Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

Editing campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign finance receipts and form: A comprehensive guide

Understanding campaign finance receipts

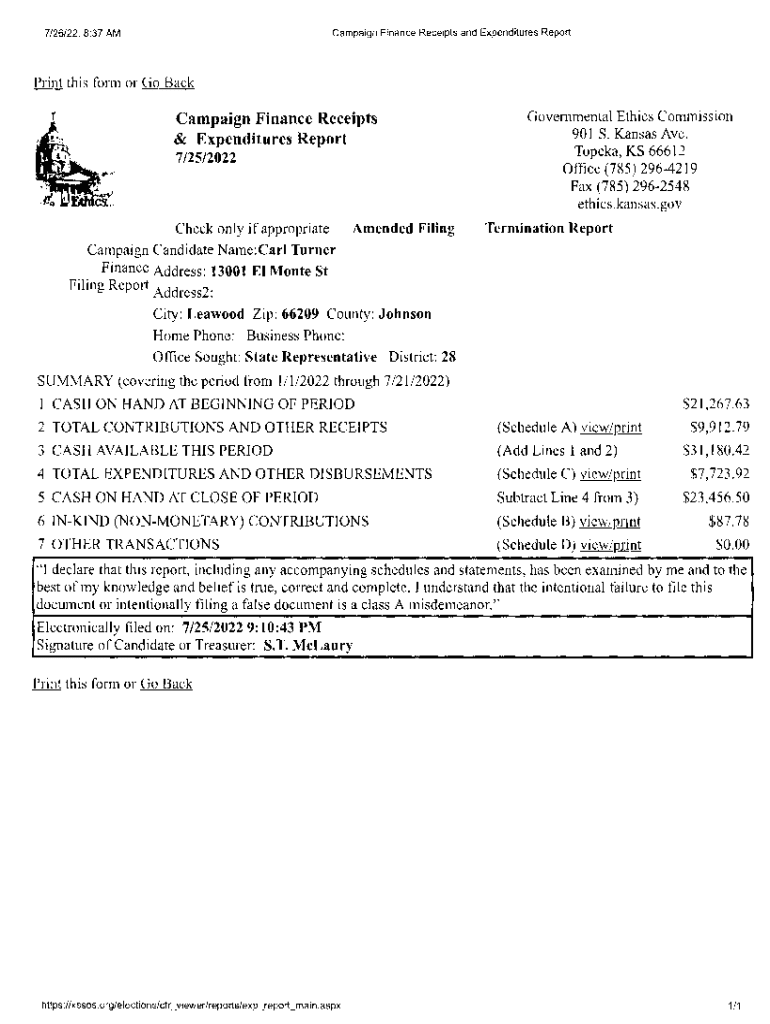

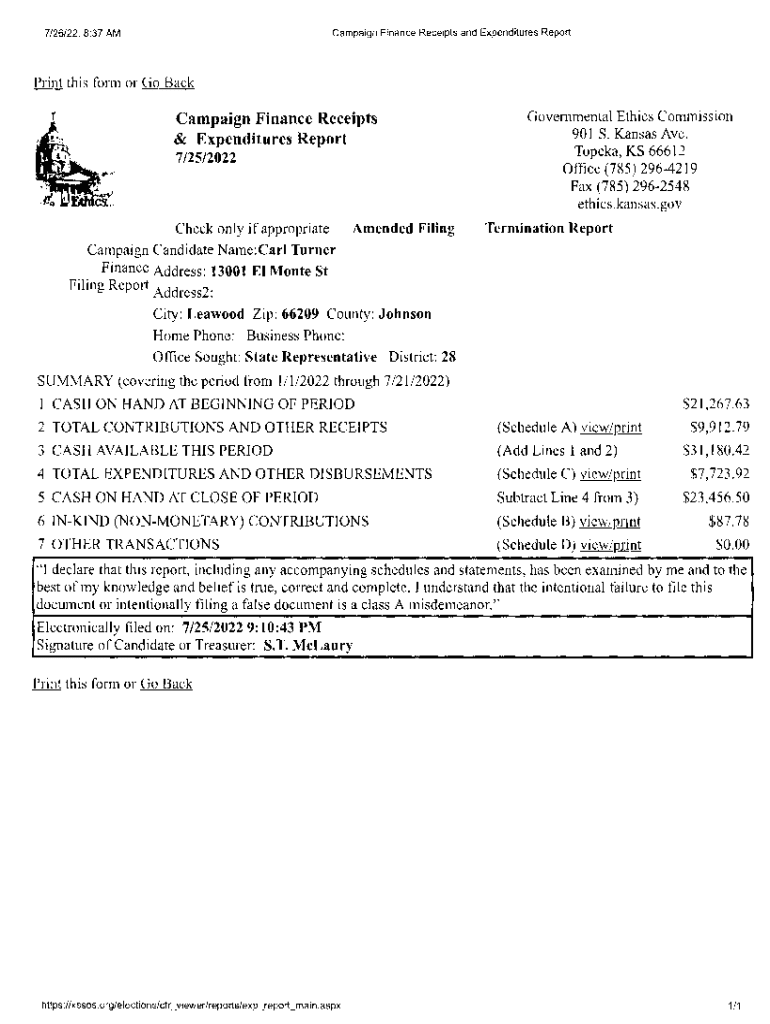

Campaign finance receipts serve as crucial documentation in the political landscape, ensuring transparency and accountability in the funding of political campaigns. These receipts detail the contributions received by candidates or political committees, encapsulating details such as the donor's name, amount donated, and the date of the contribution. The legal stipulation for documenting donations lies in the necessity to maintain comprehensive reports that comply with both federal and state regulations, ensuring that all financial activity is traceable and verifiable.

Accurate receipts are not just a legal obligation; they also play a vital role in fostering trust with constituents. By providing clarity on funding sources, candidates can demonstrate their integrity and promote transparency in their financial dealings. Failing to maintain accurate documentation can lead to serious legal repercussions, including fines, penalties, or even disqualification from an election. Therefore, understanding the intricacies of campaign finance receipts is essential for any campaigning political team.

Types of campaign finance receipts

Campaign finance receipts vary significantly depending on the origin of the contribution, and understanding these types is critical for proper record-keeping. The three primary categories include individual contributions, corporate donations, and in-kind contributions. Each type has distinct regulations and documentation requirements that organizations need to follow to remain compliant with campaign finance laws.

Individual contributions

Individual contributions are monetary gifts provided by private citizens to support a campaign. In many jurisdictions, there are limits on the amount an individual can donate to a candidate per election cycle. For instance, federal limits can vary, and any donation exceeding a certain threshold must be reported in more detail. Documentation standards require that receipts include not only the donor's name and address but also the occupation and employer to ensure transparency.

