Get the free Ap Checks - January Thru March 2025

Get, Create, Make and Sign ap checks - january

Editing ap checks - january online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ap checks - january

How to fill out ap checks - january

Who needs ap checks - january?

AP Checks - January Form: Your Comprehensive Guide

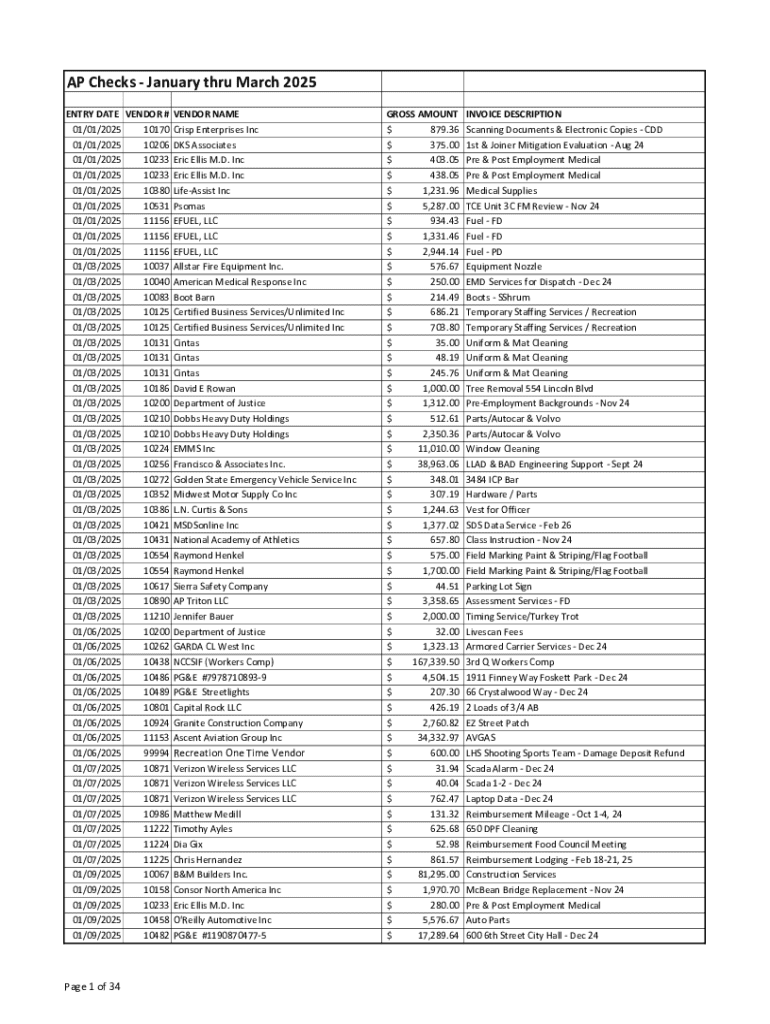

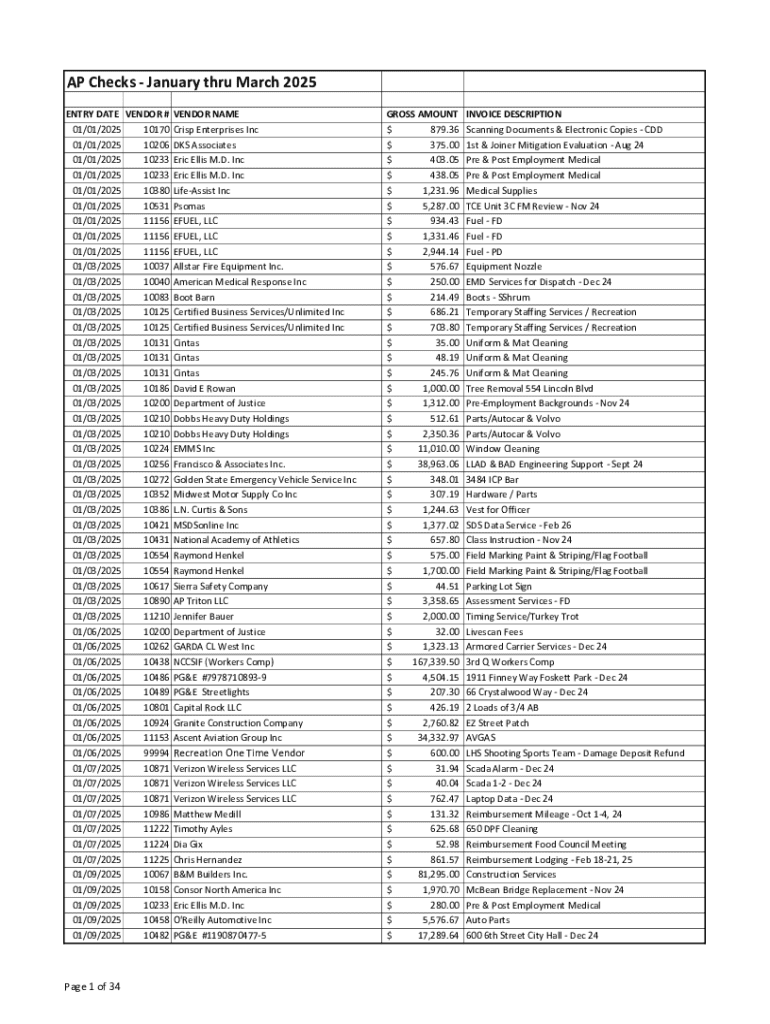

Overview of AP checks

AP checks, or accounts payable checks, are crucial financial instruments that organizations utilize to manage their payables efficiently. They ensure timely payments to vendors, which helps maintain positive business relationships and financial credibility. Properly executed AP checks play a vital role in the cash flow management of a business.

Key components of an AP check include vital details like payee information, the payment amount, and the date of the check's issuance. Each of these components must be accurately filled to ensure that the payment process flows without a hitch.

Understanding the January form

The January AP check form serves a specific purpose in financial documentation. This form is primarily used to facilitate payments at the beginning of the year, aligning with fiscal planning and accounting practices. Companies often find themselves clearing outstanding invoices from the previous year, making this form essential during January.

Key deadlines for submitting the January AP check form are critical for maintaining timely payments and securing any early payment discounts. Many organizations emphasize completing the documentation by the end of the first week of January to ensure all payments are processed before fiscal year-end reports are generated.

Step-by-step guide to completing the January AP check form

Completing the January AP check form requires meticulous attention to detail. Start by collecting the necessary information. First, you'll need vendor details, including their business name, address, and payment instructions. Next, gather invoice information to ensure accurate payment amounts.

Filling out the form involves several key sections. In the payee information section, input the vendor's details exactly as they appear on their official documents. For the payment amount, include the exact total stated in the invoice, ensuring there are no discrepancies. Additionally, a notes or comments section can provide useful context or clarifications regarding the payment.

Editing and customizing the January form

pdfFiller offers efficient editing functionalities for the January AP check form. Users can edit fields directly within their PDF documents. Live editing capabilities allow for adjustments to be made in real-time, creating a fluid workflow for teams working collaboratively.

Another significant feature is the ability to add or remove fields as necessary. This flexibility ensures that teams can customize their forms to suit their unique accounting needs. Collaboration is simplified via pdfFiller, where sharing options foster real-time feedback and opportunities for revisions.

eSigning the January AP check form

eSignatures are becoming increasingly important in accounts payable processes. When completing the January AP check form, securing an eSignature provides legal verification and enhances accountability among stakeholders. With pdfFiller, eSigning is straightforward and integrates seamlessly into the workflow.

