Get the free Certification of Final Taxable Value - vcpa vcgov

Get, Create, Make and Sign certification of final taxable

Editing certification of final taxable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certification of final taxable

How to fill out certification of final taxable

Who needs certification of final taxable?

Certification of Final Taxable Form - A Comprehensive Guide

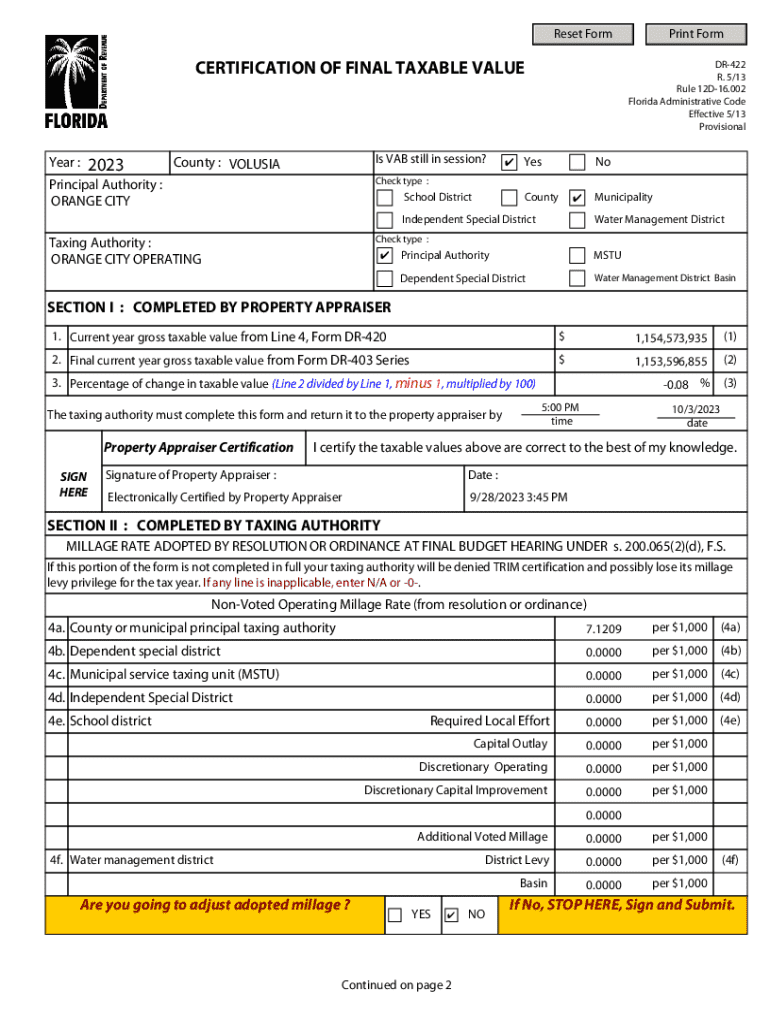

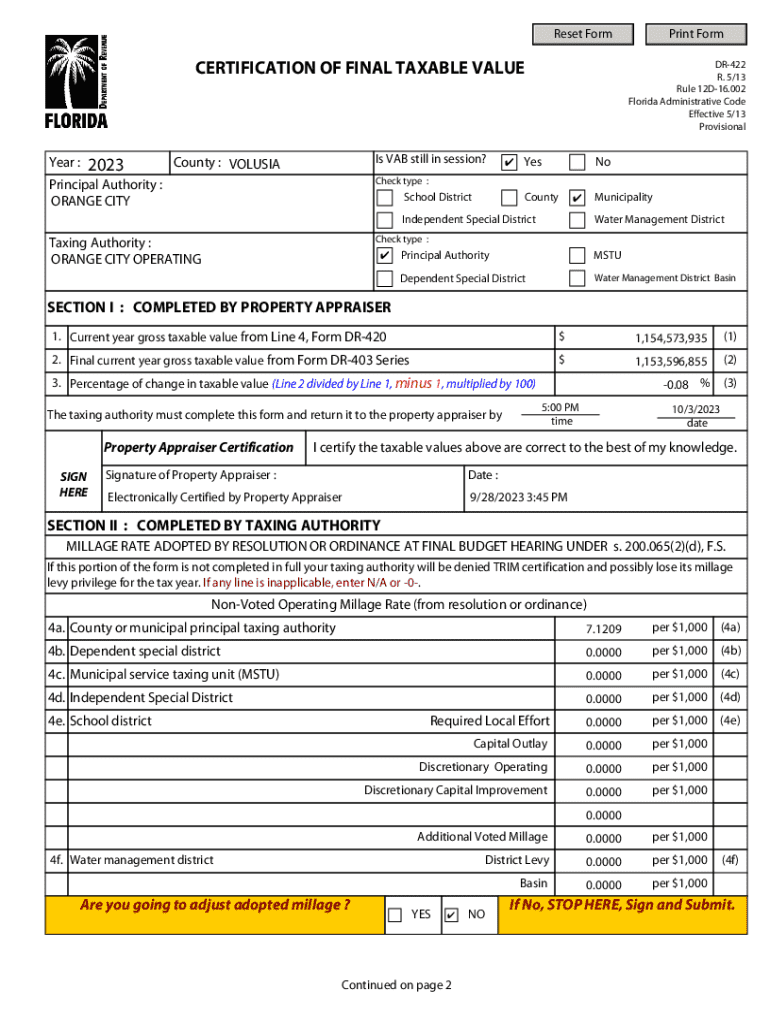

Understanding the certification of final taxable form

The certification of final taxable form is a critical document in the realm of taxation, particularly for property owners. This form serves as an authoritative declaration of the taxable value of a property, as determined by local tax authorities. Essentially, it outlines the final assessed value that will be used to compute annual property tax obligations.

The primary purpose of this form is to ensure proper tax processing and compliance, streamlining the tax collection process for both the taxpayer and government. When certified, it verifies that the information is accurate and up to date, reinforcing the integrity of tax assessments.

Understanding who needs this form is equally crucial. Generally, property owners, businesses, and real estate investors must complete this form, especially if they have undergone recent changes in property value or ownership status. Ensuring that the right parties are involved in this process mitigates errors and ensures fair tax obligations.

Key components of the certificate

A well-structured certification of final taxable form consists of several key components that offer up detailed insights into a taxpayer's obligation. Each section is designed to capture relevant information to facilitate accurate tax processing.

Among the essential information included are:

Additionally, certification notices and relevant dates, such as submission deadlines, help streamline communications and compliance with local tax authorities.

Steps for certifying a final taxable form

Certifying a final taxable form involves a methodical process that can significantly affect how your property taxes are calculated. Here are the crucial steps to follow:

Interactive tools for document management

As technology evolves, so do the tools available for managing documents. Utilizing platforms like pdfFiller can simplify the process of filing your certification of final taxable form. Here’s how to leverage these resources effectively.

