Get the free Verification of Non-filing

Get, Create, Make and Sign verification of non-filing

Editing verification of non-filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of non-filing

How to fill out verification of non-filing

Who needs verification of non-filing?

Verification of Non-Filing Form: How-to Guide

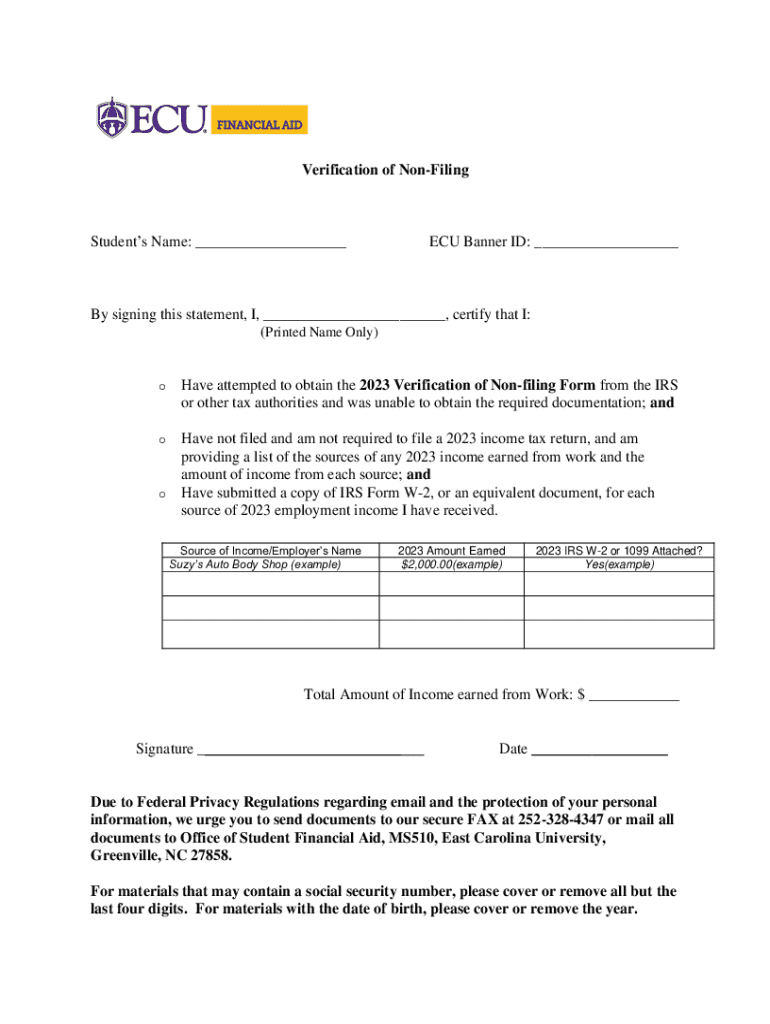

Understanding the verification of non-filing form

The Verification of Non-Filing Form is an essential document provided by the IRS, which certifies that an individual or entity did not file a tax return for a particular year. This form is typically requested for specific financial applications, such as for federal student aid or loans. Its primary purpose is to establish that the filer has not historically reported income to the IRS, which can affect eligibility for financial assistance or certain financial products.

This documentation holds significant importance for both individuals and businesses, especially those facing unique financial situations. By obtaining this form, you can effectively communicate your tax status to educational institutions, lenders, and grant providers, ensuring a smoother application process.

Who needs a verification of non-filing form?

Individuals who have not filed a tax return often encounter circumstances where a Verification of Non-Filing Form is necessary. This can happen for several reasons, such as being a student or dependent who may not meet income thresholds for filing. For these individuals, especially students applying for FAFSA, the form is crucial for demonstrating their income status during the financial aid process.

Similarly, businesses or organizations that operate in certain capacities might require this form when applying for grants or loans, particularly if they are classified as non-filers. Understanding the scenarios that necessitate this form can help streamline the application process and ensure compliance with financial regulations.

How to request an IRS verification of non-filing letter

Requesting an IRS Verification of Non-Filing Letter involves a structured approach to ensure eligibility and completeness. Firstly, determining if you are eligible is key. Generally, you need to show that you have not filed a tax return for the year in question and demonstrate intent or eligibility for the verification.

