Get the free Matching Gift Program

Get, Create, Make and Sign matching gift program

Editing matching gift program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift program

How to fill out matching gift program

Who needs matching gift program?

Matching Gift Program Form: A Comprehensive Guide

Understanding matching gifts

Matching gift programs serve as a powerful tool for amplifying charitable donations. At their core, these programs allow companies to match the contributions made by their employees to eligible nonprofits, effectively doubling or even tripling the impact of individual gifts. Historically, matching gift initiatives gained traction during the 1950s as corporations began recognizing the value of supporting employee philanthropy, leading to a culture of corporate social responsibility that continues to thrive today.

The benefits of matching gifts extend beyond just nonprofit funding. For donors, these programs allow for enhanced giving potential, making their contributions stretch farther. Furthermore, employees often enjoy tax deductions associated with both their original donation and the employer's matched amount. This mutualistic relationship promotes a sense of community and shared values, aligning the interests of companies with those of their employees and the causes they care about.

Understanding how these corporate matching gift programs function is crucial. The basic mechanics involve a donor making a financial gift to a nonprofit, after which they submit a request for the company to match the donation. Key stakeholders in this process include the donor, their employer, and the nonprofit organization, all of whom play vital roles in ensuring the success of this philanthropic initiative.

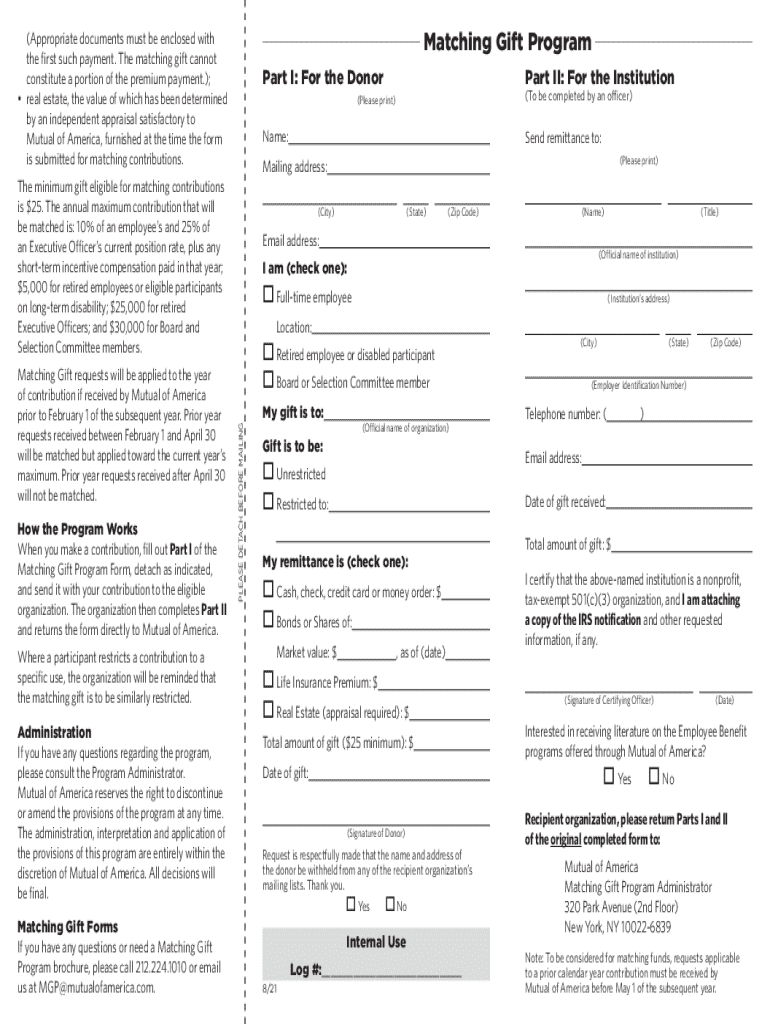

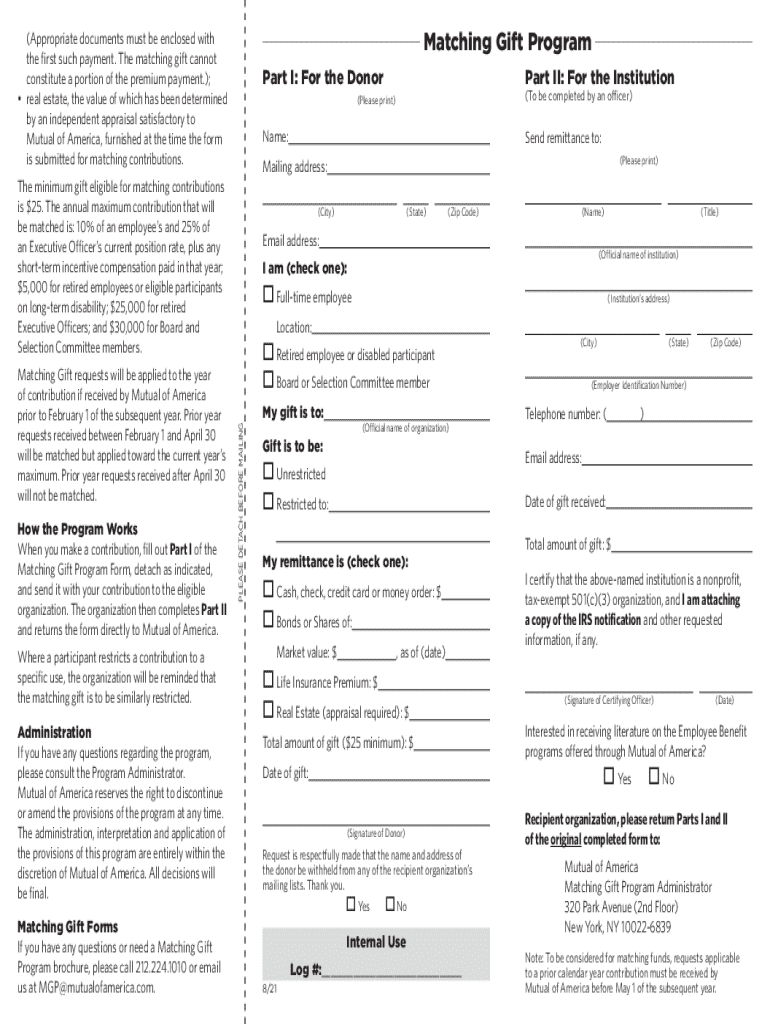

Types of matching gift submission forms

