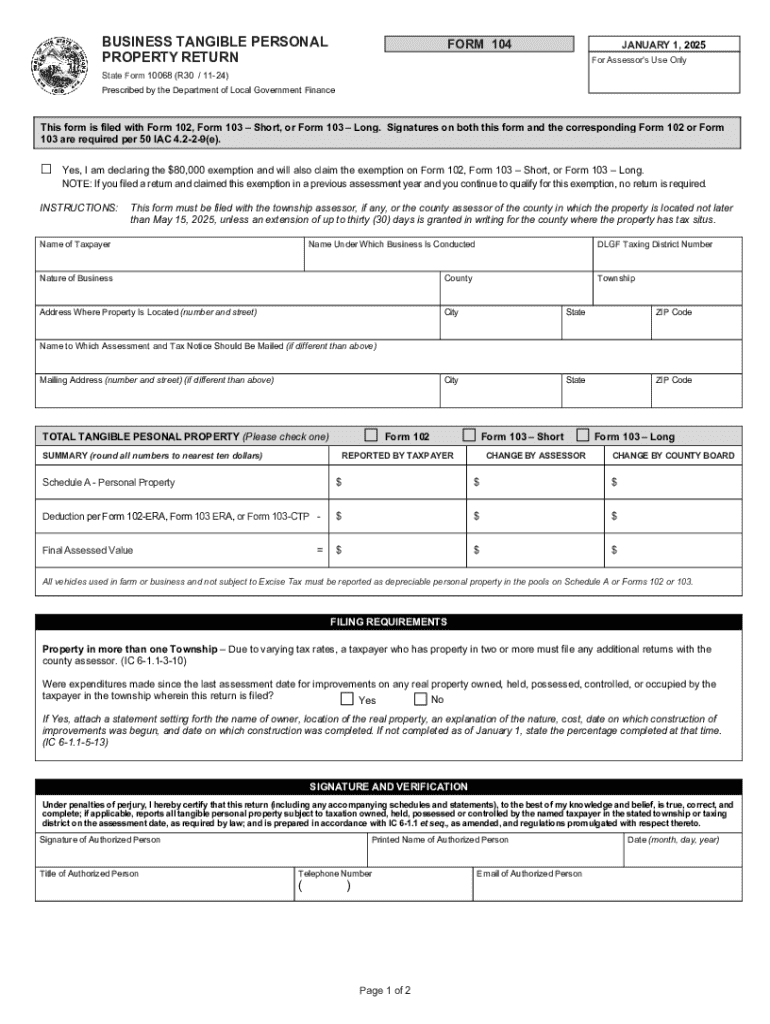

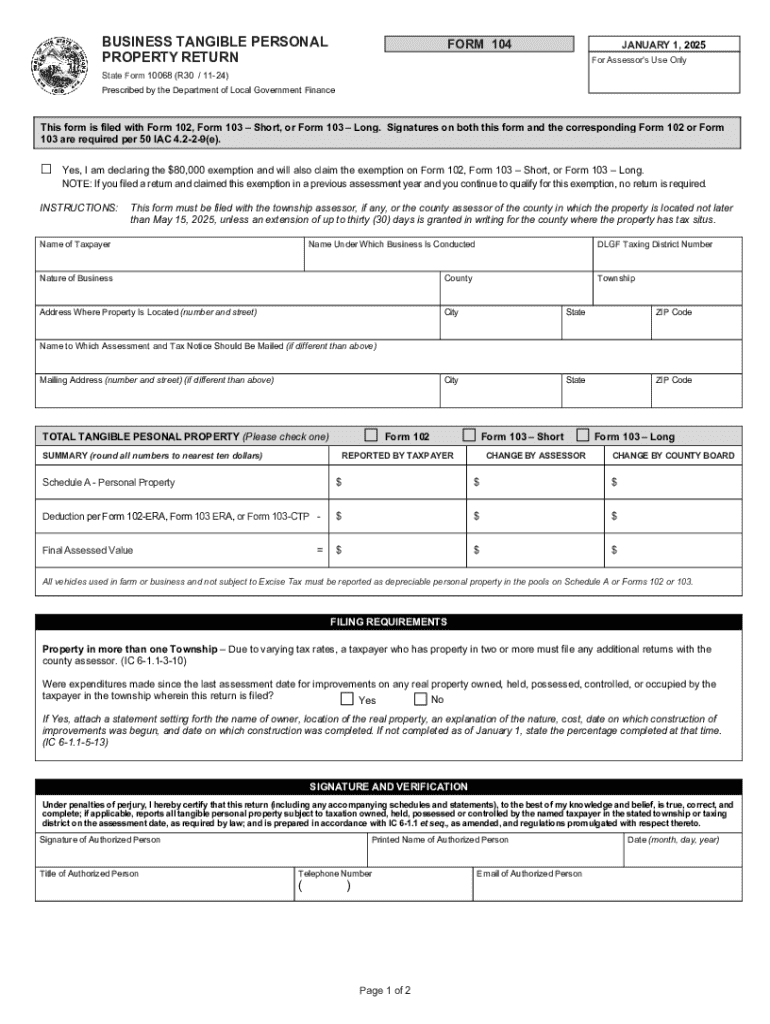

Get the free Business Tangible Personal Property Return

Get, Create, Make and Sign business tangible personal property

Editing business tangible personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tangible personal property

How to fill out business tangible personal property

Who needs business tangible personal property?

