Get the free Business Personal Property Rendition of Taxable Property

Get, Create, Make and Sign business personal property rendition

How to edit business personal property rendition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property rendition

How to fill out business personal property rendition

Who needs business personal property rendition?

Business Personal Property Rendition Form: A Comprehensive How-to Guide

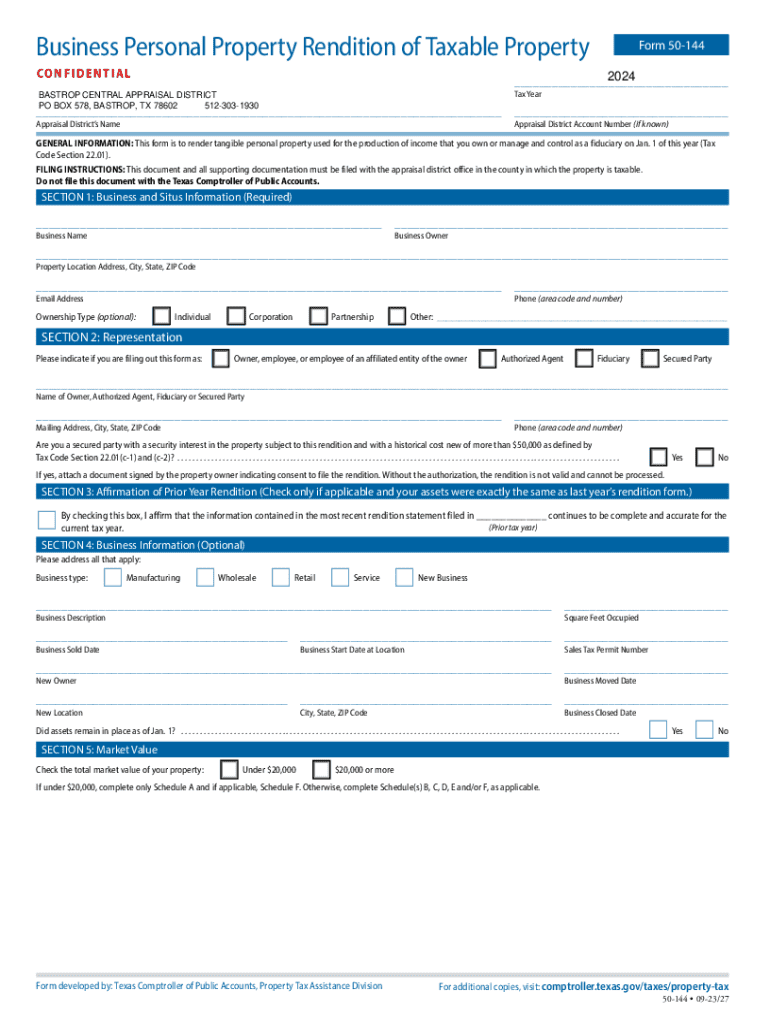

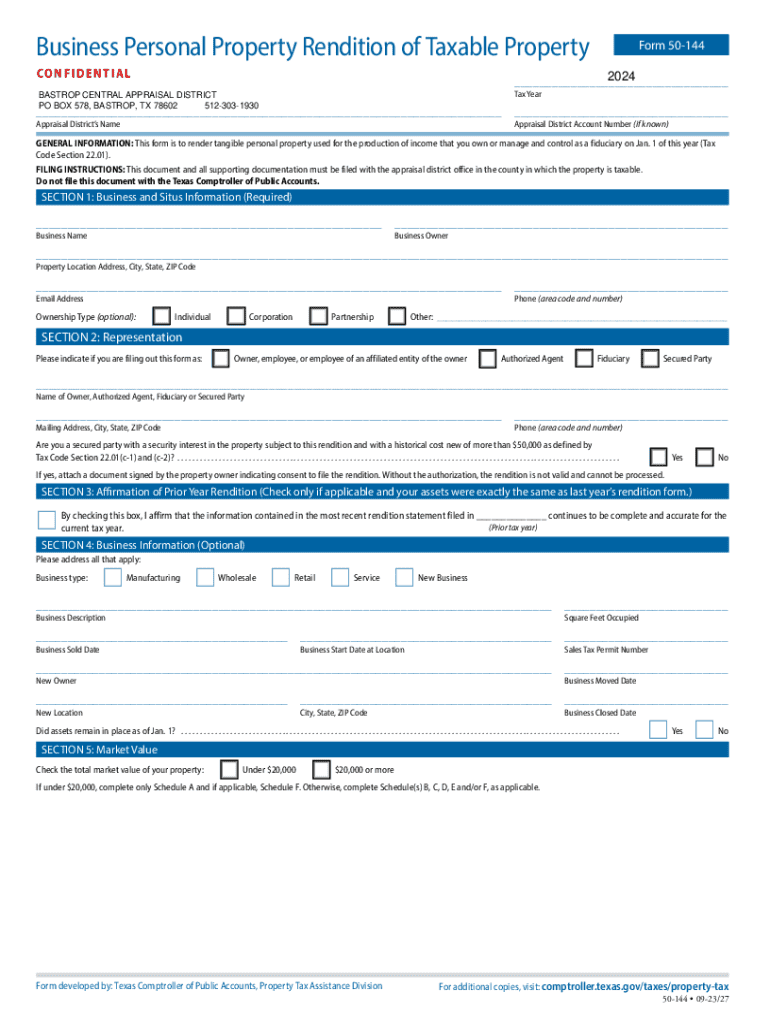

Understanding the business personal property rendition form

The business personal property rendition form is a crucial document required for tax assessment purposes. It serves as a declaration of the personal property owned by a business entity within a specific jurisdiction. By filing this form, businesses ensure that their assets are accurately reported for tax purposes, which, in turn, affects tax liability.