Matching gift submission forms can vary significantly in structure and function. Standard matching gift request forms are commonly used, requiring donors to fill in essential information such as their name, contact details, and employment information. These forms serve a straightforward purpose: to formalize the donor's request for a matching contribution from their employer.

In today’s digital age, online submission forms have gained immense popularity. These digital tools offer various advantages, including accessibility from anywhere and the ability to submit requests quickly and securely. Some online forms come equipped with features that simplify the process, such as automatic eligibility checks based on employer data, which streamline the submission process.

Hybrid submission forms combine traditional paper elements with digital innovations, allowing for flexibility in how donors can present their requests. They may cater to organizations that still prefer the tangible aspect of paper while incorporating digital elements for efficiency. Understanding which type of submission form aligns best with your situation can make a significant difference in successfully facilitating matching gifts.

Key elements of a matching gift program form

When completing a matching gift program form, certain essential information must be included. The donor's details typically include their full name, contact information, the date of their donation, and any required identification numbers linked with their donor account. Additionally, the form should collect information about the employer, such as company name and confirmation of match eligibility, which is crucial for processing the request effectively.

Instructions on how to complete the form are equally important. A well-structured form will include clear, step-by-step guidance to assist donors in filling it out accurately. One can also provide helpful tips to ensure the accuracy of information, which helps prevent delays in matching gift processing.

