Get the free Admissions Tax Return

Get, Create, Make and Sign admissions tax return

How to edit admissions tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out admissions tax return

How to fill out admissions tax return

Who needs admissions tax return?

Comprehensive Guide to the Admissions Tax Return Form

Understanding the admissions tax return

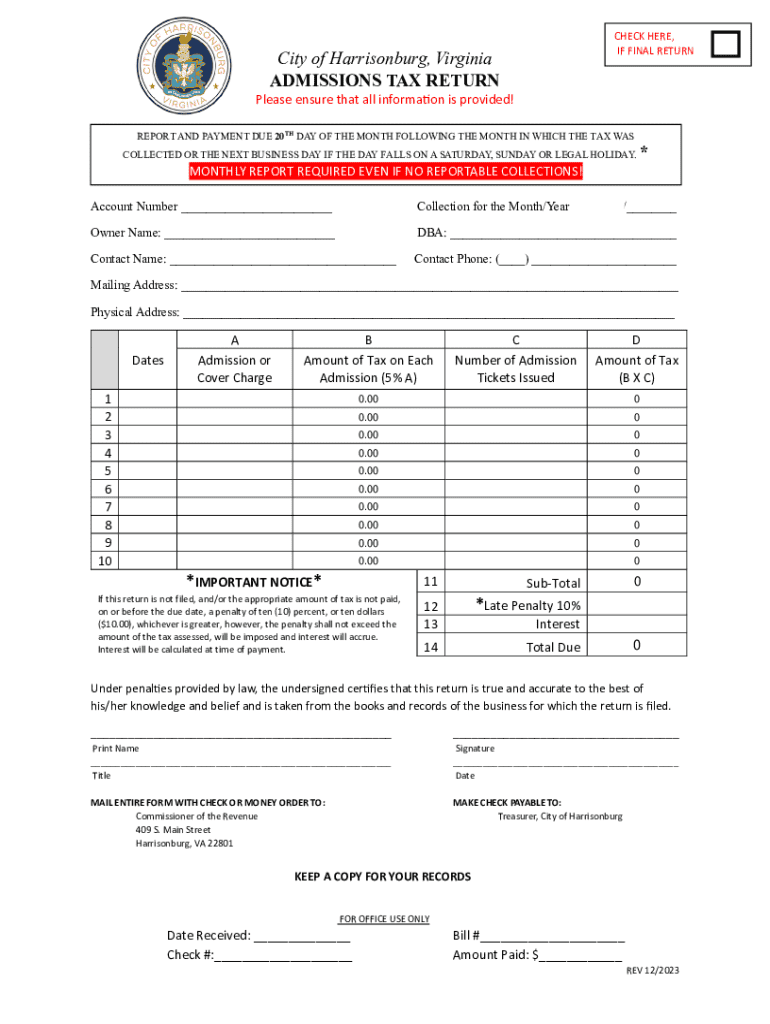

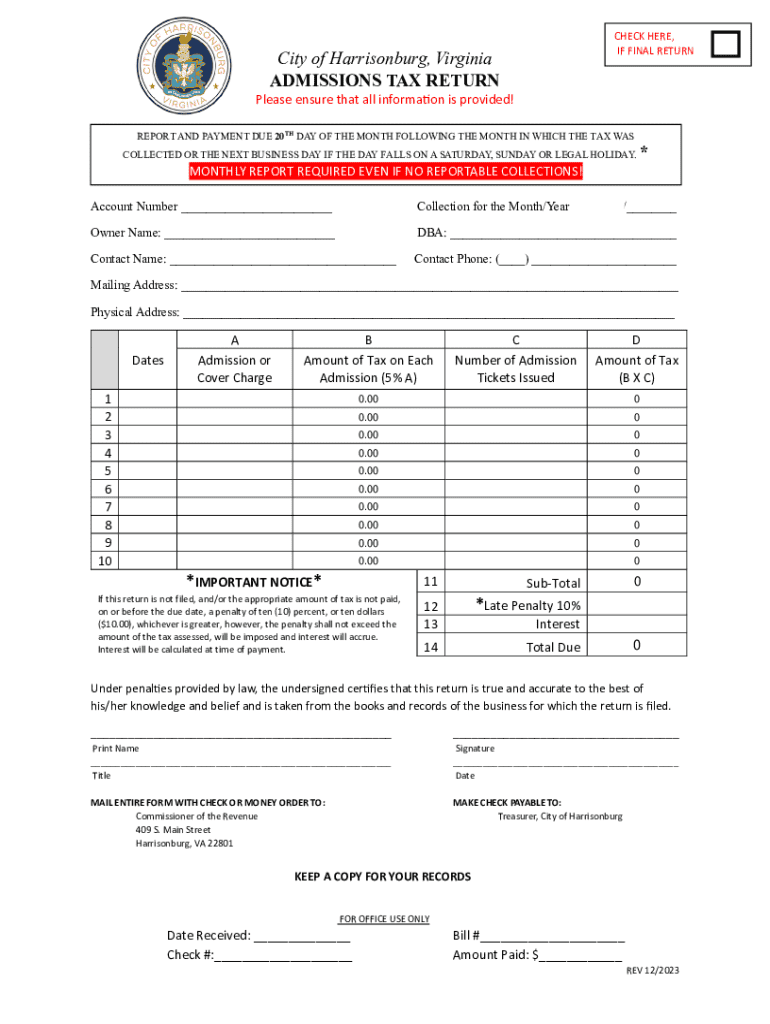

The admissions tax return form serves as a crucial document for entities responsible for collecting admissions tax on ticket sales or entry fees. It’s designed for venues, organizations, or businesses that charge an admission fee and need to report their earnings to the tax authorities in their respective jurisdictions.