To access and use interactive tools on pdfFiller, follow these basic steps:

Submission guidelines

Understanding where and how to submit the certification of final taxable form is pivotal. Taxpayers have the option to choose between digital and physical submissions, each with its own set of advantages and disadvantages.

Here's a quick breakdown to help you decide:

Do not forget to take note of important deadlines. These can vary by state or region, but timely submissions are crucial to avoid penalties or delayed processes.

Common issues and solutions

Navigating the certification of final taxable form process can be fraught with potential issues. Here are some common pitfalls and how to address them effectively.

Addressing frequently asked questions not only eases anxiety but also empowers you with clarity regarding the tax submission process.

Expert tips for success

For many individuals and teams, ensuring efficient handling of tax records can prove to be a complex task. However, adopting some best practices can significantly ease the burden.

Additional features of pdfFiller relevant to tax certification

The pdfFiller platform offers more than just tools for the certification of final taxable form; it encompasses a range of features to simplify general tax document management.

The advantages of using pdfFiller include:

Staying informed

Keeping up with changes in tax laws and submission requirements is vital for successful property tax management. Engaging with resources that provide timely updates can help you stay ahead.

Interactive FAQ section

An interactive FAQ section can be a game-changer for individuals or teams navigating the complexities of the certification of final taxable form. Addressing common queries provides immediate answers to potential concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit certification of final taxable from Google Drive?

Can I create an eSignature for the certification of final taxable in Gmail?

How do I fill out the certification of final taxable form on my smartphone?

What is certification of final taxable?

Who is required to file certification of final taxable?

How to fill out certification of final taxable?

What is the purpose of certification of final taxable?

What information must be reported on certification of final taxable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.