Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Your Comprehensive Guide to Campaign Finance Receipts Expenditures Form

Understanding campaign finance basics

Campaign finance plays a pivotal role in the electoral process by ensuring that candidates can effectively communicate their messages and reach voters. The complexity of funding in campaigns necessitates a system of checks and balances to prevent corruption and ensure equitable access to political office. Understanding campaign finance not only aids candidates in compliance but fosters a transparent environment where voters can make informed decisions based on who finances their candidates.

Transparency and accountability are crucial as they help combat potential corruption. When the flow of money into campaigns is monitored, the potential for illicit influence is significantly reduced. This applies particularly to campaign finance receipts expenditures forms, which directly account for the inflow and outflow of campaign funds, thereby allowing for public scrutiny of financial activities.

Key terminology

To effectively navigate the landscape of campaign finance, it's essential to grasp key terms. Receipts refer to all funds received by a campaign, including contributions from individuals, organizations, and political action committees (PACs). Expenditures are the expenses incurred by the campaign, such as advertising, staff payments, and event costs. Contributions specifically denote donations made to support a campaign, often regulated to ensure fairness in electoral competition.

The importance of campaign finance receipts and expenditures forms

Filing campaign finance receipts expenditures forms is not merely a bureaucratic exercise; it’s a legal requirement that underscores the essence of democracy. Various laws govern the reporting of campaign finances, and understanding these is crucial for any candidate or campaign team. Compliance with these regulations helps maintain the integrity of the electoral process and fosters public trust.

Failing to comply with filing rules can have serious consequences, including hefty fines or even disqualification from the election. The purpose of receipts and expenditures forms is two-fold: they ensure that all campaign finances are documented and provide the public with insights into how political campaigns are funded and how they spend their money. This promotes an environment where voters can hold candidates accountable for their financial conduct and priorities.

Types of campaign finance forms

Campaign finance forms vary significantly depending on the purpose they serve. Generally, they can be categorized into several types, including forms for individual contributions, expenditure tracking forms, and aggregate reports, which vary for candidates and PACs. Each form serves a specialized purpose and complies with specific legal requirements dictated by regulatory bodies.

