Get the free form 8866

Get, Create, Make and Sign form 8866

How to edit form 8866 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8866

How to fill out form 8866

Who needs form 8866?

How to Complete IRS Form 8866: A Comprehensive Guide

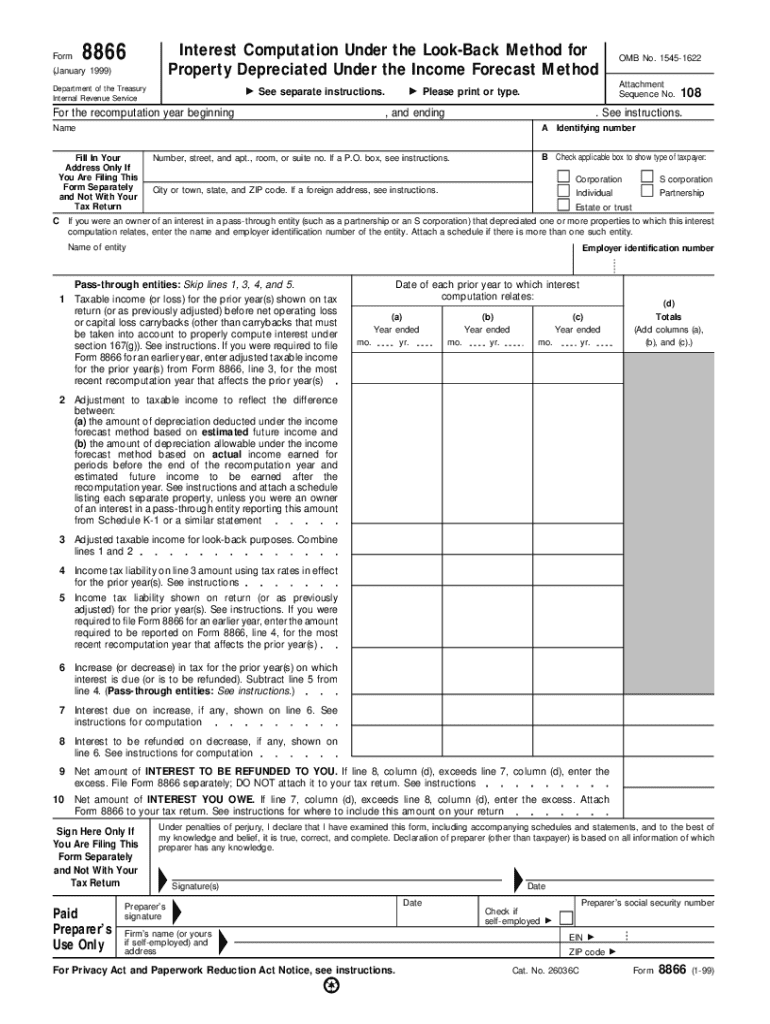

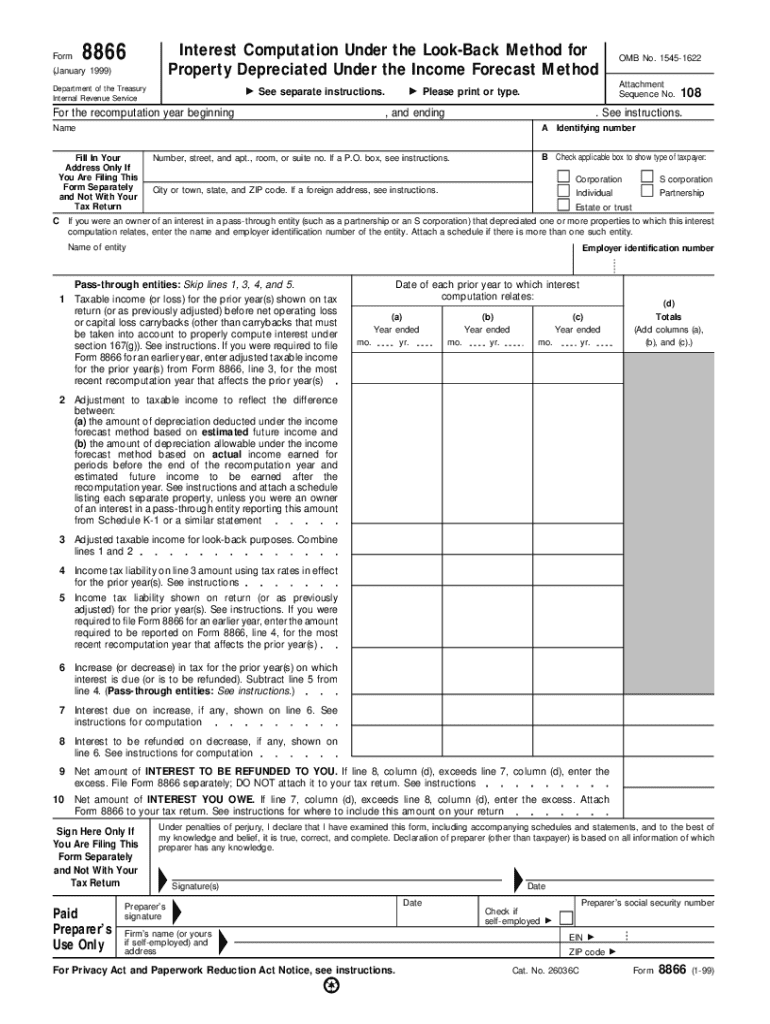

Overview of IRS Form 8866

IRS Form 8866, titled 'Interest Computation Under the Look-Back Method for Completed Contracts,' is a form utilized by taxpayers who engage in long-term contracts that require the look-back method for reporting. This method is essential for accurately computing the interest owed or refundable under the Internal Revenue Code. Completing this form accurately is critical for ensuring compliance and avoiding penalties related to tax miscalculations.

Who needs to complete Form 8866?

Taxpayers involved in long-term contracts must complete Form 8866. This typically includes businesses that generate revenue through contracts that last longer than one year. If your business operates in sectors such as construction, manufacturing, or any service that requires a contractual commitment over an extended period, this form is relevant to your financial reporting obligations.

Additionally, partners in partnerships that engage in such contracts may also need to fill out this form. Each owner must understand their tax reporting obligations, especially if there are multiple entities involved in the contractual agreement.

Understanding the purpose of Form 8866

The primary purpose of Form 8866 is to determine the interest computation on taxes due for contracts extending over multiple years. This involves reconciling the income reported in earlier tax years and adjusting for any discrepancies in tax payments. By following the instructions in this form, taxpayers can ensure that they are in alignment with IRS requirements regarding revenue recognition and financial reporting.

This form becomes particularly crucial when determining tax overpayments or underpayments, which can lead to refunds or additional taxes owed. Understanding how to navigate Form 8866 allows taxpayers to manage their tax liabilities better and could potentially result in saving money through accurate reporting of interest.

Step-by-step guide to filling out Form 8866

Completing Form 8866 requires careful attention to detail. Below is a straightforward guide to successfully fill out this essential document.

4.1. Gather necessary information

Before diving into the form, gather all pertinent information and documents needed for completion. This includes:

4.2. Detailed instructions for each section

4.2.1. Part : Identifying information

In this section, provide your name, address, and taxpayer identification number. Ensure that all details are accurate to avoid errors that could delay processing.

4.2.2. Part : Required actions

This section outlines the steps you must take regarding interest computation and required actions based on the contracts reported. Follow the form’s guidelines to ensure you make the necessary calculations.

