Get the free Campaign Finance Receipts and Expenditures Report - ethics ks

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign finance receipts and form: A comprehensive guide

Understanding campaign finance receipts

Campaign finance receipts are crucial documents that record the funds received by candidates and political committees during their campaigns. These receipts are not just a formality; they serve as the primary evidence of how much money a campaign has raised, allowing for transparency and accountability in the political funding process.

Legally, candidates must collect and keep receipts for contributions to demonstrate compliance with campaign finance laws. These laws vary by state but generally require candidates to report their financial activities regularly. The importance of campaign finance receipts lies in their ability to foster trust among the electorate by disclosing who is financially backing candidates.

Types of campaign finance receipts

Campaign finance receipts consist of various types of contributions and expenditures that campaigns must track. Contributions can come from individuals, businesses, or organizations, each governed by different regulations. It's vital to categorize these receipts accurately to ensure compliance with financial disclosure regulations.

Expenditures refer to funds spent during the campaign, including both direct payments for services and in-kind contributions, such as donated goods or services. Furthermore, fundraising events generate income through ticket sales and auction items, which must also be documented as part of the campaign finance receipts.

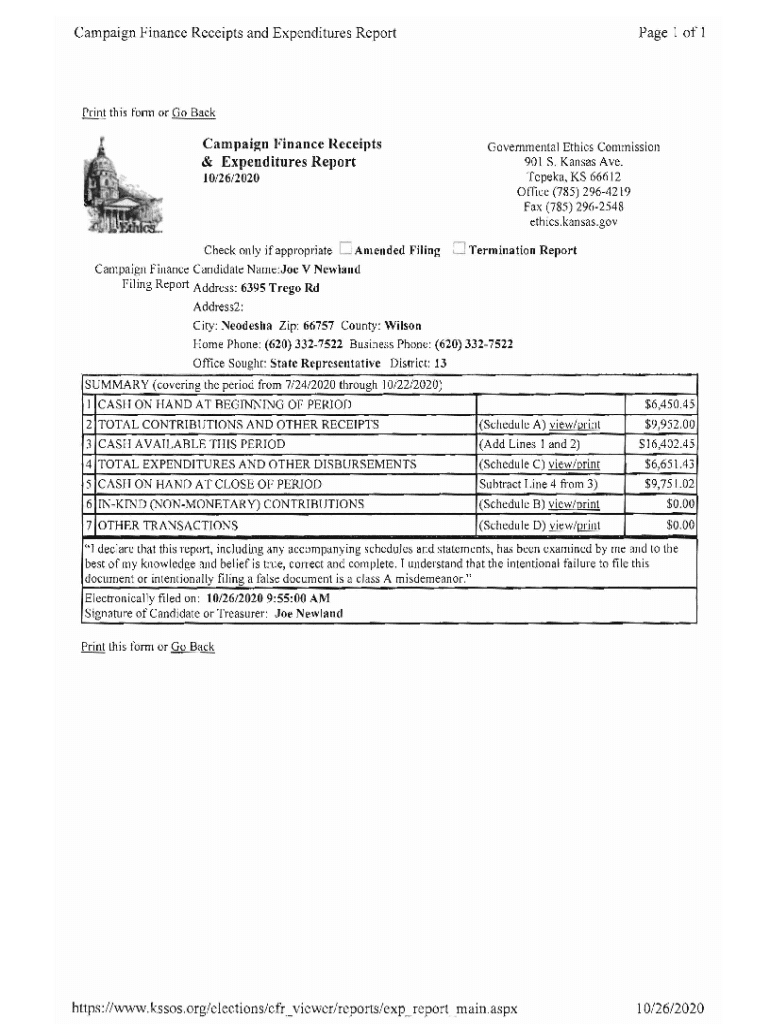

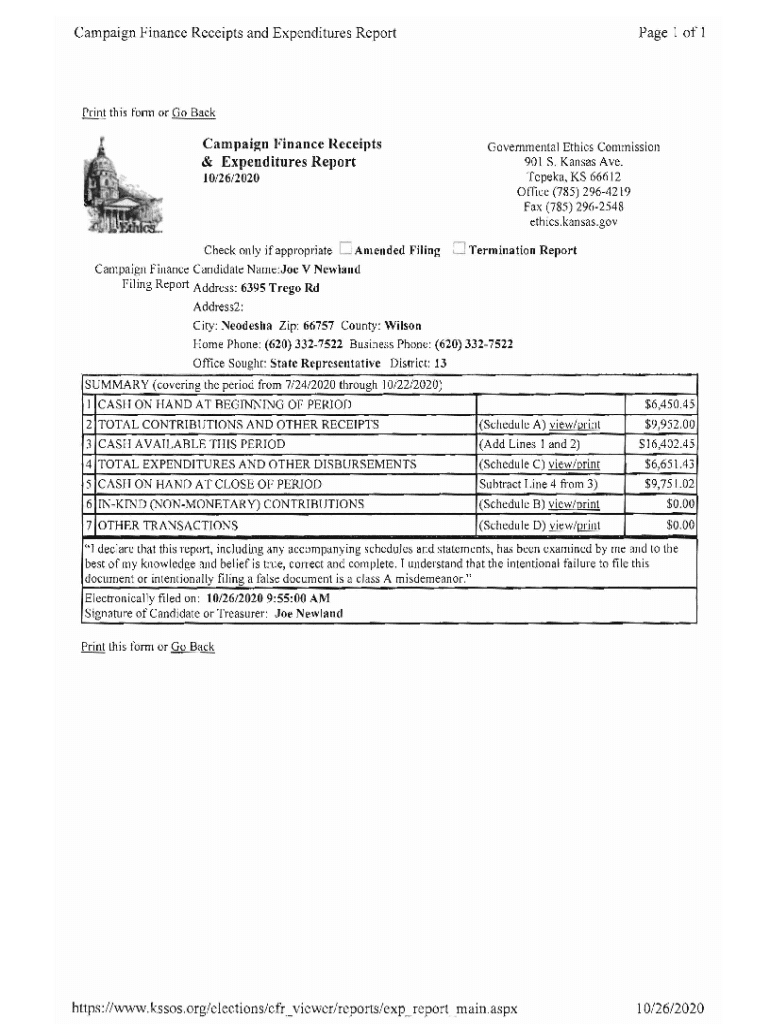

The campaign finance form: An in-depth look

The campaign finance form is a structured document designed to encapsulate all financial activities of the campaign. Key components include the identification information of the candidate or committee, a breakdown and categorization of receipts, and expenditure reporting. Each section must be filled out with accuracy to avoid legal complications and to ensure compliance with campaign finance laws.

Signatures and certifications are vital elements of the campaign finance form, serving as a declaration that the information provided is accurate and in compliance with regulatory requirements. Common mistakes to avoid include underreporting contributions, failing to include in-kind donations, and neglecting to file forms on time.

Step-by-step guide to completing the campaign finance form

Completing the campaign finance form requires a methodical approach to ensure every detail is accurately reported. Start by gathering necessary documentation, including proof of contributions such as receipts and bank statements. This foundational work is critical to maintaining organized records as you proceed.

Filling out the form involves several steps: First, enter the identification information, which includes the candidate's name and the committee's details. Next, report the contributions received, ensuring you categorize them by type. Document all expenditures following that before reviewing the information for accuracy. Finally, sign and submit the form, with options for electronic signing and submission methods, whether online through platforms like pdfFiller or offline.

Tools for editing and managing campaign finance documents

Managing campaign finance documents can be cumbersome without the right tools. Utilizing pdfFiller’s Document Creation Suite allows campaign teams to streamline their document management processes. Features like collaborative editing and comprehensive editing tools simplify form filling and enable campaigns to stay organized and compliant.

Beyond basic editing, pdfFiller offers cloud-based solutions that facilitate access from anywhere. Real-time collaboration ensures that multiple team members can work on documents simultaneously, allowing for easy sharing and feedback, which is essential for successful campaign management.

Interactive tools for monitoring campaign finance compliance