Common mistakes to avoid when filling out the form include submitting incomplete information that might hinder processing, or misunderstanding the eligibility of gifts, which could lead to wasted time and effort. Ensuring each field is filled thoroughly and correctly is key to a successful submission.

Streamlining the matching gift process

Utilizing matching gift databases is an effective strategy for simplifying the matching gift process. Matching gift databases provide valuable resources that enable donors to check their employer’s eligibility and the specifics of matching gift programs. This eliminates confusion and accelerates the submission process, providing crucial information at the donor's fingertips.

Additionally, the role of automation cannot be overstated. Automation tools can significantly simplify form submissions, allowing donors to manage their requests efficiently without the hassle of printed documents or manual entry. Many companies today leverage software platforms that integrate documentation processes, enabling users to create, edit, and submit forms seamlessly through pdfFiller.

Tracking your matching gift submissions is crucial for both donors and nonprofits. Recommended tracking systems can help keep comprehensive records of each request, ensuring follow-up actions can be taken promptly. This practice not only promotes transparency but fosters trust between donors and the organizations they support.

Supporting stakeholders in the matching gift process

For donors looking to maximize contributions, understanding the specifics of matching gift programs is essential. Steps such as verifying employer participation and learning about submission deadlines or specific requirements can amplify their philanthropic efforts. Donors should actively communicate with their employers to ensure they follow the necessary procedures and obtain any supporting documentation needed for successful processing.

Nonprofits also play a significant role in managing these forms effectively. By implementing best practices that encourage donor participation, nonprofits can substantially increase the amount of matching gifts they receive. This can be achieved by actively promoting matching gift programs and providing training for staff to assist donors with the submission process.

For companies, building a robust matching gift program is a vital aspect of engaging employees in corporate philanthropy. It's critical to establish clear company policies on eligibility and the gift process. By doing so, companies can inspire employees to take an active role in giving back, knowing their contributions will be matched and maximized.

FAQs about matching gift programs and forms

Common questions from donors often revolve around eligibility and processes. Many individuals might wonder, 'How can I know if my employer matches gifts?' This information is usually available through HR departments or corporate websites featuring matching gift program details. On the other hand, some may ask, 'What if my company doesn't have a matching gift program?' In such scenarios, encouraging your company to establish one can foster a culture of community support.

Nonprofits frequently inquire about how to promote matching gifts to their donors. Effective marketing strategies include highlighting matching gifts in donation appeals, newsletters, and social media campaigns. Tracking the metrics of their success is equally important, as it aids in understanding which strategies resonate best with donors.

Companies interested in setting up matching gift programs often ask about the necessary steps involved. Establishing a matching gift program involves determining eligibility criteria and outlining policies, all while ensuring compliance with legal considerations necessary for execution. Engaging stakeholders in this process helps create a thoughtful and impactful program.

The future of matching gift programs

Trends in corporate philanthropy illustrate an evolving landscape where both donors and nonprofits expect more from their partnerships. Companies are increasingly recognizing the importance of aligning corporate values with social impact initiatives, driving a more engaged and socially conscious workforce.

Innovations in matching gift technology are advancing rapidly, leading to emerging tools and platforms that streamline processes further. These innovations enhance accessibility, allowing donors to engage with their philanthropic efforts easily through mobile applications and integrated software solutions.

Advocating for enhanced matching gift opportunities is an essential step for all stakeholders. By taking proactive measures to influence corporations, nonprofits can foster a collective movement that prioritizes community support and corporate responsibility. The future of matching gifts appears bright, with potential for expanding opportunities that benefit all involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute matching gift program online?

Can I edit matching gift program on an iOS device?

How do I complete matching gift program on an iOS device?

What is matching gift program?

Who is required to file matching gift program?

How to fill out matching gift program?

What is the purpose of matching gift program?

What information must be reported on matching gift program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.