Eligibility requirements

To be eligible for the non-filing letter, you should be a non-filer for the tax year in question and not have submitted any income tax returns. Key documentation includes your personal identification and any previous tax forms if applicable.

Collect necessary documents like your Social Security number or Individual Taxpayer Identification Number (ITIN) and a copy of the IRS Form 4506-T, which is essential for requesting the verification.

Step-by-step guide to requesting the letter

In certain cases, institutions might accept previous tax documents as a substitute for the non-filing letter. It's advisable to check with the specific institution to understand their requirements, ensuring they accept alternative verification.

Common issues and troubleshooting

When requesting a Verification of Non-Filing Letter, applicants may encounter various common issues, such as denials. These denials may occur due to incomplete information, discrepancies in documentation, or failure to meet eligibility requirements. Understanding the reasons behind these denials can help applicants rectify their requests effectively.

Typical problems when requesting verification

If you encounter any issues, contacting the IRS is a practical step for clarification. The agency provides assistance for application issues, ensuring you understand the process better.

In the event of a denial, you may appeal the decision by following specific IRS guidelines. Collect any pertinent documentation that supports your case, and be ready to provide accurate details during the appeal.

FAQs related to applying for aid using verification of non-filing

What can use a verification of non-filing letter for?

A Verification of Non-Filing Letter serves multiple purposes in various financial applications. Most notably, it is essential for completing the Free Application for Federal Student Aid (FAFSA), allowing students to demonstrate their non-filing status when applying for federal financial aid. Additionally, it can be used for loan applications and grants where proof of income reporting is required.

How long does it take to obtain a verification of non-filing letter?

Processing times for the Verification of Non-Filing Letter typically range from 5 to 10 business days. Several factors can affect these processing times, including the IRS's current workload and the accuracy of the submitted application. Be mindful that any discrepancies can lead to delays.

Can request multiple verification letters?

Absolutely, you can request multiple Verification of Non-Filing Letters. For each year that you need verification, you will need to fill out a separate Form 4506-T and submit it accordingly. Institutions might have specific guidelines about how many years of verification they require for financial aid or loans, so always clarify their requirements.

Additional information on IRS verification of non-filing letters

Duration of validity of the letter

The Verification of Non-Filing Letter usually remains valid for one financial aid year, although some institutions may require more recent documentation. If applying for new financial aid or loan opportunities, checking the validity period requested by specific institutions can prevent potential issues.

Different purposes might necessitate a different length of validity, so always ensure your documentation aligns with the requirements of the specific application you're submitting.

Using the letter for different purposes

The purpose of the Verification of Non-Filing Letter can differ based on the application. For educational loans, it serves to establish a clear financial picture, while for mortgages, it helps verify the lender’s understanding of the applicant's financial background. Ensure you tailor the information from this letter to meet the specific needs of your application.

Managing your documents effectively with pdfFiller

Editing and filling out the verification of non-filing form

pdfFiller simplifies the process of managing your IRS Verification of Non-Filing Form by providing user-friendly tools for efficient editing, filling, and submission. With interactive features, users can easily navigate through the form fields, ensuring accuracy and reducing the potential for errors.

eSigning and collaborating real-time

The platform also offers eSigning capabilities, allowing users to securely sign documents online. Real-time collaboration features foster teamwork, essential for teams that need to discuss and finalize the form efficiently before submission.

Storing and retrieving documents in the cloud

Moreover, pdfFiller enables users to store and retrieve their sensitive verification documents in the cloud securely. This feature grants you easy access from any device, ensuring you can manage your information efficiently, no matter where you are.

Contact us for support

When to seek professional help

In some cases, individuals may find that navigating the complex world of non-filing documentation requires professional help. If you experience ongoing issues or uncertainties regarding the process, it may be beneficial to consult a tax professional who can provide tailored guidance suited to your situation.

Contact information

For expert support on managing the verification process, utilize the resources available on pdfFiller. Reach out through our dedicated support channels to answer any queries about filling out, submitting, and utilizing your Verification of Non-Filing Letter effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my verification of non-filing in Gmail?

How do I execute verification of non-filing online?

How do I fill out verification of non-filing using my mobile device?

What is verification of non-filing?

Who is required to file verification of non-filing?

How to fill out verification of non-filing?

What is the purpose of verification of non-filing?

What information must be reported on verification of non-filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.