Get the free Buchanan County Return of Tangible Personal Property

Get, Create, Make and Sign buchanan county return of

How to edit buchanan county return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buchanan county return of

How to fill out buchanan county return of

Who needs buchanan county return of?

Buchanan County Return of Form: A Comprehensive Guide

Overview of Buchanan County Return of Form

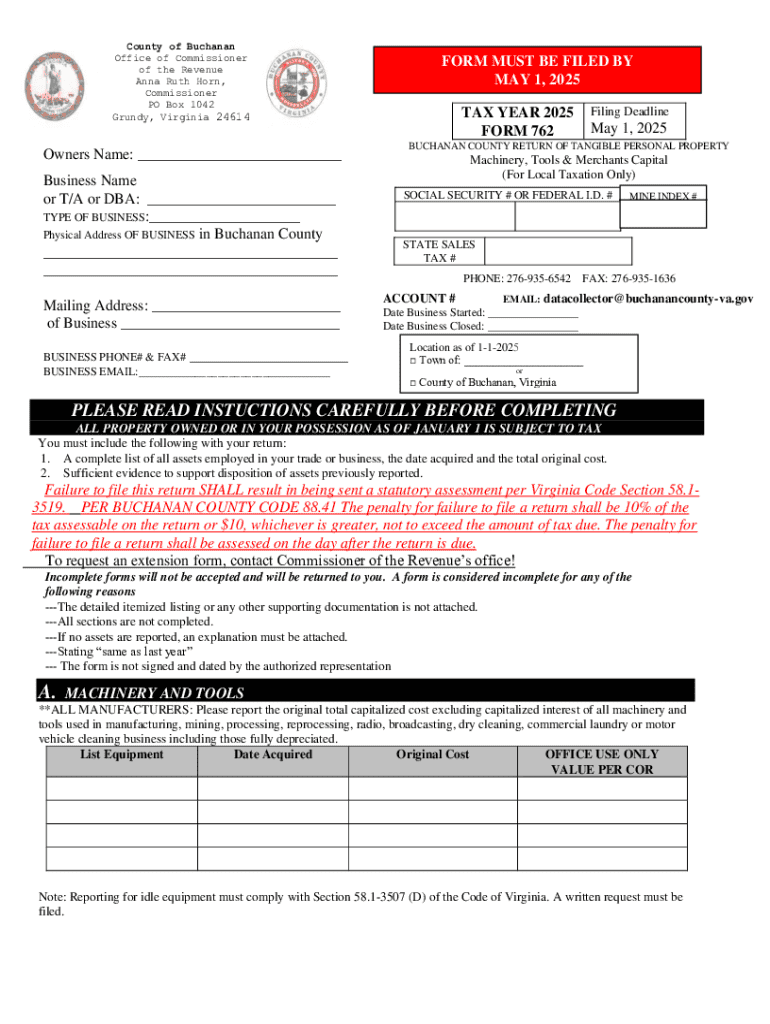

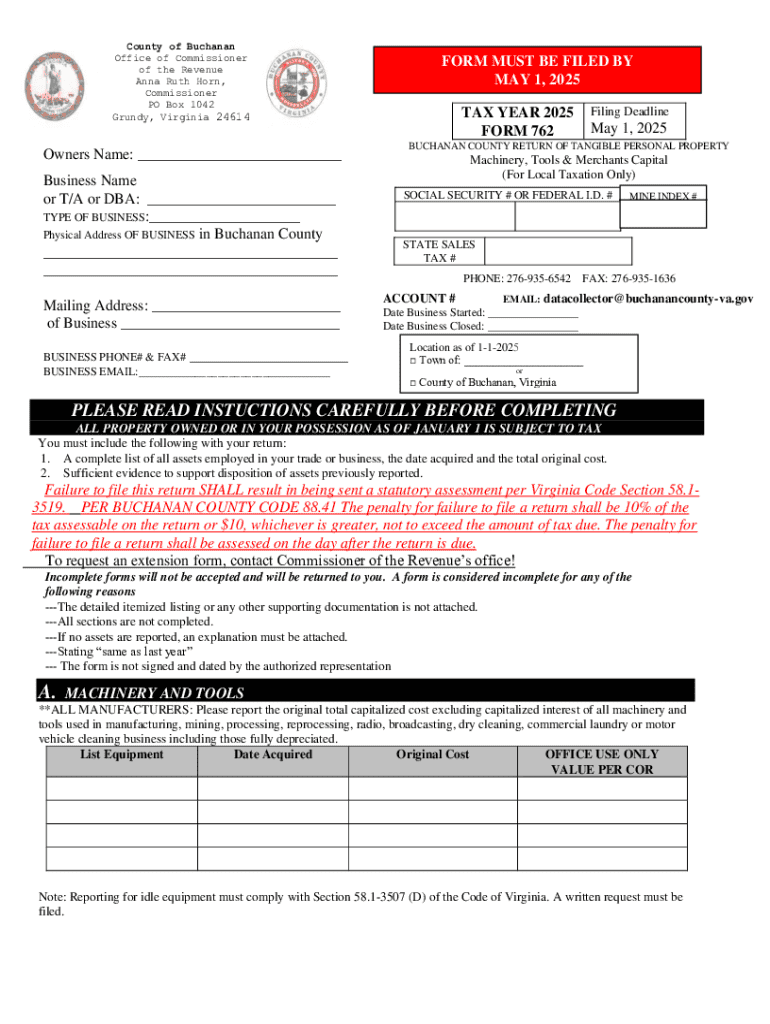

The Buchanan County Return of Form is a critical document within local governance that ensures transparency and accountability for various activities and transactions in the county. This form serves multiple purposes, from collecting important financial disclosures to ensuring compliance with local regulations. For citizens and organizations operating in Buchanan County, understanding this form is necessary for maintaining any operational licenses or permits.

The Return of Form is designed not only to gather data but also to provide the Buchanan County government with essential insights to better serve its constituents. Properly completed forms can significantly speed up administrative processes and enhance public services. Keeping track of key deadlines and submission dates is essential for compliance, helping avoid penalties or missed opportunities.

Key components of the Buchanan County Return of Form

Completing the Buchanan County Return of Form involves several crucial components. Each section is designed to capture specific information, ensuring all necessary data is collected for review. A comprehensive understanding of what is required will streamline your submission process.

The form typically includes a personal information section, where you outline your basic identification details such as your name, address, and contact information. Following this is the financial disclosure section, which aims to provide insight into your financial activities, including income and expenditures related to your operations. Lastly, for property owners, a property details section may be included, asking for information about your real estate assets, if applicable.

Common mistakes include failing to double-check personal information for accuracy, neglecting to provide full financial details, and omitting property-related disclosures when relevant. Being thorough and attentive could save you from having to redo your submission or facing penalties.

How to access the Buchanan County Return of Form

Accessing the Buchanan County Return of Form has been made straightforward for residents and stakeholders in the region. The official form is available through the Buchanan County website, where residents can download it directly in PDF format. The online portal offers the most recent updates and revisions, ensuring that users are utilizing the correct document.

Alternatively, for those who may have trouble navigating the website or prefer a different access point, local offices such as public libraries or county offices often have printed copies. These can be filled out on-site or taken home for completion. Keeping in mind the accessibility of the form ensures that all residents can fulfill their obligations without unnecessary delays.

Step-by-step instructions for completing the form

