Get the free New Account Application - colsa unh

Get, Create, Make and Sign new account application

How to edit new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

Everything You Need to Know About the New Account Application Form

Understanding the new account application form

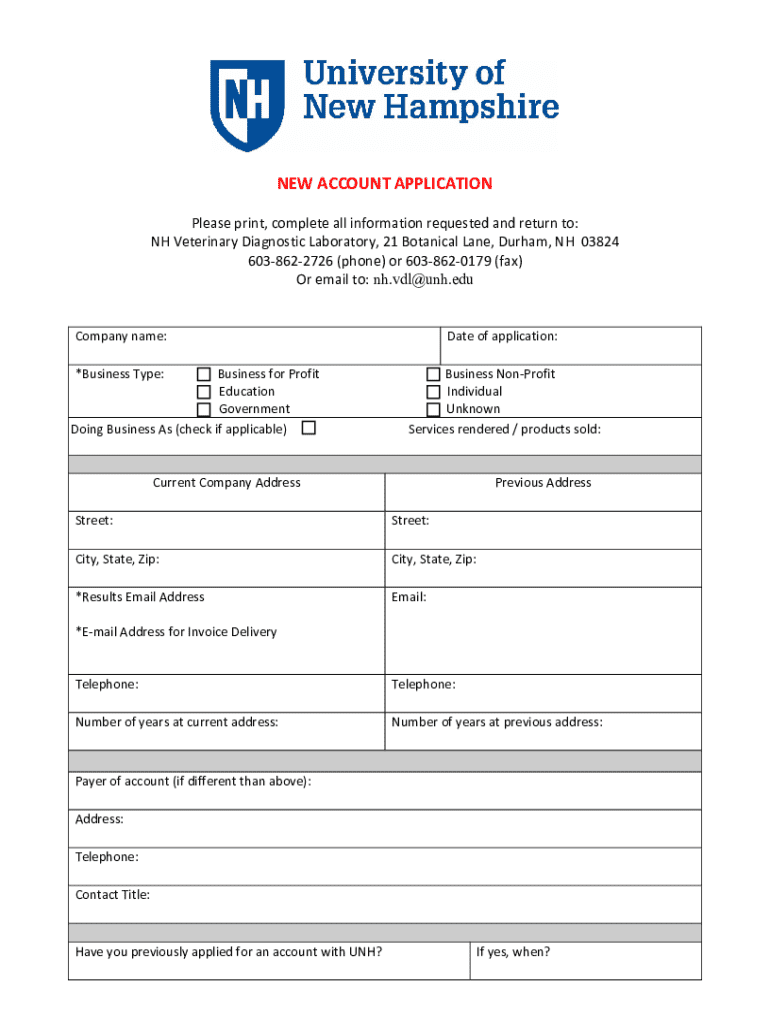

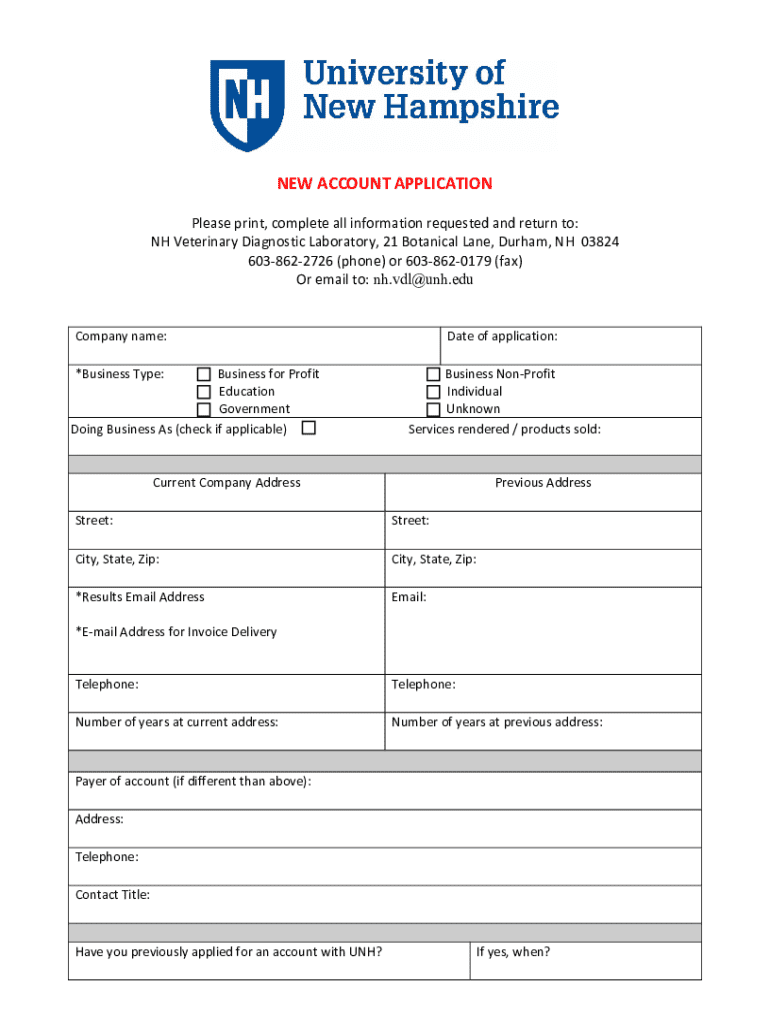

A new account application form is a crucial document required by various institutions, ranging from banks to e-commerce platforms, to gather essential details about applicants before opening a new account. This form serves as the gateway for individuals or businesses to access services offered by the institution, and it's paramount that both parties ensure accurate and complete information is submitted.

