Get the free 457(b) Deferred Compensation Ez Enrollment Form

Get, Create, Make and Sign 457b deferred compensation ez

How to edit 457b deferred compensation ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 457b deferred compensation ez

How to fill out 457b deferred compensation ez

Who needs 457b deferred compensation ez?

457b Deferred Compensation EZ Form - How-to Guide

Understanding the 457b deferred compensation plan

A 457b deferred compensation plan is a type of retirement savings plan available to certain employees, primarily local and state government workers, as well as some non-profit organizations. Unlike traditional retirement plans, a 457b plan allows employees to control their contributions and investments, eventually offering them a streamlined method to save for their retirement needs while deferring taxes on the money until withdrawal.

Key benefits for participants include tax-deferred growth, the ability to withdraw funds upon separation from service without a penalty, and the option for significant catch-up contributions if nearing retirement age. Unlike 401(k) and IRA retirement accounts, 457b plans do not impose early withdrawal penalties for distributions after separation from service before the age of 59½, making them a flexible option for many employees.

Eligibility criteria for 457b plans

Eligibility for a 457b deferred compensation plan generally includes employees of state and local governments, as well as employees of tax-exempt organizations. Certain conditions may apply based on the employer's specific plan offerings. For instance, some employers may restrict participation to full-time employees or specific job classifications.

Special considerations apply for government employees, who may also have access to 403(b) plans. Additionally, employees of governmental units must check if their employer sponsors a 457b plan. Understanding the unique enrollment criteria is essential for accessing the benefits of a 457b plan.

Getting started with the 457b program

To enroll in a 457b deferred compensation plan, individuals need to follow specific steps. The enrollment process typically begins at the start of the calendar year or during employer-specific enrollment periods. Interested participants should first review their employer’s plan document, which outlines the specific provisions and eligibility requirements.

Necessary documentation generally includes personal identification, tax information, and the specific 457b EZ form, which simplifies the application process. Employees are encouraged to submit their enrollment applications either electronically or via hard copy, depending on their employer's procedures. The ease of accessing the EZ form through platforms like pdfFiller enhances the experience significantly.

Understanding contribution limits and options

Annual contribution limits for 457b plans change frequently, but they are typically set by the IRS. For the year 2023, participants can contribute up to $22,500, with an additional catch-up contribution of $7,500 for those aged 50 and over. Knowing these limits is crucial, as they dictate how much can be deferred annually and can impact long-term savings.

Participants have options for contributing on a pre-tax basis, which reduces taxable income for the year, or on a Roth basis, where contributions are made after tax, but withdrawals in retirement are tax-free. This flexibility allows employees to develop a retirement strategy aligned with their financial situation.