Who is required to file this form? Typically, all businesses, organizations, or governmental entities that charge for admission to events or venues must complete and file the admissions tax return form. This can include theaters, concert venues, museums, and various event organizers.

For instance, if you operate a theater in New York and collect an admissions fee, you're obligated to file this form with the local tax authority to report and remit the appropriate taxes. Being aware of the specific reporting requirements in your locality is essential to ensure compliance and avoid penalties.

Importance of timely submission

Submitting the admissions tax return form on time is crucial for several reasons. Late filing can lead to penalties, interest charges on unpaid taxes, and possible legal ramifications. Many jurisdictions impose strict deadlines, and failing to meet these can result in expensive consequences.

On the flip side, timely submission provides benefits including maintaining a good standing with tax authorities, establishing a clear record for audits, and helping to keep track of financial health. It demonstrates responsibility on the part of the business or organization, which can be beneficial in establishing trust with stakeholders.

Key components of the admissions tax return form

The admissions tax return form is structured in sections that collectively gather all necessary information to compute the tax owed. Each section serves a distinct purpose for accurate reporting.

Completing each section accurately is vital, as errors can lead to miscalculations or unnecessary penalties due to liabilities that were incorrectly reported.

Required documents

Before filing, it’s essential to gather the necessary documents to support your admissions tax return form. Proper preparation will enhance accuracy and reduce the likelihood of complications during the filing process.

By collecting these documents in advance, you streamline the process and ensure that the information reported is verified and compliant with local regulations.

Detailed step-by-step instructions for completing the form

Filling out the admissions tax return form requires methodical attention to detail. Follow these steps to ensure accuracy and completeness.

Following these steps with diligence will not only facilitate your filing but also mitigate the potential for errors that could lead to issues down the line.

Common mistakes to avoid when filing

Filing the admissions tax return form is straightforward, yet there are recurring pitfalls that many filers encounter. One primary error is incorrect calculations of the tax owed. Double and triple-checking calculations can prevent such issues.

Additionally, incomplete or inaccurate information can lead to rejections or fines. Ensure that all required fields are filled and that the data entered is correct. Finally, don't overlook submission deadlines. Missing these can lead to legal complications that could be avoided.

eSigning and collaborating on your admissions tax return

As many businesses operate remotely, utilizing electronic signing capabilities has become increasingly important. The pdfFiller platform enables you to eSign the admissions tax return form seamlessly, allowing for quick and efficient submissions.

Collaboration is also simplified with pdfFiller. Team members can review documents in real-time, providing feedback that enhances the quality of the return filed. This capability is particularly beneficial for larger organizations that may have multiple stakeholders involved in the process.

Managing your documents

After completing your admissions tax return, managing your documents efficiently is vital. pdfFiller offers options to save and organize your completed forms, ensuring that you can easily access them for future reference or audits.

Secure sharing options also allow you to distribute your admissions tax return safely to relevant stakeholders, ensuring everyone is on the same page.

Frequently asked questions

It's common for filers to have questions after submitting their admissions tax return form. One frequent query relates to how to correct mistakes made during submission. If an error is discovered, the first step is to check the jurisdiction's guidelines on amending a filed return.

If your queries become complex, seeking help from a trusted professional or accountant knowledgeable in tax laws can be invaluable. Additionally, there are contact numbers and online chat support available through pdfFiller for more immediate assistance on the platform.

Navigating changes in admissions tax regulations

Tax regulations are subject to change, often necessitating adaptation on the part of taxpayers. Staying informed about recent updates is key to ensuring compliance with the law.

Looking to the future, building a proactive approach to your admissions tax filing will help manage changes smoothly. Keeping detailed records and understanding how potential reforms may affect your reporting will position you for success.

Interactive tools for enhanced tax filing experience

Various interactive tools provided by pdfFiller can significantly enhance your tax filing experience. Utilizing templates for the admissions tax return form can streamline data entry and ensure accuracy in submissions.

Additionally, calculators can assist you in estimating your tax liability quickly, reducing the pressure of manual computations and allowing your organization to focus more on strategic aspects of business management rather than getting bogged down in paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit admissions tax return on an iOS device?

How do I complete admissions tax return on an iOS device?

How do I complete admissions tax return on an Android device?

What is admissions tax return?

Who is required to file admissions tax return?

How to fill out admissions tax return?

What is the purpose of admissions tax return?

What information must be reported on admissions tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.