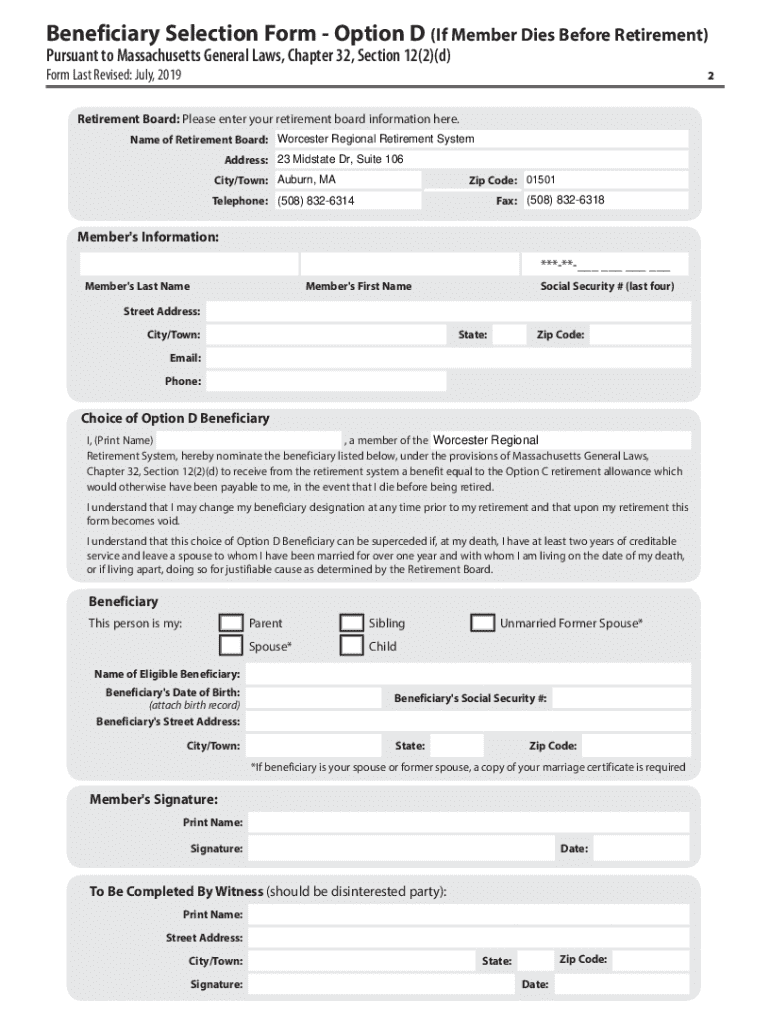

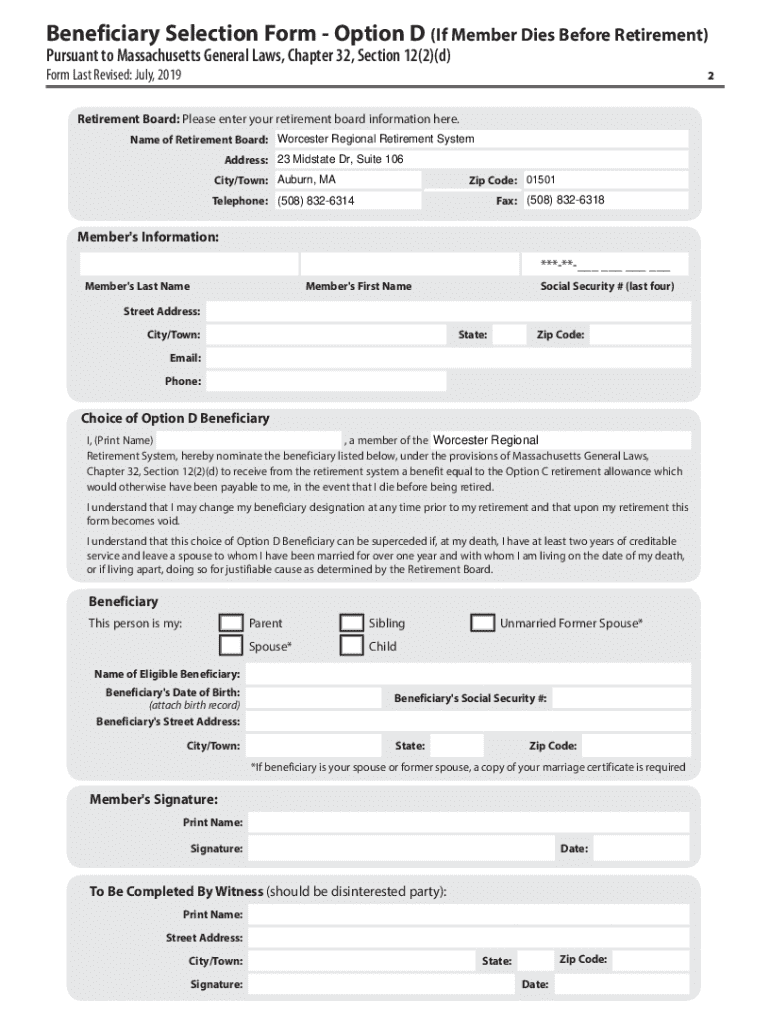

Key components of the beneficiary selection form

When filling out a beneficiary selection form, specific elements must be included for it to be valid and effective. The personal information section is crucial; it typically requires details such as full names, dates of birth, Social Security numbers, and contact details for both yourself and your selected beneficiaries. This ensures that there is no confusion regarding the identities of those involved.