The importance of a new account application cannot be overstated. For financial institutions, it helps verify the identity and financial status of the applicant, adhering to compliance and regulatory standards. E-commerce platforms rely on these forms to manage customer relationships effectively, while insurance firms need detailed applications to assess risk and determine premium rates.

Types of new account application forms

New account application forms come in various formats, primarily categorized into personal and business accounts. Personal applications are straightforward, catering to needs such as individual banking or personal insurance. In contrast, business accounts require more comprehensive documentation due to the complexity of business operations and more significant financial implications.

Additionally, applications can be classified as online or offline. Online forms offer ease of access and completion, particularly through platforms like pdfFiller, where users can edit and submit documents digitally. Offline applications, while still prevalent, often require mailing or in-person submission.

Key sections of a new account application form

A well-structured new account application form typically includes several key sections designed to collect comprehensive information from applicants. First, the personal information section asks for identification details that establish the applicant's identity. This includes full name, social security number, and date of birth.

Next, the contact information section gathers essential address, email, and phone details, which are critical for communication purposes. Financial information follows, where applicants must provide income verification, assets, and other economic evidence to facilitate the institution’s risk assessment. Lastly, the account preferences section guides users to specify the type of account they desire, along with any additional services needed, tailoring the account setup to their requirements.

Step-by-step guide to filling out a new account application form

Filling out a new account application form can seem daunting, but with careful preparation, the process becomes seamless. Start by gathering all relevant documents that you will need to reference, which often include forms of identification, proof of residence, and financial statements. Ensuring you have this information readily at hand can significantly reduce errors during submission.

Next, when you begin completing the application, take your time with each section. Provide detailed information as requested, paying close attention to required fields. One common pitfall is neglecting to double-check entries, so a thorough review before final submission is critical. Submitting inaccurate or incomplete applications can lead to delays or even rejection.

Editing and customizing your application form

Customizing your new account application form can enhance your brand’s identity and streamline the completion process. Using tools like pdfFiller, you can easily edit form fields to suit your specific requirements, ensuring that all relevant information is collected efficiently. For business accounts, incorporating branding elements such as logos and design themes helps reinforce brand recognition.

Additionally, adding interactive elements like checkboxes and dropdowns can simplify the user experience. These features keep the form organized and improve the overall aesthetics of the application, making it more user-friendly. This is beneficial not only for applicants but also for institutions looking to reduce the time and effort spent on handling incomplete or improperly filled applications.

Signing the new account application form

In the digital age, eSignatures have become an integral part of the new account application process. The implementation of eSignatures streamlines the approval workflow, reducing the time required for applicants and institutions alike. With pdfFiller, signing your application electronically is straightforward and secure, allowing you to finalize your document anytime, anywhere.

It's crucial to understand the legality and security surrounding eSignatures. They hold the same legal standing as traditional handwritten signatures if conducted through compliant platforms. Adobe Sign and similar technologies ensure your signatures are secure, protecting sensitive data while simplifying the authorization process.

Submitting your application

Once you’ve completed and signed your new account application form, the submission phase begins. Various submission methods exist, primarily influenced by whether the application is digital or paper-based. With pdfFiller, online submissions are optimized for speed and tracking, allowing applicants to receive confirmation immediately upon submission.

For physical submissions, ensure you follow the institution's guidelines, which may include mailing protocols or in-person drop-off locations. Understanding processing times is also vital; applicants should inquire about how long it will take to review and approve the applications, which could vary widely across different industries. Additionally, tracking your application status can alleviate anxiety during the waiting period.

Managing your new account post-approval

Once approved, managing your new account offers a range of tools that can enhance your experience. With functionalities provided by platforms like pdfFiller, account holders can access their accounts from any location, allowing for easy monitoring of transactions or settings adjustments. This flexibility is particularly beneficial for business users who need to collaborate with team members remotely.

In addition, effective account management involves utilizing various tools designed to streamline operations. pdfFiller integrates documents and collaborative features that empower teams to share access, edit collectively, and manage reports swiftly. By leveraging these capabilities, users can ensure compliance while facilitating better efficiency across their processes.

Frequently asked questions about new account application forms

Navigating the new account application process can raise various questions. One common concern is what to do if your application gets rejected. If this happens, reviewing the reasons for rejection typically outlined by the institution will provide clear steps for resubmission. You may need to gather additional documentation or clarify specific information.

Amending an existing application is also a common inquiry. Most institutions provide a way to update your application, either directly through an online portal or with customer service support. They may ask familiar questions to verify your identity before processing changes. Lastly, applicants should be aware that institutions may follow up with additional questions for clarification, especially in complex cases.

Conclusion: The advantage of using pdfFiller for your new account application needs

Utilizing pdfFiller for managing your new account application form brings several advantages, chiefly the seamless integration of editing, signing, and document management. Users benefit from a cloud-based platform that centralizes all tasks, making it easier to handle applications proficiently. This centralization minimizes the stress of document management while enhancing convenience.

Moreover, pdfFiller’s accessibility and collaboration features enable teams and individuals alike to work on documents from any location. This flexibility empowers users to navigate the complexities of account applications with confidence, ensuring compliance and accuracy throughout the entire process. In an increasingly digital world, embracing these tools not only improves efficiency but also enhances the overall user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get new account application?

How do I make changes in new account application?

Can I create an eSignature for the new account application in Gmail?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.