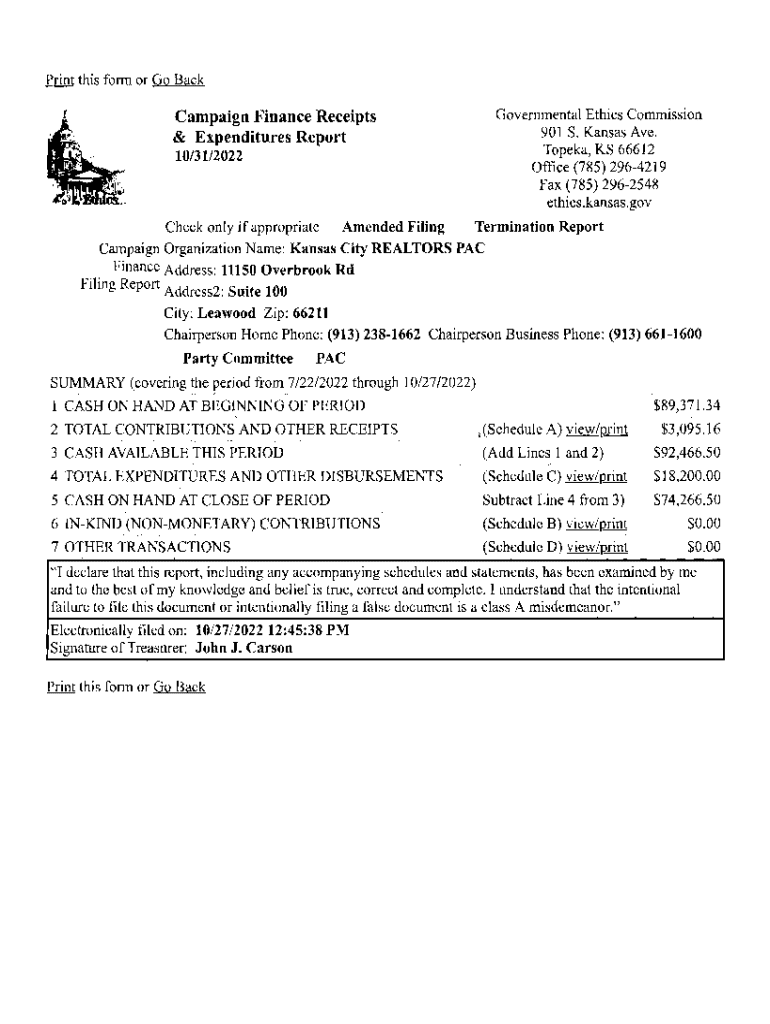

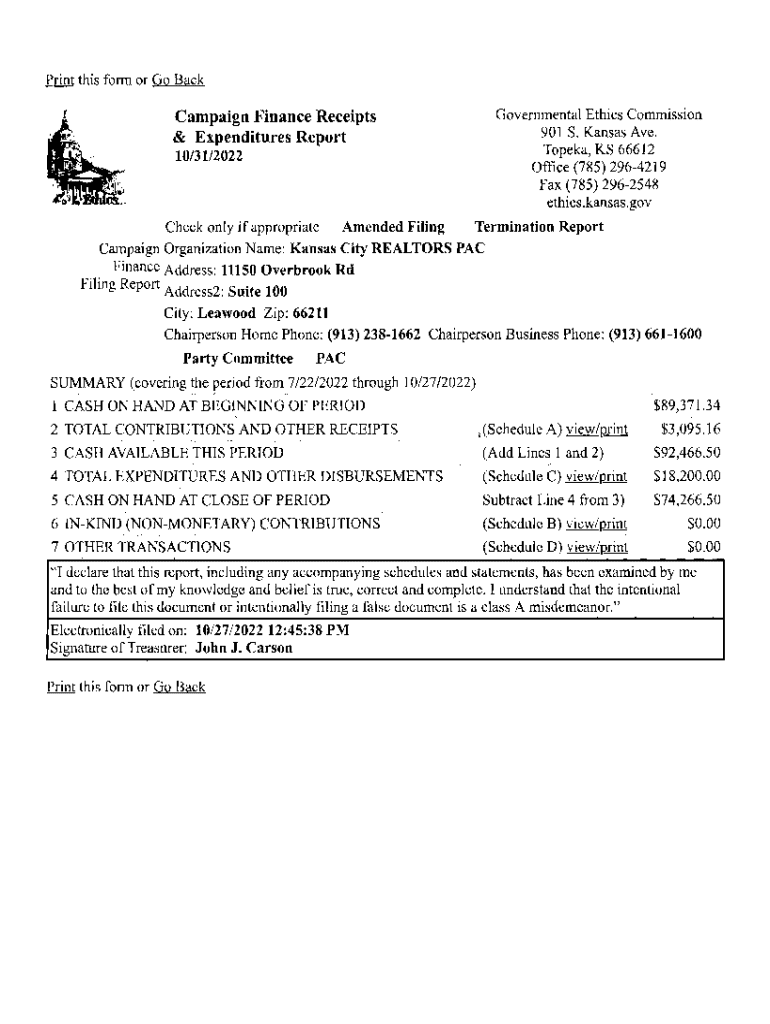

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding Campaign Finance Receipts Expenditures Form

Understanding campaign finance basics

Campaign finance is the management of funds raised and spent during an election campaign. It plays a crucial role in determining the competitiveness and transparency of political processes. Effective management of campaign finances ensures adherence to laws, aids in strategy formulation, and fosters public trust. Transparency in funding is paramount, as it helps voters make informed choices, promoting a healthy democratic environment.

Various documents are essential in campaign finance, serving different purposes. Among these, the campaign finance receipts expenditures form stands out as it provides a detailed account of all monetary transactions associated with a campaign. This includes donations received (receipts) and expenses incurred (expenditures), which are critical in tracking the financial health of a campaign.

The campaign finance receipts expenditures form

The campaign finance receipts expenditures form is a standardized document that requires candidates, committees, and organizations to report their financial activities during an election cycle. This form aids in compliance with existing campaign finance laws and regulations to promote transparency in how campaigns are funded and managed. It holds significance that extends beyond mere compliance by fostering accountability amongst candidates and enhancing voter trust.

Anyone who raises or spends a certain threshold amount must file this form. Criteria vary by jurisdiction, but generally, candidates for public office, political parties, and political action committees (PACs) are required to submit the form. Understanding your obligations as a candidate or campaign manager is essential in ensuring correct documentation.

