General Forbearance Request Template Form: Your Essential Guide

Understanding general forbearance

General forbearance is a temporary relief option provided by lenders that allows borrowers to pause or reduce their loan payments, especially during periods of financial difficulties. This option can be particularly beneficial for those facing unexpected hardships that may hinder their ability to make regular payments on loans, including student loans. Understanding the key concepts surrounding forbearance can help borrowers navigate their financial responsibilities effectively.

Forbearance is crucial in financial management because it prevents further debt accumulation during challenging periods. By allowing borrowers to delay payments, forbearance can shield them from the adverse effects of missed payments, such as foreclosure or ruining credit scores. However, not every borrower may qualify for forbearance; thus, it’s vital to assess eligibility criteria carefully.

You must have a qualifying loan type.

You should provide evidence of financial hardship.

Your lender must accept your request.

Types of forbearance

Forbearance can generally be categorized into two types: mandatory and discretionary. Mandatory forbearance is required by law; lenders must grant it under specific circumstances, such as active military service or qualifying professor loans. Discretionary forbearance, on the other hand, is offered at the lender's discretion, meaning they determine whether to grant your request.

Eligible situations for forbearance can vary, but common qualifiers include financial hardship, significant medical expenses, unemployment, or other unexpected circumstances that could disrupt your ability to repay loans. For instance, if you lose your job or face extreme medical bills, you might find yourself eligible for a forbearance request, allowing for temporary relief from your payment obligations.

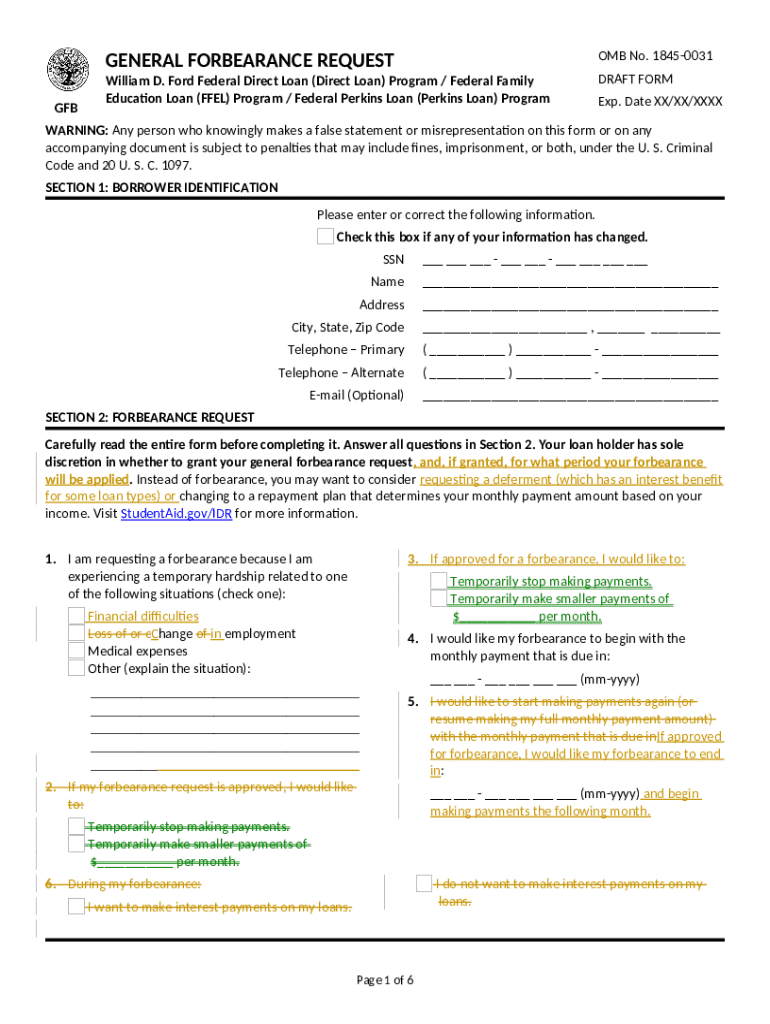

Step-by-step guide to the general forbearance request template form

Filling out the general forbearance request template form involves specific steps designed to streamline the application process. The template form typically consists of several sections that require personal information, loan details, and the reason for requesting forbearance. Ensuring all information is correctly provided will increase your chances of approval.