The legality of eSignatures is upheld by the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring users can trust the compliance aspects of their digitally signed documents. This compliance reduces the chance of fraudulent activities and contributes to a more secure document management process.

Managing your AP checks with pdfFiller

With pdfFiller, managing AP checks becomes a systematic and organized process. Users can store and organize their checked forms within a single cloud-based platform, which simplifies document retrieval at any time from anywhere. This cloud capability is a game-changer for teams that often work remotely or on the go.

Additional security features included within pdfFiller protect sensitive information, ensuring that all checks and associated details remain confidential. This emphasis on security is particularly important in today's digital environment, where data breaches can have significant ramifications.

Additional tools and resources for AP checks

Various interactive tools are available on pdfFiller that enhance the experience of managing AP checks. For instance, users can calculate payment amounts directly within the form, ensuring accuracy before submission. Additionally, pdfFiller allows tracking of submission statuses, providing clear visibility into the payment processes.

Frequently asked questions related to AP checks are also addressed within the platform. Whether it's how to handle errors or request a stop payment, these resources guide users through common scenarios.

Finding more support

Navigating customer support within pdfFiller is intuitive. Users can access a wealth of tutorials and webinars regarding document management, which deepens their understanding of how to use the platform effectively. Moreover, community forums provide an excellent avenue for users to share strategies and troubleshooting tips related to AP processes.

This support infrastructure not only enhances user capabilities but also encourages engagement with the pdfFiller community, fostering a collaborative environment for individuals involved in accounts payable.

The benefits of using pdfFiller for AP checks

Utilizing pdfFiller for managing AP checks streamlines workflow and significantly enhances efficiency. The platform's robust functionalities alleviate many frustrations associated with traditional document handling, from paperwork to physical signatures. This shift transforms payment processing into a modern, efficient practice.

Moreover, pdfFiller ensures compliance and security in document handling. For example, user case scenarios demonstrate the platform in action, showcasing successful implementations in various businesses. By harnessing pdfFiller, organizations witness improved turnaround times and reduced errors in their AP processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ap checks - january from Google Drive?

How do I edit ap checks - january online?

How do I fill out ap checks - january using my mobile device?

What is ap checks - january?

Who is required to file ap checks - january?

How to fill out ap checks - january?

What is the purpose of ap checks - january?

What information must be reported on ap checks - january?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.