Get the free Non-filing Income Statement: Parent

Get, Create, Make and Sign non-filing income statement parent

How to edit non-filing income statement parent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-filing income statement parent

How to fill out non-filing income statement parent

Who needs non-filing income statement parent?

Understanding the Non-Filing Income Statement Parent Form

Understanding the non-filing income statement parent form

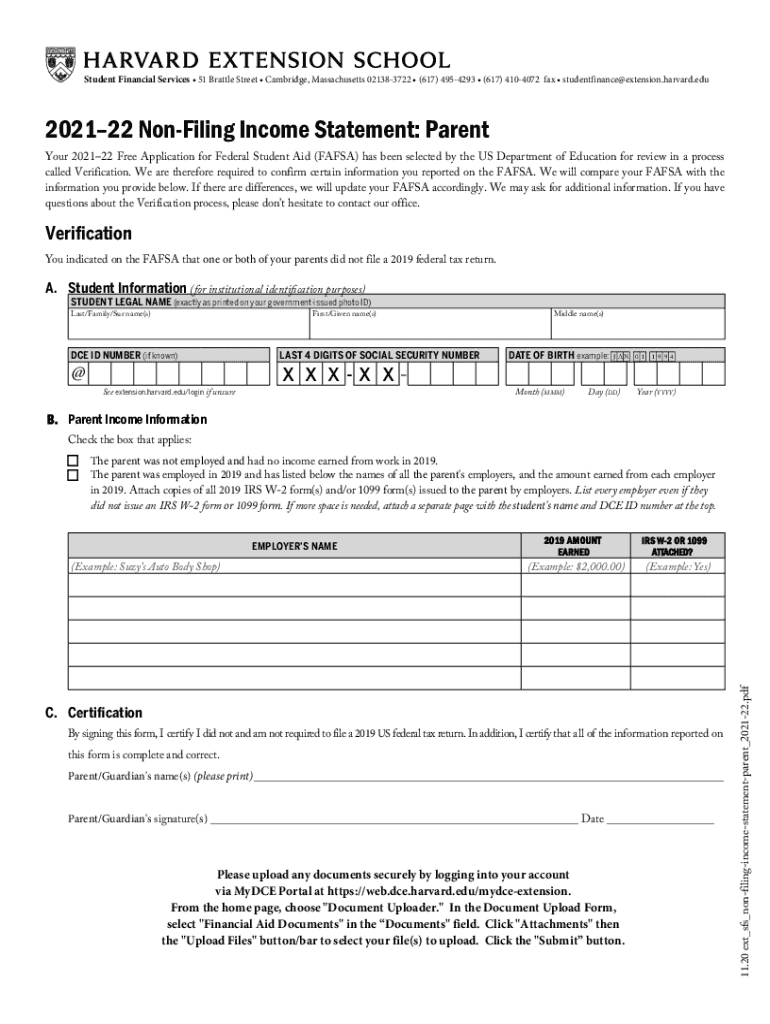

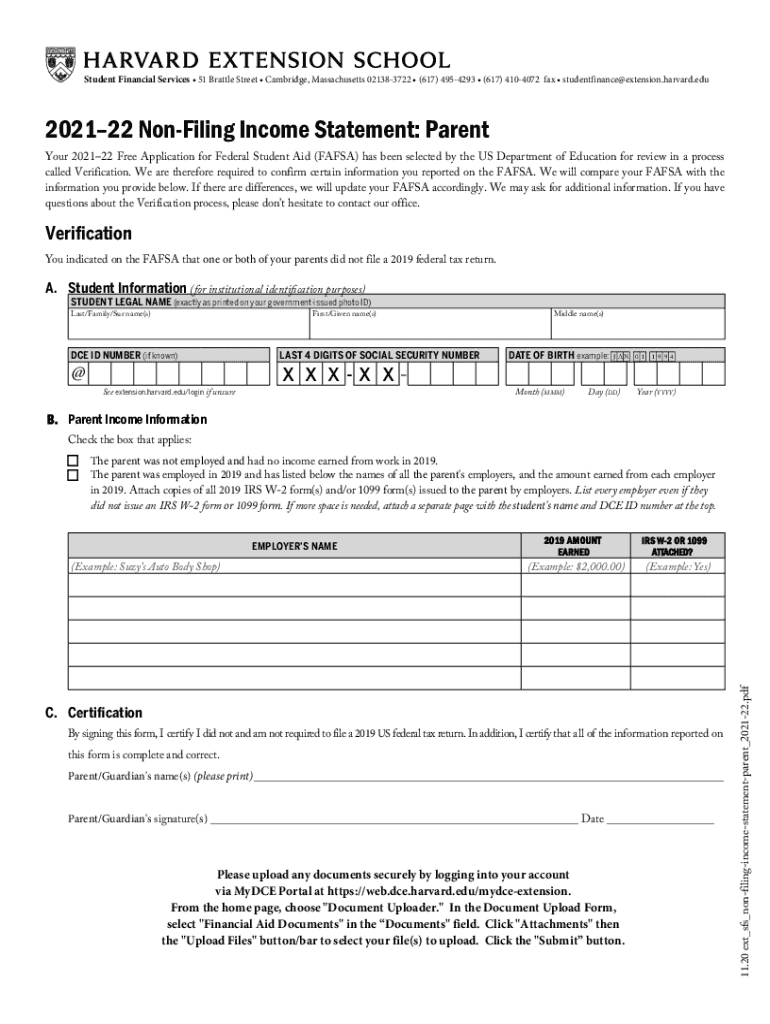

A non-filing income statement parent form is a crucial document used primarily in financial aid applications. It serves as an official declaration for households that do not file a federal income tax return. For students seeking financial support for college, this form communicates their family's financial situation, particularly when parents or guardians have income but are exempt from filing taxes.

The importance of the non-filing income statement lies in its role in verifying eligibility for various financial aids, scholarships, and assistance programs. By providing this documentation, families help educational institutions ascertain their financial need, allowing for a more accurate assessment of support that the student may require.

Who needs this form

Typically, a non-filing income statement is necessary for families who earn an income below the threshold that requires them to file a federal tax return. Common scenarios where this form is utilized include applying for federal financial aid through the FAFSA or when students seek scholarships that demand proof of income declaration from parents or guardians.

If your household includes a veteran, grandparent, or individuals in specific occupations that exempt them from standard tax filing, you may need this non-filing income statement. Additionally, students from low-income families or single-parent households often encounter situations that necessitate the completion of this form to confirm their non-filer status.

Key features of the non-filing income statement parent form

The non-filing income statement parent form encompasses several essential components. It typically includes personal identifiers like the names and addresses of the parent(s), Social Security numbers, and relationship to the student. Moreover, it requires disclosures regarding income sources, amount earned, and explicit confirmation of the non-filing status. It's crucial to ensure that all sections are filled accurately to prevent delays or issues with aid applications.

Variations may exist based on the state or institution. For instance, some states could require additional information or specific formats for this form. Educational institutions might also have tailored requirements, necessitating that applicants consult their individual guidelines for submission.

Step-by-step guide to completing the non-filing income statement parent form

Completing the non-filing income statement parent form can be straightforward when you are prepared. Begin by gathering necessary documents, such as any W-2 forms, previous tax returns (if applicable), and other income verification letters. Knowing whether to fill out a PDF form or an online submission can also save time.

Avoid common mistakes by double-checking that your form has all required signatures, accurate figures, and completion of all sections to enhance your submission's success.

Utilizing pdfFiller for managing your non-filing income statement