You can access and download the template from pdfFiller, a cloud-based document management platform. Utilizing pdfFiller simplifies the process, allowing you to fill out the form electronically rather than managing cumbersome paper copies.

Filling out the general forbearance request template form

When filling out the forbearance request form, it’s essential to follow clear instructions for each section. The first section will require your personal details such as name, address, and contact information. Be thorough and make sure this information is accurate, as lenders will need to reach you for further communication.

The second section focuses on your financial information, including details about the loan, type, amount, and the loan servicer's information. Clearly outline the reasons for your request in the third section. Common mistakes include leaving sections blank or failing to provide sufficient documentation of hardship, so double-check that every required field is completed accurately.

Editing and customizing your forbearance request form

Once you have completed the basic details, utilizing pdfFiller's editing tools allows you to customize your forbearance request form further. You can edit text fields easily, enabling you to clarify any points that require elaboration to strengthen your application. Adding signatures and dates is also essential to validate your form.

Customization can be a powerful tool to increase your request's chances of approval. For example, including specific details related to your financial situation or circumstances surrounding your forbearance request can present a compelling case to your lender.

Submitting the forbearance request

After you’ve filled out and customized the form, the next step is submission. You have several options for submitting the completed general forbearance request template form. Electronic submission methods such as email or using an online portal provided by your lender are often quicker. When submitting electronically, ensure the documents are in the correct format and follow any specific guidelines.

If you choose to mail your submission, properly address the form to avoid any delays. It’s also critical to keep a copy of the completed form and any additional documentation. This serves as proof of your submission and is useful for tracking the progress of your request.

After submission: What to expect

Once you've submitted your forbearance request, anticipate a response from your loan servicer. Response times may vary based on your lender's processing capabilities, but generally expect a timeframe of weeks. It’s normal to feel anxious during this waiting period; however, understanding that your request will be carefully reviewed can help ease concerns.

In the event of approval, you’ll receive a notification detailing the terms of your forbearance, including the duration and any obligations you’ll need to meet. Conversely, if your request is denied, you will also receive a notification, often outlining the reasons for denial. Knowing these next steps is significant for developing your repayment strategy.

Managing your loans during forbearance

While you are in forbearance, it’s important to stay proactive and manage your financial responsibilities effectively. Borrowers should seek ways to remain financially stable during the forbearance period, like creating a strict budget to maintain control over expenses. Communication with loan servicers is also key to mitigating misunderstandings and ensuring you comply with any requirements during forbearance.

You should also understand that interest may continue to accumulate on your loans during the forbearance period, meaning you might owe more once the forbearance ends. Keeping track of this interest and planning your payment strategy accordingly will help you avoid future financial complications.

Alternative options if forbearance is not granted

If your forbearance request is declined, don’t despair; there are alternative options available. Exploring other repayment plans can help lighten your financial burden, such as income-driven repayment plans designed to match your payment with your earnings. These plans are particularly beneficial for borrowers whose income levels fluctuate.

Additionally, consider options such as loan consolidation or refinancing to manage student loan debt burdens effectively. These alternatives can still offer relief, allowing for more manageable payments tailored to your current financial situation.

Resources for further assistance

Seeking assistance from financial counselors can provide valuable insights and guidance as you navigate your loan options. They can help assess your situation and suggest the best course of action, whether it involves forbearance or exploring different repayment strategies. Moreover, utilizing additional tools available on pdfFiller for document management can simplify the process of managing your finances.

Lastly, familiarize yourself with frequently asked questions regarding forbearance and loan management. By understanding common concerns and solutions, you can empower yourself to make informed decisions regarding your financial future.

Using pdfFiller to simplify document management

pdfFiller stands out in simplifying document management for users, including features that facilitate eSigning and collaboration. This platform allows you to streamline the process, enabling easy access and management of your forbearance request forms from any location. The cloud-based nature of pdfFiller means all your documents are readily available when you need them, without the hassle of physical copies.

The testimonials from users rave about pdfFiller's efficiency in managing documents, especially during critical financial planning stages. By optimizing your document handling, you can focus on your financial strategies instead of getting bogged down with paperwork.