Corporate donations

Corporate donations are often subject to regulatory nuances, and depending on the state, they may or may not be permitted. In jurisdictions where corporate contributions are allowed, it’s crucial to follow guidelines for recording, including noting the corporation's information, the amounts donated, and ensuring that funds have not been collected from stockholders or stakeholders in violation of the law. Organizations should ensure they familiarize themselves with the laws governing corporate donations to avoid inadvertent violations.

In-kind contributions

In-kind contributions refer to non-monetary gifts such as services, goods, or volunteer work. These contributions must be documented with a description of the goods or services provided, their fair market value, and any receipts or written agreements that detail the agreement between the parties. This type of contribution is often overlooked; however, failing to accurately document in-kind contributions can lead to serious compliance issues.

Campaign finance forms

A variety of forms are essential for reporting campaign finance receipts to ensure that contributions are disclosed accurately. Among the most commonly used forms is the FEC Form 1, which is necessary for registering as a candidate, and others that detail contributions, expenditures, and debts. Available on government websites, these forms should be downloaded and filled out with meticulous attention to detail, capturing all relevant information as mandated by law.

Completing campaign finance forms accurately is imperative. Start with gathering essential information such as donor details, contribution amounts, and transaction dates. After completing the form, a thorough review is critical to catch any mistakes that could lead to regulatory scrutiny. Submitting forms through the appropriate channels, whether electronically or via mail, must be done on time to meet filing obligations.