pdfFiller offers significant advantages when managing your non-filing income statement. Its cloud-based platform allows for seamless editing, eSigning, and sharing of the document, making the process notably efficient. Additionally, collaboration features enable family members or students to work on the form together, ensuring accuracy.

Step-by-step guide to using pdfFiller

FAQs related to the non-filing income statement parent form

Frequently asked questions about the non-filing income statement revolve around various aspects of its use. One critical question is, 'What if I need to amend my non-filing income statement?' If your financial situation changes or you realize an error, promptly contact the institution requiring the form to discuss the amendment process.

Another common concern is regarding the impact of this form on financial aid eligibility. Submitting an accurate non-filing income statement is crucial. It does streamline your application process for obtaining financial aid since it clarifies your family's financial circumstances.

Lastly, many people query about electronic submission options. The good news is that pdfFiller supports electronic submission, ensuring you can send your forms without traditional mailing delays.

When to seek help with the non-filing income statement parent form

In some cases, individuals might benefit from seeking professional assistance when filling out their non-filing income statement. Examples include complex family financial situations, inconsistencies in income verification, or when navigating financial aid opportunities becomes overwhelming.

It’s advisable to consult with a tax professional for nuanced advice. Community organizations providing assistance with financial aid forms can also be an invaluable resource. They can offer guidance, specific advice for your state, and help navigate any complications you may face.

Contact information and support resources

For questions or support related to the non-filing income statement, pdfFiller offers excellent customer service. You can reach them via email, chat, or phone for immediate assistance. Their expert team is ready to provide guidance tailored to your document management needs.

Support is generally available during standard business hours. For precise details on availability, be sure to check their official website for the most current information.

Tools and resources to enhance your document management experience

pdfFiller also offers various interactive tools to improve your document management experience. Features like easy navigation, document sharing capabilities, and templates for similar forms ensure you spend less time managing paperwork and more time focusing on important decisions.

For those who find themselves frequently needing forms to manage personal or family finances, you might explore additional templates like income verification letters, loan applications, or tax-related documents to streamline your submissions and simplify the verification process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-filing income statement parent in Gmail?

How do I complete non-filing income statement parent on an iOS device?

Can I edit non-filing income statement parent on an Android device?

What is non-filing income statement parent?

Who is required to file non-filing income statement parent?

How to fill out non-filing income statement parent?

What is the purpose of non-filing income statement parent?

What information must be reported on non-filing income statement parent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.