Understanding and Managing Your Business Tangible Personal Property Form

Understanding business tangible personal property

Business tangible personal property encompasses the physical assets that contribute to a company's operations, distinct from real estate. This includes equipment, furniture, inventory, and other fixed assets. Accurate reporting of these assets is crucial for tax purposes and financial accounting, as they contribute to a business's overall value and can be depreciated over time.

Many entrepreneurs underestimate the importance of correctly reporting tangible personal property. Misclassification or underreporting can lead to financial discrepancies, tax audits, or even penalties from tax authorities. It's vital for business owners to grasp common misconceptions; one being that all assets are automatically taxable, which is not always the case depending on location or asset type.

Types of business tangible personal property

Understanding the various types of business tangible personal property helps in accurately assessing and reporting these assets. Each category has its specific characteristics and regulations, so let's break them down.

The role of the business tangible personal property form

The business tangible personal property form serves as the official document to report your assets to local tax authorities. This form is significant not just for taxation but also for maintaining accurate financial records. Proper filing is essential, as inaccuracies may lead to audits or tax disputes, highlighting the importance of thorough documentation.

It's important to note that requirements differ by state. The process may vary in quận Cam as opposed to other regions due to variations in local tax laws. Understanding these differences can save a business owner time and legal trouble during the filing process.

Filling out the business tangible personal property form

Filling out the business tangible personal property form can seem daunting, but with the right approach, it becomes manageable. Begin by gathering all necessary documentation and information related to your property.

Be cautious of common mistakes, such as underreporting asset values or misclassifications, as these can lead to issues with compliance and penalties.

Editing and signing the business tangible personal property form

Once the form is completed, it's essential to review it for accuracy. Using pdfFiller’s features allows for easy editing of forms, letting you make necessary adjustments before final submission.

Electronic signatures have become increasingly common for document efficiency. pdfFiller's platform makes it simple to eSign and streamline this process, allowing for collaboration with team members who may need to review or sign the document before finalization.

Managing your business tangible personal property form

Effective document management is vital for a successful business. Storing your business tangible personal property form securely and retrieving it efficiently should be a priority. Utilizing cloud solutions like pdfFiller ensures your documents are accessible from anywhere, providing flexibility and security.

Establish best practices for maintaining your records. For instance, create a system for naming and organizing files, incorporate version control, and set reminders for yearly updates or audits. This proactive approach minimizes stress and confusion during tax season.

Filing the business tangible personal property form

Filing requirements for the business tangible personal property form vary based on your location. Understanding your local filing deadlines is crucial; missing these can result in penalties or fines. For businesses in Condado de Orange or quận Cam, be sure to verify local regulations to avoid any oversight.

After submission, follow up to confirm that your form has been received and accepted. A confirmation email or a notice from your local tax office can provide peace of mind and ensure your records are in order.

Resources and tools for business tangible personal property management

pdfFiller offers interactive tools that assist in simplifying the process of managing your business tangible personal property form. These tools allow users to track changes, collaborate efficiently, and maintain a clear overview of their property management.

In addition to editing and signing, various templates are available to help with future filings. Using customizable templates saves time and ensures compliance with any regulatory changes that may arise.

Case studies and examples

Companies that have successfully navigated the business tangible personal property filing process often share common strategies. For example, some have invested in comprehensive training for their staff to correctly assess and report assets, directly enhancing compliance rates.

In contrast, case studies of businesses that faced challenges reveal the importance of continual education about property laws and tax guidelines. Lessons learned from these experiences can provide invaluable insights into increasing efficiency and compliance.

FAQ about business tangible personal property forms

The business tangible personal property form can raise several questions. Common inquiries include what's considered taxable property and the criteria for determining asset valuation. It’s also standard to have queries about how often these forms need to be filed or whether any exemptions apply.

Clarifying these terms and processes ensures that all business owners can navigate the filing requirements confidently. In case of issues or complications arising during filing, resources like local tax offices or platforms like pdfFiller offer additional support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business tangible personal property online?

How do I edit business tangible personal property online?

Can I sign the business tangible personal property electronically in Chrome?

What is business tangible personal property?

Who is required to file business tangible personal property?

How to fill out business tangible personal property?

What is the purpose of business tangible personal property?

What information must be reported on business tangible personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.