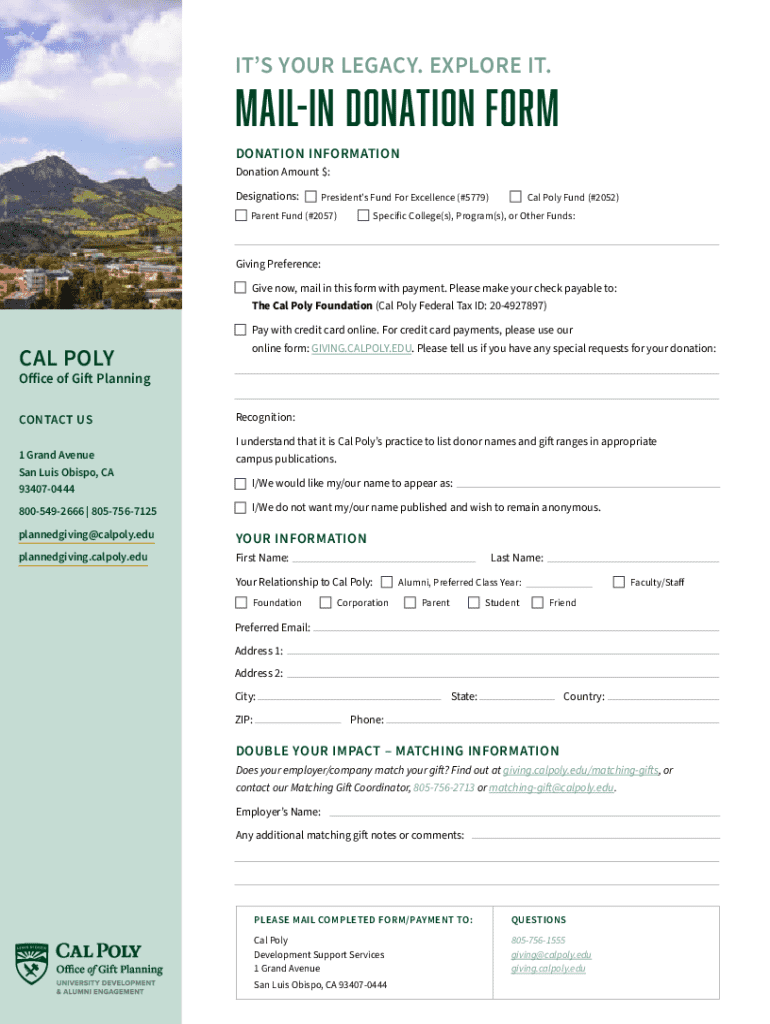

Get the free Mail-in Donation Form

Get, Create, Make and Sign mail-in donation form

Editing mail-in donation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mail-in donation form

How to fill out mail-in donation form

Who needs mail-in donation form?

Mail-in Donation Form How-to Guide

Understanding mail-in donations

Mail-in donations are contributions sent by individuals or organizations using postal mail rather than digital means. This method holds a significant place in fundraising as it accommodates those who may not be comfortable with online transactions or who prefer traditional methods. Mail-in donations also allow nonprofits to reach demographics less engaged with technology, ensuring inclusivity in charitable efforts.

Benefits for charities include cost-effective fundraising strategies, as the associated costs with online processing fees can often be circumvented. For donors, mail-in forms provide a tangible way to contribute and sometimes allow for more thoughtful engagement, such as adding personal messages or notes. This process fosters a unique connection between the donor and the cause.

Overview of the mail-in donation form

A mail-in donation form typically comprises several standard sections designed to gather necessary information efficiently. Users can expect to find areas designated for donor details, amounts, payment methods, and personal messages. This structured approach simplifies processing and ensures that charitable organizations can meet donor needs effectively.

When utilizing mail-in donation forms, it is also essential to be mindful of legal considerations such as ensuring compliance with relevant tax laws. Charitable organizations must provide accurate documentation to donors, which aids in fundraising transparency and trust.

Accessing the mail-in donation form

Obtaining a mail-in donation form has never been easier, particularly with resources like pdfFiller. To find the appropriate form, start by searching within the platform’s comprehensive template library, where a wide array of donation forms is available for different causes and formats.

After choosing the right form, you can download it in various formats, including PDF and editable forms, to suit your preference for filling it out manually or digitally.

Filling out the mail-in donation form

Completing your mail-in donation form accurately is crucial. Start with providing your donor information clearly to ensure the charity can recognize and acknowledge your support. You'll need your name, mailing address, and in some cases, contact information. Be meticulous about spelling and provide a valid address to avoid any issues with processing your donation.

Before sending the form, double-check all sections to avoid common mistakes such as incorrect amounts or incomplete information. Such oversights may lead to processing delays or lost donations, undermining your effort to support a worthy cause.

Editing the mail-in donation form

Once you’ve completed the mail-in donation form, you may wish to make edits or annotations. pdfFiller’s suite of interactive tools makes this process simple. Users can easily review their forms and utilize editing tools to update information, whether it’s changing a donation amount or adding a signature.

Saving your changes effectively is important. Make use of cloud storage solutions provided by pdfFiller, allowing you to maintain document versions and have access to previous drafts if needed.

Signing the mail-in donation form

A signature on your mail-in donation form serves as a validation and can be essential for processing. Whether using traditional ink or an electronic signature, it's vital to ensure that it meets legal expectations. Electronic signatures, in particular, have gained legitimacy in many jurisdictions, making them a practical choice for many donors.

Taking the time to ensure your signature is included properly will eliminate potential issues during processing and allow your donation to be acknowledged promptly.

Submitting the mail-in donation form

Once your mail-in donation form is complete and signed, it's time to submit it. Selecting the right envelope is crucial; ensure it is sturdy enough to protect the contents during transit. Be mindful of postage; using a reliable service will ensure that your donation reaches its destination safely.

To track the status of your mailed donation, consider using delivery services with tracking options. This can provide peace of mind and verify that your generous contribution has been received effectively.

Managing your donation records

Keeping track of your contributions is necessary, especially for tax purposes. pdfFiller enables users to manage their documents effectively in a cloud-based environment, which simplifies access and organization. Having a centralized document repository allows for easy retrieval and ensures you never misplace important records.

Maintaining organized records gives donors insight into their charitable contributions and helps ensure that their support of preferred causes is well-documented.

Frequently asked questions (FAQs) about mail-in donations

Understanding the nuances of mail-in donations can elevate the donor experience. Below are some frequently asked questions that often arise:

User testimonials and case studies

Many individuals and teams have experienced success using mail-in donation forms. Testimonials often highlight the personal touch of handwritten messages or notes that accompany their contributions. Users can share how incorporating mail-in donations into their strategies enhanced engagement and support for their causes.

These experiences also underscore how accessible and fulfilling mail-in donations can be, fostering a deeper connection with charitable organizations.

Outreach and communication

Post-donation outreach is vital in maintaining relationships with donors. Keeping contributors updated about how their funds are being utilized can significantly enhance trust and foster long-term commitments. Communication methods may include thank-you letters, email newsletters, or regular impact reports.

By investing time in outreach, charities not only honor the donor's contribution but also create a community of engaged supporters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mail-in donation form online?

How can I fill out mail-in donation form on an iOS device?

How do I fill out mail-in donation form on an Android device?

What is mail-in donation form?

Who is required to file mail-in donation form?

How to fill out mail-in donation form?

What is the purpose of mail-in donation form?

What information must be reported on mail-in donation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.