Keeping track of compliance with campaign finance laws requires diligent oversight. Interactive tools such as compliance checklists can guide campaign teams through each requirement, making it easier to manage deadlines and necessary reports. Alerts for filing deadlines help ensure that no important dates are overlooked, which is vital in maintaining compliance and avoiding potential penalties.

Further, tracking changes and amendments in campaign finance regulations can protect campaigns from inadvertent breaches of the law. Utilizing technology effectively to monitor compliance not only mitigates risks but also helps to maintain the integrity of the campaign funding process.

Best practices for managing campaign finance receipts

To efficiently manage campaign finance receipts, it is crucial to organize and store all receipts systematically for future reference. Establishing a robust filing system, whether digital or physical, ensures that you can quickly retrieve documents when necessary. Regular auditing is another best practice that helps identify discrepancies in reporting, ensuring the accuracy of financial records.

Lastly, staying informed about changes in campaign finance laws is paramount. Laws frequently evolve, and adapting to new regulations is essential for compliance. Continuously educating yourself and your team on these changes will ensure that your campaign remains both transparent and accountable.

Frequently asked questions about campaign finance receipts and forms

Campaign managers and candidates often have questions regarding their responsibilities. For example, if a mistake is made on the form, it's vital to understand the procedure for correcting it. Generally, amendments can be filed to rectify any discrepancies; however, prompt action is crucial to avoid penalties.

Additionally, handling undocumented contributions poses a challenge. Best practices suggest documenting all contributions as thoroughly as possible, even when complete records might not be available. Finally, understanding the penalties that exist for late or inaccurate submissions is fundamental to ensuring compliance and safeguarding the integrity of your campaign.

Navigating state-specific regulations and requirements

Campaign finance laws vary significantly from state to state, thereby necessitating an understanding of the specific regulations applicable to each jurisdiction. Some states may have stricter rules regarding contribution limits, disclosure requirements, and filing deadlines. Therefore, candidates must familiarize themselves with these variations to ensure compliance.

Resources like state election offices or reputable online platforms can provide clarity on state-specific rules. Staying informed about such variations not only avoids legal repercussions but also promotes a smoother campaign experience.

Conclusion: Expanding your knowledge and resources

Managing campaign finance receipts and forms requires diligence and organization. Candidates and campaign teams benefit from leveraging resources like pdfFiller to streamline document creation, ensure compliance, and facilitate collaboration among team members. Continuous learning about campaign finance regulations and best practices is critical to fostering accountability and transparency.

Staying updated on changes in campaign finance legislation helps prevent lapses in compliance and equips campaign teams to navigate the evolving landscape effectively. By adopting a proactive approach, candidates can ensure their campaigns run smoothly and ethically.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute campaign finance receipts and online?

How do I edit campaign finance receipts and in Chrome?

How do I edit campaign finance receipts and on an Android device?

What is campaign finance receipts and?

Who is required to file campaign finance receipts and?

How to fill out campaign finance receipts and?

What is the purpose of campaign finance receipts and?

What information must be reported on campaign finance receipts and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.