Get the free Nm Business Personal Property Report

Get, Create, Make and Sign nm business personal property

How to edit nm business personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nm business personal property

How to fill out nm business personal property

Who needs nm business personal property?

The Complete Guide to the NM Business Personal Property Form

Understanding the NM Business Personal Property Form

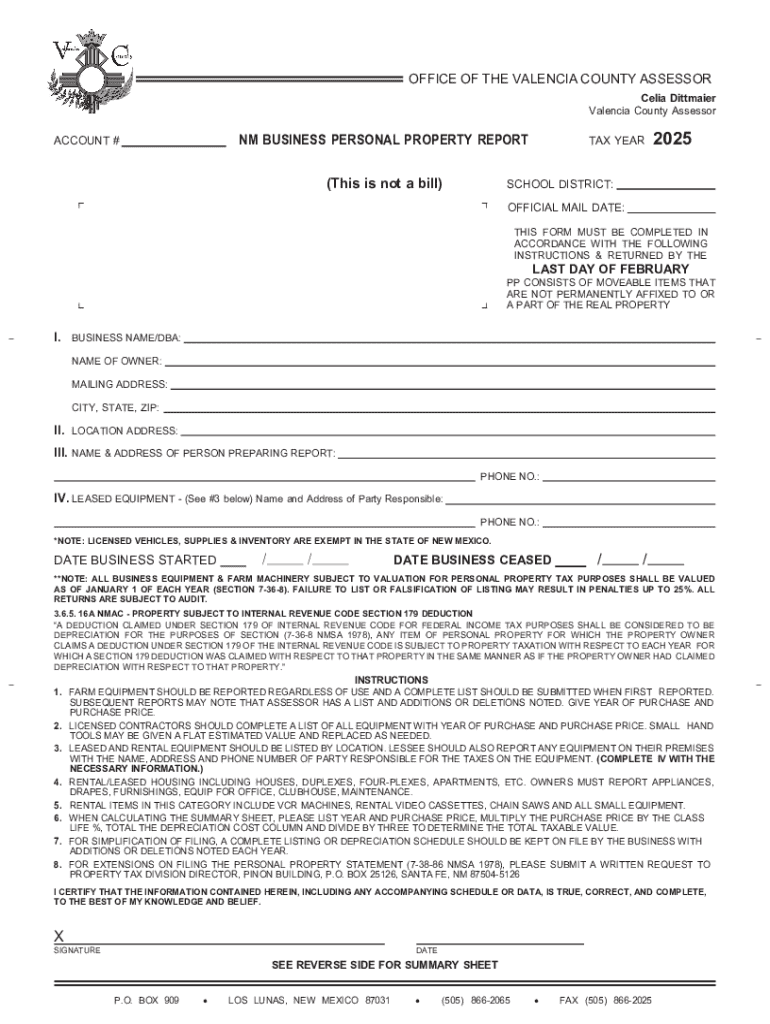

The NM Business Personal Property Form is a crucial document that businesses in New Mexico must file to report their personal property annually. This form serves the purpose of calculating property taxes owed on physical assets owned by the business, ranging from office furniture to machinery. Understanding this form is vital for compliance with New Mexico's taxation regulations, ensuring businesses correctly assess and report their assets to the Taxation and Revenue Department.

Filing the NM Business Personal Property Form is not only a legal obligation for businesses but also plays a significant role in financial planning. By accurately reporting personal property, entrepreneurs can mitigate tax liabilities and avoid penalties associated with noncompliance. Essentially, capturing a detailed inventory of personal property can help businesses maintain a transparent and responsible financial status.

Who needs to file this form?

Every business operating in New Mexico that holds personal property with a value exceeding a specific threshold must complete the NM Business Personal Property Form. This requirement encompasses a wide range of business entities, including sole proprietorships, partnerships, corporations, and limited liability companies. If your business uses equipment, furniture, vehicles, or any other personal property that impacts your operations, you are likely required to file this form.

Failure to submit the NM Business Personal Property Form can lead to severe legal implications, including fines or property tax assessments that could jeopardize a business's financial health. Thus, it is paramount for businesses to familiarize themselves with the filing requirements and timelines associated with this form to ensure compliance and maintain positive standing with tax authorities.

Preparing to fill out the NM Business Personal Property Form

Preparation is critical when getting ready to fill out the NM Business Personal Property Form. Businesses should gather all necessary information and documentation beforehand to ensure a smooth and prompt submission process. Key documents might include purchase invoices, previous year’s filings, and any records supporting the valuation of property items. Specific details such as the descriptions of assets, dates of acquisition, and current valuations are vital for an accurate submission.

Understanding property classification is also essential. Different categories of personal property exist, such as tangible property, which includes office equipment and machinery; intangible property, like patents and trademarks; and personal items not essential for operational purposes. Knowing how to classify your business assets can significantly simplify the reporting process and ensure compliance with state regulations. For example, office furniture is categorized distinctly from industrial machinery based on its use and value.