Completing the Buchanan County Return of Form involves a systematic approach to ensure accuracy and compliance. Below are the key steps to follow when filling out the form, aimed at simplifying the process.

When submitting the form physically, ensure that all copies are sent to the correct address outlined in the instructions. For those opting for electronic submission, eSignature solutions can streamline the process further, eliminating the need for printing and scanning.

Tips for editing and collaborating on the form using pdfFiller

Utilizing pdfFiller can greatly enhance your experience in managing the Buchanan County Return of Form. This cloud-based platform enables users to edit PDFs seamlessly, with a host of tools designed for collaboration and security. Here are some practical tips for maximizing the platform.

Using pdfFiller not only allows for more efficient management of the form itself but also reinforces compliance through secure and collaborative editing, giving you peace of mind as you prepare your submission.

Common FAQs regarding the Buchanan County Return of Form

As with any official document, questions may arise regarding the Buchanan County Return of Form pertaining to its submission, completion, and deadline management. Here are some frequently asked questions to clarify common concerns.

Related documents and forms in Buchanan County

Alongside the Buchanan County Return of Form, there are several other documents and forms that may be required for various reasons. Understanding the full landscape of requirements can help streamline your administrative responsibilities.

For easy access to these documents, visit the Buchanan County official website or contact local offices. Understanding the full scope of compliance will ensure smooth operations.

Feedback and updates

Encouraging user feedback on the Buchanan County Return of Form process is essential to continuous improvement. County offices often seek community input to refine forms and processes, making them more user-friendly and efficient.

It is equally important to stay updated with any changes to regulations or requirements regarding the form. Local governance can change policies based on community feedback, and being informed will help ensure compliance and effective participation in county initiatives.

Further assistance and contact information

For those seeking further assistance with the Buchanan County Return of Form or any related queries, local county offices are the best resource. They can provide direct support, answer your questions, and guide you through the process.

Additionally, if you encounter challenges while using pdfFiller, their support team is equipped to assist you with any technical or document-related issues. Ensuring proper communication with relevant contacts is key to a successful submission experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find buchanan county return of?

How do I fill out the buchanan county return of form on my smartphone?

How do I complete buchanan county return of on an Android device?

What is buchanan county return of?

Who is required to file buchanan county return of?

How to fill out buchanan county return of?

What is the purpose of buchanan county return of?

What information must be reported on buchanan county return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.