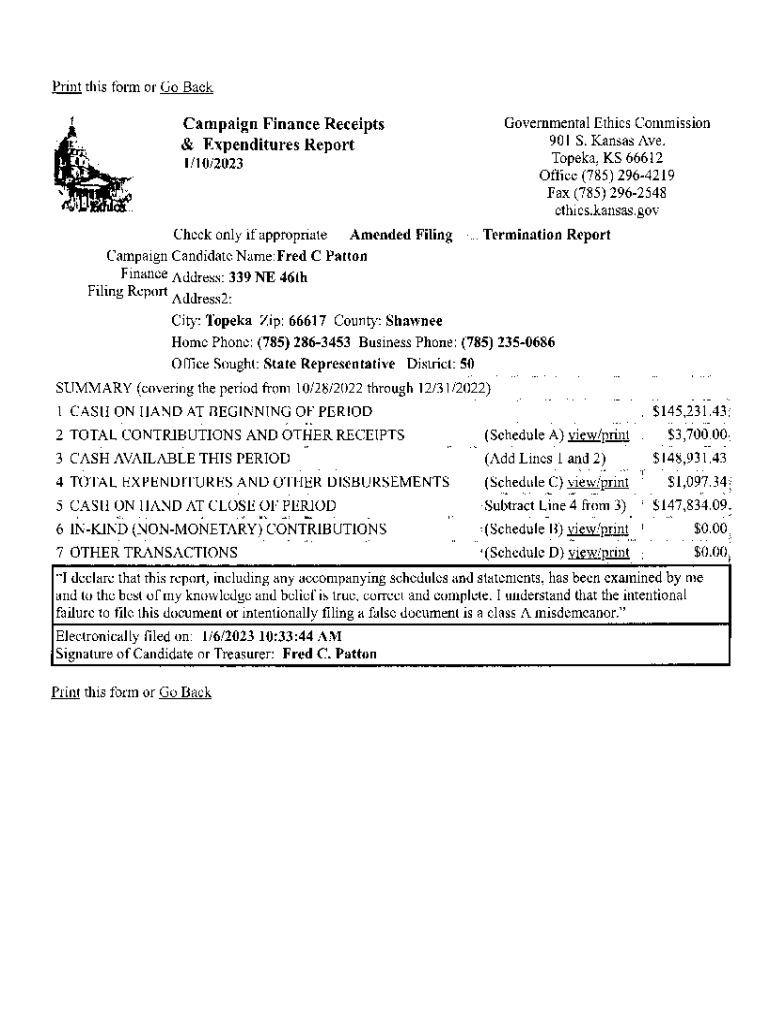

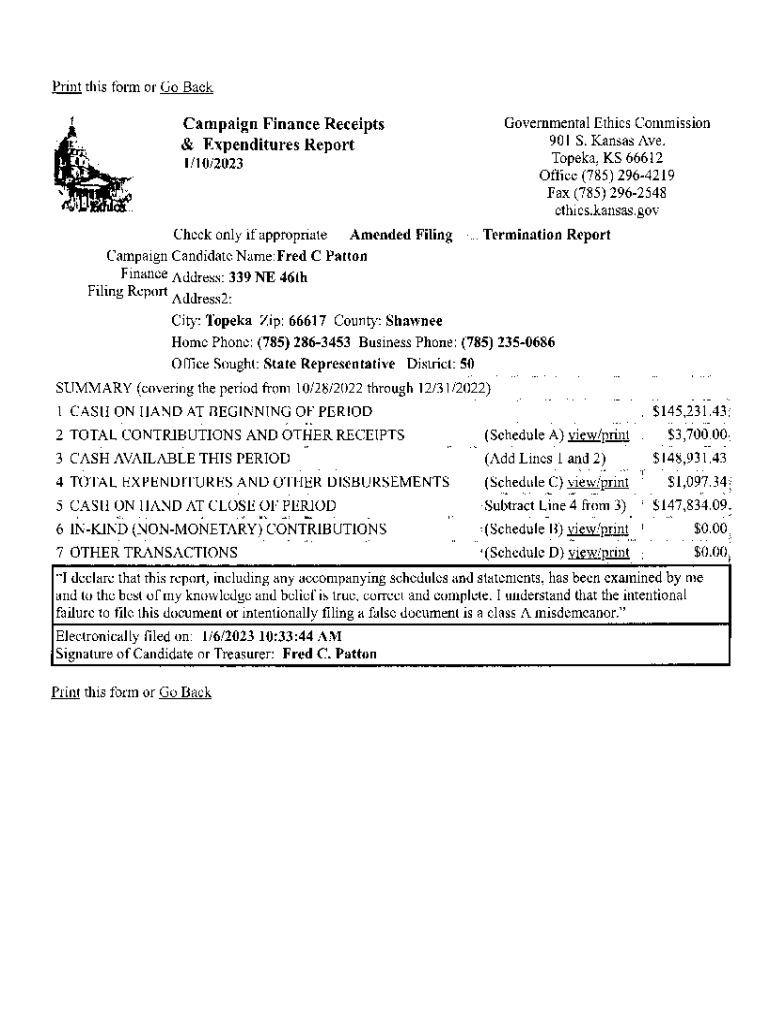

A specific example of these forms is the receipts expenditures form, designed to document all contributions received and expenses incurred during a campaign. This form is vital for providing a clear financial picture of a campaign's health and adherence to transparency laws. Accurately completing this form is crucial for compliance and offers valuable data that can be analyzed post-election for future campaigns.

Preparing to fill out the form

Before you begin filling out the campaign finance receipts expenditures form, collecting the necessary information is essential. Start by organizing all receipts for donations, ensuring you have clear records of each contribution’s source, amount, and date. This will not only ease the filling out process but also help avoid potential discrepancies during audits.

In addition to gathering donation receipts, compile all relevant details regarding expenditures. This includes invoices, receipts for services rendered, and documentation for any operational costs incurred. Avoid common mistakes such as misreporting funds or failing to include essential details, as these can lead to complications with regulatory bodies.

Step-by-step guide to filling out the campaign finance receipts expenditures form

To accurately fill out the campaign finance receipts expenditures form, follow a structured approach. Start with section one, wherein you need to provide personal and campaign information, including candidate details and campaign name. Then, move to the section documenting contributions, clearly indicating who contributed, the amount given, and the date of the contribution.

Next, report expenditures by itemizing all expenses in detail, ensuring clarity and compliance with financial reporting requirements. Utilize tools like pdfFiller, which allow you to fill, edit, and manage forms seamlessly. Cloud-based solutions also provide the advantage of accessing your documents from anywhere and safe storage.

Reviewing and editing your submission

Accuracy in your campaign finance receipts expenditures form is paramount. Before submission, create a checklist of items to review, such as the completeness of contributions and clarity of expenditures. Cross-reference with supporting documents to ensure everything matches accurately.

If you need to make edits to your form, using pdfFiller's intuitive editing tools simplifies this process. You can conveniently alter fields as required and ensure your final submission is clear and precise.

Submitting your campaign finance receipts expenditures form

Understanding the submission protocols for your campaign finance receipts expenditures form is vital for ensuring timely compliance. Different methods exist for submission, ranging from online platforms to physical mail. Be aware that each method may have different processing times and verification mechanisms. Hence, ensuring you meet reporting deadlines is critical.

Once you have submitted your form, it's wise to obtain confirmation of receipt. This can often be achieved through automated emails in online submissions or return confirmations in physical submissions. Following up ensures that you have peace of mind and can address any issues before they escalate.

Managing future campaign finance activities

Maintaining meticulous records of your campaign finance activities is invaluable for future elections. Adopt best practices for recordkeeping, such as organizing receipts and expenditures by date and category. This not only aids in filing future forms but also helps in strategizing for upcoming campaigns based on past financial performance.

Utilizing pdfFiller for ongoing campaign needs can greatly enhance your efficiency. You can set up templates for future forms, reducing the preparatory workload. The collaborative features of pdfFiller also allow team members to access and update shared documents conveniently, ensuring everyone stays on the same page.

Frequently asked questions about campaign finance reporting

Navigating the complexities of campaign finance reporting often leads to common queries. Frequently, candidates or campaign managers inquire about how to classify certain contributions, the duration for retaining financial records, and clarity around the limits on contributions from various sources. Addressing these queries proactively can help prevent compliance issues later.

Additionally, troubleshooting common issues with forms, such as technical difficulties with online submissions or unclear guidance on completing specific sections, can be crucial in maintaining momentum during the reporting phase. Engaging with local election officials or utilizing online resources can provide clarity and guidance.

Expert tips for effective campaign finance management

Ensuring financial transparency is essential in any successful campaign. Best practices include regularly updating financial records and establishing a clear protocol for documenting transactions. Transparency builds trust with voters and promotes an ethical campaign environment.

Leveraging technology can be particularly beneficial for compliance and efficiency. Tools like pdfFiller facilitate seamless document management, e-signature capabilities, and collaborative features, which all contribute to a smoother campaign finance process. A structured approach to financial management ultimately leads to better strategies and resource allocation in political campaigns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts expenditures directly from Gmail?

How can I modify campaign finance receipts expenditures without leaving Google Drive?

How do I fill out the campaign finance receipts expenditures form on my smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.