Understanding the types of beneficiaries is also key. There are primary beneficiaries, who are the first in line to receive your assets, and contingent beneficiaries, who will inherit the assets if the primary beneficiaries are unavailable. Furthermore, beneficiaries can be individuals or organizations, so it’s essential to specify this to avoid any legal conflicts.

Step-by-step guide to filling out the beneficiary selection form

To complete a beneficiary selection form successfully, follow a meticulous step-by-step approach. Begin by gathering the necessary information, such as your identification documents and contact details for anyone you plan to name as a beneficiary. Having clear and accurate information at hand is essential to avoid delays or errors.

Next, complete the personal information section. Ensure that all details are correct and legible. When selecting beneficiaries, consider factors like their financial situation and your relationship with them. Specifying distribution percentages is also vital; it helps avoid any misunderstandings later. If you are naming more than one beneficiary, be clear about how you want to divide your assets. With this information organized, review the completed form carefully before signing it to confirm all details are accurate.

Editing and managing the beneficiary selection form

Managing your beneficiary selection form is just as crucial as filling it out initially. Tools like pdfFiller enable real-time edits, allowing users to access their forms online and make adjustments easily. This is particularly helpful if you need to change beneficiaries or update personal information due to life events.

When it comes to signing, electronic signatures have become an increasingly secure and efficient method. pdfFiller supports eSigning, which allows all parties to sign documents directly through the platform, streamlining the completion process. Furthermore, collaborating with stakeholders—such as legal advisors or family members—can be done effortlessly by sharing the document digitally, thus improving communication and ensuring everyone is informed.

Situations requiring updates to the beneficiary selection form

Life can be unpredictable, and several changes necessitate a review of your beneficiary selection form. Events such as marriage, divorce, the birth of a child, or the death of a beneficiary can all drastically alter whom you wish to inherit your assets. It’s essential to review and update your designations regularly to ensure they accurately reflect your current situation and intentions.

Moreover, you should be aware of any legal considerations that could impact your beneficiary designations. For instance, some states may have laws that influence how assets are distributed if beneficiaries are not explicitly identified. Timely updates can save your loved ones from navigating unnecessary legal complexities, clarifying your intentions greatly.

Common mistakes when completing the beneficiary selection form

Completing a beneficiary selection form is an important task, yet many individuals make mistakes that could lead to complications. A common error is failing to specify distribution percentages; this can result in assets being allocated evenly, contrary to the grantor's wishes. Ensure precise allocation to reflect your intent.

Another prevalent mistake is neglecting to update the form after significant life events, like divorce or the death of a beneficiary. This can create vast discrepancies between your intended allocations and what the official documents state. By keeping your selections current, you reduce potential disputes among heirs and ensure your assets are distributed as you desire.

Related information and resources

For those looking for additional forms, pdfFiller provides a plethora of resources related to beneficiary designations. It offers templates that can assist users in crafting their selection forms based on their individual needs. Furthermore, frequently asked questions about beneficiary designation are addressed, equipping users with the knowledge to make informed choices.

Understanding the order of precedence in beneficiary designations is essential. This refers to the hierarchy established by law regarding how beneficiaries are inherited in absence of a selection. Recognizing these default hierarchies can help individuals avoid unintentional consequences of not filling out a beneficiary selection form correctly.

Tips for ensuring your beneficiary selection is legally binding

To ensure that your beneficiary selection is legally binding, follow best practices for validation. Always keep copies of your form secured; digital storage on pdfFiller can help ensure they are accessible yet protected. It may also be wise to consult with a legal advisor to verify that your selections comply with applicable laws, especially if there are complex family dynamics.

The importance of witnesses or notarization should not be overlooked. Depending on your jurisdiction, having your form witnessed or notarized might be necessary for it to be enforceable. This will lend credibility to your designations and help safeguard against future disputes related to your estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary selection form from Google Drive?

Can I create an electronic signature for signing my beneficiary selection form in Gmail?

How do I edit beneficiary selection form on an iOS device?

What is beneficiary selection form?

Who is required to file beneficiary selection form?

How to fill out beneficiary selection form?

What is the purpose of beneficiary selection form?

What information must be reported on beneficiary selection form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.