Filing this form is not merely a bureaucratic obligation; it plays an important role in maintaining compliance with local tax laws. Failure to submit this document may lead to penalties, unauthorized property assessments, and even audits.

Who needs to file

Typically, all businesses that own or lease personal property are required to file a rendition form. This includes sole proprietorships, partnerships, corporations, and even non-profits, as long as they have assessable personal property. The specific criteria may vary slightly depending on local regulations.

Types of properties that are covered include, but are not limited to, office furniture, machinery, equipment, computers, and inventory. It is essential for businesses to identify all qualifying assets to ensure compliance and avoid potential penalties.

Key components of the form

The business personal property rendition form typically consists of several key sections that capture essential information about the business and its assets. Understanding these components is crucial for accurate completion.

Breakdown of sections

Section 1: Identification Information requires businesses to provide their name, address, and type of business. This section allows tax assessors to easily identify the business entity and its location.

Section 2: Property Information mandates a description of the personal property and its location. Businesses need to detail significant assets to ensure that all properties are assessed appropriately.

Section 3: Valuation Data involves reporting the estimated value of the personal property. Businesses must assess the current market value of their assets accurately to prevent overpayment or underpayment of taxes.

Supporting documents required

Accompanying the rendition form, businesses may need to submit various supporting documents. These documents can include purchase invoices, inventory lists, and depreciation schedules. Providing this additional information can enhance the accuracy of the tax assessment.

Step-by-step guide to completing the form

Completing the business personal property rendition form may seem daunting, but breaking it down into manageable steps can simplify the process.

Step 1: Gather necessary information

Before starting the form, compile the following information:

Step 2: Filling out the form

Start by filling out Section 1 with your business identification information. Next, describe your personal properties in Section 2, ensuring that each asset is detailed adequately. Finally, assess the value of your properties in Section 3, referencing accurate market rates for your assets.

Step 3: Reviewing your submission

It’s advisable to double-check your submission for accuracy. Look for common mistakes, such as typos in property description or numerical errors in valuation. Having another set of eyes review the form can also help catch any overlooked mistakes.

Step 4: Submitting the form

Once the form is complete, you can submit it through various channels: online, by mail, or in person at your local tax office. Be mindful of submission deadlines, as late submissions can result in penalties, which can range from fines to an increased assessment of your properties.

Interactive tools for form management

Utilizing digital tools can streamline the preparation and submission of your business personal property rendition form.

Utilizing pdfFiller for editing and signing

pdfFiller offers a cloud-based platform where you can edit PDFs, including rendition forms. Accessing pdfFiller is straightforward, and it allows businesses to modify form fields easily and input accurate information directly into the PDF.

Additionally, pdfFiller features an eSignature option, allowing users to sign forms digitally, which provides a convenient way to finalize submissions without the need for printing or scanning.

Collaboration features

For teams, pdfFiller’s collaboration tools enable multiple users to work on the same document simultaneously. Teams can share access to the rendition form and make real-time updates, ensuring everyone contributes accurate information seamlessly.

Common challenges and solutions

Despite guidance, businesses can encounter obstacles when navigating the business personal property rendition form. Recognizing these challenges enables proactive solutions.

Frequently encountered issues

Common mistakes include misreporting property values, failing to include all personal property, and incorrect identification information. These errors can lead to penalties or audits and should be avoided.

Troubleshooting tips

If any issues arise, always refer to local tax authority guidelines. These usually provide explicit instructions and details. Online forums and tax consultation services can also offer additional support if your business faces unique complexities.

Important tax considerations

Accurate reporting on the business personal property rendition form can have significant implications for tax liability. Businesses that underreport their assets may find themselves underprepared for increased assessments, while overreporting can lead to unnecessary tax burdens.

Potential audits and risks

Misreporting can trigger audits by local tax authorities, which can be time-consuming and costly. Being diligent in recording and reporting personal property will mitigate these risks, ensuring compliance and minimizing the chances of unfavorable audits.

FAQs about the business personal property rendition form

It’s common for businesses to have questions when navigating the intricacies of the business personal property rendition form.

Some frequent concerns include filing procedures, managing changes in property status throughout the year, and how to interpret complex instructions. Employers are encouraged to reach out to local tax offices or utilize resources like pdfFiller to obtain accurate guidance.

Contact information for assistance

When facing difficulties with the business personal property rendition form, don’t hesitate to reach out for help.

State or county tax office contact details

Every state or county typically has a designated tax office that can assist with specific questions or concerns related to the form. You'll find their contact information on your local tax authority website, often listed under 'Taxpayer Assistance.'

pdfFiller customer support options

For technical support while using pdfFiller, users can access customer support options through the website, including live chat, email support, and comprehensive FAQs to guide you through any questions regarding form customization and submission.

Privacy and security measures

Ensuring the security of personal information during the completion of the business personal property rendition form is paramount. pdfFiller takes data security seriously, implementing industry-standard encryption and secure servers to protect user information.

User responsibilities to maintain privacy

Users are encouraged to follow best practices for personal data privacy. This includes regularly updating passwords, avoiding public Wi-Fi for sensitive transactions, and reviewing the privacy settings within their pdfFiller account to ensure maximum security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business personal property rendition directly from Gmail?

Where do I find business personal property rendition?

Can I create an electronic signature for signing my business personal property rendition in Gmail?

What is business personal property rendition?

Who is required to file business personal property rendition?

How to fill out business personal property rendition?

What is the purpose of business personal property rendition?

What information must be reported on business personal property rendition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.