Get the free My Personal Credit Report

Get, Create, Make and Sign my personal credit report

Editing my personal credit report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out my personal credit report

How to fill out my personal credit report

Who needs my personal credit report?

My Personal Credit Report Form: A Comprehensive How-To Guide

Understanding your credit report

A credit report is a detailed record of your credit history, compiled by credit reporting companies like Equifax, Experian, and TransUnion. Understanding your credit report is crucial as it plays a significant role in your financial health. Lenders assess your credit report to help determine your creditworthiness when you apply for loans or mortgages. A good credit report can lead to favorable loan terms, while a poor report may result in higher interest rates or declined applications.

Your credit report impacts various financial decisions, including insurance premiums and rental agreements. It's a window into your financial behavior that lenders and service providers use to predict your future repayment behavior. Thus, regularly reviewing your credit report is essential for maintaining good financial standing.

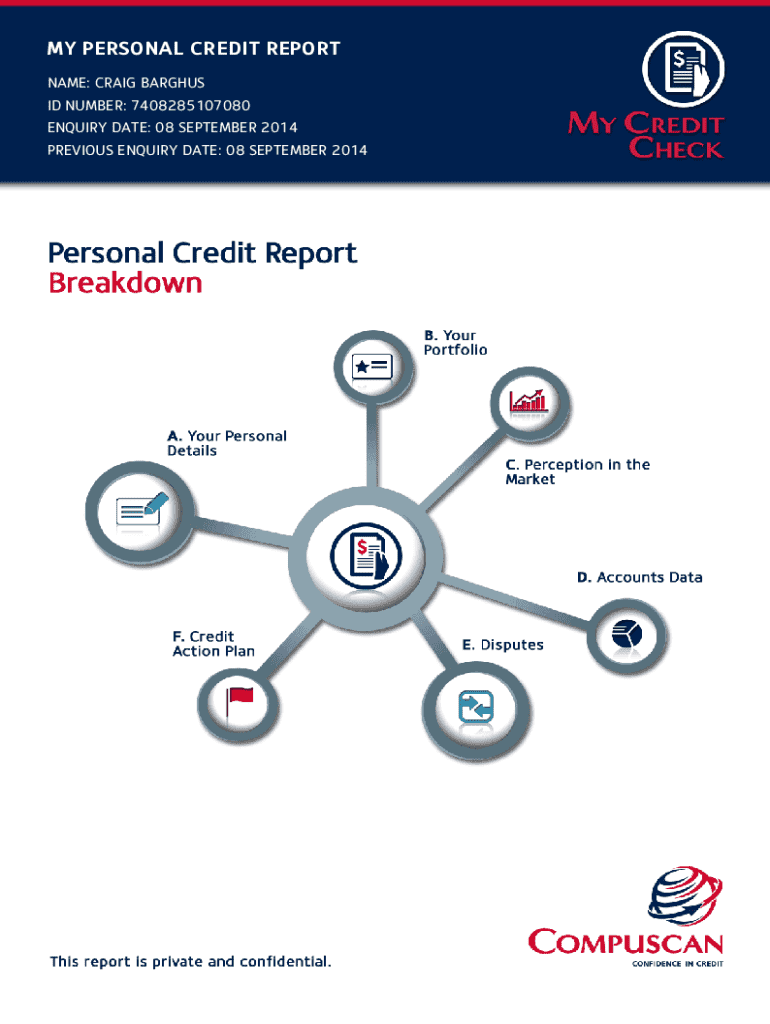

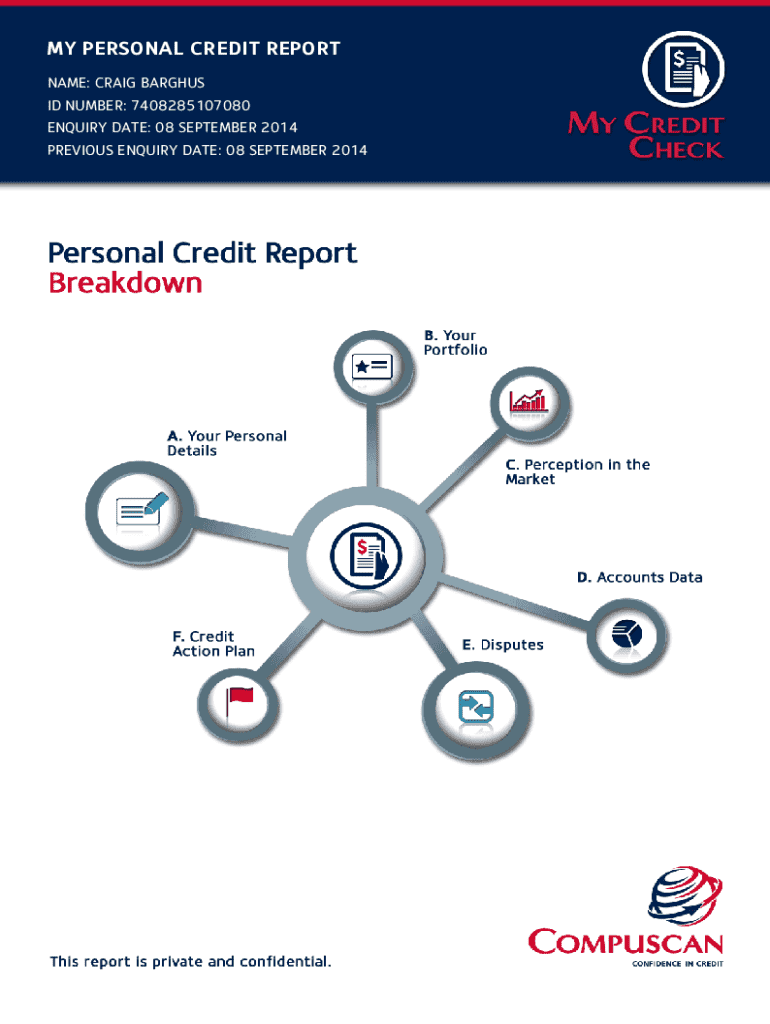

Components of a credit report

A credit report consists of several key components that provide a comprehensive view of your credit history. The primary sections include:

How to obtain your personal credit report

All individuals are entitled to obtain a free copy of their credit reports from the three main credit bureaus annually. You can access these reports by visiting AnnualCreditReport.com, a site established by federal law to help consumers manage their credit information effectively. Simply follow the prompts to request your free copies, ensuring you have access to the most accurate and up-to-date information about your credit history.

In addition to the federal entitlement, many financial institutions and credit card issuers offer free credit report access as part of their services. Furthermore, various credit monitoring services may provide ongoing access to your credit reports along with alerts for any significant changes, allowing you to keep tabs on your credit status.

Filling out your credit report form

Filling out your personal credit report form accurately is essential for ensuring correct information is filed. First, locate your report through one of the methods mentioned earlier. Once you have your report, review it for completeness and ensure that your personal information is correct—this forms the foundation of your report.

Key sections to pay attention to include your contact information, account statuses, and any reports of discrepancies or errors. When filling out the form, include every relevant detail, reflecting your credit history accurately. If you find inconsistencies, documenting them clearly will facilitate any necessary disputes down the line.

Editing and signing your credit report form

Utilizing digital tools like pdfFiller can make editing your credit report form both easy and efficient. With pdfFiller, you can upload your report and make interactive edits, ensuring that all information accurately represents your financial history. Moreover, highlighting errors or areas that need clarification can streamline communication with credit bureaus.

In addition to editing, pdfFiller also offers e-signing technology, making it easy to sign documents electronically. E-signatures are legally accepted in financial documents, simplifying the process of submitting disputes or formal requests based on your credit information. As you fill out or edit your forms, ensure that you’re also including clear e-signatures where required to maintain legitimacy.

Managing your credit report

Regular monitoring of your credit report is a proactive approach to managing your financial health. Changes to your credit report can occur due to multiple factors, including missed payments or new accounts opening. By keeping a close eye on your report, you can quickly identify and address any issues before they escalate.

Setting up alerts for unusual activity or changes is another effective strategy. Many credit monitoring services provide notifications when your credit report changes, allowing you to act promptly. This vigilance not only helps you manage your credit but can also improve your credit score over time as you take steps to maintain good financial practices.

Disputing errors

If you encounter discrepancies in your credit report, disputing errors is critical. The first step is to gather documentation related to the specific issue you're disputing. Once you have your documentation ready, file a dispute directly with the credit bureaus through their respective websites, providing all necessary information and evidence.

pdfFiller can aid in managing the dispute documents efficiently, providing templates that simplify the process of creating and submitting dispute letters. By ensuring that your dispute is well-documented and clearly presented, you increase the likelihood of a favorable resolution.

Additional tips for understanding your credit report

Understanding the terminology used in credit reports can significantly enhance your management of credit. Equip yourself with a glossary of common terms such as 'credit inquiry', 'credit utilization', and 'payment history'. Grasping these terms not only aids in your understanding but empowers you to make more informed financial decisions.

Moreover, staying informed about credit scoring models, such as FICO and VantageScore, is essential for improving your credit score. Best practices for enhancing your score include paying your bills on time, reducing outstanding debts, and limiting new hard inquiries. This knowledge equips you to maintain a good credit profile over time, benefiting you in loan applications and other financial endeavors.

Frequently asked questions

1. How do I get a free copy of my credit reports? You can obtain free copies of your credit reports annually from AnnualCreditReport.com.

2. Where can I get a credit report? You can receive credit reports from the three major credit bureaus or through various financial institutions and websites.

3. How can I get additional free credit reports? In addition to the annual report, you can obtain additional reports if you are a victim of identity theft or if a lender has denied your application based on your credit history.

4. What to do if I don’t see what I’m looking for? If you are missing information or have questions about your report, contact the credit bureau directly for assistance.

Legal considerations

Understanding your rights regarding credit reports is paramount for individuals managing their finances. Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccurate information and receive a timely investigation. It's crucial to be aware of your rights to ensure your credit report reflects accurate information.

If you suspect identity theft, act swiftly: place a fraud alert on your reports and consider freezing your credit to prevent unauthorized access. These steps can help protect your financial standing and personal information in a vulnerable situation.

Related tools and resources

For those looking to tap into additional resources, many online questions and forums are available for further guidance regarding credit reports. Utilize the pdfFiller platform to elevate your credit management experience through easy document management, including editing, signing, and sharing forms. pdfFiller empowers users to streamline their report management, transforming a potentially complex task into a manageable one.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify my personal credit report without leaving Google Drive?

Where do I find my personal credit report?

How do I execute my personal credit report online?

What is my personal credit report?

Who is required to file my personal credit report?

How to fill out my personal credit report?

What is the purpose of my personal credit report?

What information must be reported on my personal credit report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.