Tips for auditing your campaign finance forms

Auditing campaign finance forms is crucial for maintaining compliance and avoiding penalties. Create a checklist that includes verifying the donor information, ensuring all contributions are accounted for, and checking that all forms are submitted within the correct deadlines. Some common mistakes to avoid include inaccurately reporting amounts or failing to disclose required information. Establishing a routine review process can help catch errors before they become regulatory issues.

Using interactive tools for receipts management

Efficient management of campaign finance documents can significantly streamline your processes. Tools like pdfFiller not only provide a platform for editing and signing documents but also enable collaboration among team members. By utilizing these functionalities, campaigns can manage receipts and forms swiftly and effectively.

Features of pdfFiller for campaign finance documents

pdfFiller offers a myriad of features tailored for campaign finance management. Editing capabilities allow users to quickly adjust receipts and forms on the go, while eSignature functionalities facilitate fast donor acknowledgment without the need for physical paperwork. Teams can also benefit from collaborative tools, easily sharing documents and receiving input in real-time, enhancing overall productivity.

Collaborative tools for team management

In the dynamic world of political campaigns, teams often find themselves working remotely or from different locations. Cloud-based solutions like pdfFiller enable users to work collaboratively on campaign finance documentation regardless of geographical barriers. This fosters a culture of teamwork where everyone can contribute to ensuring accurate and compliant financial reporting.

Best practices for managing campaign finance receipts

Organizing digital receipts and forms is essential for any campaign. A strategic approach to storing documents can lead to significant time savings when retrieving information. Implementing folders categorized by donor type, contribution amount, or date can enhance efficiency. Additionally, using tags to pinpoint key information will allow for easy access to specific documents when needed.

Regular updates and record keeping

Consistency is vital when it comes to updating and maintaining campaign finance records. Set reminders for timely reporting, ensuring you never miss a filing deadline. It's important to maintain comprehensive records that reflect all financial activity accurately; this bolsters compliance and aids in preparing necessary disclosure reports for meetings and audits, hence protecting your campaign’s integrity.

Compliance and best practices

Understanding regulatory frameworks concerning campaign finance is non-negotiable. There are both federal and state regulations that must be adhered to, and these can change periodically. Regulations can dictate everything from contribution limits to what constitutes a reportable transaction. Staying updated on these changes is crucial for maintaining compliance and avoiding potential sanctions.

Consequences of non-compliance

Non-compliance with campaign finance regulations can trigger severe penalties, including hefty fines or criminal charges. Moreover, any lapses in financial reporting can severely damage a campaign’s reputation. Voters and donors value transparency, and the perception of mismanagement can lead to a loss of support or momentum. Keeping records in order and adhering to established guidelines is paramount for any campaign aspiring to success.

Addressing common campaign finance challenges

Candidates frequently encounter unique challenges when managing campaign finance receipts, particularly concerning uncommon contribution scenarios like internet fundraising. Understanding how to properly document these contributions, ensuring compliance, and developing a strategy for managing them will mitigate risk and maintain compliance, especially in a digital fundraising landscape.

Strategies for record keeping during high-volume campaigns

During high-volume campaigns, organizing and managing a large influx of donations can become overwhelming. One effective strategy is to utilize automation tools to streamline the capture and recording of contribution data. Setting up automated reminders and utilizing accounting software can also greatly alleviate the burden of manual data entry and prevent errors, ultimately leading to a seamless tracking process.

Getting help with your campaign finance documents

Professional consultation can provide invaluable insights when navigating the complexities of campaign finance documents. Engaging legal experts ensures that you fully understand your obligations and that your records are compliant with current regulations.

Utilizing support resources from pdfFiller

pdfFiller offers numerous support resources to assist users in managing their campaign finance documents. From educational materials to customer assistance, users can find help at various stages of the document management process, ensuring that all forms and receipts are executed accurately and effectively, thus supporting smoother compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit campaign finance receipts and in Chrome?

Can I create an electronic signature for signing my campaign finance receipts and in Gmail?

How do I complete campaign finance receipts and on an iOS device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.