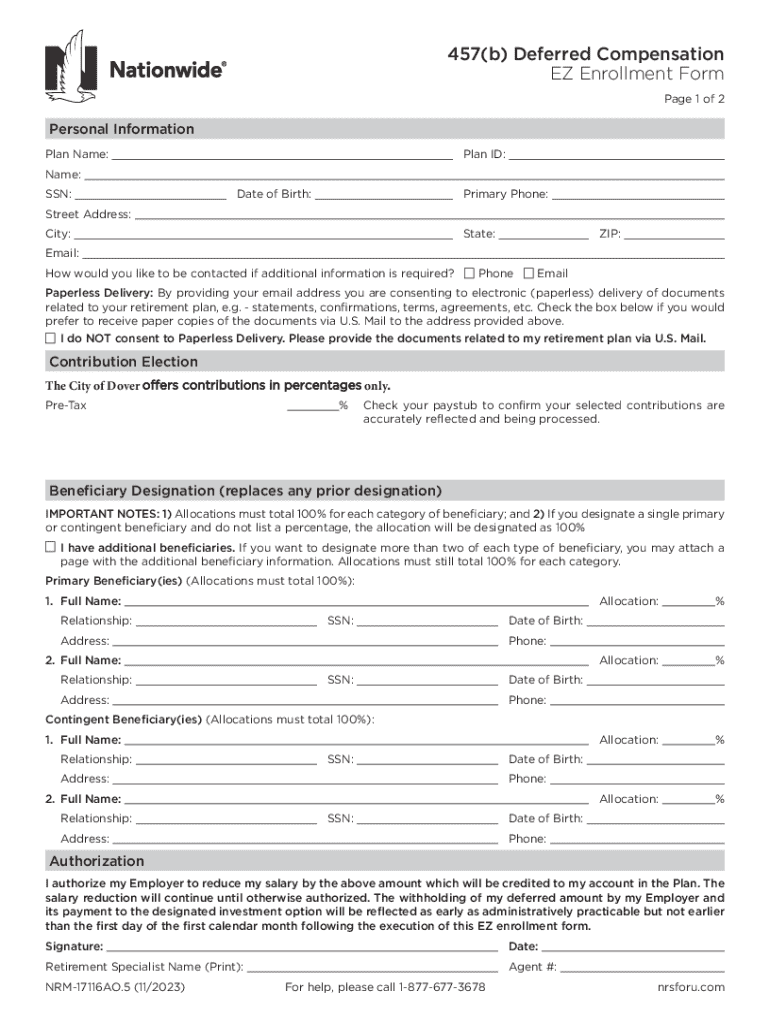

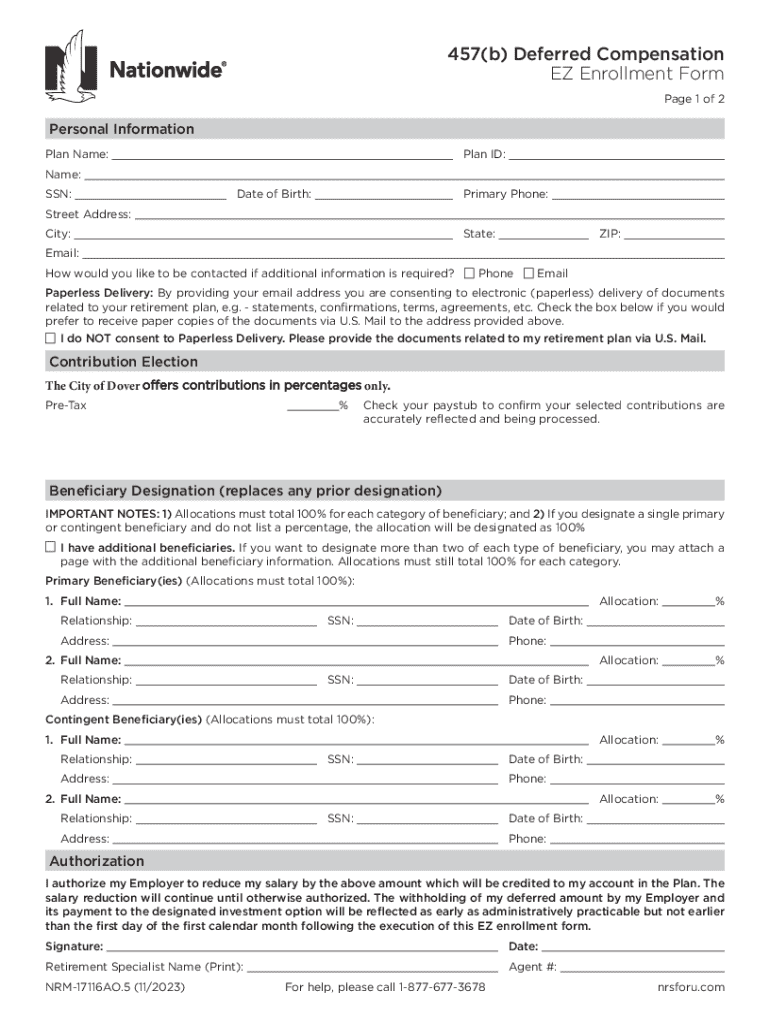

Filling out the 457b EZ form (step-by-step guide)

Accessing the 457b EZ form is simple with pdfFiller. The form can typically be found directly on the website or requested from your HR department. It's vital to use the correct, up-to-date version of the EZ form to ensure accuracy and compliance with IRS guidelines.

