Get the free Amended Annual Report

Get, Create, Make and Sign amended annual report

How to edit amended annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amended annual report

How to fill out amended annual report

Who needs amended annual report?

Amended Annual Report Form: Comprehensive Guide

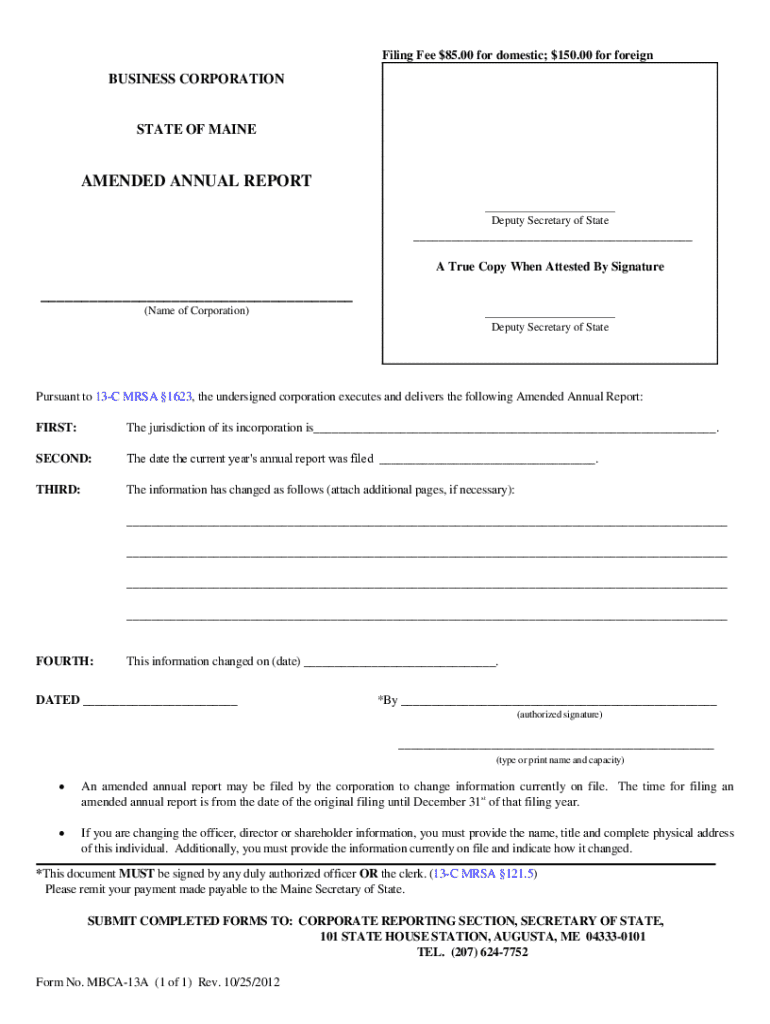

Understanding the amended annual report form

An amended annual report form is a crucial document that ensures the accuracy and compliance of an organization's annual report submitted to relevant authorities. This form is typically required when changes or corrections need to be made to previously filed annual reports. Due to the dynamic nature of businesses, information related to finances, directorship, and organizational structure may necessitate periodic updates in order to maintain transparency and uphold regulatory integrity.

Filing an amended annual report form serves not only to rectify errors but also to reflect significant changes that may affect stakeholders. For example, if a hospital underreported its income or if new contributions altered the financial picture, the organization must file this form to convey accurate information. Thus, the integrity of financial reporting is preserved, ensuring trust among investors, users of the report, and regulatory bodies.

Who needs to file an amended annual report?

Typically, corporations, non-profits, and other registered entities are required to submit an amended annual report form when significant changes occur. Organizations that must file this form can include healthcare facilities, educational institutions, and businesses operating under specific regulatory frameworks. For instance, if a non-profit changes its board of directors or a business updates its contact information, an amended report is essential.

Specific scenarios that might trigger the need for an amendment include alterations in financial data, changes to filing status, relocation of the business address, or adjustments in leadership roles. Non-compliance with filing these amendments could lead to penalties ranging from administrative fines to potential loss of operational licenses, showcasing the importance of timely and accurate reporting.

Preparing to fill out the amended annual report form

The process of preparing to fill out the amended annual report form begins with gathering essential documentation. This includes previous annual reports, updated financial data, and any other relevant forms that directly impact the amendment. It's critical to have current and accurate information, as any discrepancies can lead to further complications or additional amendments required down the line.

Understanding the reporting period covered in the amendment is equally important. Organizations must clearly define their fiscal year, which affects all reporting periods and deadlines. Most states have specific timelines for filing amended reports after changes occur, often ranging from 30 to 90 days post-amendment or the discovery of inaccuracies. Knowing these dates ensures timely compliance and prevents administrative penalties.

