Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

A Comprehensive Guide to Campaign Finance Receipts Expenditures Form

Understanding campaign finance receipts and expenditures

Campaign finance receipts and expenditures play a crucial role in the political ecosystem, dictating how candidates raise and spend funds during their campaign. Understanding these components is vital for every candidate and campaign manager to ensure compliance with financial regulations.

What are campaign finance receipts?

Campaign finance receipts refer to the money that candidates and their committees receive to fund their campaign activities. These funds can come from various sources such as contributions from individuals, political parties, and businesses. Loans taken out specifically for campaign purposes also fall under receipts.

What are campaign finance expenditures?

On the other hand, campaign finance expenditures are the expenses incurred during the campaigning process. This may include costs associated with advertising, staffing, event organization, and operational expenses. Monitoring these expenditures is crucial for candidates to ensure they do not exceed their budget or violate financial limits established by law.

The importance of accurate reporting

Accurate reporting of campaign finance receipts and expenditures is not just good practice; it is legally mandated. Both federal and state laws require candidates to disclose their financial activities to promote transparency in the election process.

Legal requirements for campaign finance reporting

Candidates must comply with the Federal Election Commission (FEC) regulations, which outline detailed protocols for collecting and reporting campaign finance data. Non-compliance can lead to severe consequences, including fines and loss of public trust.

Best practices for maintaining accuracy

To maintain accurate financial records, candidates should implement a systematic approach to documenting every receipt and expenditure. Regularly updating financial reports and maintaining organized records will streamline the submission process and help avoid last-minute mistakes.