Key deadlines for filing differ based on local regulations. Missing these deadlines could result in fines or penalties. Therefore, it is crucial to familiarize yourself with filing dates for your specific area, ensuring all submissions are timely and correct.

How to complete the campaign finance form

Completing the campaign finance receipts expenditures form necessitates gathering comprehensive, accurate information. Critical data includes all contributions received, which should detail the name of the donor, their address, and the amount contributed. Additionally, any expenditures must be recorded—this includes the vendor's name, the amount spent, and the purpose of the expense. Collecting well-organized information makes for a smoother filing process.

Here's a step-by-step guide for filling out the form effectively: **Step 1:** Begin with personal and campaign identification. Clearly list the candidate's name and campaign committee name, along with any required identification numbers. **Step 2:** Report all receipts meticulously. Aggregate donations from each donor separately for transparency. Include the cumulative amount raised and how it aligns with fundraising goals. **Step 3:** Move on to report expenditures, ensuring that each expense is accounted for with necessary details. Be thorough, as incomplete forms can lead to challenges later. **Step 4:** End with certification and signatures, confirming the accuracy of the information provided and ensuring accountability.

Double-checking your entries is essential to minimize errors. Common mistakes include miscalculations, omitting necessary signatures, or failing to report all required information. Reviewing your entries can prevent incorrect filing, which may lead to delays or compliance issues.