When completing the EZ form, personal information is required at the outset, including name, address, and Social Security number. Next, you will need to provide employer information, which normally includes the employer's name and address, and any other details requested. Additionally, the form will outline various contribution selections that you must choose based on your financial goals.

Avoiding common mistakes is crucial during this process, such as incomplete information or failing to sign the form. After completing the EZ form, review it thoroughly before submitting. Using pdfFiller's editing tools can help streamline this process and ensure that all sections are adequately filled out.

Managing your 457b account

Once enrolled in a 457b plan, having a firm grasp on the investment options available becomes essential. Typical investment choices may include stocks, bonds, and mutual funds, allowing participants to diversify their retirement portfolio. Analyzing personal risk tolerance and long-term goals can assist in crafting an effective investment strategy.

Checking performance regularly and adjusting contributions in light of life changes is critical. Automated contributions can simplify the savings process, enabling employees to adjust their deferrals based on current income and family obligations. It is imperative to keep a close eye on the account to ensure it aligns with financial objectives and market conditions.

Withdrawals and distributions from your 457b plan

Understanding the eligibility requirements for withdrawals is crucial for managing your 457b plan. Employees can begin withdrawals upon separation from service, regardless of age, which is a key distinction from other plans like 401(k)s. To initiate a withdrawal or distribution request, participants must follow their employer's specific procedures, which typically include submitting a form and may require additional documentation.

It's equally important to consider tax implications upon withdrawing funds. Withdrawals from a 457b plan are taxed as ordinary income, so strategizing withdrawals can help minimize tax burdens. Consulting with a financial advisor before making withdrawals can provide sound advice tailored to individual circumstances.

Leveraging pdfFiller for your 457b form needs

pdfFiller offers multiple features that enhance document management experiences for users filling out the 457b EZ form. Its editing capabilities allow users to streamline the filling process efficiently, while eSigning features ensure necessary permissions are quickly secured. Collaboration with financial advisors or HR teams is simplified through shared access, making the overall experience more efficient.

Additionally, pdfFiller provides secure cloud storage, allowing participants to access their documents from anywhere at any time. Whether you need to retrieve completed forms or adjust certain information, users can confidently rely on pdfFiller for their document management needs.

FAQs about 457b deferred compensation and using the EZ form

Common questions arise about eligibility and contributions regarding 457b plans. Many prospective participants wonder how contributions work, what the limits are, and how to access their funds. Troubleshooting tools provided by pdfFiller can guide users through the form-filling process, ensuring they have the accurate information needed at each step.

For further assistance or any specialized inquiries, individuals are encouraged to reach out to their employer's HR department or utilize the extensive support options offered by pdfFiller.

Making the most of your 457b deferred compensation plan

To maximize the benefits of a 457b account, integrating it with other retirement accounts, such as 401(k)s or IRAs, can create a balanced long-term financial strategy. Staying informed about investment options and tax implications can significantly affect retirement outcomes. Utilizing resources for retirement planning, such as financial advisors or retirement calculators, strengthens the foundation for future financial security.

Regular reviews and consultations with financial professionals are invaluable. This expert guidance ensures alignment with personal goals and the latest market trends, leading toward a more prosperous retirement. Engaging actively in the management of your 457b plan helps secure a brighter financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 457b deferred compensation ez in Gmail?

How can I get 457b deferred compensation ez?

Can I edit 457b deferred compensation ez on an iOS device?

What is 457b deferred compensation ez?

Who is required to file 457b deferred compensation ez?

How to fill out 457b deferred compensation ez?

What is the purpose of 457b deferred compensation ez?

What information must be reported on 457b deferred compensation ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.