Step-by-step guide: completing the amended annual report form

Completing the amended annual report form involves several key sections that need careful attention. The first section, 'Organization Information,' requires details about the organization such as its name, address, contact information, and any other identifiers that differentiate it from other entities. Accuracy here is crucial, as mismatches can create misunderstandings with regulatory bodies.

In the 'Financial Summary' section, organizations must present a breakdown of their finances, including income, expenses, and any changes resulting from the amendment. It's essential to ensure that all figures are aligned with official financial statements, as this adds credibility to the reported numbers. Lastly, the section on 'Changes Made' is where organizations will document the specifics of what amendments were required. This section should be transparent and thorough, explaining why changes were necessary.

Interactive tools: enhancing the filing experience

Utilizing online form filling tools can greatly enhance the experience of completing the amended annual report form. Platforms like pdfFiller offer various features that simplify the filing process, including auto-fill capabilities and error-checking functions. These tools reduce time spent on paperwork and significantly increase accuracy during the filing process, which is paramount for compliance.

Among the advantages of using pdfFiller is its eSigning capability, allowing users to securely electronically sign their amended report. This feature not only speeds up the filing process but also ensures legal validity, as electronic signatures are recognized in many jurisdictions, making it easier for organizations to meet their deadlines efficiently.

Collaborative features for teams

One of the standout features of using pdfFiller for filing your amended annual report is its collaborative functionality. Teams can work together in real-time on the amendment process, enabling multiple users to view, edit, and leave comments directly on the form. This level of collaboration ensures that all parties involved can contribute to the accuracy of the report and stay informed on any necessary changes during the filing process.

Moreover, managing roles and permissions allows team leaders to control who has access to sensitive information. Setting user access levels ensures that only authorized personnel can make critical changes to the amended report and enhances data security significantly. This is particularly relevant for organizations dealing with sensitive data, such as hospitals and other healthcare organizations, where confidentiality and compliance are non-negotiable.

Submitting the amended annual report: final steps

After completing the amended annual report form, it's critical to conduct a final review using a checklist to ensure that every detail is accurate. Each section should be verified against supporting documentation to avoid any discrepancies that could result in penalties or require further amendments post-filing. This step is crucial for maintaining operational integrity and responding effectively to regulatory expectations.

When it comes to submission methods, organizations often have the option to file electronically or via traditional paper submissions. Electronic filing tends to be more efficient with immediate confirmations, while paper submissions may lead to delays in processing. It’s recommended to follow up with the relevant authority post-submission to ensure that the amendment was received and filed correctly.

FAQs regarding the amended annual report form

When dealing with the amended annual report form, questions often arise concerning environment-specific regulations, filing deadlines, and requirements that differ based on the organization’s status. Common inquiries center around whether previous filings should be included for reference and the timeframe in which amendments should be submitted.

To troubleshoot common issues, organizations can refer to state-specific guidelines on the amended annual report process. This knowledge empowers entities to navigate potential hurdles, such as the submission of incomplete or erroneous amendments, which could result in delayed processing or additional fines.

Maintaining compliance post-submission

After successfully submitting the amended annual report form, organizations must focus on maintaining compliance by tracking all future amendments and annual reports. Keeping accurate records is vital for both internal management and for future filings, ensuring that the organization does not lose sight of prior changes that may impact ongoing reports.

Additionally, staying informed on regulatory changes that might affect reporting requirements is essential for avoiding compliance issues. Resources such as legal advisories, regulatory body notifications, and industry-specific newsletters can provide critical updates on changes that impact how organizations report their financials and operational modifications.

Leveraging pdfFiller: seamless document management

pdfFiller provides a comprehensive solution for managing the entire process of completing and filing the amended annual report form. Its features enable users to create, edit, and manage documents efficiently, with robust tools that enhance user experience across various devices. Accessibility from anywhere means teams can work together effectively, regardless of their location, further improving the likelihood of timely compliance.

In addition to editing and eSigning capabilities, pdfFiller offers a variety of support features that cater to different user needs, making it a valuable asset for organizations looking to simplify their reporting processes. With easy access to templates, collaborative tools, and efficient filing options, pdfFiller empowers users to navigate the complexities of the amended annual report form with confidence and precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get amended annual report?

How do I edit amended annual report straight from my smartphone?

How do I edit amended annual report on an Android device?

What is amended annual report?

Who is required to file amended annual report?

How to fill out amended annual report?

What is the purpose of amended annual report?

What information must be reported on amended annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.