4.2.3. Part : Tax computation

In Part III, you will calculate your tax obligations based on the interest you computed in the previous section. Careful attention should be paid here, as mistakes can directly impact your tax liabilities.

4.2.4. Part : Other information

The final section of the form may ask for additional information or special circumstances related to your contracts. It's essential to respond thoroughly to avoid any compliance issues.

4.3. Final review of completed form

After completing the form, conduct a thorough review. Create a checklist to ensure:

Common mistakes to avoid when filling out Form 8866

Individuals often make certain errors while completing Form 8866, leading to submission issues. Some common mistakes include:

Avoiding these mistakes is crucial for timely and accurate filing. Implementing a thorough review process can significantly decrease the likelihood of errors.

Interactive tools for managing Form 8866

Utilizing interactive tools can streamline the completion and submission process for Form 8866. Here are some features that can aid taxpayers:

6.1. PDF editing features

With pdfFiller, users can edit PDF files directly in their browser. This allows for real-time modifications, ensuring all information is accurate before submission.

6.2. Collaboration tools for team reviews

Taxpayers working in teams can benefit from collaborative features that allow for multiple users to review and edit the form simultaneously. This ensures that everyone is on the same page, helping to mitigate errors due to miscommunication.

6.3. eSign options for secured submission

pdfFiller also provides secure eSign options, eliminating the need for printing and scanning. This feature is vital for busy taxpayers who want to seamlessly complete the process while ensuring their submissions are legally binding.

Frequently asked questions about Form 8866

7.1. What is the deadline for submitting Form 8866?

Typically, Form 8866 must be submitted by the due date of your tax return, including extensions. It's crucial to be mindful of this timeline to avoid penalties.

7.2. How can amend my Form 8866?

If you need to amend your Form 8866, you must re-file a corrected form clearly indicating the changes made. Ensure that you send this to the same address where the original was filed.

7.3. What are the penalties for incorrect submissions?

Incorrect submissions can lead to penalties ranging from fines to additional interest owed on underpayments. Understanding these implications can provide motivation to complete the form correctly.

Related tax articles and resources

For further reading and understanding of tax compliance, check out these additional resources from pdfFiller:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8866 in Gmail?

How do I edit form 8866 in Chrome?

Can I edit form 8866 on an iOS device?

What is form 8866?

Who is required to file form 8866?

How to fill out form 8866?

What is the purpose of form 8866?

What information must be reported on form 8866?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.