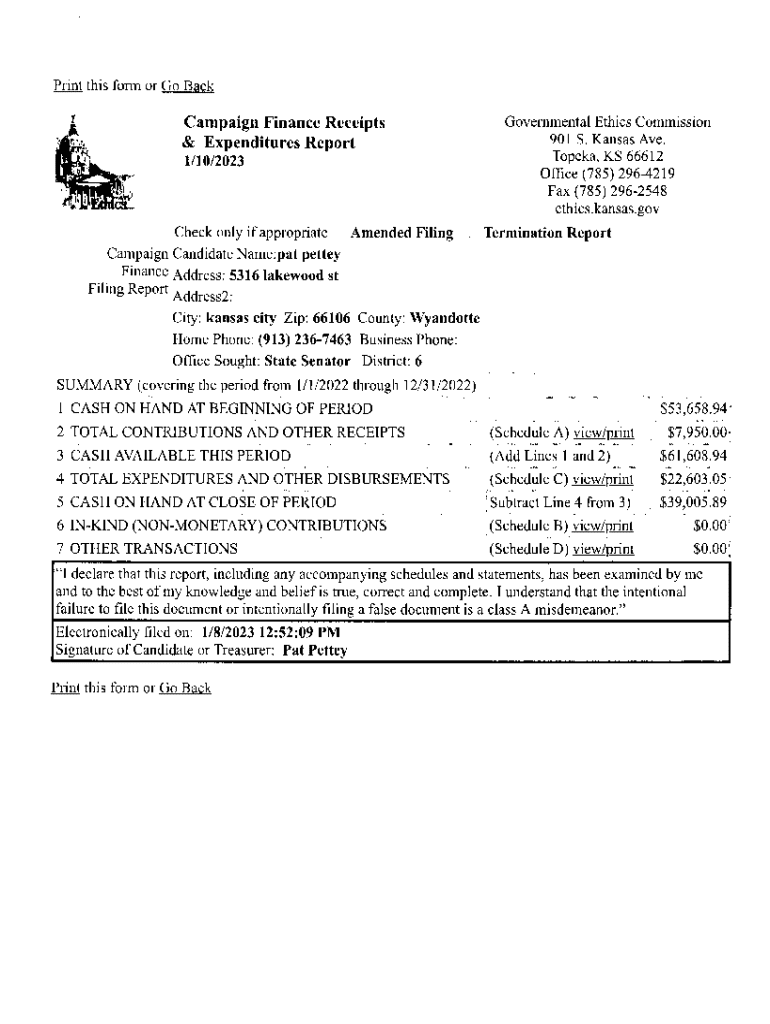

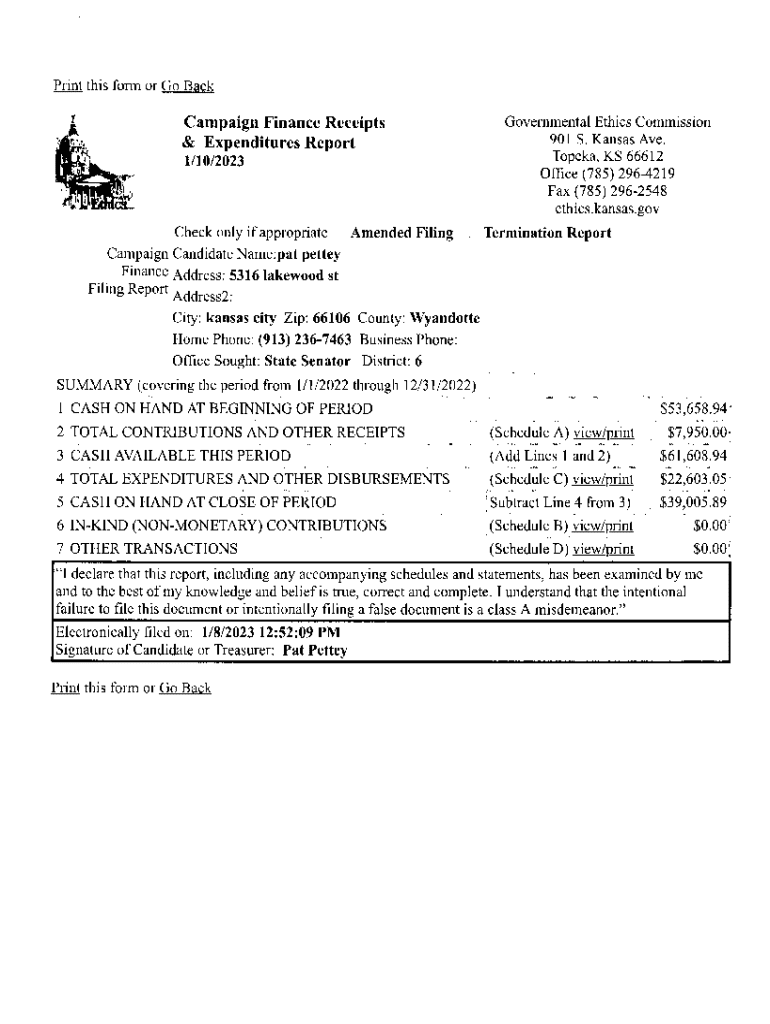

Overview of the campaign finance receipts expenditures form

The campaign finance receipts expenditures form is a critical document that provides a structured framework for candidates to report their financial activities. Understanding the purpose and how to use this form is essential for compliance.

Purpose and use of the form

This form is used to summarize all financial transactions related to a campaign, linking receipts and expenditures to paint a comprehensive picture of campaign finances. Candidates are required to file this form periodically during their campaign and after elections.

Key sections of the form

The form includes key sections such as donation details, expenditure categories, and summary totals. Each section serves to highlight different aspects of campaign finances, ensuring thorough reporting.

Step-by-step guide to filling out the form

Filling out the campaign finance receipts expenditures form can seem daunting, but breaking down the task into manageable steps can simplify the process significantly.

Gathering necessary information

Before filling out the form, gather all necessary documents, including bank statements, donation receipts, and invoices for expenditures. This will ensure that all figures are accurate and verifiable.

How to complete each section

To complete the receipts section, begin by entering the name of each donor along with the amount contributed. When recording expenditures, categorize each expense – such as advertising or venue rental – and specify the amount. An example scenario is including a donation from a local business, where the form should detail the business name and the contribution amount.

Common mistakes to avoid

Often, candidates may forget to include certain donations or misclassify expenditures. To avoid such pitfalls, regularly review your entries and reference back to supporting documents to ensure nothing is overlooked.

Managing and submitting the form

Once the form is completed, thoroughly review it to catch any potential errors. Effective management of this process can save time and reduce stress, especially as deadlines approach.

Reviewing your completed form

Before submission, use a checklist to confirm all sections are completed accurately. Additionally, utilize online validation tools to correct any errors immediately.

Submission methods and deadlines

Candidates may submit the form online via the FEC website or through traditional mail. Awareness of key deadlines for submissions is crucial, as failing to submit on time can have serious implications, including regulatory penalties.

Interactive tools for campaign finance management

pdfFiller offers innovative tools to facilitate the management and editing of campaign finance documents, including the receipts expenditures form.

Using pdfFiller for enhanced document management

With pdfFiller, users can easily edit PDFs, eSign, and collaborate across a cloud-based platform. Specific features help streamline the process of completing campaign finance forms without hassle.

Collaboration tools for teams

Leveraging pdfFiller's collaboration tools allows team members to work together in real-time. This simplifies the collection of data necessary for completing the campaign finance receipts expenditures form, making feedback and edits seamless.

Frequently asked questions (FAQs)

As candidates become familiar with the campaign finance receipts expenditures form, they often have common inquiries. Addressing these concerns ensures a smoother process of filling and submitting the form.

Common inquiries about campaign finance forms

Candidates may wonder about the differences between receipts and expenditures or how to handle in-kind contributions. Clarifying these points before tackling the form is essential for ensuring accurate reporting.

Support resources available

pdfFiller's customer service can answer specific questions regarding document handling, aiding users in navigating the complex terrains of campaign finance.

Tips for staying compliant with campaign finance laws

Staying compliant with campaign finance laws is essential to maintaining a credible campaign. Regular education and awareness of the current regulations help candidates remain on the right side of the law.

Importance of staying up-to-date on legislation

Candidates should monitor changes in campaign finance legislation through dedicated resources and by engaging with professional organizations. This helps ensure adherence to evolving legal requirements.

Additional resources and tools

Utilizing platforms for tracking campaign finance and networking opportunities can provide additional support. Joining relevant organizations helps foster connections with fellow campaign managers for best practices and advice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in campaign finance receipts expenditures?

How do I make edits in campaign finance receipts expenditures without leaving Chrome?

How do I edit campaign finance receipts expenditures straight from my smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.