Editing and managing your campaign finance documents

Utilizing tools like pdfFiller can streamline the process of editing and managing your campaign finance forms. The platform provides advanced features that allow users to easily edit PDFs, add notes, or highlight critical information on the campaign finance receipts expenditures form. This functionality makes it more efficient to ensure that all details are correct before submission.

Moreover, once the form is completed, you can eSign it digitally. This process involves a few simple steps: Uploading your document to pdfFiller, navigating to the eSigning feature, and following prompts to provide your digital signature. This provides a quick and legally valid method to certify your documentation without the need for printing or scanning.

Collaboration on campaign finance documents is made simple through pdfFiller. The platform allows multiple team members to work on the same document in real time. You can share the document via email or a link, making it easier for teams to communicate changes and ensure everyone is on the same page, which is a huge benefit during the frantic campaign season.

Submitting the campaign finance receipts expenditures form

Submitting your campaign finance receipts expenditures form is straightforward but varies based on local regulations. Most jurisdictions allow electronic submissions via dedicated campaign finance websites, while others may require physical documents to be mailed or delivered in person. Understanding the preferred method of submission for your area is crucial to ensure timely compliance.

After submitting the form, expect a processing timeframe that can range from a few days to several weeks, depending on the volume of submissions and the specific agency handling them. If issues arise or further information is needed, your campaign may receive follow-up requests from election officials.

If your submission is not accepted, don't panic. The first course of action should be to understand the reasons behind the rejection. Common issues may include errors in data or missing components of the form. Address these points systematically, then resubmit your form correctly to remain in compliance with campaign finance laws.

Understanding compliance and legal obligations

Campaign finance laws exist at both federal and state levels, encompassing regulations that dictate how funds can be raised, reported, and spent. Familiarizing yourself with these laws is essential not just for compliance, but for ethical campaigning and maintaining public trust. Each state may have distinct rules regarding contribution limits, reporting frequency, and documentation required.

Non-compliance can lead to significant penalties, including fines, administrative actions, or even legal consequences. Penalties vary widely depending on the severity of the violation, and could deter potential candidates from running for office. Understanding your obligations ensures that your campaign remains intact and above board.

For those navigating legal complexities, numerous resources are available for assistance. Many organizations provide guidance on campaign finance issues, offering expert advice tailored to specific situations. Engaging these resources can help clarify intricate regulations and provide the support necessary for successful compliance.

Frequently asked questions

Several common queries often arise regarding the campaign finance receipts expenditures form, including the reporting thresholds, acceptable forms of donations, and expenditure categorization. Clarifying these aspects can help demystify the process for new candidates and campaign managers.

It’s also essential to address misconceptions surrounding campaign finance reporting. For example, some believe small contributions do not need reporting, which is inaccurate in many jurisdictions. All contributions must typically be disclosed, regardless of size, to maintain transparency in campaign financing.

Interactive tools and resources

Accessing templates and samples of the campaign finance receipts expenditures form can eliminate confusion regarding format and required information. Many online resources offer downloadable blank forms that comply with local regulations, providing a solid foundation for your campaign’s specific needs.

Additionally, interactive budgeting calculators are invaluable in estimating campaign budgets. They aid candidates in managing finances effectively by providing tools to project potential income and expenses. Utilizing these resources ensures campaigns remain organized and prepared, maximizing their chances of success.

Case studies and success stories

Numerous campaigns have successfully navigated the complexities of campaign finance by utilizing comprehensive strategies. For instance, some local races saw improvements in community engagement with proper financial disclosures, reflective of their transparency and ethical commitment. These case studies spotlight the importance of good financial practices and illustrate best practices that future candidates can learn from.

Lessons learned from these success stories emphasize the importance of detailed record-keeping, timely reporting, and clear communication with donors. A strong financial management strategy not only strengthens a campaign's credibility but also builds an advantageous reputation amongst voters, ultimately driving the success of aspiring candidates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find campaign finance receipts expenditures?

How do I execute campaign finance receipts expenditures online?

How can I fill out campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.