Step-by-step guide to completing the form

Accessing the NM Business Personal Property Form is straightforward. You can find the document designed specifically for this purpose on the New Mexico Taxation and Revenue Department's website. Additionally, businesses can utilize platforms like pdfFiller to download and fill out the form conveniently. By navigating to the required section on the website, you can easily download the form in PDF format or complete it online.

When entering your business information, accuracy is key. Include your business name, address, and contact details correctly to avoid issues with processing and tax assessments. After filling out these preliminary sections, the next step involves detailing your business personal property. Report the value of each asset clearly. Common mistakes include underreporting asset values or omitting property altogether; thus, taking careful inventory is crucial. Make sure to apply the correct classified values for each property type according to current market conditions.

As you finalize the form, a thorough review becomes essential. Creating a checklist can guide you through this process, ensuring that all entries are complete and accurate. Double-check entry data against supporting documents to eliminate errors that could attract penalties or delays in processing. This final step not only enhances the correctness of your submission but also reflects your commitment to comprehensive business practices.

Editing and e-signing using pdfFiller

With pdfFiller's intuitive editing tools, customizing the NM Business Personal Property Form becomes an effortless task. Business owners can easily make changes to text, add images, or even annotate sections of the form. The platform's user-friendly features allow for hyperlinking to resources that provide additional context to entries, enriching the form with needed information as a business owner prepares to submit.

Adding an e-signature is another vital aspect of completing the form online. E-signatures give legal validity to your submission, streamlining the approval process with tax authorities. By following the pdfFiller step-by-step guide to insert a signature, you can create a legally binding document without needing to print or scan.

Additionally, if your business involves teamwork, utilizing pdfFiller's collaboration tools allows for sharing the document among team members effortlessly. This feature promotes real-time input, enabling members to comment and revise the document collectively, enhancing overall accuracy and compliance.

Submitting the NM Business Personal Property Form

After completing the NM Business Personal Property Form, the next significant step involves submission. You can submit your completed form through various methods, including online filing directly via the Taxation and Revenue Department's portal, mailing a physical copy, or submitting in person at your local tax office. Each method has specific deadlines associated with it, which is crucial to monitor to ensure compliance.

Following up on your submission is equally important. Businesses should track their submissions to ensure proper processing by the tax authorities. Most states, including New Mexico, allow you to verify submission status online or by contacting the local tax office. Keeping records of your filings ensures that you have documentation available for any inquiries or future audits.

If any issues arise during the processing of your form, timely communication with the tax office can help you resolve discrepancies quickly and effectively, preserving your business reputation and accountability.

Managing personal property records with pdfFiller

Once you have submitted the NM Business Personal Property Form, managing your documentation becomes paramount. pdfFiller provides an ideal solution for storing and organizing your business documents securely in the cloud. Establishing a proper filing system, including categorizing forms in specific folders, ensures easy retrieval and maintains document integrity over time.

Moreover, utilizing templates within pdfFiller makes it much easier to prepare for future filings. Businesses can create custom templates based on previous forms, saving time and reducing the chance of errors in subsequent years. This feature allows quick modifications to accommodate any changes in asset valuation or classification, streamlining the filing process for years to come.

FAQs about the NM Business Personal Property Form

The NM Business Personal Property Form often generates many questions from business owners. Addressing common concerns ensures clarity and aids in successful compliance. One frequent misconception is that all businesses must file, regardless of the type of property they own. In reality, the necessity to file depends on whether your business holds personal property above the threshold determined by local tax authorities.

It's essential to consult resources for further assistance, including the New Mexico Taxation and Revenue Department's publications folder or their website, which provides comprehensive guidance on legislative updates and frequently asked questions, ensuring businesses navigate the complexities of property tax regulations successfully.

Testimonials and success stories from pdfFiller users

Numerous users of pdfFiller have reported positive experiences when utilizing the platform to manage their NM Business Personal Property Form. Many have highlighted how pdfFiller's intuitive interface and robust editing features have allowed them to simplify the form-filling process, ultimately leading to timely submissions and a reduction in paperwork-related stress.

The accessibility and efficiency that pdfFiller provides not only simplifies the completion of the NM Business Personal Property Form but also reinforces the integration of technology in streamlining essential business operations. Users have embraced the cloud-based document solutions, remarking on how it allows for seamless management of important tax-related documents.

Next steps after filing the NM Business Personal Property Form

After filing the NM Business Personal Property Form, it’s crucial to adhere to ongoing obligations linked to personal property reporting. Businesses must remain vigilant regarding any changes in their asset values or acquisitions throughout the year and be prepared to update their filings accordingly. Understanding these requirements ensures that your business does not face unexpected tax liabilities.

Additionally, leveraging other services on pdfFiller can simplify documentation needs further. With an array of tools for document automation, e-signing, and collaboration features, pdfFiller stands out as a reliable solution for businesses seeking efficiency in their paperwork management. By continuously utilizing these resources, businesses can enhance their operational workflows and maintain compliance with regulatory standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nm business personal property to be eSigned by others?

How can I fill out nm business personal property on an iOS device?

Can I edit nm business personal property on an Android device?

What is nm business personal property?

Who is required to file nm business personal property?

How to fill out nm business personal property?

What is the purpose of nm business personal property?

What information must be reported on nm business personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.